Organizations offering insurance services are required to maintain accounting records. Their activities are controlled by the insurance market department that exists under the Central Bank.

Question: How are the costs of insuring property (including leasing and rented property) reflected in accounting and tax accounting? The organization entered into a property insurance contract for a period of 12 months (365 days) and paid a lump sum insurance premium in the amount of 146,000 rubles. The insurance contract is valid from March 1 of the current year (the date of payment of the insurance premium) to February 28 of the next year inclusive. For tax purposes, income and expenses are accounted for on an accrual basis. Reporting periods for income tax are the first quarter, half a year, and nine months of the calendar year. Interim financial statements are prepared on the last day of each quarter. View answer

Primary documents

Primary documentation is the papers on the basis of which accounting is carried out. Primary information for an insurance organization:

- Founding papers: charter, license.

- Insurance contracts.

- Papers confirming the occurrence of the event (application, insurance certificate).

- Papers confirming coverage of losses.

- Tax accounting registers.

The insurance company needs to approve the document flow schedule and document forms that are necessary for accounting needs.

the insurance premium reflected in accounting when terminating a compulsory motor liability insurance contract ?

Accounting for the costs of purchasing an OSAGO and CASCO policy

Enterprises in their economic life can use various vehicles, in particular cars.

After purchasing a car, the organization must first enter into a compulsory civil liability insurance agreement (MTPL), since liability insurance for car owners is mandatory (clauses 1, 2, article 4 of the Federal Law of April 25, 2002 No. 40-FZ “On compulsory civil liability insurance of vehicle owners funds"), and the received MTPL policy is necessary for registering a vehicle with the traffic police, its technical inspection and operation (clause 2 of article 19, clause 3 of article 16 of the Federal Law of December 10, 1995 No. 196-FZ “On Road Traffic Safety” ; clauses 1, 3 of Article 32 of the Federal Law of April 25, 2002 No. 40-FZ).

Payments under compulsory motor liability insurance may not fully cover the damage that may be caused to a car during an accident (traffic accident). In addition, only the injured party is compensated for losses. Therefore, organizations, in addition to compulsory motor liability insurance, enter into voluntary property insurance contracts for the vehicle itself against theft and possible damage as a result of an accident, illegal actions of third parties and damage due to other risks. In auto insurance practice, such contracts are called CASCO contracts (from the Spanish casco - “hull”, “hull”).

OSAGO and CASCO agreements are usually concluded for one year and come into force from the moment the policy is paid for. In accounting, the costs of purchasing MTPL and CASCO policies are recognized as expenses for ordinary activities (clause 5 of PBU 10/99).

At the same time, according to the interpretation of P112 “On the participation of an organization in insurance contracts as an insured”, adopted by the Accounting Development Fund “National non-state accounting regulator “Accounting Methodological Center”” (see https://bmcenter.ru/Files/P112), the purchase of a policy does not result in the occurrence of future expenses in the accounting records of the insured organization.

Payment for the policy by the policyholder is accounted for as an advance payment for services (advances for services), which is recognized as an expense of the organization as insurance services are consumed, i.e., as the insurance period expires. The specified prepayment is reflected in the account for settlements with insurers. Before the expiration of the paid insurance period, the corresponding amounts are reflected in the balance sheet depending on their materiality under an independent item or are included in the aggregate item “Other current assets” or “Other non-current assets” (if paid for a period of more than a year).

To account for settlements with insurers for prepayment amounts in the interpretation of P112, it is recommended to use account 76 “Settlements with various debtors and creditors” subaccount 76-1 “Settlements for property and personal insurance”.

In tax accounting, the cost of an MTPL policy is taken into account when taxing profits within the limits of insurance tariffs (Clause 1, Article 263 of the Tax Code of the Russian Federation).

Costs for CASCO insurance are recognized when taxing profits in the amount of actual costs (subclause 1, clause 1, clause 3, article 263 of the Tax Code of the Russian Federation).

At the same time, insurance premiums under MTPL and CASCO contracts are recognized evenly during the term of the contract - in proportion to the number of calendar days in the reporting period (clause 6 of Article 262 of the Tax Code of the Russian Federation). The costs of paying premiums are included in other expenses associated with production and (or) sales (clauses 2 and 3 of Article 263 of the Tax Code of the Russian Federation).

To account for prepayment amounts under MTPL and CASCO contracts in 1C: Accounting 8, subaccount 76.01.9 “Payments (contributions) for other types of insurance” is intended. Analytical accounting for Subconto 2 in subaccount 76.01.9 is carried out according to items of expenses of future periods, which allows automatic write-off of the amounts recorded in this subaccount according to certain rules, in particular, evenly - in proportion to the number of calendar days in the reporting period.

We will consider the procedure for accounting for the costs of purchasing MTPL and CASCO policies in 1C: Accounting 8 using the following example.

Example1

| In connection with the purchase of a car, the organization insured its civil liability on October 1, 2012, and also issued a CASCO agreement. The cost of the MTPL policy was 6,000 rubles, CASCO - 60,000 rubles. The amount of insurance premiums for compulsory motor liability insurance was transferred on October 1, 2012. The CASCO agreement provides for payment of the insurance premium in two stages: until October 2, 2012 and until April 1, 2013. Payment of contributions for the first 6 months was made on October 1, 2012. The insurance period under MTPL and CASCO contracts is from October 1, 2012 to September 30, 2013. |

Let's consider the reflection of these events in the organization's accounting.

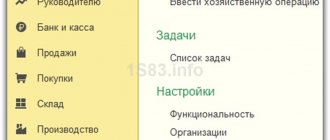

1) The transfer of the insurance premium is reflected in the documents Write-off from the current account for the type of transaction Other write-off:

from 01.10.2012 - for the amount of insurance premiums under compulsory motor liability insurance and the first payment under the CASCO agreement;

dated March 30, 2013 - for the amount of the second payment under the CASCO agreement.

In the Payment Decoding section of the document Write-off from the current account form, the following is indicated:

- debit account 76.01.9 “Payments (contributions) for other types of insurance”;

- analytics for the subconto Counterparties and Deferred Expenses.

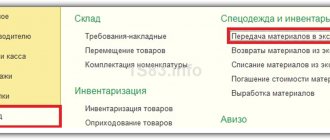

The description of the deferred items in the reference book Deferred Expenses indicates (Fig. 1):

- Type of RBP - Other;

- Method of recognizing expenses - By calendar days;

- Amount - the amount of the transferred insurance premium;

- Start of write-off and End of write-off - paid insurance period;

- Account and Subconto - account and analytics to which insurance premiums are written off;

- Type of asset - “Other current assets”.

Rice. 1

2) The monthly inclusion of paid insurance premiums in the expenses of the current period in terms of the insurer’s services consumed is carried out when performing the routine operation of closing the month Write-off of future expenses.

To document the amounts included in expenses, it is recommended to create and print out on paper a Statement of Calculation for the transaction (Fig. 2), compiled separately “according to accounting data” and “according to tax accounting data.”

Rice. 2

Accounting for payments under basic agreements with policyholders

The organization makes insurance payments when insured events occur. They may relate to various areas:

- Property (payments are made in cases of theft, flooding and other damage).

- Medicine (payments in case of illness).

- Auto (payments in case of car theft).

How is accounting carried out when insuring the leased asset by the lessee (sublessee)?

Insurance payments are formed from the totality of all proceeds from people who have entered into an insurance agreement with the organization. Payments are recorded on account 22. Information about them is collected in registers. Analytical accounting is carried out in the context of agreement forms and policyholders. Information is recorded in accounting on the date of occurrence of insurance rights.

Accounting for repair costs and damage compensation in case of an accident

During operation, the organization's vehicle may be damaged in an accident. Damage caused to the car in this case can be compensated:

- within the framework of the MTPL agreement by the insurance company of the person responsible for the accident, if the organization did not purchase a CASCO insurance policy and the accident was not caused by its employee;

- within the framework of the CASCO agreement, regardless of who is found to be at fault - an employee of the organization or the owner of another car.

At the same time, under both the MTPL agreement and the CASCO agreement, the insurance company can compensate the amount of damage by means of a monetary payment or, against this payment, organize and partially or fully pay for repairs at a car repair organization chosen by it or the injured party.

When an insurance company pays compensation in monetary terms, it is recognized in accounting as other income (clause 7 of PBU 9/99), and for profit tax purposes it is taken into account as non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation). The date of its receipt is considered to be the date of recognition by the insurance company of the amount of compensation for damage (subclause 4, clause 1, article 271 of the Tax Code of the Russian Federation).

The amounts of insurance compensation received upon the occurrence of an insured event are not related to payment for goods, works, services sold, therefore they are not included in the VAT base (letter of the Ministry of Finance of Russia dated December 24, 2010 No. 03-04-05/3-744 and the Federal Tax Service of Russia dated December 29, 2006 No. 14-2-05/ [email protected] ).

We will consider accounting for compensation of damages in cash in “1C: Accounting 8” using the following example.

Example 2

| The organization owns a car. The CASCO agreement with the insurance company was not concluded: — 12/01/2012 — the organization’s car was involved in an accident. The driver of the other car was found to be at fault; - 12/14/2012 - the insurance organization of the person responsible for the accident accepted the payment of compensation in the amount of 29,500 rubles; — December 20, 2012 — the amount of damages in the amount of RUB 29,500. credited to the organization's bank account. |

Let's consider the reflection of these events in the organization's accounting.

1) On the date the insurance company recognizes the culprit of the accident as the amount of compensation for damage, the document Operation (accounting and tax accounting) with posting is entered

Debit 76.01.1 “Calculations for property and personal insurance” Credit 91.01 “Other income”

For tax accounting purposes, the amount of compensation is indicated in the resources Amount NU Dt and Amount NU Kt (Fig. 3).

Rice. 3

Analytics for account 76.01.1 - insurance company and basis for calculations (application for compensation of losses). Analytics for account 91.01 - an item for accounting for income and expenses for insured events with the type Other non-operating income (expenses).

2) Receipt of the amount of compensation for damage to the organization’s account is registered with the document Receipt to the current account for the type of transaction Other settlements with counterparties. In the Settlement account field, account 76.01.1 is indicated.

Repair costs are recognized in the general manner provided for in Article 260 of the Tax Code of the Russian Federation, as expenses for the repair of fixed assets.

They are reflected in the implementation period in the amount of actual costs (letter of the Ministry of Finance of Russia dated March 31, 2009 No. 03-03-06/2/70).

VAT deduction on goods, works and services purchased to repair a damaged car is made on a general basis, regardless of the fact that the cost of repair work is compensated by an insurance organization (letters of the Ministry of Finance of Russia dated July 29, 2010 No. 03-07-11/321 and dated April 15. 2010 No. 03-07-08/115).

Let's look at accounting for the cost of car repairs after an accident in 1C: Accounting 8 using an example.

Example 3

| The organization's car, used for management purposes, was involved in an accident on December 1, 2012. On December 20, 2012, the insurance company of the person responsible for the accident received an amount of compensation for damage in the amount of 29,500 rubles to the bank account. The car was repaired on December 24, 2012 by the Autoservice organization, for which a transfer and acceptance certificate of the work performed was drawn up. The cost of repairs amounted to 23,600 rubles, including VAT of 3,600 rubles. The contractor has issued an invoice for the work performed. On December 26, 2012, the organization paid the contractor for the car repair work in the amount of 23,600 rubles, including VAT of 3,600 rubles. |

Let's consider the reflection of these events in the organization's accounting.

1) On the date of the acceptance certificate of completed car repair work, the document Receipt of goods and services is entered for the Purchase, commission operation.

On the Services tab, the tabular section indicates the work performed, its cost, invoices and analytical features of accounting and tax accounting (Fig. 4).

Rice. 4

On the Invoice tab, specify the details of the invoice received from the contractor, and select the Reflect VAT deduction in the book checkbox.

2) The transfer of payment to the contractor for work performed is reflected in the documents Payment order (to prepare a payment order to the bank) and Write-off from the current account for the Payment to supplier transaction (to reflect the transfer on the accounting accounts).

If the insurance company compensating for the damage itself organizes and pays for the repair of the damaged car to pay compensation, the organization that owns the damaged car does not recognize in accounting and tax accounting either income in the form of insurance compensation (it does not receive it) or expenses in the form of the cost of repairs (paid by the insurer).

Accounting for bonuses

Insurance premiums are payments made by a person to an organization. The insurance agreement comes into force either from the date specified in it or from the date of payment of the first premium.

How is accounting carried out when insuring cargo by the shipper ?

Compensation in the event of an insurance event is paid only when the person has no arrears on premiums. All amounts for the past period must be paid.

The compensation paid to the insured may be counted towards the following insurance premiums.

Let's look at an example. The insured person was awarded compensation in the amount of 50,000 rubles. Additional expenses associated with the insured event were also confirmed. The person decided to use half of this amount towards future insurance payments. In this case, these postings are used:

- DT22/1 KT51. Payment of insurance compensation.

- DT22/1 KT51. Payment of additional expenses.

- DT22/1 KT77/1. Crediting part of the indemnity amount against the following insurance premiums.

The legality of all payments is confirmed by the primary source.

Accounting for expenses and compensation when liquidating a car after an accident

As a result of an accident, the fact of total or constructive loss of the vehicle may be recorded. Constructive loss is said to occur when the cost of restoring the vehicle exceeds 75 percent of the insured value under the CASCO agreement. Constructive loss is equivalent to the complete loss of property.

If an organization waives its rights to a car, payment of compensation in the event of its total or constructive loss is made in the amount of the full insured amount minus depreciation of the car for the period of validity of the contract that elapsed before the insured event (Clause 5 of Article 10 of the Law of the Russian Federation of November 27, 1992 No. 4015 -1 “On the organization of insurance business in the Russian Federation”).

Insurance compensation in accounting is recognized as other income (clause 7 of PBU 9/99), and for profit tax purposes it is taken into account as non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation). The date of its receipt is considered to be the date of recognition by the insurance company of the amount of compensation for damage (subclause 4, clause 1, article 271 of the Tax Code of the Russian Federation).

In “1C: Accounting 8”, calculations for insurance compensation for the total or constructive loss of a car are reflected in the same way as the accounting for calculations for funds for car repairs discussed above (see Example 2).

A car that cannot be restored is written off from accounting and tax records on the basis of an act on the write-off of motor vehicles. The fact of write-off is also noted on the fixed assets inventory card. To stop paying transport tax, the vehicle being written off must be deregistered with the traffic police.

In accounting, the write-off of a car is reflected in the following entries:

Debit 01.09 “Retirement of fixed assets” Credit 01.01 “Fixed assets in the organization” - the book value of the retiring car was transferred to a separate subaccount; Debit 02.01 “Depreciation of fixed assets accounted for on account 01” Credit 01.09 “Disposal of fixed assets” - accumulated depreciation on a retiring car was transferred to a separate subaccount; Debit 91.02 “Other expenses” Credit 01.09 “Disposal of fixed assets” - the residual value of the disposed car is written off as other expenses.

In tax accounting, the residual value and expenses associated with the decommissioning of a vehicle that cannot be restored are included in non-operating expenses (subclause 8, clause 1, article 265 of the Tax Code of the Russian Federation).

In “1C: Accounting 8”, the write-off of a car from accounting and tax records as a result of total or constructive loss is reflected in the document Write-off of OS (Fig. 5). As an analytical indicator, account 91.02 indicates the item of other income and expenses with the type Income (expenses) associated with the liquidation of fixed assets.

Rice. 5

Accounting for reinsurance

Reinsurance is the transfer of obligations to protect against risks. It is assumed that these obligations are transferred from one organization to another. That is, a person enters into an agreement with one organization. She will be considered the primary insured. It is she who is responsible to clients. She also accepts various insurance claims.

If reinsurance is carried out, these transactions become relevant:

- DT92/4 KT77/4. Premium aimed at reinsurance.

- DT77/4 KT91/1. Money received from the reinsurer.

- DT77/4 KT77/6. Money deposited under agreements submitted to reinsurance.

The reinsurance agreement is a separate contract. The reinsurer makes payments only in the amounts established by the contract. Amounts above the limit are paid by the primary insurer.

What do expenses affect?

If we consider the insurer's expenses from the perspective of the consumer (client), then the policyholder can use them to track how effectively the company fulfills its obligations to clients. If the insurer regularly refuses payments or underestimates them, or delays the transfer of funds, this indicates its unreliability, which may be associated with the poor financial position of the organization.

Tracking whether an insurer pays compensation to its customers is quite simple. To do this you should:

- Read reviews about the company on the popular portals “Banks.ru”, “Sravni.ru” or other forums dedicated to financial and insurance services in the Russian Federation. If there are a lot of negative reviews about the insurer on the website, it is likely that the company often deceives its customers.

- Analyze financial statements. Go to the company’s official website and see where and in what amount the company’s funds were spent.

- Look at the lists of insurers in the ratings of the Expert RA agency. The company regularly publishes ratings on the financial stability and reliability of insurance companies.

ADVICE. Don't have time to study reports or ratings? Go to the Central Bank website. If the insurance company is not on the list of companies deprived of a license (or under supervision/rehabilitation of the Central Bank of the Russian Federation), it means that the financial position of the insurer in the current period is quite stable.

Accounting for payments under coinsurance agreements

A person may enter into insurance agreements with several organizations. In this case, the companies will be jointly and severally liable to the person in the event of an insured event. That is, each organization contributes a certain share. There are 2 options for drawing up an agreement:

- The person enters into separate agreements with each company. Calculations are carried out by each organization separately.

- All operations are carried out by one organization, which acts on behalf of others.

If agreements are concluded with each organization separately, these postings are used:

- DT77/1 KT92/1. Calculation of insurance premium.

- DT51 KT77/1. Payment of the premium.

- DT22/1 KT77/1. Calculation of payment upon the occurrence of an insured event.

- DT77/1 KT51. Transfer of payment.

If settlements are carried out by one organization, accounting is carried out by each insurance company. Accounting reflects amounts proportional to the organization's share.

What types of insurance apply?

In practice, a significant number of types of insurance are used. Namely:

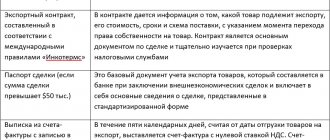

| operation | its meaning |

| Personal property of citizens (property type) | In order to protect the insured item from damage, as well as reduce the risk in cases of damage caused by a third party or due to circumstances beyond human control (force majeure) |

| Personal | To ensure in cases of harm to human health or life |

| Risks | Financial, technical, legal: · the goods are insured against damage, spoilage and loss during transportation; · the carrier insures the delivery vehicle: car, aircraft, water vessel. |

| Responsibility | The interest of the lender, borrower, and developer is protected. Automotive or professional situation. |

The rate at which the insurance premium is determined is regulated by the state supervisory authority. And the final cost of payment is indicated in the contract and depends on the current rates of the insurer.

Please note that certain situations are insured both for the benefit of the policyholder personally and for the benefit of a third party. Also, the same subject of insurance can act as insurance for several types of security at once. Voluntary and compulsory (CASCO and MTPL, compulsory medical insurance and voluntary medical insurance).

Payment of the insurance premium is carried out in favor of the insurer by the person or organization with which the contract is concluded. The payers are:

- Employing organizations under voluntary, personal medical insurance contracts;

- The owner of a property by right of ownership or operational management (for the purposes of economic activity);

- The person receiving the property for temporary use: transport company, tenant, etc.;

- Organization, when using a dangerous object that can cause significant harm to others, harm to the health and life of citizens, as well as in the event of a fire or accident.

In relation to objects that, during their operation, cause critical damage that affects the positive state of the environment and human health, there is a mandatory need for risk insurance. This is indicated by paragraph 1 of Art. 15, paragraph 1, art. 9 of Federal Law No. 116-FZ of July 21, 1997.

Such sources of increased danger are listed in Article 15 of Law 116-FZ. These, in particular, include construction and installation sites where construction, lifting and other equipment and mechanisms are located. The same provision regulates the amount of the insurance contract, a minimum of 100,000 rubles.

Accounting for liability insurance

Liability insurance involves compensation for damage caused by the insurer to a third party. For example, a person received insurance in case of apartment flooding. And then he flooded his neighbor's apartment. In this case, the insurance company compensates for the damage caused to this neighbor. Let's look at other common cases of liability insurance:

- Damage caused to someone else's vehicle during its operation.

- Damage caused to the environment or people due to potentially hazardous activities.

- Damage caused to third parties in connection with the performance of legal or medical activities.

Let's look at the entries made for liability insurance (example):

- DT22/1 KT51. Payment of damages to a person injured in a car accident.

- DT91/2 KT22/1. The payment is included in the spending structure.

- DT50 KT91/1. Receipt of money from a person found guilty of an accident.

FOR YOUR INFORMATION! You can insure business risks. In this case, the insurance agreement ends early upon termination of business activity.

conclusions

The company's insurance activities involve regular expenses for various needs. Conclusions on the topic:

- All expenses of the insurer are conditionally divided into 3 groups: aimed at insurance, investment and other activities.

- Some expenses are regulated at the legislative level, the rest the company can change (increase, reduce) at its discretion.

- Monitoring the insurer's expenses will allow the client to know what financial position the company is in. If an organization fulfills its obligations to clients in a timely manner, and income exceeds expenses, then the risk of being left without payment with such an insurer is minimal.

Want to learn more about what insurer costs are? Ask questions to the portal’s duty lawyer. Consultations are free. Don’t forget about likes and reposts: share interesting news about insurance in the Russian Federation with your loved ones.

Read further about the formation and accounting of funds of insurance organizations in 2021.

Features of VHI accounting

VHI is one of the types of personal insurance. As a rule, it is included in the “social package” provided by the employer. Contributions for voluntary health insurance are included in expenses if there are circumstances specified in subparagraph 16 of article 255 of the Tax Code of the Russian Federation. Consider these circumstances:

- The VHI agreement is signed for a period of more than a year.

- The insurance company has a license to conduct insurance activities.

- Expenses are fixed at no more than 6% of total labor costs.

In accounting, expenses for voluntary health insurance relate to the period in which they arose. Insurance payments are recorded on the DT of expense accounts (for example, account 20, 26, 44). The company may make insurance payments for persons with whom labor relations have not been formalized. Related expenses will be recorded on DT 91. A subaccount 02 will be opened for it.

Why were amendments needed?

In conclusion, we will try to answer the most important question: why did the Ministry of Finance even issue such changes that, in fact, did not change anything?

It seems that the answer is much simpler than one might expect: with such changes, the financial department tried to recall the requirement of prudence (clause 6 of PBU 1/2008 “Accounting Policies of the Organization”) and emphasize that only such expenses should be reflected as deferred expenses , which actually relate to future periods. In particular, expenses incurred during the period of lack of revenue cannot and should not be taken into account in this capacity (and this procedure was very often used and is still used in practice - first of all, to please the tax authorities who do not want to see losses in accounting) . Advances issued should not be reflected as deferred expenses, since they have not yet become expenses, but represent only an outflow of cash.

In other words, as part of deferred expenses, only those expenses should be reflected that, on the one hand, are really expenses (as they are described in paragraphs 2 and 3 of PBU 10/99 “Expenses of the organization”), and on the other hand, relate to future reporting periods. That is, there is and can be reliably determined a period during which the expenses incurred will bring economic benefits to the organization.

* Let us recall that according to paragraph 7.2.1 of the Concept of Accounting in a Market Economy of Russia (approved by the Methodological Council on Accounting under the Ministry of Finance of the Russian Federation, the Presidential Council of the IPB RF on December 29, 1997), future economic benefits are the potential of assets to directly or indirectly contribute to the inflow of cash funds to the organization. It is considered that an asset will bring economic benefits to the organization in the future when it can be: a) used separately or in combination with another asset in the production of products, works, services intended for sale; b) exchanged for another asset; c) used to pay off an obligation; d) distributed among the owners of the organization

Features of creating insurance reserves

The formation of insurance reserves is an event considered mandatory for an insurance company. The mandatory creation of such reserves is stipulated in Article 26 of Federal Law No. 4015-1 “On the Insurance Business” of November 27, 1992. The sequence of formation of reserves is specified in the order of the Ministry of Finance No. 51 n dated June 11, 2002.

Let's consider the sequence of formation of reserves:

- Establishing the required type of reserve. Orders of the Ministry of Finance 32n and 51n will help with this. You also need to focus on the local regulations of the company.

- Establishing a method for determining the reserve.

- Determination of the reserve for each insurance agreement.

The reserve is needed to ensure that the organization always has the amount of funds that is needed in the event of an insured event.

Insurance company reporting

Since the activities of insurers are open, they are required to publish their expenses on the official website. If the client does not have the opportunity to view the financial statements of the insurance company online, he can find out about them on the Central Bank website.

Insurance company reporting allows you to find out what financial position the company is in. This is important information for customers. Insurers with an unstable position often delay payments or completely unreasonably refuse to receive insurance compensation.

REFERENCE. Concealing the insurer's reporting, as well as illegally changing the real financial condition of the company, is a violation. Having caught the insurance company in such actions, you can send a complaint to the supervisory authority.