Deductions

Primary documents are approved by the manager and must contain all the mandatory details specified in Art. 9

Since labor legislation does not have direct answers to the questions posed, different points can be found

Shift work and wages for it are a considerable problem for accountants and

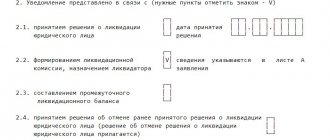

An organization can be liquidated voluntarily by a unanimous decision of its participants. Reasons for cessation of activity may

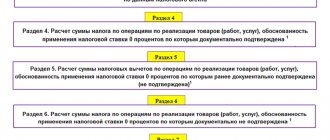

The Universal Transfer Document (UDD) is developed based on the invoice form. The use of UPD allows, without disturbing

A tax deduction is an amount by which you can reduce the VAT charged on the sale of goods,

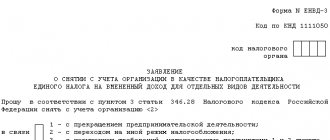

Why is UTII form 3 submitted? An application for UTII form 3 is submitted if the organization

Account 66 in accounting Subaccounts of the account “Settlements for short-term loans and borrowings” are presented

When INV-11 is used Using the INV-11 form, an act is drawn up in which the inventory commission records information

Taxpayers who carried out transactions not subject to VAT under Articles 146, 147, 148 or 149