An organization can be liquidated voluntarily by a unanimous decision of its participants. The reasons for cessation of activity may be different, but liquidation of an enterprise is a rather lengthy and not simple procedure that raises many questions. To avoid delays, most often associated with the refusal of authorized bodies to register due to errors in documents, a special law firm is usually hired. Of course, this requires additional financial expenses, which in some situations is an unaffordable luxury. In the PPT.ru material, we will consider in detail the procedure for filling out the main documents for submission to the registration authority in the event of independent liquidation of an organization by the owners.

Liquidation commission

After the decision to terminate the activities of the organization , the founders (participants) appoint a liquidation commission (liquidator) and establish the procedure and timing for carrying out the necessary measures in this regard.

(Clause 3 of Article 62 of the Civil Code of the Russian Federation). From this moment on, the powers to manage the company’s affairs are transferred to the liquidation commission. (clause 4 of article 62 of the Civil Code of the Russian Federation). The next step is the publication of a notice about the liquidation of the company, the procedure and deadline for filing creditor claims in the journal “Bulletin of State Registration”. The period for submitting claims by creditors cannot be less than two months from the date of publication of the notice of liquidation (Clause 1 of Article 63 of the Civil Code of the Russian Federation). After the deadline for submitting claims by creditors, the company's employees must fill out a special form of financial statements - an interim liquidation balance sheet.

Regulatory regulation

The main regulatory documents governing the procedure for filling out this form:

- Civil Code of the Russian Federation, in particular - Federal Law No. 51 of November 30, 1994, with amendments and additions that came into force on January 1, 2021. It states that after settlements with creditors have been made, the liquidation commission will draw up a balance sheet approved by the founders.

- Reference information “Forms of budget reporting of government institutions...”.

- Liquidation balance sheet form for Limited Liability Companies P16001, which contains a template for filling out the document.

- Federal Law “On Limited Liability Companies” No. 14FZ of February 8, 1998.

This is not the entire list of documents regulating the norms and procedures for drawing up the liquidation balance sheet. However, the above papers are basic and are used in practice most often.

Notice of liquidation of a legal entity form P15001

Until July 2013, for each listed action, a separate document had to be filled out and submitted to the registration service of the Federal Tax Service:

- Р15001 (notification of a decision to liquidate a legal entity),

- R15002 (notification of the formation of a liquidation commission, the appointment of a liquidator (bankruptcy trustee)),

- R15003 (on the preparation of an interim liquidation balance sheet).

However, today each of the three actions is accompanied by filling out and submitting to the registration authority only one form P15001 “Notice of liquidation of a legal entity.”

Where and when should I submit form P16001?

At the final stage of the company liquidation procedure, namely after all settlements with creditors, closing bank accounts and dividing the remaining property between participants, the owner of the company must notify the registration authority that the company must be excluded from the Unified State Register of Legal Entities. It is for these purposes that an application in form P16001 is used. It should be taken into account that the document can be submitted only after the liquidation balance sheet has been approved and all other procedures have been completed.

A notice of liquidation of a legal entity, a sample of which can be found below, is submitted to the tax service at the place of registration of the company simultaneously with the liquidation balance sheet, the decision on its approval and a receipt for the transfer of state duty. The inspector of the Federal Tax Service, who accepted the package of documents, will issue the applicant a receipt for receipt of the documents. After 5 working days, the person who submitted the notification in form P16001 must again come to the Federal Tax Service with a passport and receipt. Here he will be given a record sheet from the Unified State Register of Legal Entities, indicating the liquidation of the company.

You can also submit documents by mail (with a list of attachments) or electronically using the service on the]]> website of the Federal Tax Service]]>.

Requirements for filling out form P15001: step-by-step filling

Since forms P15001 and P16001 are the main ones for registering liquidation, we will consider the basic requirements for filling them out, which are established by Order of the Federal Tax Service of Russia N MMV-7-6 / [email protected] General requirements for filling out both forms are contained in Section I of such a document as “ General requirements for the preparation of submitted documents.” In the same appendix to the order of the Federal Tax Service of the Russian Federation there is a sample of filling out forms P15001 and P16001 line by line.

So, when filling out these forms, legal entities must:

- black ink should be used both when filling out manually and when printing on a printer);

- it is necessary to write only in capital letters in Courier New font 18 points high, each of which, as well as quotation marks, dashes, hyphens and numbers are placed in a separate cell;

- do not allow corrections or additions, as they are prohibited;

- do not allow hyphens, the word that does not fit must be continued to be written on the next line (if it ends in the last cell of the first line), the next line begins with an empty cell (space between words);

- do not print or attach blank sheets to notifications;

- When printing an application on a printer, changing the location of fields and sizes of characters is not allowed;

- Do not use double-sided printing of completed forms, as it is prohibited.

Requirements for filling out form P15001 are contained in section IX of the Requirements. This form includes a first page consisting of two sections, as well as two separate sheets: sheet A and sheet B.

Fill out section 2 of form P15001

In this sheet, you should put a “tick” (“V” sign) in the relevant points in connection with which a notification is being submitted:

- if a decision has been made to liquidate a legal entity, then put a tick in clause 2.1, this field also indicates the date of its adoption;

- if a commission has been formed and a liquidator has been appointed, then put a tick in clause 2.2.;

- if an interim liquidation balance sheet has been drawn up, then check the box in clause 2.3;

- if a decision is made to cancel a previously made decision to terminate activities, then put a tick in clause 2.4.

The requirements do not contain a ban on filling out several items at the same time. Therefore, you can, for example, check two boxes: about making a decision to terminate work (clause 2.1.) and forming a liquidation commission (clause 2.2.).

If a decision is made to continue the work of the company (clause 2.4.), then the decision to cancel the decision to liquidate the legal entity must be attached to the notification.

The section “For official marks of the registering authority” is not filled out.

How to fill out the application form P15016

The application can be filled out manually or on a computer. All text values are written in capital letters. Completed pages are numbered consecutively. Detailed general rules for filling out an application are given in paragraph 4-24 of the Requirements for filling out.

Form P15016 includes:

- Title page.

Here you must indicate the OGRN and TIN of the legal entity, as well as the reason code for which notification P15016 is generated. Based on this code, it is determined whether sheet A should be included in the document.

- Leaf A.

It is mandatory to fill out sheet A in application P15016:

- if the Title Page in clause 2 contains code 2 (formation of a liquidation commission, appointment of a liquidator) or 3 (making a decision on liquidation);

- in the event that code 6 is entered, except for an LLC operating on the basis of a standard charter, which provides that each participant in the LLC is its sole executive body (director) and independently acts on its behalf (or that each participant, together with the other participants of the company, exercises the powers of such body (director)).

Let us note that one of the innovations provided for by the form is the possibility of its use at all stages of liquidation. For example, to reflect the extension of the liquidation period of an LLC (indicating code 5 on the Title Page).

If the code is 1, 3 or 5, then the next field indicates the period of liquidation of the company.

Sheet A consists of two pages. The sheet records information about persons who have the right to act on behalf of the company without a power of attorney. Since on one copy of Sheet A it is possible to indicate data for only one individual or legal entity, if it is required to indicate data for several individuals (legal entities), several Sheets A are included in Form P15016.

The sheet (on one or more of its copies) may be marked with a note restricting access to information about a particular specified individual or legal entity.

- Sheet B is filled out if a mark(s) are placed on sheet A regarding access restrictions in relation to an individual or legal entity.

Clause 16 of the Requirements provides a regulatory framework that defines the grounds for appropriate restrictions on access to information about legal entities or citizens specified in clauses 1, 2, 3 of sheet A: Law of 03.08.2018 No. 290-FZ and Decree of the Government of Russia dated 06.06.2019 No. 729. For example, the reason for restricting access to information about a legal entity in the Unified State Register of Legal Entities may be the introduction of international sanctions against it.

- Sheet B reflects information about the individual applicant.

Here they indicate information about an individual representing an organization without a power of attorney (for example, about a director), or on the basis of the authority provided for by federal law or an act of a state or municipal body. Information on Sheets A and B about the same individual who submits and fills out P15016 may thus be duplicated (in this case, it would be a good idea to make sure that they are the same in different sheets so that there are no errors). It is possible to include several sheets B in the application, because There may be several corresponding authorized persons.

On the first page the passport details of the applicant are indicated (clause 2), and on the second page of sheet B in clause 3, they confirm the accuracy of the information specified in the application, the fact that settlements with creditors have been completed, and also certify that settlements with employees in connection with the liquidation of the company have been carried out. This is also one of the innovations in filling out “liquidation” documentation for the Federal Tax Service.

The telephone number and e-mail of the applicant are also indicated here, to which the documentation from the Federal Tax Service is sent electronically. If you enter code 1 in the “issue on paper” field, the Federal Tax Service, having processed the application under consideration, will issue response documentation to the applicant on paper.

Next, the applicant personally enters his last name, first name and patronymic, and puts a personal signature. If the application is sent to the Federal Tax Service electronically, these lines are not filled in, but the applicant will need an enhanced qualified electronic signature.

Clause 4 of sheet B is filled out by a notary or other authorized person who has witnessed the personal signature of the applicant, and his TIN is indicated (subclause 4 of clause 106 of the Requirements approved by the order).

Below is the completed form P15016, a sample document is also available at the link below.

Fill out sheet B

The first page and sheet B are filled out if clauses 2.1 (decision on liquidation), 2.3 (interim liquidation balance sheet) or 2.4 are noted in the application. (decision to cancel the liquidation decision). The first page, sheets A and B should be drawn up when appointing a commission (clause 2.2).

What do we fill out in sheet A “Information on the formation of the liquidation commission/appointment of a liquidator”? In section 1, “1” is entered if a commission is appointed, and “2” if a liquidator is appointed. Section 2 indicates the date of formation of the liquidation commission or appointment of a liquidator. Section 3 in Russian indicates the last name, first name and patronymic (if any) of the head of the liquidation commission or the liquidator. If he has a TIN, we indicate it in section 4. Section 5 indicates the date and place of birth of the liquidator, the telephone number by which he can be contacted.

How to fill out a document

Filling out form P16001 during liquidation should not cause any particular difficulties.

The title page must include the following information:

- OGRN codes, TIN codes of the legal entity being liquidated;

- full name of the organization being liquidated;

- date of publication of the message about the decision on liquidation in the journal “Bulletin of State Registration”.

Sheet “A” consists of four sections; it must contain information about the applicant. In section No. 1, in a special cell, indicate who the applicant is: put “1” if he is the head of the liquidation commission, “2” - the liquidator (a sample form P16001 is given below).

Section No. 2 indicates the following data:

- FULL NAME. applicant (in full);

- TIN;

- date of birth;

- Place of Birth;

- type of identification document (passport, etc.);

- series and number, by whom and when it was issued, code of the unit that issued the document;

- address of residence (zip code, city, street, house and apartment number);

- contact details of the applicant (telephone, E-mail).

In section No. 3, the applicant personally indicates his full name. and puts his signature. It is necessary to note the desired method of obtaining an extract from the Unified State Register of Legal Entities confirming the fact of liquidation of the legal entity (number “1” - issue to the applicant, “2” - to the applicant or authorized person, “3” - send by mail).

Section No. 4 provides information about the notary who certified this application.

Read also: How to close an individual entrepreneur in 2021

Form P16001 (new) for 2018-19 and a sample of its completion is available for download below.

Fill out sheet B

In sheet B “Information about the applicant” in section 1, we indicate with a number who the applicant is:

- “1” - for the founder (participant) - an individual;

- “2” - for the founder (participant) - a legal entity;

- “3” - for the body that made the decision on liquidation;

- “4” - for the head of the liquidation commission.

It is important to correctly determine in what cases and which of the entities listed above can act as an applicant. As the Federal Tax Service of Russia explains in a letter dated October 15, 2014 N SA-4-14/ [email protected] , when submitting form P15001 to the registration authority in connection with a decision to liquidate a legal entity, the applicants are the founders (participants) of the legal entity or the body that adopted decision to liquidate the organization. If the document is sent in connection with the decision to liquidate the company and the formation of a liquidation commission (appointment of a liquidator), as well as in connection with the preparation of an interim liquidation balance sheet, then the applicant is the founders (participants) of the organization or the body itself that made the corresponding decision. The head of the liquidation commission (liquidator) can also act as an applicant.

Sections 2-5 should be completed depending on who the applicant is. Section 6 must be completed by hand in the presence of a notary. Next, you should indicate the most acceptable way to obtain a document confirming the fact of making an entry in the Unified State Register of Legal Entities, or a decision to refuse state registration (the document must be delivered personally to the applicant, to a person acting on the basis of a power of attorney, or by mail). Section 7 is filled out by the notary, indicating his status and TIN. You can download the form p15001 2021 for free, a sample of how to fill it out, at the end of the article.

NEWFORMES.RF

Attention! From November 25, 2020, when registering legal entities and individual entrepreneurs, new application forms are used, available at the link.

Liquidation of an LLC is a more complex, expensive and time-consuming process than registering an LLC or closing an individual entrepreneur. It is no secret that in addition to the liquidation of a legal entity by the official method (voluntary liquidation), there are also alternative methods of liquidation. From this article you will learn in the most accessible form how to liquidate a debt-free LLC yourself officially, without resorting to the services of law firms, which will save you up to 40,000 rubles, depending on the region.

Form P15001 is intended for notification of liquidation of a legal entity.

—

— official requirements for issuing a notification in the form P15001 2021

Form P16001 is intended for state registration of a legal entity in connection with its liquidation.

—

— official requirements for filling out an application in form P16001 2021

— prepare a set of documents for LLC liquidation online

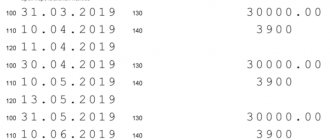

Typical costs for liquidating an LLC in Moscow:

— state duty for liquidation of an LLC – 800 rubles.

— legal services for preparing and submitting documents – from 15,000 to 30,000 rubles.

— notarization of 2 notifications Р15001 and application Р16001 – from 3000 to 4500 rubles.

— notarized power of attorney for a representative – from 1000 to 1500 rubles.

— publication of a message about the liquidation of the LLC in the journal “Bulletin of State Registration” — 2300 rubles.

The procedure for voluntary liquidation of an LLC takes at least three months and consists of the following four main stages:

Making a decision to liquidate an LLC and notifying about the start of the LLC liquidation procedure

The founders (participants) of the LLC at the general meeting make a decision on the liquidation of the LLC and the formation of a liquidation commission or the appointment of a liquidator. The decision on liquidation is made by the participants unanimously (paragraph 2, paragraph 8, article 37 of the Federal Law “On LLC”). Within 3 working days after the date of the decision to liquidate the LLC, you must submit to the tax office at the location of the LLC a notarized Notice of Liquidation of a Legal Entity in Form P15001. Attached to it is a decision (protocol) on the liquidation of the LLC. The applicant throughout the entire liquidation procedure is the head of the liquidation commission or the liquidator of the LLC.

Publication of a notice about the liquidation of an LLC in the journal “Bulletin of State Registration”

After entering information into the Unified State Register of Legal Entities about the beginning of the liquidation procedure, it is necessary to publish in the journal “Bulletin of State Registration” a message about the liquidation of the LLC, as well as about the procedure and deadline for filing claims by creditors. Publication in the Bulletin before filing a notice of the commencement of liquidation (and simultaneously with it) is not permitted. The company is obliged to notify in writing all creditors known at the time of making the decision to liquidate the LLC about the planned termination of activities.

Notification on the preparation of an interim liquidation balance sheet of an LLC

No earlier than 2 months after the publication of information about the beginning of the liquidation procedure of the LLC in the journal "Bulletin of State Registration", the accounting department draws up an interim liquidation balance sheet, approved by the general meeting of participants (the only participant), which is recommended to be submitted for state registration along with a notice of liquidation of the legal entity by form P15001. There is no direct obligation to submit the PLB itself to the tax authorities, only a notification of its preparation and the corresponding decision of the OSU is sufficient, however, many tax authorities continue to require it.

Attention!

A notification about the preparation of an interim liquidation balance sheet cannot be submitted to the registration authority if any legal proceedings have been initiated and not completed in relation to the LLC, which is in the process of liquidation, or an on-site tax audit has been initiated and not completed.

After filing the interim liquidation balance sheet, it is necessary to make settlements with creditors, sell property, distribute proceeds after settlements and sales between participants (if any), and close bank accounts.

Submission of the liquidation balance sheet of the LLC and the application for liquidation of the LLC

After entering into the Unified State Register of Legal Entities information on the preparation of an interim liquidation balance sheet, the accounting department draws up a liquidation balance sheet, approved by the general meeting of participants (single participant), which must be submitted along with an application for state registration of a legal entity in connection with its liquidation in form P16001, not forgetting to attach a receipt for payment of the state duty for the liquidation of the LLC in the amount of 800 rubles.

Necessary documents for notarization of applications for LLC liquidation

When liquidating an LLC, it is necessary to notarize the applicant’s signature on forms P15001 and P16001. In addition to the documents indicated above, the notary will require:

1. Extract from the Unified State Register of Legal Entities (fresh);

2. Charter of the LLC;

3. OGRN certificate;

4. TIN certificate;

5. Decision (minutes) on the appointment of a manager (general director of the LLC).

Attention!

— As a rule, the originals of the above documents are more than enough. You can clarify the list of documents required for liquidation of an LLC directly from your notary.

— Before going to the notary, be sure to order an extract from the Unified State Register of Legal Entities. How to order an extract from the Unified State Register of Legal Entities yourself, read the article Obtaining an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs.

Liquidation of LLC 2021 step-by-step instructions:

Stage 1 - Making a decision to liquidate the LLC and notifying the start of the LLC liquidation procedure

1.

We prepare a protocol on the liquidation of the LLC and the appointment of the liquidator of the LLC. If there is only one participant, then a decision on the liquidation of the LLC and the appointment of a liquidator is prepared accordingly.

2.

Download the current form for notification of liquidation of a legal entity and fill it out. A sample notice of liquidation of LLC 2021 in form P15001 with explanations will help you with this. To view the sample, you will need a free PDF reader, the latest version of which can be downloaded from the official Adobe Reader website.

3.

The liquidator of the LLC goes to the notary to certify his signature on the application P15001, taking with him his passport and the necessary package of LLC documents, which was mentioned above.

4.

Next, the liquidator of the LLC goes to the tax office, taking his passport with him, and submits application P15001 - 1 piece, decision (protocol) on the liquidation of the LLC - 1 piece. to the inspector at the registration window, after which he receives, with the inspector’s mark, a receipt for receipt of the documents submitted by the applicant to the registration authority.

You can track the state of readiness of documents using the service “Information about legal entities and individual entrepreneurs in respect of which documents for state registration have been submitted.”

5.

After a week (5 working days), the liquidator of the LLC goes with a passport and a receipt to the tax office and receives a record sheet of the Unified State Register of Legal Entities (USRLE record sheet), indicating that the LLC is in the process of liquidation.

Stage 2 - Publication of a message about the liquidation of the LLC in the journal “Bulletin of State Registration”

1.

We are submitting an application for publication of a notice of the liquidation of the LLC in the journal “Bulletin of State Registration”. Detailed instructions for filling out, paying and submitting an application for publication in the article - Publication of a message about the liquidation of a legal entity in the journal “Bulletin of State Registration”.

Stage 3 - Notification of the preparation of the interim liquidation balance sheet of the LLC

1.

2 months after the publication of the notice of liquidation of the LLC, we prepare a protocol (decision) on approval of the interim liquidation balance sheet of the LLC.

2.

We fill out the form for notification of liquidation of a legal entity in connection with the preparation of an interim liquidation balance sheet -. A sample notification on the preparation of the interim liquidation balance sheet of LLC 2021 in form P15001 with explanations will help you with this.

3.

The liquidator of the LLC goes to the notary to certify his signature on the application P15001, taking with him his passport and the necessary package of LLC documents, which was mentioned above.

4.

Next, the liquidator of the LLC goes to the tax office, taking his passport with him, and submits an application P15001 - 1 piece, a decision (protocol) on approval of the interim liquidation balance sheet - 1 piece, an interim liquidation balance sheet of the LLC - 3 pieces. to the inspector at the registration window, after which he receives, with the inspector’s mark, a receipt for receipt of the documents submitted by the applicant to the registration authority.

5.

After a week (5 working days), the liquidator of the LLC goes with a passport and a receipt to the tax office and receives a record sheet of the Unified State Register of Legal Entities (USRLE record sheet), indicating the registration of the interim liquidation balance sheet of the LLC.

Stage 4 - Submission of the liquidation balance sheet of the LLC and the application for liquidation of the LLC

1.

We prepare a protocol (decision) on approval of the liquidation balance sheet of the LLC.

2.

Download the current application form for state registration of a legal entity in connection with its liquidation and fill it out. A sample application for liquidation of LLC 2021 in form P16001 with explanations will help you with this.

3.

The liquidator of the LLC goes to the notary to certify his signature on the application P16001, taking with him his passport and the necessary package of LLC documents, which was mentioned above.

4.

We pay the state fee for the liquidation of a legal entity. The Federal Tax Service service for payment of state duty will help you in generating a receipt for payment of the state duty; we print it out and pay (800 rubles) without commission at any bank. Payment is made by the liquidator of the LLC. We attach the paid receipt to the top edge of the first sheet of application P16001.

5.

Next, the liquidator of the LLC goes to the tax office, taking his passport with him, and submits application P16001 - 1 piece, a decision (protocol) on approval of the liquidation balance sheet - 1 piece, a receipt of paid state duty - 1 piece, liquidation balance sheet of the LLC - 3 pieces. to the inspector at the registration window, after which he receives, with the inspector’s mark, a receipt for receipt of the documents submitted by the applicant to the registration authority.

6.

After a week (5 working days), the liquidator of the LLC goes with a passport and a receipt to the tax office and receives a record sheet of the Unified State Register of Legal Entities (USRLE record sheet), indicating the liquidation of the LLC.

Information required when filling out forms P15001 and P16001:

— Find out your/someone else’s TIN from their passport

— Find out the postal code by address

— Codes of subjects of the Russian Federation

— Abbreviations for the names of address objects

— Document type codes

Prepare a set of documents for LLC liquidation online

Do you want to voluntarily liquidate your LLC, but you don’t want to understand the intricacies of filling out forms and are afraid of being refused?

Use the online document preparation service that will help you prepare documents for LLC liquidation without errors! Our lawyers will check the prepared documents and provide the necessary advice and answers to any question. Leave your comments and suggestions for improving this article in the comments.

Requirements for filling out form P16001

Form P16001 is submitted when the liquidation balance sheet is compiled. Requirements for filling out the P16001 form are contained in section X of the Requirements. This is a simpler form, consisting of one page and sheet A for the applicant (four pages).

On the first page, information about the liquidated organization is entered according to data from the Unified State Register of Legal Entities. Section 2 indicates the date of publication of the notice of the decision on liquidation in the press. In sheet A we put the number corresponding to the applicant. Information about it is filled out according to rules similar to those indicated above for form P15001. Section 3 is completed by hand in black ink and in the presence of a notary.

Correctly filling out notifications P15001 and P16001 will significantly shorten the period for registering the liquidation of an organization. The ability to fill out such forms yourself will naturally reduce the financial costs of the organization. Careful reading of the material presented and the documents linked to it will help resolve both of these difficulties. You can download form P15001 2021 for free and a sample of filling out its lines at the end of this material. This is Appendix No. 20 to the order of the Federal Tax Service of Russia dated January 25, 2012 N ММВ-7-6/ [email protected] “On approval of forms and requirements for the execution of documents submitted to the registration authority for state registration of legal entities, individual entrepreneurs and peasant (farmer) farms" (registered with the Ministry of Justice of Russia on May 14, 2012 N 24139).

Р15001 2021 in excel

Form P15001 2021 in .pdf format

Form P16001 2021 in .pdf format

Completion of the liquidation procedure

The final stage of liquidation is the formation and approval of an interim (liquidation) balance sheet, which indicates the shares of the remaining property of each of the founders. Next, you need to notify the registration authority about the completion of the procedure: fill out the form P16001, attach the liquidation balance sheet to it and pay the amount of the state fee.

Document 16001 includes a title page and page “A” for the applicant - the head of the liquidation group or the sole liquidator.

The main sheet should reflect:

- information about the company that is going through the final stage of the liquidation process (clearly in accordance with the Unified State Register of Legal Entities);

- the date of publication of the decision on liquidation adopted by the participants in the official publication.

(Size: 107.5 KiB | Downloads: 24,139) (Size: 162.0 KiB | Downloads: 36,258) (Size: 172.5 KiB | Downloads: 40,790) (Size: 113.0 KiB | Downloads: 22 118)