BASIC

All organizations and entrepreneurs that apply the general taxation system are VAT payers. Foreign organizations operating in Russia are also recognized as VAT payers. This follows from Article 143 and paragraph 2 of paragraph 2 of Article 11 of the Tax Code of the Russian Federation.

Foreign organizations registered with the tax office pay tax on their own. This follows from the provisions of paragraph 1 of Article 143, Article 83, paragraph 7 of Article 174 of the Tax Code of the Russian Federation. If they are not registered for tax purposes in Russia, then VAT for them is transferred by organizations acting as tax agents for:

- purchasing goods (works, services) from them (clause 2 of article 161 of the Tax Code of the Russian Federation);

- sales in Russia of their goods (works, services, property rights) on the basis of agency agreements, agency or commission agreements (clause 5 of Article 161 of the Tax Code of the Russian Federation).

VAT is charged when performing the following transactions:

- sale of goods (work, services) and property rights on the territory of Russia (in this case, the gratuitous transfer of goods, work and services is also considered a sale);

- transfer of goods on the territory of Russia (performance of work, provision of services) for one’s own needs, the costs of which are not taken into account when calculating income tax;

- performing construction and installation work for own consumption;

- import of goods.

This is stated in paragraph 1 of Article 146 of the Tax Code.

When carrying out transactions that are subject to VAT, issue an invoice (clause 5 of Article 168, subclause 1 of clause 3 of Article 169 of the Tax Code of the Russian Federation).

There is no need to charge VAT on transactions that:

- are not recognized as subject to VAT (clause 2 of Article 146 of the Tax Code of the Russian Federation);

- exempt from taxation (Article 149 of the Tax Code of the Russian Federation).

Compensation payments

Situation: should the contractor (performer) pay VAT on compensation for additional costs associated with the execution of the main contract? The customer reimburses the contractor (performer) for additional expenses above the price of the main contract.

Yes, I should.

VAT is imposed on transactions involving the sale of goods (work, services) on the territory of Russia (Clause 1, Article 146 of the Tax Code of the Russian Federation). At the same time, the tax base increases by all amounts associated with payment for goods, works, and services sold (subclause 2, clause 1, article 162 of the Tax Code of the Russian Federation). In this regard, compensation for additional costs (for example, travel or transportation expenses) incurred during the execution of the contract, which the customer pays to the contractor, should be included in the VAT tax base. Moreover, regardless of whether these expenses were immediately provided for in the contract (initial estimate), or the invoice for their payment was issued separately.

This point of view is reflected in letters of the Ministry of Finance of Russia dated August 15, 2012 No. 03-07-11/300 and October 14, 2009 No. 03-07-11/253.

An exception is compensation with which the customer reimburses the contractor (performer) for the cost of lost or damaged property. The Russian Ministry of Finance admits that such amounts are not related to payment for work (services) performed. Therefore, there is no need to include them in the VAT tax base (letter of the Ministry of Finance of Russia dated July 29, 2013 No. 03-07-11/30128).

An example of how compensation for additional expenses incurred by the performer (contractor) is reflected in accounting and taxation

Alpha LLC (customer) entered into an agreement with Proizvodstvennaya LLC (contractor) to carry out commissioning work on gas equipment. Contract price – 118,000 rubles. (including VAT – 18,000 rubles). In addition, the parties entered into an agreement that the customer reimburses the contractor for travel expenses in excess of the price of the main contract. The amount of travel expenses for “Master” employees involved in the execution of the contract amounted to 30,000 rubles. (including VAT - 4000 rubles (part of the expenses is not subject to VAT)).

After signing the acceptance certificate for the work performed, Alpha transferred payment in the amount of 118,000 rubles to the Master. and reimbursed travel expenses in the amount of 30,000 rubles.

When calculating VAT on compensation for travel expenses, Master’s accountant was guided by the position of the Russian Ministry of Finance.

The following entries were made in the organization's accounting:

Debit 71 Credit 50 – 30,000 rub. – money was given to the employee on account;

Debit 20 Credit 71 – 26,000 rub. (RUB 30,000 – RUB 4,000) – travel expenses are taken into account;

Debit 19 Credit 71 – 4000 rub. – VAT on travel expenses is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 4000 rub. – accepted for deduction of VAT on travel expenses;

Debit 62 Credit 90-1 – 148,000 rub. (RUB 118,000 + RUB 30,000) – revenue from the sale of work performed is reflected, taking into account compensation for travel expenses;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 22,576 rubles. (RUB 148,000 × 18/118) – VAT is charged;

Debit 51 Credit 62 – 148,000 rub. – payment was received from the customer for the work performed, taking into account compensation for travel expenses.

When calculating the income tax, the Master's accountant included in the income the proceeds from the sale of work performed (taking into account compensation for travel expenses) minus VAT - 125,424 rubles. (RUB 148,000 – RUB 22,576).

Advice: there are arguments that allow contractors (performers) not to pay VAT on compensation for additional expenses that are reimbursed by the customer in excess of the contract price. They are as follows.

If additional expenses (for example, travel expenses of the contractor, expenses of the buyer for eliminating defects in the delivered goods, etc.) are not included in the cost of the main work under the contract (initial estimate) and are reimbursed by the customer separately in the amount of actual costs, then the amount of compensation cannot be qualified as proceeds from sales. The fact is that when additional expenses are reimbursed, the ownership rights to any goods, results of work performed, or services provided do not transfer to the customer (clause 1 of Article 39 of the Tax Code of the Russian Federation). Consequently, funds received by the contractor (performer) as compensation for additional expenses are not recognized as revenue and are not subject to VAT (clause 1 of Article 146 of the Tax Code of the Russian Federation). This conclusion is confirmed by arbitration practice (see, for example, the rulings of the Supreme Arbitration Court of the Russian Federation dated September 11, 2009 No. VAS-12036/09, dated June 14, 2007 No. 6950/07, resolutions of the FAS Moscow District dated February 2, 2012 No. A40 -35336/11-140-155, Ural District dated May 25, 2009 No. Ф09-3324/09-С3, Volga-Vyatka District dated February 19, 2007 No. A17-1843/5-2006, Northwestern District dated May 26, 2010 No. A66-7801/2009, dated August 25, 2008 No. A42-7064/2007 and dated August 25, 2008 No. A42-190/2008, East Siberian District dated March 10, 2006 No. A33 -20073/04-С6-Ф02-876/05-С1). However, taking into account the position of the financial department, the legality of excluding from the VAT tax base the amount of additional expenses reimbursed by the customer will have to be proven in court by the organization.

Situation: is it necessary to pay VAT on income received by a Russian sports club under a transfer contract? The contract was concluded in connection with the transfer of an athlete (professional football player) to another club.

No no need.

When a professional football player moves from one club to another, a transfer contract is concluded. It, in particular, stipulates the conditions and amount of compensation payments (transfer payments) associated with the athlete’s transfer. During the execution of this contract, the sale of goods (works, services) in the meaning defined in Article 39 of the Tax Code of the Russian Federation does not occur. Such relations cannot be considered as an operation of transfer of property rights. Consequently, compensation payments received under transfer contracts are not subject to VAT.

The legality of this approach is confirmed by the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 27, 2007 No. 11967/06 and the letter of the Ministry of Finance of Russia dated November 22, 2010 No. 03-07-07/74, in which the financial department shares the position of the Supreme Arbitration Court of the Russian Federation.

It should be noted that previously the regulatory agencies took a different position. Representatives of the Ministry of Finance of Russia (in oral explanations) and the Department of Tax Administration of Russia for Moscow, in a letter dated November 2, 2001 No. 02-11/50841, equated compensation payments under the transfer contract to payment for services for the professional training of an athlete. That is, to revenue from the sale of services, which is subject to VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). Some courts supported this point of view (see, for example, the resolution of the Federal Antimonopoly Service of the Ural District dated August 23, 2006 No. F09-7230/06-S2). However, with the release of the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 27, 2007 No. 11967/06 and the appearance of the letter of the Ministry of Finance of Russia dated November 22, 2010 No. 03-07-07/74, the previous explanations have lost their relevance, and arbitration practice on this issue should become uniform .

Situation: is it necessary to charge VAT on the amount of payment for a negative impact on the operation of a centralized sewerage system? The organization provides water supply and sanitation services to the population and urban organizations.

Yes need.

Payment for the negative impact on the operation of the centralized sewerage system is essentially a payment for preventive (repair) measures that neutralize the impact of pollutants on the water supply and sewerage network. Such activities are carried out by organizations that provide water supply and sanitation services. They issue invoices to subscribers for transferring fees and are the recipients of these funds. This procedure is provided for in paragraphs 118 and 119 of the Rules, approved by Decree of the Government of the Russian Federation of July 29, 2013 No. 644.

Sales of services on the territory of Russia are subject to VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). And the tax base is revenue from the sale of services, which includes all income associated with settlements for payment for these services (clause 2 of Article 153 of the Tax Code of the Russian Federation).

The list of services not subject to VAT is given in Article 149 of the Tax Code of the Russian Federation. But water supply and sanitation services are not among such operations. And the benefit provided for by paragraph 29 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation applies only to intermediaries in settlements between service providers and consumers (management companies, homeowners' associations). Based on this, payments for negative impacts on the operation of the centralized sewerage system are subject to VAT on a general basis.

The tax base is the size of the fee. Determine the value of this indicator using the formulas given in paragraphs 120 and 123 of the Rules, approved by Decree of the Government of the Russian Federation of July 29, 2013 No. 644. The fee does not include VAT. Therefore, the tax should be calculated not at an estimated rate, but at a direct rate of 18 percent.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated June 23, 2014 No. 03-07-RZ/29787.

Situation: is it necessary to charge VAT on the amount of compensation that a Russian importing organization receives from a foreign seller located abroad? The latter compensates for the cost of mandatory certification of imported goods; the certificate remains at the disposal of the Russian organization.

No no need.

Compensation for certification costs is in no way connected with payment for goods, works or services sold, therefore there is no reason to increase the VAT tax base by this amount (subclause 2, clause 1, article 162 of the Tax Code of the Russian Federation). In addition, there is no implementation of services for organizing certification, since the Russian importer receives a certificate for himself (clause 1 of Article 39 of the Tax Code of the Russian Federation). This means that the object of VAT taxation does not arise and VAT does not need to be charged (clause 1 of Article 146 of the Tax Code of the Russian Federation).

Is it possible to do it differently?

To avoid disputes with the tax authorities, you can, of course, do exactly as officials advise. However, there is one subtlety here: according to the Civil Code of the Russian Federation, agency and commission agreements are not gratuitous, which means that some remuneration must be provided for them. And even if the contract does not provide for this, it must still be paid after fulfillment of obligations in an amount similar to the prices charged for similar services.

Therefore, if you decide to conclude a mediation agreement, it will be necessary to provide for some amount of remuneration, even the smallest one. This amount for the seller (who is the intermediary here) will be income, and in accounting, transportation services will transit through account 76.

However, it is worth remembering that the Civil Code of the Russian Federation does not oblige anyone to act according to such a scheme, and the conditions for organizing the transportation of goods can be fixed in other ways. For example, you can provide in the contract for a change in price depending on any indicators that determine it.

Then the price of the product will consist of two parts: constant and variable, determined by the amount of delivery costs. This scheme kills two birds with one stone: transportation costs are compensated, but at the same time there is no mediation.

Residential maintenance

Situation: can an organization use a VAT benefit when selling maintenance services for residential premises (garbage removal, cleaning staircases, heating services, elevator maintenance, etc.)?

Only homeowners' associations (HOAs), housing cooperatives or other specialized consumer cooperatives, as well as management organizations can apply VAT benefits for the sale of maintenance services for residential premises (subclauses 29, 30, clause 3, article 149 of the Tax Code of the Russian Federation). However, this benefit can be used subject to the following conditions:

- utilities were purchased directly from resource supply organizations specified in paragraph 1 of Article 2 of Law No. 210-FZ of December 30, 2004. It should be taken into account that utility services include payments for cold and hot water supply, sewerage, electricity supply, gas supply and heating (Part 4 of Article 154 of the Housing Code of the Russian Federation);

- utilities are sold at a cost corresponding to the cost of their acquisition from the resource supplying organization (including input VAT).

In the same manner, the performance of work (provision of services) for maintenance (maintenance and repair) of common property in apartment buildings is also exempt from VAT. That is, you can take advantage of the VAT benefit if:

- works (services) were purchased from contractors (organizations and entrepreneurs) who perform (provide) them, including with the involvement of subcontractors. It should be taken into account that the maintenance of property in apartment buildings includes the work (services) listed in paragraph 11 of the Rules, approved by Decree of the Government of the Russian Federation of August 13, 2006 No. 491;

- works (services) are sold at a cost corresponding to the cost of their acquisition (including input VAT).

If homeowners' associations, cooperatives or management organizations sell work (services) performed (provided) on their own or at a price higher than the cost of their acquisition, the benefits provided for in subparagraphs 29 and 30 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation do not apply.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated August 6, 2010 No. 03-07-11/345, dated April 27, 2010 No. 03-07-07/18, dated March 12, 2010 No. 03-07-14/ December 18 and December 23, 2009 No. 03-07-15/169 (the last letter was addressed to the Federal Tax Service of Russia for use in the work of tax inspectorates).

An additional condition for using the benefit is the performance of maintenance (maintenance and repair) work on common property in apartment buildings under the apartment building management agreement. The requirements for such an agreement are established by Article 162 of the Housing Code of the Russian Federation. If such work (services) are performed (provided) within the framework of an agreement that does not comply with the requirements of Article 162 of the Housing Code of the Russian Federation, the benefit provided for by subparagraph 30 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation does not apply. This conclusion is confirmed by the Ministry of Finance of Russia in a letter dated August 6, 2010 No. 03-07-11/345.

VAT benefits for the sale of utility services and for the performance of maintenance (maintenance and repair) work on common property in apartment buildings are provided regardless of to whom these services (work) are provided (performed): the population or organizations (letter from the Ministry of Finance of Russia dated April 30, 2010 No. 03-07-07/21), owners or tenants (users) of premises (letter of the Federal Tax Service of Russia dated May 28, 2010 No. ShS-37-3/2791).

Compensation for losses is not subject to personal income tax

Let's consider another case. Let's imagine that your company damaged the property of an individual and, in this regard, compensates him for real damage. Basis - art. 15 Civil Code. There are plenty of examples from life. For example, builders, while renovating an apartment, flooded the residents on the ground floor. Or another example: while repairing the roof of a building, workers dropped a construction tool onto a car parked below.

Affected individuals can count on the favor of the tax authorities. Although, again, officials do not provide specific arguments to support their opinion. They argue that the individual did not receive an economic benefit. This conclusion was made by specialists of the financial department in Letters dated 10/07/2010 N 03-04-06/6-243, dated 05/05/2010 N 03-04-06/10-89 and dated 04/08/2010 N 03-04-05/10 -172. Accordingly, compensation amounts are not income and are not taken into account when determining the tax base for personal income tax.

But let’s assume that your company compensates for moral damages to the buyer on the basis of Art. 15 of the Law of the Russian Federation dated 02/07/1992 N 2300-1 “On the protection of consumer rights.”

The Moscow Office of the Federal Tax Service of Russia in Letter dated 05/06/2010 N 20-14/3/ [email protected] rightly explains that such compensation is not subject to personal income tax only if it is ordered by the court. This conclusion is based on the wording used in the Law of the Russian Federation of 02/07/1992 N 2300-1.

Educational services

Situation: can an organization use VAT benefits when providing services in the field of education (conducting lectures, seminars, etc.) if, based on the results of training, it does not conduct certification and does not issue educational documents?

Only non-profit organizations can use VAT benefits when providing services in the field of education (subclause 14, clause 2, article 149 of the Tax Code of the Russian Federation). Therefore, if educational services are provided by a commercial organization, it is obliged to charge VAT on their entire cost.

Non-profit organizations are exempt from taxation when selling educational services within the framework specified in the licenses:

- general education programs;

- professional (main and (or) additional) educational programs;

- vocational training programs or educational process.

A complete list of services for the implementation of educational programs is given in the appendix to the regulations on licensing of educational activities, approved by Decree of the Government of the Russian Federation of October 28, 2013 No. 966.

In addition, VAT is not assessed on the sale of additional educational services that, in terms of level and focus, correspond to the programs specified in the license.

If an organization licensed for educational activities, as part of this activity, conducts one-time classes in the form of lectures, seminars, internships, then these additional educational services are also not subject to VAT.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated April 28, 2012 No. 03-07-07/47.

Services related to the sale of precious metals

Situation: can an organization use VAT benefits when providing services related to the sale of precious metals to the Bank of Russia (sorting, weighing, packaging, storage)?

No, he can not.

In accordance with subparagraph 9 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation, it is the sale of precious metals on the interbank market that is exempt from VAT. At the same time, tax legislation means the transfer of ownership of property from one person to another on a compensated and gratuitous basis (clause 1 of Article 39 of the Tax Code of the Russian Federation). The benefits provided for in subparagraph 9 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation do not apply to services for sorting, weighing, packaging and storage of precious metals.

What expenses are considered reimbursable?

First, let's figure out exactly what expenses are called reimbursable. It’s not very complicated here: these are expenses that were made in the interests of another person. Reimbursement of costs is most often formalized in contracts for the provision of services, rental or intermediary. Here are examples of the most common cases:

- food expenses;

- medical services;

- insurance;

- transport;

- utilities;

- travel allowances, etc.

But, of course, the most significant share of all types of reimbursed services are services for the delivery and transportation of goods. Let's look at them in more detail.

Sale of medical property

Situation: is it necessary to pay VAT on the sale of products intended for internal prosthetics?

Yes need.

In accordance with the All-Russian Classification of Products, products intended for internal prosthetics have code 93 9818 and are included in subgroup 93 9800 “Other medical materials and devices.” This means that these products do not belong to prosthetic and orthopedic products (code 93 9600 according to the All-Russian Product Classifier), the sale of which is exempt from VAT on the basis of subparagraph 1 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation.

Thus, when selling products intended for internal prosthetics, the organization cannot take advantage of the VAT benefit provided for in subparagraph 1 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation. Therefore, when selling them, pay VAT, and apply a rate of 10 percent (clause 1 of Article 146, subclause 4 of clause 2 of Article 164 of the Tax Code of the Russian Federation).

Situation: is it necessary to pay VAT when selling an ambulance?

Yes need.

The list of the most important and vital medical equipment, the sale of which is not subject to VAT, was approved by Decree of the Government of the Russian Federation of September 30, 2015 No. 1042. In accordance with it, preferential equipment includes means for movement and transportation, which are included in the group of products with the code according to the All-Russian Product Classifier 94 5100. An ambulance does not belong to this group, since it is assigned code 45 1485. Therefore, when selling it, pay VAT in the general manner (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated June 2, 2008 No. 03-07-07/65.

An example of VAT calculation on the sale of an ambulance

Alpha LLC is a commercial medical center. In 2013, the organization purchased an ambulance. The initial cost of the car, both according to accounting and tax records, was 350,000 rubles. The car was used in the main activity of the organization - providing paid medical services to the population. When selling medical services, the organization used the benefit in the form of exemption from VAT, provided for in subparagraph 2 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation. Therefore, the VAT paid to the supplier was taken into account in the original cost of the car. The vehicle was not revalued.

In February 2015, Alpha sold the car. The selling price of the car was 200,600 rubles. (including VAT – RUB 30,600). At the time of sale, the amount of depreciation accrued on the car in both accounting and tax accounting amounted to 161,200 rubles. Thus, the residual value of the car at the time of sale was 188,800 rubles. (RUB 350,000 – RUB 161,200). In the same month, the buyer transferred money for the car to the organization.

Since the initial cost of the car included the amount of “input” VAT, when it was sold, a special procedure was established for calculating the tax base. Its accountant calculated it as the difference between the sales price (including VAT) and its residual value (clause 3 of Article 154 of the Tax Code of the Russian Federation). Thus, when selling a car, the accountant charged VAT in the amount of: (200,600 rubles – 188,800 rubles) × 18/118 = 1,800 rubles.

Alpha's accountant reflected the sale of the car as follows:

Debit 76 Credit 91-1 – 200,600 rubles. – revenue from the sale of a car is reflected;

Debit 01 subaccount “Disposal of fixed assets” Credit 01 – RUB 350,000. – the original cost of the car has been written off;

Debit 02 Credit 01 subaccount “Disposal of fixed assets” – 161,200 rubles. – the amount of accrued depreciation is written off;

Debit 91-2 Credit 01 subaccount “Disposal of fixed assets” – 188,800 rubles. – the residual value of the car is written off;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 1800 rubles. – VAT payable to the budget has been accrued;

Debit 51 Credit 76 – 200,600 rub. – money received from the buyer.

Situation: is it necessary to pay VAT when leasing medical equipment, the sale of which is exempt from VAT?

Yes need.

Subparagraph 1 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation provides that the sale of medical equipment that is listed in the List approved by Decree of the Government of the Russian Federation of September 30, 2015 No. 1042 is exempt from VAT. Thus, this benefit applies only to operations for its sale . Therefore, when leasing medical equipment, pay VAT in the general order (clause 1, article 39, subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

Sale of property of a liquidated organization

Situation: is it necessary to pay VAT when transferring the property of a liquidated organization to the founders?

Yes, it is necessary if the value of the transferred property exceeds the amount of the founder’s initial contribution to the authorized capital of the liquidated organization.

The transfer of property of a liquidated organization to its founders within the limits of their initial contribution is not recognized as a sale and is not subject to VAT (subclause 5, clause 3, article 39, clause 2, article 146 of the Tax Code of the Russian Federation). If the value of the transferred property exceeds the amount of the down payment, then this operation is recognized as a sale and is subject to VAT (subclause 5, clause 3, article 39, subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). On the amount of excess of the market value of the transferred property over the amount of the initial contribution, the liquidated organization must charge a tax at a rate of 18 percent and issue an invoice to the founder (clause 2 of Article 154, clause 3 of Article 164, clause 1 of Article 168, subclause 1 clause 3 article 169 of the Tax Code of the Russian Federation).

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated April 17, 2012 No. 03-07-11/112. In arbitration practice there are examples of court decisions confirming the legality of this approach (see, for example, the resolution of the FAS of the North Caucasus District dated January 23, 2006 No. F08-6609/2005-2602A).

It should be noted that when transferring securities or funds to the founders, the liquidated organization should not charge VAT. Such transactions are not subject to taxation. This follows from the provisions of subparagraph 12 of paragraph 2 of Article 149, subparagraph 1 of paragraph 3 of Article 39 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated January 20, 2005 No. 03-05-02-04/6.

The only arbitration precedent

Judicial practice in favor of taxpayers is represented by one single case. This is the Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated 08/02/2010 in case No. A29-10481/2009. This document is noteworthy in that its decision is supported by the Determination of the Supreme Arbitration Court of the Russian Federation dated December 13, 2010 N VAS-16460/10.

This Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District considered a dispute between the tax inspectorate and a tax agent who did not withhold personal income tax when paying compensation for legal expenses to an employee.

The arbitrators agreed that the application of penalties to the company under Art. 123 of the Tax Code is unreasonable. They considered that the employee did not receive an economic benefit because he was merely reimbursing his costs.

The author does not share this approach and believes that there is a prospect of winning such a dispute when the costs of an individual are limited by state duty.

Carrying out post-warranty repairs

Situation: is it necessary to pay VAT when selling post-warranty repair services?

Yes need.

Services provided on the territory of Russia without charging additional fees for the repair and maintenance of goods during the warranty period of their operation are not subject to VAT (subclause 13, clause 2, article 149 of the Tax Code of the Russian Federation). For services related to post-warranty repairs, the Tax Code of the Russian Federation does not provide for VAT exemption.

Therefore, when selling them, you pay VAT in the general manner at a rate of 18 percent (clause 3 of Article 164 of the Tax Code of the Russian Federation).

Proceeds from participants in shared construction

Situation: is it necessary to pay VAT to the developer on amounts received from participants in the shared construction of a residential building? The residential building has not been put into operation.

Yes, it is necessary, but only from a portion of the funds received from participants in the shared construction of a residential building to pay for construction work performed by the developer himself.

Under an agreement for participation in shared construction, the developer undertakes to build a property and, after receiving permission to put it into operation, transfer it to the participants in shared construction. In turn, each participant must pay the amount stipulated by the contract and, upon completion of construction, accept their part of the facility.

The developer can carry out construction on its own and (or) by contractors.

This is stated in Part 1 of Article 4 of the Law of December 30, 2004 No. 214-FZ.

The contract amount may include:

- the cost of the developer’s services (regardless of the method of construction);

- the cost of construction work, namely, reimbursement of the developer’s costs for attracting contractors (when construction is carried out by contractors) and (or) the cost of work performed directly by the developer (when construction is carried out on its own).

This follows from the provisions of Part 1 of Article 5 of the Law of December 30, 2004 No. 214-FZ.

The services of the developer under the equity participation agreement are not subject to VAT (subclause 23.1, clause 3, article 149 of the Tax Code of the Russian Federation). An exception to the rule is developer services provided during the construction of industrial facilities. At the same time, industrial objects include objects intended for use in the production of goods (performance of work, provision of services). According to the Federal Tax Service of Russia, such objects include non-residential premises of apartment buildings, which are not part of the common property and are intended for conducting business activities (location of offices, shops, catering facilities, etc.). Thus, the benefit provided for by subclause 23.1 of clause 3 of Article 149 of the Tax Code of the Russian Federation applies only to the services of the developer under contracts that provide for the transfer to shareholders of residential premises, as well as premises intended for personal or family needs (for example, parking spaces in an underground parking lot) . If the agreement provides for the transfer to shareholders of non-residential premises intended for business activities, then the developer must charge VAT on the cost of services related to this part of shared construction. To do this, he will have to keep separate records.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated June 26, 2012 No. 03-07-15/67, dated May 4, 2012 No. 03-07-10/10, Federal Tax Service of Russia dated July 16, 2012 No. ED-4- 3/11645.

From funds received from participants in shared construction in payment for construction work that the developer carries out on his own, the developer must pay VAT as on proceeds from sales (Article 39 and sub-clause 1, clause 1, Article 146 of the Tax Code of the Russian Federation).

In terms of construction work carried out by contractors, amounts received from participants in shared construction do not constitute sales revenue for the developer. They represent reimbursement of the developer’s expenses for paying for the services of contractors, on which VAT is not required.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated July 7, 2009 No. 03-07-10/10, dated March 25, 2008 No. 03-07-10/02, dated July 12, 2005 No. 03-04-01/ 82. Despite the fact that the above letters were issued before the introduction of VAT benefits for developer services, their provisions, which explain the taxation procedure for the costs of hiring a contractor and construction work carried out independently by the developer, can still be applied now, since the legislation on them has not changed.

The above equally applies to settlements with any participants in shared construction, including participants who are also contractors for the construction of a residential building. There are no exceptions for them by law. In this case, instead of settlements in cash, the contractor and the developer can set off. In the situation under consideration, each of the parties has homogeneous counter-obligations: the developer - under a construction contract, the contractor - under an agreement for participation in shared construction. Such obligations may be terminated by offset. This follows from Article 410 of the Civil Code of the Russian Federation.

What are reimbursable travel expenses?

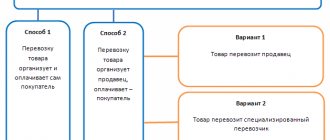

Let's consider several options related to the delivery of goods.

- The buyer can pick up the goods independently, on a self-pickup basis. For the supplier, this is perhaps the ideal option: he will only need to release the goods from the warehouse directly to the buyer himself or the transport organization hired by him. In this case, the buyer bears all delivery costs personally.

- The supplier can sell his goods at a price that already includes transportation costs. In this case, they will be part of its commercial costs, and the buyer will account for them as part of the purchase price.

- Often the supplier carries out several types of activities - for example, the sale of goods and the provision of transport services. Then it turns out that the buyer purchases each of these services separately - under two different contracts or under a mixed one. In this case, the delivery cost is billed to the buyer in a separate document or is generally highlighted on a separate line.

- And another way is when delivery is organized by the supplier, but not on its own, but with the involvement of a third-party transport company, concluding an agreement with it for the provision of relevant services. However, the cost of delivery is ultimately paid by the buyer of the goods, and not by the supplier, although it is the latter who pays the carrier with funds received from the buyer in the amount of the cost of transport services provided to him. It is these transportation costs that are usually called reimbursable.

Funds from the state budget

Situation: are funds received from the budget to finance public works activities subject to VAT? The funds are allocated as part of a regional program to reduce tensions in the labor market.

No, they are not taxed.

The procedure for organizing and financing public works is regulated by Law No. 1032-1 of April 19, 1991 and the Regulations approved by Decree of the Government of the Russian Federation of July 14, 1997 No. 875. The areas in which public works can be organized are listed in paragraph 6 of these Regulations . These, in particular, include work related to the construction of housing and roads, landscaping and landscaping, care for the elderly, disabled and sick, etc.

The performance of work (provision of services) as part of measures aimed at reducing tensions in the labor market is not recognized as subject to VAT. This procedure is provided for in subparagraph 11 of paragraph 2 of Article 146 of the Tax Code of the Russian Federation. For example, there is no need to charge VAT on the cost of work that, within the framework of contracts with employment centers, was carried out for the needs of the organization and in which employees who were transferred from main to temporary jobs participated (letter of the Ministry of Finance of Russia dated April 23, 2010 No. 03-04-06 /1-82).

If an organization carries out operations both subject to VAT and exempt from tax, then organize separate accounting of such operations (clause 4 of Article 149 of the Tax Code of the Russian Federation).

The procedure for calculating VAT in certain situations is shown in the table.

Results

So, we looked at the main situations for calculating VAT on reimbursable expenses and got acquainted with the opinions of officials and judges.

You will have to decide for yourself which position to adhere to. However, you need to understand that if you do not follow the recommendations of financiers, you may have to defend your opinion in court. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

simplified tax system

Organizations using the simplification must pay VAT only in the following cases:

- when importing goods (clause 2 of article 346.11 of the Tax Code of the Russian Federation);

- if the buyer is issued an invoice with an allocated amount of VAT (clause 5 of Article 173 of the Tax Code of the Russian Federation);

- if the organization conducts general affairs in simple partnerships, is a trustee or concessionaire (clause 2 of article 346.11, article 174.1 of the Tax Code of the Russian Federation).

In addition, organizations applying the simplification are not exempt from fulfilling the duties of a tax agent to withhold and pay VAT (Article 161 of the Tax Code of the Russian Federation).

UTII

Payers of UTII are exempt from paying VAT on transactions that, in accordance with Article 146 of the Tax Code, are recognized as subject to VAT, but are carried out within the framework of activities subject to a single tax. An exception is the import of goods into Russia: when performing such operations, UTII payers must pay VAT. This follows from the provisions of paragraph 3 of paragraph 4 of Article 346.26 of the Tax Code.

VAT must be charged on transactions that do not relate to activities subject to UTII and are recognized as subject to VAT. In particular, obligations to pay VAT arise if an organization that is a UTII payer:

- transfers goods to employees as payment for labor;

- sells fixed assets to employees (materials and other property not intended for resale).

When selling goods (works, services) for which UTII is applied, do not draw up invoices. If, nevertheless, an invoice was issued and transferred to the buyer, then transfer the amount of VAT allocated in the invoice to the budget (clause 5 of Article 173 of the Tax Code of the Russian Federation). Do not deduct VAT presented by suppliers (Article 171 of the Tax Code of the Russian Federation).

Organizations that use UTII are not exempt from performing the duties of a tax agent for VAT (Article 161 of the Tax Code of the Russian Federation).