Taxpayers who carried out transactions not subject to VAT under Articles 146, 147, 148 or 149 of the Tax Code of the Russian Federation must include Section 7 in their VAT return for the reporting period. The tax authority has the right to request explanations and documents for such preferential transactions. At the same time, the number of documents can be reduced if you provide the tax office with explanations in the form of a register of supporting documents, as well as a list and forms of standard agreements used when carrying out transactions under the corresponding codes. Using the example of the 1C: Accounting 8 version 3.0 program, 1C experts tell you how to account for VAT on non-taxable transactions, fill out Section 7 of the VAT return and the register of supporting documents.

How to deal with operation codes?

Taxpayers who submit VAT returns to the inspectorate are often faced with the need to reflect the codes of certain transactions.

Codes are required to complete sections 2, 4-7. Find out what sections these are in the picture:

Codes are sets of 7 digits, each of which represents a specific operation. All codes are divided into 5 groups and are described in Appendix No. 1 to the Procedure for filling out a VAT return, approved. by order of the Federal Tax Service dated October 29, 2014 No. MMB-7-3/ [email protected]

The VAT return, starting with the report for the 4th quarter of 2021, must be submitted in a new form, as amended. Order of the Federal Tax Service of Russia dated August 19, 2020 No. ED-7-3/ [email protected] The changes did not affect transaction codes. ConsultantPlus experts spoke about the procedure for filling out the updated declaration. Study the material by getting trial access to the K+ system for free.

The figure below shows:

- the name of each group of operation codes;

- the range of codes provided for each group;

- link to the article of the Tax Code of the Russian Federation.

The list of codes valid in 2021 - 2021 can be downloaded in this material.

What happens if you don’t put the transaction code in the declaration? It will not pass logical control, and the controllers will not accept it. Therefore, it is necessary to understand the codes and correctly reflect them in the declaration, if the need arises.

Next we will tell you more about individual codes.

List of transaction type codes (KVO): 21–26

| No. | Name of the type of operation | Applicability in the declaration section | A comment | |||

| 8, 8.1 | 9, 9.1 | 10 | 11 | |||

Operations to restore tax amounts specified in clause 8 of Art. 145, paragraph 3 of Art. 170 (except for paragraphs 1 and 4 of paragraph 3 of Article 170), Art. 171.1 of the Tax Code of the Russian Federation, as well as when performing transactions taxed at a tax rate of 0% for VAT

A counter entry on the invoice can be with KVO 01, 02, 13, 25

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

For use in transactions, see Prepaid Transactions

Operations for the return of advance payments in the cases listed in the second paragraph of clause 5 of Art. 171, as well as the operations listed in paragraph 6 of Art. 172 Tax Code of the Russian Federation

The counter entry on the invoice must be with KVO 02

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

For use in transactions, see Prepaid Transactions

Purchasing services issued with strict reporting forms in the cases provided for in paragraph 7 of Art. 171 Tax Code of the Russian Federation

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

Registration of invoices in the purchase book in the cases provided for in the second paragraph of clause 9 of Art. 165 and paragraph 10 of Art. 171 Tax Code of the Russian Federation

The counter entry on the invoice must be with KVO 01

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

Registration of invoices in the purchase book in relation to amounts of value added tax previously restored when performing transactions taxed at a tax rate of 0%, as well as in cases provided for in paragraph 7 of Art. 172 Tax Code of the Russian Federation

A counter entry on the invoice can be with KVO 01, 21

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

Drawing up invoices, primary accounting documents and other documents that contain summary (summary) data on transactions performed during the calendar month (quarter) when the seller sells goods (work, services), property rights to VAT defaulters and payers exempt from calculation and payment of VAT. Code also used:

- in the event of a change in the cost of goods (work, services, property rights) shipped to specified persons;

- upon receipt from the specified persons of payment (partial payment) on account of upcoming deliveries of goods (works, services), property rights;

- when registering the specified documents in the purchase book in the cases provided for in paragraphs 6 and 10 of Art. 172 Tax Code of the Russian Federation

A counter entry on the invoice can be with KVO 16, 17, 22

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

For use in transactions, see Returning goods to the seller

You indicated the QUO correctly, but what about your counterparty? Check with the VAT+ service so that the Federal Tax Service does not have any questions.

Explanation of terms with links to legal regulations for code 1010292

What legal acts do you need to know in order to correctly reflect transactions under code 1010292 in the declaration:

- subp. 15 clause 3 art. 149 of the Tax Code of the Russian Federation - determines that loan transactions, including interest on them, are not subject to VAT on the territory of the Russian Federation;

- pp. 44.2-44.5 Procedure for filling out a VAT return - decipher the procedure for reflecting information in the lines of section 7, dedicated to non-taxable transactions.

- The Civil Code of the Russian Federation and other legal acts - regarding the definition of the terms “money loan”, “securities loan”, “loan interest”, “repo operation”.

List of transaction type codes (KVO): 15–20

| No. | Name of the type of operation | Applicability in the declaration section | A comment | |||

| 8, 8.1 | 9, 9.1 | 10 | 11 | |||

Drawing up (receipt) of an invoice by a commission agent (agent) when selling (receiving) goods (work, services), property rights on his own behalf. The invoice contains information about your own goods (work, services) and property rights, as well as information about goods (work, services) and property rights that are sold (purchased) under a commission agreement (agency agreement)

Receipt by the seller of goods returned by buyers who do not pay VAT by payers exempt from calculating and paying VAT, including cases of partial return of goods by specified persons, as well as refusal of goods (work, services) in the case provided for in paragraph two of clause 5 of Art. 171 of the Tax Code of the Russian Federation, with the exception of operations listed by code 17

The counter entry on the invoice must be with KVO 01 or 26

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

For use in transactions, see Returning goods to the seller

Receipt by the seller of goods returned by individuals, as well as refusal of goods (work, services) in the case specified in paragraph two of clause 5 of Art. 171 Tax Code of the Russian Federation

The counter entry on the invoice must be with KVO 26

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

For use in transactions, see Returning goods to the seller

Drawing up or receiving an adjustment invoice in connection with a decrease in the cost of shipped goods (work, services) and transferred property rights (including in the case of a decrease in prices (tariffs) and (or) a decrease in the quantity (volume) of shipped goods (work, services) , transferred property rights)

The counter entry on the invoice must be with KVO 01

Import of goods into the territory of the Russian Federation and other territories under its jurisdiction from the territory of the states of the Eurasian Economic Union

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

For use in operations, see Import-related operations

Import of goods into the territory of the Russian Federation and other territories under its jurisdiction in customs procedures of release for domestic consumption, processing for domestic consumption, temporary import and processing outside the customs territory

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

For use in operations, see Import-related operations

Submit your VAT return through Kontur.Extern. When you upload a file, the system will check it for formatting and calculation errors and ensure that the amounts in the attachments match the amounts in the declaration.

Reporting through another system? Connect to Extern with a 50% discount (not valid in all regions).

Scheme for using code 1010292

Let's consider the scheme for using code 1010292, concentrating in it the necessary information for filling out the declaration:

Based on this diagram, we will fill out section 7 using the example data.

PJSC "Spring Wind" entered into a loan agreement with a domestic company. Its amount is 3,400,250 rubles. In the 2nd quarter, accrued interest on the loan amounted to RUB 38,253. When filling out section 7, please note that:

- for the lender (PJSC "Spring Wind"), issuing loans is not the main activity;

- The lender has no general business expenses for non-taxable transactions.

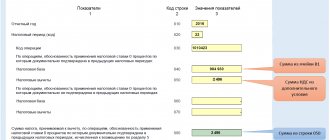

What the completed section 7 of the VAT return with transaction code 1010292 looks like, see below:

When filling out column 2, you should take into account that it is not the “loan body” that is entered, but the amount of accrued interest (letter of the Federal Tax Service dated April 29, 2013 No. ED-4-3/7896).

List of transaction type codes (KVO): 33–38

| No. | Name of the type of operation | Applicability in the declaration section | A comment | |||

| 8, 8.1 | 9, 9.1 | 10 | 11 | |||

Registration of invoices (adjustment invoices) issued upon receipt of payment (partial payment) against the upcoming delivery of raw hides (scrap) from the tax agent

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

The KVO was introduced in the first quarter of 2021; it is incorrect to apply it in declarations for previous periods

Registration of invoices (adjustment invoices) issued (received) by the commission agent (agent) when shipping raw hides and scrap to the tax agent, as well as when the cost of shipments increases

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

The KVO was introduced in the first quarter of 2021; it is incorrect to apply it in declarations for previous periods

Drawing up a document (check) to compensate for the amount of value added tax when a retail trade organization sells goods to an individual - a citizen of a foreign state;

registration of the specified document (check) in the sales book

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

The KVO was introduced in the first quarter of 2021; it is incorrect to apply it in declarations for previous periods

Deductions of VAT amounts calculated by taxpayers - retail trade organizations in the cases provided for in clause 4.1 of Art. 171 Tax Code of the Russian Federation

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

The KVO was introduced in the first quarter of 2021; it is incorrect to apply it in declarations for previous periods

Sales of raw materials exported under the customs export procedure, taxation of which is carried out at a rate of 18% in accordance with clause 7 of Art. 164 Tax Code of the Russian Federation

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

The KVO was introduced in the first quarter of 2021; it is incorrect to apply it in declarations for previous periods

Sales of non-commodity goods exported under the customs export procedure, taxation of which is carried out at a rate of 18% in accordance with clause 7 of Art. 164 Tax Code of the Russian Federation

Relationship between codes 1010292 and 1010256

The relationship is as follows: code 1010256 in the VAT return, just like code 1010256, is reflected in the same section (section 7). Both of these transactions belong to the group of non-taxable (exempt from taxation).

What else do these codes have in common? If there are the specified codes in section 7, tax authorities, when conducting desk audits, try to request additional documents from the taxpayer. Which? We are talking about documentary evidence of the legality of reflecting non-VAT-taxable transactions in the declaration. Moreover, the controllers justify their demands by the fact that the exemption of these operations from VAT is in the nature of a tax benefit.

However, the judges do not agree with them - the taxpayer manages to prove in court that the obligation to submit documents along with the declaration is contrary to clause 88 of the Tax Code of the Russian Federation (decrees of the Supreme Arbitration Court of the Russian Federation dated January 31, 2014 No. VAS-497/14, Supreme Arbitration Court of the Russian Federation dated November 12, 2012 No. VAS-6809/12).

We will tell you more about when you need to enter code 1010256 in section 7 of the VAT return in the next section.

Resolution of the Federal Arbitration Court of the Moscow District of August 20, 2013

In accordance with the Tax Code of the Russian Federation, a desk tax audit is carried out at the location of the tax authority on the basis of tax returns (calculations) and documents submitted by the taxpayer, as well as other documents on the activities of the taxpayer available to the tax authority. In the cassation appeal, the inspection refers to the fact that the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 18, 2012 N 4517/12 is not applicable in this case, since within the framework of this case the situation was considered regarding the requisition of documents in relation to the operation for the sale of land plots that are not subject to taxation in accordance with the Tax Code of the Russian Federation, whereas in the present case the legality of requesting documents on transactions exempt from taxation on the basis of another norm - the Tax Code of the Russian Federation - is considered.

Implementation according to code 1010256 (topologies of integrated circuits, industrial designs, etc.)

Code 1010256 is entered in the VAT return if exclusive rights to the results of intellectual activity are realized during the reporting period.

An exclusive right is the right of a person to use protected objects (including the right to prohibit their use).

What is meant by the term “results of intellectual activity”? The basic concepts are deciphered below:

So:

- Realization of exclusive rights to the specified objects under subparagraph. 26 clause 2 art. 149 of the Tax Code of the Russian Federation is not subject to VAT.

- When such transactions are reflected in section 7 of the declaration, code 1010256 is entered.

Documentary confirmation of VAT benefits

- benefit code in accordance with the order of the Department of Internal Affairs of the Ministry of Internal Affairs of the Russian Federation No. ММВ-7-3-558 dated October 29, 2014. This code is the same code that is indicated in the seventh section of the VAT tax return;

- type of operation;

- transaction amount (non-taxable total amount for all preferential transactions of the organization);

- type of document that confirms the VAT benefit. Most often, such documents are an agreement or a payment order;

- details of supporting documents: date and number, its amount;

- full name of the counterparty, his details (TIN and KPP).

Value added tax benefits are provided for certain transactions. These include the sale of a certain group of goods (for example, medicines), transportation of citizens, and trade in scrap metal. A detailed list of groups of activities for which benefits are provided is reflected in Art. 149 of the Tax Code of the Russian Federation.

Features of using code 1010256

From the previous section we found out that the implementation of exclusive rights to intellectual property is not subject to VAT. A single rule applies to all the objects considered: if such a sale occurred in the reporting quarter, this operation is subject to reflection in section 7 of the VAT return with code 1010256.

This is a general approach that may have interpretations in the course of business activities.

For example, a Russian organization acquired from a foreign company the rights to use the results of a production secret (know-how). The transfer of rights to the results of intellectual activity is a service. The question arises: what will be recognized as the place of sale of the service in this situation? According to sub. 4 paragraphs 1 art. 148 of the Tax Code of the Russian Federation is the territory of the Russian Federation if the buyer operates in our country. And the operation to exercise exclusive rights to a production secret is not subject to VAT (for the position of officials of the Ministry of Finance, see letter dated November 18, 2016 No. 03-07-08/68105).

Check whether you are using the codes correctly in your VAT return with the help of explanations from ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

List of transaction type codes (KVO): 01–14

Shipment (transfer) or purchase of goods (work, services), property rights, including:

- operations listed in paragraphs. 2 and 3 clauses 1 art. 146, 162, in paragraphs 3, 4, 5.1 of Art. 154, in paragraph 3 of Art. 170 Tax Code of the Russian Federation;

- transactions taxed at a tax rate of 0%;

- operations under commission agreements and agency agreements, which provide for the sale and (or) acquisition of goods (work, services), property rights on behalf of the commission agent (agent) or on the basis of transport expedition agreements;

- operations involving the return of goods by the taxpayer-buyer to the seller or the receipt by the seller of goods from a specified person (except for operations listed under codes 06, 10, 13, 14, 15, 16, 27);

- drawing up or receiving a single adjustment invoice

Applies instead of excluded KVO 03, 04 (except for operations for which KVO 15 is established), 07, 08, 09, 11 (except for operations for which KVO 14 is established)

Payment, partial payment (received or transferred) for upcoming deliveries of goods (work, services), property rights, including transactions under commission agreements and agency agreements that provide for the sale and (or) acquisition of goods (work, services), property rights:

- on behalf of the commission agent (agent);

- based on transport expedition contracts (except for operations listed by codes 06, 28)

Applies instead of the excluded KVO 05, 12. The counterparty must also have a counter entry on the invoice with KVO 02

For use in transactions, see Prepaid Transactions

Operations performed by tax agents listed in Art. 161 of the Tax Code of the Russian Federation, including transactions for the acquisition of goods (works, services), property rights based on:

- agency agreements;

- commission agreements;

- agency agreements concluded by tax agents with the taxpayer (except for transactions specified in paragraphs 4 and 5 of Article 161 of the Tax Code of the Russian Federation)

The counter entry on the invoice must be with KVO 06

For use in transactions, see Tax Agent Deduction

Shipment (transfer) of goods (performance of work, provision of services), property rights free of charge

The counterparty should not record the counter invoice in its purchase ledger

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

Performance by contractors (developers, customers performing the functions of a developer, technical customers) of work during capital construction, modernization (reconstruction) of real estate or the acquisition of this work by taxpayer-investors;

transfer by specified persons (purchase) of completed (unfinished) capital construction objects, equipment, materials as part of the execution of contracts for capital construction (modernization, reconstruction)

The counterparty must have a counter entry on the invoice with KVO 13

Transfer of property rights listed in paragraphs 1–4 of Art. 155 Tax Code of the Russian Federation

Applies instead of the excluded KVO 11 (except for operations for which KVO 01 is established)

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

Are you specifying transaction type codes correctly? Register for free and check.

When do technical inspection services fall into section 7 of the VAT return with code 1010203?

Section 7 of the VAT return reflects a wide variety of transactions that are not subject to VAT. Thus, code 1010203 is intended to reflect a VAT-free transaction for the sale of technical inspection services (subclause 17.2, clause 2, article 149 of the Tax Code of the Russian Federation). However, such a service will not be taxed only under certain conditions - they are specified in the Law “On Technical Inspection...” dated July 1, 2011 No. 170-FZ. What are these conditions?

VAT is not assessed on technical inspection if it is carried out by a company or individual entrepreneur (including a dealer) duly accredited to conduct technical inspection (subclause 7 of Article 1 of Law No. 170-FZ). They are called inspection operators. At the same time, the rules for accreditation of operators are strictly regulated (approved by order of the Ministry of Economic Development of Russia dated November 28, 2011 No. 697). Only in this case will the taxpayer who provided the service legally fill out code 1010203 in section 7 of the declaration.

If a technical inspection service is provided by a company or individual entrepreneur that has not been accredited, such services are subject to VAT, and this operation should not be reflected in section 7 with code 1010203 (letter of the Ministry of Finance of Russia dated 04/05/2012 No. 03-07-11/101).

VAT benefits: cases of provision and features of their application

- The company does not have sufficient revenue (limit – 2,000,000 million rubles for three consecutive months).

- Organizations and companies participating in the implementation of government innovation projects.

- Importers of products specified in Article 150 of the Tax Code of the Russian Federation (benefits for payment of VAT when importing goods).

- types of work or goods described in the Tax Code . This is due to activities in the field of medicine, transport, art, sports, postal services, housing construction, and advertising. And also when carrying out research, repair, restoration and warranty work.

- Benefits that apply to certain categories of companies . The condition for benefits in this case should be work in: the field of culture, education, cinema, sanatorium rehabilitation, sales of agricultural products, funeral services, archival affairs, banking and insurance operations. Services for extracurricular work with children and assistance to the disabled and elderly citizens are also considered here as a condition.

- Benefits covering certain commercial and business operations . Research work, participation in targeted programs, rental housing, some financial services, charitable activities, trading in shares or shares in the authorized capital.

Please note => Benefits for disabled people of group 3 for transport tax in the Republic of Belarus

No license: will codes be needed?

Lack of a license for certain types of activities specified in Art. 149 of the Tax Code of the Russian Federation (transactions not subject to VAT), deprives companies and individual entrepreneurs of this benefit.

For example, one of the types of transactions that must be reflected in section 7 of the VAT return is gambling services (code 1010226). However, gambling organizers have the right to use the VAT exemption only if they have a special license (Clause 6, Article 149 of the Tax Code of the Russian Federation). Mandatory licensing of this activity is provided for in clause 31, part 1, art. 12 of the Law “On Licensing of Certain Types of Activities” dated 04.05.2011 No. 99-FZ.

If there is no such license, VAT must be calculated and paid in the general manner (clause 11 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33).

The same rule equally applies to other operations exempt from VAT (if a license is required). For example:

publication will introduce you to a complete list of transactions not subject to VAT .

VAT benefits, their documentary evidence

In accordance with Art. 56 of the Tax Code (hereinafter referred to as the Code), tax and fee benefits are recognized as benefits provided to certain categories of taxpayers and fee payers provided for by the legislation on taxes and fees compared to other taxpayers or fee payers, including the opportunity not to pay a tax or fee or to pay them in a smaller amount . For example, to exempt from taxation research and development work carried out at the expense of the federal budget, a contract for the performance of work indicating the source of funding is required, as well as a written notification to the contractors and co-executors of the customer, to whom funds have been allocated from the federal budget. targeted budget funds allocated to him to pay for these works. To justify this benefit, tax authorities have the right to request from the taxpayer other documents: technical specifications, additional agreements to the contract, calendar plan, maintaining separate records, etc.

Please note => Register a New Articles of Association of St. Petersburg with the Tax Office Step-by-Step Instructions

Let's get acquainted with the code 1011712

In order to correctly reflect transaction code 1011712 in the VAT return, you also need to familiarize yourself with some terms and articles of the Tax Code of the Russian Federation.

This code is entered in section 2 of the VAT return by tax agents. Let's see who tax legislation classifies as tax agents and when they should enter the specified code in the declaration:

Please note that code 1011712 is entered when ordering work or services from a foreigner - not when purchasing goods (when purchasing goods from a foreigner, the transaction code is 1011711).

This is where we encounter the difficulty associated with determining the place where the work or service will be sold. If everything is more or less clear with the goods (the goods were shipped in Russia, which means the Russian Federation is recognized as the place of sale), then services and work are a separate matter.

We will tell you how a tax agent can correctly determine the place of sale of work (services) in the next section.

Register of documents confirming the application of VAT benefits, example of filling

Dear readers, the information in the article may be out of date, please take advantage of a free consultation by calling: Moscow +7 , St. Petersburg +7 or using the feedback form below. Thus, the organization is obliged to provide the tax inspector with a register of documents confirming the VAT benefit. Also, the employee of the organization must attach to the register all forms of standard agreements that were used when carrying out preferential transactions with counterparties.

Nuances of using code 1011712

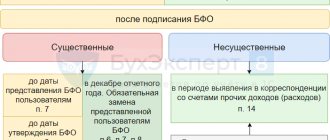

What might be difficult? The fact is that it will be necessary to fulfill the duties of a tax agent of a Russian company or individual entrepreneur only if a transaction with a foreigner (for the purchase of works or services) took place on the territory of our country. Therefore, before you start preparing section 2 of the VAT return, make sure of this (Article 148 of the Tax Code of the Russian Federation). The diagram below will help us understand this circumstance:

As you can see, difficulties in determining the place where the service is provided (the work is performed) are quite possible. An incorrect assessment of this circumstance may affect the correct completion of section 2 of the VAT return and the reasonable application of code 1011712.

List of transaction type codes (KVO): 27–32

| No. | Name of the type of operation | Applicability in the declaration section | A comment | |||

| 8, 8.1 | 9, 9.1 | 10 | 11 | |||

Drawing up an invoice based on two or more invoices for the sale and (or) acquisition of goods (work, services), property rights in the case provided for in clause 3.1 of Art. 169 of the Tax Code of the Russian Federation, as well as receipt of the specified invoice by the taxpayer

Drawing up an invoice based on two or more invoices upon receipt of payment, partial payment for upcoming deliveries of goods (work, services), property rights in the case provided for in clause 3.1 of Art. 169 of the Tax Code of the Russian Federation, as well as receipt of the specified invoice by the taxpayer

Adjustment of the sale of goods (works, services), transfer of property rights and the enterprise as a whole as a property complex on the basis of clause 6 of Art. 105.3 Tax Code of the Russian Federation

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

Shipment of goods for which VAT was calculated during customs declaration in accordance with the first paragraph. 1.1 clause 1 art. 151 Tax Code of the Russian Federation

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

The operation of paying VAT amounts calculated during the customs declaration of goods in the cases provided for in the second paragraph. 1.1 clause 1 art. 151 Tax Code of the Russian Federation

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

Acceptance for deduction of VAT amounts paid or payable in the cases provided for in paragraph 14 of Art. 171 Tax Code of the Russian Federation

The Federal Tax Service may refuse to accept a declaration if the transaction uses a code that is not provided for this

Results

Transaction codes are entered in sections 2, 4-7 of the VAT declaration. They encode transactions that are not recognized as subject to VAT, are not subject to taxation (exempt from taxation), transactions at a 0% rate, etc. If you do not put them in the declaration, it will not pass logical control, and the tax authorities will not accept such a report.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Documentary confirmation of VAT benefits

- benefit code in accordance with the order of the Department of Internal Affairs of the Ministry of Internal Affairs of the Russian Federation No. ММВ-7-3-558 dated October 29, 2014. This code is the same code that is indicated in the seventh section of the VAT tax return;

- type of operation;

- transaction amount (non-taxable total amount for all preferential transactions of the organization);

- type of document that confirms the VAT benefit. Most often, such documents are an agreement or a payment order;

- details of supporting documents: date and number, its amount;

- full name of the counterparty, his details (TIN and KPP).

Since 2021, there have been changes in the application of VAT benefits. Now the audit of tax returns is focused on possible risks. This means that the result of a sample of transactions for which supporting documents will be requested will not be all the supporting documents available in the register, but only some of them, the most risk-oriented ones.

When you do not need to complete sections 8 and 9

Sections 8 and 9 may not be included in the declaration if during the reporting quarter you did not register a single invoice in the purchase book or sales book. This follows from the provisions of paragraph 3 of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

In addition, sections 8 and 9 do not need to be completed in amended VAT returns if there are no changes to these sections. For example, if section 8 is relevant in the primary declaration, then in the updated declaration on line 001, indicate “1”. In this case, put dashes on lines 005, 010–190.

Similarly with section 9. If you do not need to clarify it, then on line 001 indicate “1”. And on lines 005, 010–280, put dashes. This is indicated in paragraphs 45.2 and 47.2 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

In this case, in the appendices to sections 8 and 9 of the updated declaration, in column 3 on line 001, indicate “0”.

This is indicated in paragraphs 45.2 and 47.2 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated March 21, 2016 No. SD-4-3/4581.

And further. Tax agents who do not have the right to deduct the VAT they paid are exempt from completing Section 8. These are tax agents who are specified in paragraphs 4 and 5 of Article 161 of the Tax Code of the Russian Federation. Namely:

- organizations that sell confiscated and ownerless property by court decision;

- intermediaries who sell goods (work, services) of foreign organizations that are not tax registered in Russia.

This is stated in paragraph 45 of the Procedure, approved by order of the Federal Tax Service of Russia dated December 29, 2014 No. ММВ-7-3/558.

In all other cases, include sections 8 and 9 in your VAT return.

An example of filling out annexes to sections 8 and 9 of a VAT return

Organization "Alpha" is a VAT payer. In the first quarter the organization:

- accepted for deduction of VAT on the basis of the supplier’s invoice - LLC “Torgovaya” dated February 16, 2015 No. 1237. Cost of goods - 100,000 rubles. (excluding VAT), the amount of tax accepted for deduction is 18,000 rubles;

- accrued VAT payable on the invoice issued to the buyer - Beta LLC dated March 5, 2015 No. 21. Cost of goods - 150,000 rubles. (excluding VAT), the amount of accrued tax is RUB 27,000.

The total amount of VAT deductible in the purchase book for the first quarter was 1,423,510 rubles, VAT accrued in the sales book was 1,753,252 rubles. The amount of VAT payable for the first quarter is RUB 329,742.

In the second quarter, the organization needed to compile additional sheets of the purchase book and sales book for the first quarter due to the fact that:

- Torgovaya LLC sent Alpha a corrected invoice No. 1237 for the first quarter. The correction is dated May 14, 2015, correction number is 001. The cost of goods is corrected by 90,000 rubles, the correct amount of the tax presented is 16,200 rubles;

- The accountant noticed an error in the invoice issued in the first quarter to Beta LLC and issued a corrected invoice No. 21 (correction number - 001, date - June 23, 2015), changing the cost of goods shipped. New data: cost of goods – 155,000 rubles. (excluding VAT), the amount of accrued tax is RUB 27,900.

Accordingly, the total amounts have changed (taking into account additional sheets):

- according to the purchase book - 1,421,710 rubles. (RUB 1,423,510 – RUB 18,000 + RUB 16,200);

- according to the sales book - 1,754,152 rubles. (RUB 1,753,252 – RUB 27,000 + RUB 27,900).

The accountant reflected these changes in the appendices to sections 8 and 9 of the updated VAT return for the first quarter. In addition, he transferred these data to section 3, reducing the amount of VAT deductible (line 190 of section 3) and increasing the accrual tax (line 110 of section 3 ).

The amount of tax payable also changed and amounted to RUB 332,442. (RUB 1,754,152 – RUB 1,421,710). The accountant reflected it in section 1 of the updated VAT return for the first quarter.

Advice: before filling out sections 8 and 9, it makes sense to check with your counterparties the number and details of invoices, information about which you include in the declaration. In the future, this will help avoid claims from inspectors.

Take the data for reconciliation from the purchase book or sales book and format it in the form of a summary report for each counterparty. These reports can be sent to your suppliers or customers and invite them to check if everything is in order and if there are any discrepancies.