The Universal Transfer Document (UDD) is developed based on the invoice form. The use of UPD allows, without violating the law, to combine an invoice with different forms of accounting, which in many ways duplicate it TORG-12, M-15, OS-1, commodity section TTN), as well as:

- take into account the documented fact of economic life for accounting purposes;

- use the right to tax deduction for VAT;

- confirm expenses for the purpose of calculating income tax (and other taxes).

The UPD contains all the mandatory details provided for invoices and primary documents. That is, it replaces 2 documents at once (for example, an invoice and TORG-12). However, the UPD can only be used as a primary document (for example, TORG-12). To do this, the UPD does not fill in the lines established exclusively for the invoice:

- “To the payment and settlement document” (line 7);

- “Including the amount of excise tax” (column 6);

- “Tax rate” (column 7);

- “Digital code of the country of origin of the goods” (column 10);

- “Short name of the country of origin of the goods” (column 10a);

- “Customs declaration number” (column 11).

Please keep in mind that issuing a separate invoice for the shipment of goods (work, services), property rights is not required if a UPD has been drawn up.

List of transactions for which UPD can be used (see Table 1):

| Documented fact of economic life | In these cases, sellers/buyers are understood as |

| Facts of shipment of goods (any property, except real estate) without transportation with transfer of goods to the buyer (his authorized representative) Facts of shipment of goods with transportation and transfer of goods to the buyer (his authorized representative) or another person involved in the transportation of goods | Sellers and buyers are understood as directly named parties to economic relations, including if the sellers within the framework of a purchase and sale transaction are commission agents (agents, attorneys) |

| The fact of transfer of property rights | - the copyright holder transferring exclusive rights to the results of intellectual activity and (or) means of individualization, and the acquirer of these rights; — licensor and licensee; — copyright holder and user under a commercial concession agreement; - a creditor transferring rights (claims) on a reimbursable basis, and the person to whom the right (claims) is transferred |

| Facts of transfer of results of completed work | — contractor (subcontractor) and their customer (general contractor) under a contract; — performer of research works and their customer |

| Confirmation of the provision of services | — service provider and their customer; — financial agent and client; — trustee and trustee of management; — forwarder and client (when drawing up a document for the freight forwarder’s remuneration); — attorney and principal (when drawing up a document for the attorney’s remuneration); — commission agent and principal (when drawing up a document for remuneration to the commission agent); — agent and principal (when drawing up a document for the agent’s remuneration) |

| Confirmation of the facts of shipment (transfer) of goods (work, services) to the principal (principal) by the commission agent (agent) who purchased these goods (work, services) on his own behalf in the interests of the principal (principal) | Sellers are VAT taxpayers who sell goods (work, services) to a commission agent (agent) acting on their own behalf, which are purchased by the commission agent (agent) for the principal (principal). Buyers are principals (principals) for whom goods (work, services) were purchased by commission agents (agents) on their own behalf. |

UTD can also be used when the principal (principal, principal) ships goods to a commission agent (agent, attorney) for sale on his own behalf or on behalf of the principal (principal, principal). In this case, UTD is the primary document for the transfer of valuables to a commission agent (agent, attorney) for sale without transfer of ownership of them.

What is UPD used for?

It is not by chance that the universal transfer document got its name. It is called “universal” because it combines several documents. The purpose of such a merger is to reduce document flow. After all, for the same operation, 2 different documents were previously drawn up - a waybill (or act) + an invoice. The functions of these documents are different, but the data almost completely repeated each other.

Therefore, since 2013, a new document was introduced into circulation - UPD. It combines the functionality of a primary document and an invoice.

Naturally, in this case we are talking about those who apply the general taxation system. Organizations and individual entrepreneurs in special regimes are exempt from preparing invoices. Therefore, for them, the use of UTD is often not justified, although it is not prohibited .

What documents does it replace?

Above we talked about how to correctly sign the UPD for the buyer and seller. It remains to figure out what this file can be used instead.

The main purpose of this form is to be used instead of the whole set. It easily combines lines for invoices and various primary items. And the ability to create additional fields makes it truly versatile. In fact, this is a sales form with added columns about shipment and acceptance.

In addition, it is allowed to send it not only to the counterparty and the client. You can generate it and send it to the tax office. It is important not to forget to first record it in the accounting policy, and then do not change the template, use one form.

According to the law, each company can independently choose how to operate. That is, the company is able to interact in this way with only one counterparty or a group of them, or prepares similar files for everyone at its own discretion.

It is in order to determine the powers of a paper that it has a status. We have already talked about this above. We remind you that you should check whether the document is marked with 1 or 2.

It is especially important to use UPD for companies that provide services and at the same time sell goods or products. With its help, you can refuse to issue a certificate of completion of work in combination with the SF.

This was developed and proposed by Federal Tax Service specialists. It helps to significantly reduce the amount of documentation that needs to be accurately prepared and handed over to the client for signature. It is advisory in nature, so it is allowed to supplement it with other important lines for the company, so as not to create separate forms for 1-2 columns. Everything can be combined and a template can be organized once, which the enterprise will use when interacting with contractors.

This is a good file for entrepreneurs who are on a simplified basis. Although they do not create or issue invoices, they are allowed to use UTD. It is only advisable to carefully fill out all the lines, especially the status. There can only be the number “2”.

Details without which the UPD is invalid

As such, the primary document is intended to reflect the fact of economic life in the accounting accounts, as well as to record expenses incurred as expenses.

IMPORTANT!

Requirements for primary accounting are given in Federal Law dated December 6, 2011 No. 402-FZ on accounting.

An invoice is needed to confirm the right to deduct VAT. The description of this document is given in the Tax Code of the Russian Federation.

By combining both of these documents, the UPD also incorporates the requirements for them. Thus, the list of mandatory UPD details is quite extensive.

As you can see, in the UPD, the signatures of the parties are mandatory requirement.

Features of date indication

In the proposed UPD form, dates are entered in three different lines:

- on 1 – day of document execution;

- in 11 – carrying out a business transaction (shipment of products or presentation of an act of services provided);

- Line 16 indicates the day of acceptance.

If line 11 is left blank in the UPD, it is concluded that the document was issued on the day of shipment. If field 16 is empty, the dates of shipment and receipt of the goods are considered to coincide. Ideally, all three dates will coincide, but more often the first two lines - 1 and 11 - coincide. This means that the date of shipment of the product, i.e. line 11, is used to determine the taxable base for VAT.

Sometimes the UPD is drawn up before shipment. However, an invoice issued before a business transaction cannot be the basis for a refund. Therefore, the tax base is determined by the date of dispatch of the goods.

The law provides for the case when on the day of shipment it was not possible to draw up an STD, and it was issued later. Then the VAT base is also determined from the moment the goods are sent, that is, on line 11. In all of the above situations, the buyer has the right to claim a VAT deduction only after accepting the order (work or goods). This is the date in field 16. The sample UPD for individual entrepreneurs in the year differs in status and some blank fields.

Place of signatures in the UPD

The basis for the UPD form was the invoice form. In 2021, it has undergone minor changes.

IMPORTANT!

The UPD form was proposed in the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/96.

The current UPD form according to the Federal Tax Service can be downloaded for free from the link below:

Mandatory signatures in the UPD are placed in two blocks:

- invoice

- primary

The UPD can act not only as a combined document, but also as only a primary document . To differentiate, you should indicate the status in the upper left corner of the UPD:

- “1” – combined document;

- “2” – only primary (special regime officers can use UPD with this status).

Who signs the UPD on the buyer’s side is uniform, regardless of the status of the document. But the signatures in the UPD on the part of the seller may differ with the corresponding status.

The general rules for affixing signatures to the UPD are as follows:

- indicate the position of the signatory, his full name. and, in fact, the autograph itself;

- The use of a facsimile signature is unacceptable - both in the part related to the invoice and in the primary part.

When to use

It can be used when performing most acts of economic life. This may include sale, transfer of property rights, shipment, and other actions related to a change of organization. Most often it is filled out when:

- supplies, contract work;

- transactions in which the owners of property and products change;

- formalizing interactions with intermediaries.

In addition, the Federal Tax Service separately described some types of activities in the second appendix to the letter. This document is recommended, but participants in the process should remember where to sign the UPD for the buyer upon receipt, and for the seller upon transfer. Correct filling is extremely important.

Another nuance is that a legal entity can apply it at its own discretion. For example, it will switch to a similar document flow for only one type of transaction, and for the rest it will continue to use standard SF and other primary documents.

Buyer's signatures

As you know, there is no buyer's signature on the invoice. Therefore, the signer of the UTD must be determined by the same rules as the signer of the primary document.

The buyer must have 2 signatures:

Who is responsible and accepts the cargo is determined by the local acts of the organization. If this is the same person, then in line 18 it is enough to indicate the position and full name. There is no need to re-sign .

Required and optional fields

You do not have to fill in the following fields:

- Line 9 is optional, but the details of the transport documentation indicated in it will allow you to confirm the delivery of the goods.

- Line 12 is completed if there is additional information that needs to be shown.

- Field 17 indicates the occurrence of claims from the buyer during receipt of the order.

Lines 1a – 7 and the remaining fields of the invoice are intended for entering the details of the seller and buyer, data on payment documents, and the type of currency for settlements. They are filled out by organizations that pay VAT. The photo shows a sample of filling out the UTD for individual entrepreneurs with VAT.

Read more: How to organize a trade union in an organization step by step

In the section of the invoice with status 1, the signatures of the manager and chief accountant must be present; for individual entrepreneurs, details must be indicated. Sometimes a document may be endorsed by several persons. Status 2 does not require signatures in these fields.

Seller's signatures

On the seller’s side, there can be much more signatories if the UPD is compiled with status “1”. As we remember, status “1” indicates that the UPD acts as both an invoice and a primary document. Therefore, you must sign it:

- director and chief accountant of the organization (or other authorized persons) - regarding the invoice;

- the employee who shipped the goods (handed over the work, services) and the person responsible for registering the fact of ownership. worker’s life – in the primary part – lines 10 and 13.

Who these persons are is determined by the local acts of the organization. This is also true in terms of authorized persons who sign invoices.

It is not necessary to duplicate the same signature in all lines .

there is no need to put signatures on the part of the invoice .

A sample of how to sign a UPD can be viewed and downloaded for free at the following link:

SAMPLE OF SIGNATURE OF UPD

For what purposes may it be needed?

Based on this file, they claim a tax deduction, maintain correct accounting, and write off incurred costs. With its help, the time and effort of employees is seriously saved, and the number of necessary documents is reduced.

When selling or shipping goods, the company no longer collects a package of documentation from delivery notes, invoices and other transfer files. Everything is already written down on a single universal sheet.

In fact, this is the SF, supplemented with the necessary lines, in particular, about shipment and acceptance. When the paper is completed correctly, it can be sent to the tax office and contractors.

The main thing is that before switching to a new system, this should be fixed in the accounting policy. It is important to make all changes before the start of the new tax period.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

Electronic UPD

UPD in electronic form can be issued subject to certain conditions:

- Compiled in the format approved by order of the Federal Tax Service of Russia dated December 19, 2018 No. ММВ-7-15/820.

- An agreement on the exchange of UTD in electronic form has been reached and signed with the counterparty.

Signs an electronic document:

1. Selling side:

- enhanced qualified electronic signature of the manager (authorized person);

- electronic signature of the person responsible for the operation.

2. Acquiring party:

- reinforced by a qualified signature of the person responsible for registration of the fact of ownership. life;

- electronic signature of the person responsible for the operation.

Can an individual entrepreneur issue UPD on the simplified tax system?

As we have already said, entrepreneurs can submit UTD in different tax systems. The only difference is that special regime officers put the sign “2” in the document, meaning exemption from VAT. On the general taxation system, sign “1” is written in the left corner.

Thus, for an individual entrepreneur using the simplified tax system, the universal acceptance document will serve as a primary document containing information about the shipment of goods/services, without allocating VAT.

If errors are found in the completed form - the name of the product, unit of measurement, quantity are indicated incorrectly - the data is crossed out and the correct values are written on top. All adjustments made are certified by the signature of the official.

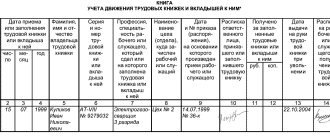

The UPD is registered in chronological order, according to the principle of any primary. To make it more informative, the form can be changed by adding new lines and columns. If you decide to use this document, do not forget to include it in the list of your document flow.

We recommend reading: Invoice from the supplier for individual entrepreneurs according to the simplified tax system.

Let's sum it up

The UPD is signed by both parties to the transaction - the seller (performer) and the buyer (customer). This is done by the persons responsible for conducting the transaction and for correctly reflecting the fact of economic life.

The UPD with status “1” is signed on the part of the seller by the manager and the chief accountant or authorized persons. If the signatory is the same person, there is no need to copy signatures on all lines: there is only one signature left on the document, and in the remaining fields you just need to put down your position and full name.

Read also

28.05.2020

Universal transfer document (UDD)

UPD is a universal transfer document . Its feature is its multifunctionality, thanks to which you can significantly reduce the volume of document flow.

What documents does the UPD replace?

On paper it can be used instead of:

- package “invoice + primary document”;

- primary document.

In electronic form - instead of:

- package “invoice + primary document”;

- primary document;

- invoices.

You choose what suits you best based on your business processes and document flow. UPD is the basis for tax and accounting, as stated in the letter of the Federal Tax Service dated 21.10.

2013 No. ММВ-20-3/ [email protected] The law does not oblige the use of a universal transfer document instead of a bill of lading, act or package of documents, including invoices and primary accounting documents.

When can UPD be used?

The UPD has been in effect since October 2013 , it was introduced and legalized by the Federal Tax Service letter dated October 21, 2013 No. ММВ-20-3/ [email protected] Since then, this document can be used.

UPD can be issued:

- supply of goods, services or works;

- transfer of property rights.

Paper UPD

Its form is also recommended by the letter of the Federal Tax Service dated October 21, 2013 No. ММВ-20-3/ [email protected]

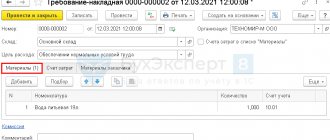

Sample of filling out the universal transfer document (UDD)

UPD (universal transfer document) sample filling - sheet 1

UPD (universal transfer document) sample filling - sheet 2

UPD forms in excel

The UPD status shows what its purpose is:

1 - invoice + act;

2 - primary document.

In status 1, the UPD is signed on the part of the seller by the employee responsible for signing invoices, invoices and acts. In status 2 - an employee who is responsible for signing primary documents.

In both statuses, on the buyer’s side, the UPD is signed by an authorized person who is responsible for processing the primary documents or transaction.

Electronic UPD

Valid from 05/07/2017, the way was opened for him by Order of the Federal Tax Service dated 03/24/2017 No. ММВ-7-15/ [email protected] It is used more widely than paper:

- as invoice (SChF);

- as a universal transfer document (SCFDOP);

- as a primary document, for example, an invoice or an act (DOP).

If this is an UPD (SCHFDOP) or an act (DOP), then the document requires the signature of the recipient, so it consists of two linked files: with the seller’s data and with the buyer’s data (clause 2.10 of Order of the Ministry of Finance No. 174n).

If it is an invoice (ICF), it does not require the recipient's signature, so it is one file of exchange with the seller's information.

XML file

If this is SSF

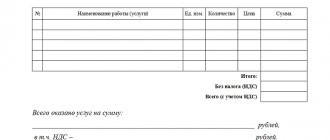

The fields that need to be filled in are defined in clause 5 of Art. 169 Tax Code of the Russian Federation:

- serial number of the document, day, month and year of its formation;

- name, address, tax identification number of both parties to the transaction;

- names and addresses of the sender and recipient of the cargo;

- number of the document that records the advance payment for upcoming deliveries;

- delivery contents, if possible - the unit of measurement of the contents;

- quantity of delivery contents in the units of measurement mentioned earlier; currency;

- price per unit of supply, excluding tax (exception - state regulated price, including tax);

- cost of supply or property rights excluding tax;

- excise tax where necessary;

- tax rate;

- tax for the buyer at current tax rates;

- delivery cost including tax;

- country of origin of the goods;

- Number of customs declaration;

- code of the type of goods according to the unified Commodity Nomenclature of Foreign Economic Activity of the Eurasian Economic Union for goods exported outside the Russian Federation to the territory of the Eurasian Economic Union.

A new mandatory field appears in the electronic format - the name of the entity that compiled the seller’s file. If the seller and the compiler are different entities, then the second fills out the field “The basis on which the economic entity is the compiler of the invoice exchange file (seller information).” This is important for outsourcers and agents.

If this is an additional

It is necessary to fill in the fields named in Art. 9 of Federal Law No. 402-FZ “On Accounting”:

- document's name;

- day, month, year of its creation;

- the economic entity that generated the document;

- essence of the transaction;

- amount or volume of delivery;

- Full name and signatures of responsible persons.

If this is UPD (SCHFDOP)

It must contain all the information listed above.

If it is used as DOP or SCHFDOP:

- May have two names. One is official regarding the fact of economic life. The second is what the counterparties agreed upon.

- There are special fields for information about the carrier.

- Requires a signature from the buyer by an authorized person who is responsible for processing the primary documents or transaction.

For all types of documents

- You can enter any additional information: type of transaction, information for the participant in the document flow, additions about the participants in the transaction.

- Information about transaction participants contains the following fields:

- OKPO code;

- structural subdivision;

- information for the document flow participant;

- for individual entrepreneurs - TIN, details of the state registration certificate, full name; for legal entities - name, tax identification number, checkpoint; for a foreign person who is not registered with the tax authorities - name and other information;

- address;

- contact information (phone number, e-mail);

- Bank details.

- The “Signatory” block includes four attributes: “Area of authority”, “Status”, “Base of authority (trust)”, “Base of authority (trust) of the organization”.

“Area of Authority” is required to be filled in, select the required one.

5 and 6 - if the UPD (SCHFDOP) is signed.

Areas of authority of the purchasing signatory

The “Status” field is required to be filled in. You can specify:

1 – seller’s employee; 2 - employee of the organization that compiled the seller’s file; 3 - employee of another authorized organization;

4 - authorized individual (including individual entrepreneur).

The information in the “Base of authority” field depends on the selected status. For 1, 2 and 3, these are “Job Responsibilities” or other basis of authority. For 4 - the basis of authority, for example, power of attorney, date, number.

The “Base of authority (trust)” field is filled in only if the signatory’s status is 3.

Be sure to indicate who signs the UPD : individual entrepreneur, individual entrepreneur or representative of the legal entity. For a private individual, only full name is required, for individual entrepreneurs - INN, full name, and for a representative of a legal entity - legal ID, position and full name.

There may be several signatories.

Source: //www.diadoc.ru/docs/upd

Compliance between UPD and invoice

Since the invoice form has changed since January 1, 2019, the UPD form also needs to be adjusted, including adding:

- Lines 8 to indicate the government contract identifier. Filled out by those who work under government contracts; the rest put a dash.

- Columns 1a to reflect the code of the type of goods exported to the EAEU countries. If there is no export to Belarus, Kazakhstan, Armenia, Kyrgyzstan, a dash is placed in the column.

- Indications that the UPD can be signed not only by an individual entrepreneur, but also by a person authorized by him.

Also in the form of the universal transfer document in column 11 you need to change the name to “Registration number of the customs declaration”.

You can adjust the invoice part of the UPD yourself. This is confirmed by the Federal Tax Service.

Download the updated UPD form in Word the link , and the form in Excel at the link.

How to properly draw up a document

Appendixes and Letters of the Federal Tax Service of Russia dated October 21, 2013 MMV-20-3/96 describe the form of universal transfer documentation and the rules for its execution, respectively. According to these applications, the UPD is filled out as follows.

| Field no. | Filling rules |

| (1)-(7), columns 1-11 | If the status is 1, the data is processed in accordance with Decree of the Government of the Russian Federation No. 1137 of December 26, 2011. With status 2, the documentation may not include (7), columns 6, 7, 10-11 |

| Count A | Filling out is optional and is done for ease of searching. |

| Count B | Not required to be filled out, but if filled in, indicate the article number and type of activity |

| (8) | Details of the operation performed |

| (9) | Details of the accompanying documentation are not required to be filled out. |

| (10) | The employee who performed the transaction is indicated. If this is the same person who endorsed the invoice, it is permissible not to fill out |

| (11) | The date of the transaction is not required. |

| (12) | Not required to be filled out. This field usually contains information about passports and certificates for the product |

| (13) | The responsible employee of the supplier is indicated. You don’t have to sign if it is also listed in (10) |

| (14) | If the document requires a stamp, it is not necessary to complete it. |

| (15) | The person who accepted the goods or services/work is indicated |

| (16) | The date of the agreement is not required. |

| (17) | Not required to be filled out. The buyer can indicate in the claim field on his part, as well as data on integral attachments |

| (18) | Filled out by the buyer's employee. If there is a seal, it is not issued |

| (19) | If there is a seal, it is not issued |

| M.P. | It is not necessary to fill in, if all the necessary data is provided |

Requirements

Since the UPD can be filled out both as a primary document and as a document on the basis of which a VAT deduction can be obtained, the requirements for registration are somewhat different.

Let's consider the requirements for UTD used within the framework of primary documentation. Article 9 No. 402-FZ equates to the mandatory details of primary documents:

- Name. In relation to UPD, this is status.

- Date of registration.

- Name of the counterparty who compiled the UTD. Since it is two-sided, it is necessary to indicate both sides of the transaction.

- The content of the fact of economic activity, which is characterized by information about counterparties, data on the subject of the agreement, clarifications about the time and circumstances of the transaction.

- How is the subject of the transaction measured and what is the price?

- Positions of the employees who performed the transaction or those who were responsible for its execution.

- Signatures of employees, indicating the data necessary for their identification.

When drawing up the UTD required to deduct value added tax, you should adhere to the requirements of the Tax Code of the Russian Federation. Article 169 obliges the following data to be indicated when filling out documentation:

- number and date of compilation;

- details of the seller and buyer, sender and recipient (name, address, TIN);

- name of the subject of the transaction, what it is measured in;

- quantity of products shipped;

- monetary measurements of products (per unit, total without VAT, total with VAT);

- country of origin.

It is worth noting that all the requirements specified above can be met, since the appropriate fields for filling out information in the UPD are available.