Ways to check reports

Law No. 125-FZ dated July 24, 1998 established that filing and checking Form 4-FSS is the responsibility of all types of employers. They prepare the document on a quarterly basis. The form has a unified template, which is fixed by Order No. 381 dated September 26, 2016. Also see “Form 4-FSS in 2021.”

The calculation according to the approved form can be submitted in paper form or electronically. Depending on the method used to prepare the finished form, the deadlines for its submission to the regulatory authority differ:

- when submitting a document on paper, verification of 4-FSS in 2018 and the fact of acceptance of the form by the responsible person in the government agency must be carried out by the 20th day of the month following the reporting quarterly interval;

- when submitting the form via TKS electronically, time restrictions are fixed within 25 days after the end of the reporting quarter.

Also see “Deadlines for submitting 4-FSS in 2021“.

In the latter case, the 4-FSS can be checked online. This is done using special services of the Social Insurance Fund on the official website of the government agency. Preliminary verification of control ratios, accounting data and numerical values reflected in the reporting form are mandatory stages in preparing a document for submission to government agencies. Options for implementing verification activities:

- checking 4-FSS on the FSS website online - carried out by policyholders independently;

- employers perform reconciliation manually without the use of software;

- a desk audit, which is initiated and carried out by the regulatory authority without the involvement of the policyholder to confirm the correctness of the information contained in the form;

- on-site inspection format.

Calculation submission deadlines

Calculation to the Social Insurance Fund for contributions to insurance from personal injury and personal injury is submitted both on paper and in electronic form. The criterion for the type of form is the number of employees of the enterprise. If the average number of employees is above 25 people, reporting is submitted only in electronic form. Other enterprises have the right to choose the form of reporting.

The average headcount indicator is calculated from the beginning of the year to the end of the reporting period. The average headcount criterion is equally applied for periods of enterprise activity:

- Operating for a long period.

- Newly created from the moment the maximum number is reached.

- Reorganized, if after the transformation the average number of employees exceeded 25 people.

The deadline for submitting the calculation depends on the form chosen by the enterprise. For calculations submitted in paper format, the due date is set to the 20th day of the month following the reporting period. When using the electronic reporting form, the deadline for submission is set to the 25th of the following month.

Do-it-yourself check

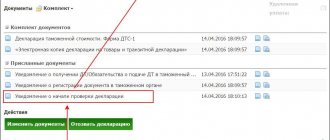

Using electronic services on the official website of the Social Insurance Fund, the 4-FSS report is checked online by the employer independently and free of charge. The sequence of actions is as follows:

- Log in to the social insurance website https://portal.fss.ru and go to the menu item https://portal.fss.ru/fss/services/f4input.

- On the portal, an electronic document template is filled out or an already generated report is uploaded.

- The 4-FSS report is checked on the FSS website, and the result produced by the program is analyzed.

How does the new 4-FSS report differ from the old form?

The new 4-FSS 2021 report contains only minor changes. The new form no longer contains a table for beneficiaries. It follows from this that legal entities employing persons with disabilities can no longer count on tariff reduction benefits.

At the same time, a column was added to the new document where it is necessary to record information about foreign employees. Such specialists must work on an official basis. These workers can now expect to receive sick pay. Data should be recorded on an accrual basis. The report should record all information about the foreign employee, including his citizenship.

Desk type of verification activities

On-site data reconciliation is carried out by employees of the regulatory body without the participation of the policyholder. The documentary basis for verification is the fact of receipt of the report. According to its content, the correctness of calculations for insurance premiums, the completeness of their transfer, and compliance with the deadlines for repayment of obligations are analyzed. A 4-FSS check (online for free or carried out by specialists as part of a mandatory desk reconciliation) is necessary to assess the legality of the costs incurred for the payment of social benefits.

Up to 3 months are allotted for non-travelling analytical reconciliations. The countdown starts from the moment the document is actually submitted to the controlling structure. If inaccuracies or gross errors are identified, the policyholder is notified in writing. In this situation, the policyholder is given the opportunity to justify his actions to reflect conflicting data by providing explanations. Each detected offense is recorded in an act.

FSS penalties

Refusal to provide documentation is regarded as an offense and entails a fine of 200 rubles for each document not provided.

When an employer believes that the inspection was carried out illegally or with violations, he can file a complaint with the higher authorities of the Social Insurance Fund in his region.

In this case, it is necessary to indicate what violations occurred during the inspection - facts, timing, decision, results.

Thus, it is in the interests of each contribution payer to promptly respond to requests from Social Insurance Fund employees during inspections in order to avoid not only fines for failure to provide documentation, but also to receive full payments for reimbursable expenses.

And also be confident in the correctness of filling out reports and calculating social insurance contributions.

Social security reporting is considered submitted if the 4-FSS report has been successfully verified. If any shortcomings are found in the document, they must be promptly eliminated in order to have time to submit a new version of the completed form within the established time frame. Identification of errors is not grounds for postponing deadlines for submitting reporting forms.

Monitoring as part of an on-site inspection

Checking the submission of the 4-FSS report online is available for registered users on the FSS website. The completed stages of automatic monitoring of information from the reporting form and the completion of a desk audit do not guarantee that fund specialists will not conduct on-site monitoring activities. The following features are typical for on-site inspections:

- the entire list of operations performed is included in the inspection plan;

- information for the reporting period and the three years preceding it will be verified;

- there can be no more than 2 months between the start date of the inspection and its end date;

- The frequency of implementation of this form of monitoring is limited to once every three years.

Control can affect not only reporting forms, but also contractual documentation, primary documents, and acts. Recommendations for checking Form 4-FSS and documents related to the report establish that if, as a result of analysis of the submitted forms, cases of understatement of obligations for insurance premiums or facts of unreasonable expenditure of funds on insurance coverage are identified, these amounts must be additionally accrued and shown in the report for the corresponding period. Such information is reflected in Table 2.

Read also

31.08.2018

Periods and duration checked by the FSS

Periods during the last three years of operation of the enterprise/individual entrepreneur, preceding the year of drawing up the decision on inspection, can be inspected.

When conducting an on-site inspection of the Social Insurance Fund, reporting periods of an unfinished calendar year can also be checked. Re-checking of already checked periods is allowed. Typically, repeat inspections are scheduled during reorganization/liquidation procedures of the payer or when providing an adjusting calculation.

The duration of the inspection is determined individually for each enterprise, taking into account several factors - the volume of documents to be studied. In normal cases, the period for checking the FSS does not exceed one month.

In some situations they can be extended to two or three months. If the organization has branches, one month is allocated to inspect each of them.

The organization is given a period of ten calendar days to submit the requested documentation. In cases where the company fails to meet the deadline, it is necessary to submit a written request for a delay, indicating the reasons and the actual deadline.

The head of the fund will review the application and make a decision on granting a deferment - positive or negative.

Calculation submission form

Starting from 9 months of 2021, payments to the Social Insurance Fund are submitted on a new form. It is allowed to submit a new sample calculation for six months. Corrective calculations for previous periods, despite indicating the indicators on an accrual basis, are presented by enterprises on the forms on which the initial reports were submitted. Changes have been made to the reporting form:

- The title contains additional information about the organization's affiliation with a budget of a certain level.

- The calculation lines have been supplemented with clauses 1.1 and 14.1 regarding calculations for separate divisions deregistered.

- The procedure for calculating the number indicated on the title has been clarified. The data is determined from the beginning of the tax period – the calendar year.

The format of reporting submitted electronically has also changed from reporting for 9 months - the period of validity of the new form. Changes were made by Orders of the Federal Social Insurance Fund of Russia dated 03/09/2017 No. 83, dated 09/11/2017 No. 416.

Enterprises that have no activity in the reporting period must submit zero reporting - a calculation with the absence of indicators. Individual entrepreneurs who do not have employees are not required to submit calculations. The calculation contains tables that are required to be presented. Enterprises are required to submit a title page, tables 1, 2, 5. The remaining data in tabular form is presented as necessary. For example, the data in Table 4 will need to be included as part of the calculation if accidents occur at the enterprise.

Using the services of electronic document management operators

The transfer of reporting can be carried out with the participation of OED - operators carrying out electronic data exchange with the Fund or the Federal Tax Service. The changes made by orders to the Technology for Receiving Payments (approved by Order of the Social Insurance Fund dated February 12, 2010 No. 19) are intended to protect electronic circulation. To send reports electronically through the OED, it is necessary to update the key certificates.

| Security element | Peculiarities |

| Electronic signature form | Actions for the electronic exchange of documents of an enterprise are certified by an electronic digital signature. The key certificate, valid until September 15, 2017, must be replaced in the program that is used to generate reports |

| Certificate | For data exchange, a public key is used to sign the receipt. The certificate is intended to certify the signature of an FSS official. More information about the form of the key is explained by the information posted on the official website of the Foundation in the section about the certification center |

| Format | The requirements for the information transmission format, logical control and encryption procedure have been changed. When passing the control, the contents of the lines, the presence of the required details, the absence of extra spaces, and compliance with the control ratios are checked. |

Using the FSS website for reporting

Taxpayers have the opportunity to use the official website of the Social Insurance Fund. Users have the right to use 2 reporting options.

| How to use the service | Peculiarities |

| Service for submitting a form without going through the registration procedure | The service offers include checking the accuracy of data to ensure that it has passed format and logical control. The availability of general data about the enterprise, territorial branch and the absence of errors in compliance with the format when entering information is checked. |

| Service for filling out a form if you are registered on the site | The program performs a mandatory check for errors to pass format control and compare data with previously submitted reports |

Separate divisions of enterprises independently report to the branch located at the territorial location of the organization. Reporting is submitted by structural departments if the department has a current account, a balance sheet, and jobs created separately from the head enterprise. The unit must be registered with the Social Insurance Fund and have a unique number assigned.

The procedure for sending reports electronically through the FSS website

When using the FSS website to transfer a calculation, you must have a key certificate for verifying a qualified digital signature issued to the policyholder by a specialized center and a key certificate from a FSS official received on the website. The implementation of the electronic form for sending reports is carried out in several steps:

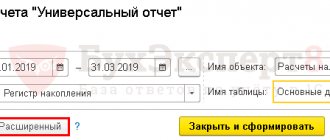

- Calculation of contributions. To create the file, online services of the FSS website or specialized reporting programs are used.

- Checking the accuracy of calculation indicators in accordance with control ratios.

- Print the document.

- Generating calculations in XML format.

- File signing and encryption.

- Transfer the file through the official website of the FSS. On the page https://f4.fss.ru you need to go to the “send document” tab, then select a file and perform the action of sending the document.

The document is processed within 24 hours. On the “check and control” tab you can monitor the processing of the file. The processing status check can be viewed after the time has elapsed with the ID data.