" Back 12.10.2018 14:45

Rostrud announced the need for employers to submit a new report to employment centers in Letter No. 858-PR dated July 25, 2018. This letter also contains the recommended reporting form.

The need to introduce a report on workers of pre-retirement age arose against the background of pension reform and actions to protect the rights of workers of pre-retirement age. It is expected that the innovations will help Rostrud and employment services monitor the situation and take appropriate measures to promote the employment of pre-retirees.

Reporting form

The final form of the report has not yet been approved, for now it will be necessary to submit it in the form recommended by regional employment services.

Employment Center report form. *xlsx file (Excel), file size 12 KB.

Employment Center report form. *xlsx file (Excel), file size 12 KB.

The report must indicate the name, INN and KPP of the employer, the number of employees who work in the organization and were fired in the last quarter, the age indicated above.

You will also need to provide the following information:

- The number of employees carrying out labor activities as of October 1, 2021 (columns 4, 5, 6).

- The number of employees carrying out labor activities as of the reporting date (columns 7, 8, 9).

- The number of employees who continued working after training, including those transferred to another area of work (column 10).

- The number of employees who stopped working during the reporting period (columns 11, 12, 13), including at the initiative of the employer (columns 14, 15, 16).

It is necessary to indicate those employed at the reporting date and those who stopped working in the organization during the reporting period.

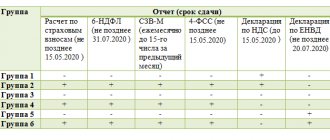

Deadlines for submitting reports on employees of pre-retirement age

Rostrud, in Letter No. 858-PR dated July 25, 2018, indicated the deadline - starting from data as of October 1, 2021, quarterly, until the 15th day of the month following the reporting month. That is, the first report must be submitted before October 15, 2021.

However, some employment services warned companies about the need to submit a report in the first ten days of October, explaining that local employment authorities need to have time to transfer the received data to the Federal Employment Service by October 15. That is, in fact, the deadlines indicated in the Rostrud Letter are established for the employment service authorities.

Thus, the deadlines for employers to submit the report are determined by local employment centers. They may vary, so it is better to check the information with your employment center branch.

Fines

There are no fines or any sanctions for the report itself and it is not necessary to submit the report itself

On October 3, 2021, Federal Law 353-FZ was adopted, which amended Art. 144 of the Criminal Code of the Russian Federation - an unjustified refusal to hire a person on the grounds that he has reached pre-retirement age, as well as an unjustified dismissal from work of such a person for the same reasons - is punishable by a fine in the amount of up to 200,000 (two hundred thousand) rubles or in the amount of wages or other income of the convicted person for a period of up to eighteen months or by compulsory work for a period of up to 360 (three hundred sixty) hours.

Who is required to submit a new employee report?

Some employment centers send targeted letters to employers asking them to fill out a report form - they have lists of organizations and individual entrepreneurs from whom they need to request a report.

However, due to the fact that it is not always possible to send a report form to the address for completion, employment services ask employers who have pre-retirement employees to send the information themselves.

| Comment by Elena Ilichkina, chief accountant of SOLAR SECURITY LLC: Currently, the current legislation does not establish an obligation to submit a report on employees of pre-retirement age and, as a result, does not provide for liability for failure to submit it. Letter of Rostrud dated July 25, 2018 No. 858-PR was issued “for the purpose of executing the protocol decisions of the meeting at the Federal Service for Labor and Employment”, is not a normative act, and has not been registered with the Ministry of Justice. The letter contains a request to organize quarterly monitoring of information. In some regions, employment centers selectively sent out letters asking for information, in others they notified legal entities by telephone, and in others they did not take any action. That is why today we can say that no one has the right to make claims against companies for this “report”. This argument is also supported by the following:

|

Who should submit the report?

The responsibility for preparing reporting documentation falls on direct employers. It is organizations, enterprises and other legal entities, as well as individual entrepreneurs, who should be involved in drawing up a pre-retirement report. In this case, the tax regime and form of ownership do not matter - all employers of employees, without exception, must report.

Do you need legal advice on labor law and pensions?

? Then ask your question using the form below and we will answer you as soon as possible. It's free and won't take much of your time!

All information is encrypted via the secure https protocol. Your correspondence with a lawyer is securely protected.

In general, according to the information collection mechanism, each employment center must have a list of individual entrepreneurs and organizations required to provide reporting documents. Based on this data, notifications are sent.

If such a notice has not been received, but employment contracts with employees of pre-retirement age exist (or any of the suitable candidates quit during the reporting period), then you must personally contact the Employment Center to clarify the issue. You can also view the information on the official website of the structure by first selecting the appropriate region.

How to fill out a new report

There are no instructions for filling out the new Form No. 1. Therefore, when filling out, you can rely on the contents of the table cells.

In 2021, the form must be submitted for employees who will retire in 2021. Accordingly, in Form 1 it is necessary to indicate information on the number of working men born in 1959 and women born in 1964.

Note!

The new report needs to indicate only persons who are not pensioners. If an employee retired early, he does not need to be included in the report.

Form 1 indicates only the number of employees; personal data is not entered.

To pass or not to pass?

There are heated debates in professional communities about whether Rostrud’s letter is mandatory, whether these reports need to be submitted in general and zero reports in particular, and whether there is a fine for failure to submit.

Indeed, a departmental letter essentially cannot be regarded as a normative legal act, for failure to comply with the requirements of which fines are provided. However, in private conversations, employees of Employment Centers remind about Article 19.7 of the Code of Administrative Offenses and a fine of 5,000 rubles. At the same time, for example, on the website of the Central Tax Service of St. Petersburg, the information about the report uses the soft wording “quarterly survey” and “proposed to be sent,” and the Moscow Central Tax Service “requests to organize the provision of information.” It seems that employers should carefully study the information of the regional division of the Central Employment Service and ask questions to their specialists.

New report to Rostrud: who passes

All employers (companies and individual entrepreneurs) must report. The form includes information on employees employed as of the reporting date, as well as those dismissed during the reporting period, but not for all - only men born in 1959 and women with a date of birth in 1964 are taken into account. There is no need to indicate the number of other personnel in the document.

There are no clear instructions from Rostrud for preparing the report yet. Let's look at filling out the form using an example.

Example

At the beginning of October 2021, 750 people work, of which 55 people fall under the requirements for inclusion in the report for persons of pre-retirement age, two of them underwent retraining, there were no dismissals. In this case, Rostrud will receive a new report from October 1, 2018 from such an employer with the following data:

- Column 1 indicates the name of the employer (Alpha LLC);

- Column 2 includes the TIN number;

- column 3 – checkpoint code;

- column 4 - the total number of employees to be reflected in the report (linked to the number of employed people as of October 1 - 55 people), columns 5 and 6 provide a breakdown of the number of men and women (34 and 21 people, respectively);

- in columns 7-9 we indicate the number of personnel of pre-retirement age as of the reporting date;

- in column 10 it is necessary to display information about employees included in the number of column 7, who were retrained, incl. those who were transferred to other positions after training (in the example there are two such employees);

- Rostrud introduced a new report for employers to be able to identify the percentage of dismissals of workers of pre-retirement age, therefore in columns 11-13 it is necessary to indicate the number of pre-retirement employees who were fired in the reporting interval (there were no dismissed men born in 1959 and women born in 1964 birth date, therefore these columns contain zeros);

- from among the dismissed persons of pre-retirement age, the number of employees who were dismissed at the initiative of the employer is highlighted (total number and broken down by women and men), columns 14-16 are allocated for this.

The completed new headcount report to Rostrud is endorsed by the head of the company. At the bottom of the form, the position and full name are indicated. the responsible executive (for example, a personnel officer or chief accountant), his contact information for prompt communication.

Letter of Rostrud No. 858-P dated July 25, 2021

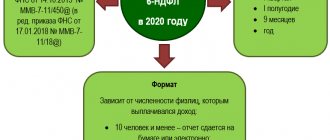

In July 2021, Rostrud published a letter on its website about conducting quarterly monitoring of information regarding the number of workers of pre-retirement age.

Immediately after its publication, the letter caused a wave of discussions among representatives of the accounting and human resources community. On the one hand, in the letter, Rostrud informs about the deadlines for submitting data, the place of their submission, and also attaches a report form for filling out.

On the other hand, the letter does not indicate the “obligatory” filing of the report, as well as penalties for failure to provide it. There are also no comments regarding special cases, namely:

- inclusion in the report exclusively of workers who work on the basis of employment agreements, or supplementing information with data on persons involved under contract agreements;

- the need to include information about the director in the report if he is the only founder.

The letter was published in July 2021, but as of December 2021, Rostrud did not provide any additional comments in writing. Officials limit themselves only to oral recommendations that they give to representatives of organizations in private.

Where, when and how to submit reports

The first report is due from October 1 to October 15, 2021. Subsequently, Rostrud ordered reporting by the 15th day of the month following the quarter. All organizations at the place of registration are attached to the district Employment Centers, where the form must be submitted. By the time the reporting was submitted, Employment Centers were required to notify firms whose staff included people who fit the described age criterion. If you have not received a notification, you should contact the Central Bank office in your area yourself. Employees of the institution must provide the email details to which the mentioned reports are collected. It is also possible to submit electronically through your personal account on the website of the regional Employment Center, if available.

What's happened?

Last year, when a law was adopted to raise the retirement age for Russians and create a new category - people of pre-retirement age, the Russian Ministry of Labor introduced a new obligation for employers. Officials have obliged organizations and individual entrepreneurs with hired employees to report every quarter on how many pre-retirees are employed. Employers were required to send this report to the employment service starting from October 1, 2021. Rostrud informed employers that information about pre-retirees is mandatory in letter No. 858-PR dated July 25, 2021. Now, some employment services have announced that from April 1, 2021, this letter should be considered invalid due to the fact that the Federal Service for Labor and Employment has completed monitoring “Information about organizations (employers) and the number of employees of organizations (men 1959, women born in 1964) who are not pensioners.”

Right or obligation

The letter from Rostrud is more of an advisory nature. This means that there should not be a fine for failure to submit the form: it is not yet subject to the provisions of Art. 19.7 of the Code of Administrative Offenses of the Russian Federation, which defines liability for failure to provide information.

The letter from Rostrud does not indicate that the provision of data must be provided by employers themselves. Most likely, regional and local employment authorities will collect such information.

While there are no official clarifications, we recommend contacting your local employment authorities to clarify the information.