Costs for compulsory motor liability insurance relate to other expenses for ordinary activities. Enterprises using the simplified tax system “Income minus expenses” when calculating the single tax base have the right to reduce income by the amount of costs listed in Art. 346.16 Tax Code of the Russian Federation. Clause 7 indicates the costs of compulsory insurance; therefore, compulsory motor liability insurance is included in the costs of the simplified tax system. According to paragraph 2 of Art. 263 of the Tax Code, compulsory insurance in the expenses of the “simplified” is recognized within the framework of insurance tariffs approved in accordance with the law. If such tariffs are not approved, the entire amount of costs can be offset against expenses.

For your information! It is impossible to take into account the costs of voluntary vehicle insurance in the tax base, since such a policy is purchased on the company’s own initiative.

For example, if a company purchased and put into operation a car for which a compulsory motor liability insurance policy worth 25,000 rubles was paid. and CASCO in the amount of 55,000 rubles, the accountant has the right to take into account only 25,000 rubles in expenses. for compulsory insurance. The base cannot be reduced by the cost of the CASCO policy.

Types of car insurance

If an organization or individual entrepreneur that uses the simplified tax system has a car, then, of course, it needs to be insured under the MTPL program. Moreover, the payer of the simplified tax system can purchase a CASCO or DSAGO policy. But what about when calculating the single tax? Can insurance fees paid to an insurance company be expensed?

OSAGO is compulsory motor third party liability insurance. Without a compulsory motor liability insurance policy, your car will not be registered, you will not be allowed to undergo a technical inspection, and a traffic police officer will fine you on the road. OASGO is a mandatory type of car insurance.

DSAGO - additional civil liability insurance on a voluntary basis. In the case of insurance under DSAGO, the amount of payments under OSAGO (for compensation for damage to property, life and health of third parties) increases.

CASCO is a voluntary insurance contract that provides compensation for damage from car damage, theft or loss of a car (at the discretion of the policyholder).

Postings for leasing a car from the lessee on the usn

Important The cost of the leased asset, recorded on the balance sheet of the lessee, is repaid by calculating depreciation over the useful life, which is established by the organization independently when accepting the object for accounting (clause

17, 18, 19, 20 PBU 6/01). Moreover, in accordance with clause PBU 6/01, the period is set based on the expected period of use of the fixed asset item in accordance with the expected productivity or capacity; expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, the repair system; regulatory and other restrictions on the use of this object (for example, rental period). The useful life can also be established in accordance with the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated 01.

How to take into account car insurance premiums under the simplified tax system

Let's see how paying for car insurance affects the reduction of the simplified tax system for different objects of taxation.

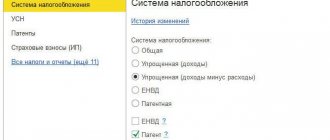

Income

If an organization or individual entrepreneur pays a single “simplified” tax on income, then the cost of car insurance does not in any way affect the calculation of tax according to the simplified tax system. After all, almost no expenses with this option are offset and the tax according to the simplified tax system is not reduced. Consequently, insurance for MTPL, DSAGO and CASCO does not reduce the simplified tax system (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

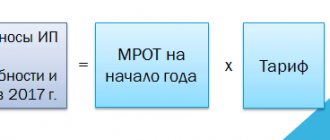

Income minus expenses

If a company or individual entrepreneur pays a single tax according to the simplified tax system on the difference between income and expenses, then the expenses under the compulsory motor liability insurance agreement (including the costs of technical inspection) reduce the tax base according to the simplified tax system. This is provided for in subparagraphs 7 and 12 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation). Take into account payments for expenses as they are paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

As for contributions for voluntary insurance (DSAGO or CASCO), they do not reduce the tax base for the single “simplified” tax. The fact is that the list of expenses that can be taken into account when calculating the single tax is exhaustive (Article 346.16 of the Tax Code of the Russian Federation). And the costs of voluntary insurance are not included (Letter of the Ministry of Finance of Russia dated May 10, 2007 No. 03-11-04/2/119).

Read also

18.01.2017

How to reflect insurance in accounting

In accounting, absolutely all expenses must be taken into account, and insurance costs are no exception. And since the machine is used in business activities, expenses associated with its maintenance and operation are expenses for ordinary activities (clauses 7 and 9 of PBU 10/99 “Expenses of the organization”).

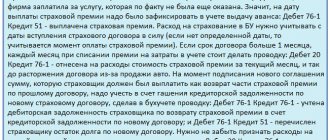

Note. Why is it not necessary to use account 97 “Deferred expenses” when accounting for the cost of insurance in accounting?

Irina Bogomolova, director of Auditorskaya LLC, member of the Governing Council of the Sverdlovsk branch of the Chamber of Tax Consultants of Russia

- Many accountants are accustomed to reflecting the cost of car insurance as deferred expenses in account 97. However, payments for both voluntary and compulsory insurance do not quite fit the concept of deferred expenses. This is explained as follows.

Firstly, there is the possibility of the policyholder returning part of the paid insurance premium in the event of early termination of the insurance contract (clause 3 of Article 958 of the Civil Code of the Russian Federation).

READ MORE: Payment orders for contributions in 2021

Secondly, when making a payment under the contract, the service is not considered fully provided, and accordingly, the expenses are not considered incurred.

Therefore, the amount transferred to the insurance company is nothing more than an advance payment. And it is advisable to reflect it on account 76 “Settlements with various debtors and creditors.” Moreover, the Chart of Accounts for the accounting of financial and economic activities of organizations provides for a special sub-account “Calculations for property and personal insurance” (Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

You can write off the cost of insurance as expenses either at a time on the date of payment (clause 18 of PBU 10/99), or evenly over the term of the insurance contract (clause 19 of PBU 10/99). The chosen method should be fixed in the accounting policy.

BASIC

Costs for compulsory property insurance should be taken into account when calculating income tax as part of other expenses within the limits of insurance tariffs, which are approved by Russian legislation and international conventions. If such tariffs are not approved, compulsory insurance costs should be included in other expenses in the amount of actual costs.

This procedure is provided for in Article 263 of the Tax Code.

Take into account the costs of voluntary property insurance when calculating income tax if they are listed in paragraph 1 of Article 263 of the Tax Code of the Russian Federation. Such expenses include voluntary insurance:

- vehicles (water, air, land, pipeline transport), including leased ones, the maintenance costs of which are included in the costs associated with production and sales;

- cargo;

- fixed assets for production purposes, intangible assets, objects of unfinished capital construction (including leased);

- inventory;

- harvest of agricultural crops and animals;

- other property that is used in carrying out activities aimed at generating income.

Include expenses for voluntary types of insurance in other expenses in the amount of actual costs.

This procedure is provided for in Article 263 of the Tax Code of the Russian Federation.

An example of how the supplier's expenses for voluntary cargo insurance are reflected in accounting and tax purposes, as well as receiving insurance compensation in connection with the loss of this cargo. Ownership of the cargo passes to the buyer at the time of its acceptance

Alpha LLC handed over the goods to the carrier for the purpose of delivering it to the buyer. Alpha insured the cargo against loss and damage. The cost of insurance is 40,000 rubles. The amount of insurance compensation is 500,000 rubles. While transporting goods, the carrier's car was involved in an accident, as a result of which the goods were completely destroyed. The insurance company paid Alfa the full amount of the insurance compensation. The actual cost of the goods is 450,000 rubles. All operations were performed in one month.

Alpha's accountant recorded insurance costs in the following way:

Debit 76-1 Credit 51 – 40,000 rub. – the insurance premium is transferred;

Debit 44 Credit 76-1 – 40,000 rubles. – the amount of the insurance premium is included in the costs.

In tax accounting, the accountant also took into account the entire amount of the insurance premium.

The accountant reflected the fact of loss of cargo and receipt of money from the insurance company with the following entries:

Debit 91-2 Credit 45 – 450,000 rub. – the actual cost of goods destroyed as a result of an accident is written off as other expenses;

Debit 76 Credit 91-1 – 500,000 rub. – the amount of insurance compensation is reflected in other income;

Debit 51 Credit 76 – 500,000 rub. – the amount of insurance compensation is credited to the current account.

In tax accounting, the accountant included the amount of insurance compensation to be received from the insurance company in non-operating income. He did this on the date the insurance company made a decision to pay the insurance compensation.

Situation: is it necessary to include property insurance costs in the cost (initial cost) of new goods, materials (fixed assets) in tax accounting?

No no need.

Previously, this was directly stated in the Methodological Recommendations for the application of Chapter 25 of the Tax Code of the Russian Federation (clause 5.3 of the Methodological Recommendations, approved by order of the Ministry of Taxes of Russia of December 20, 2002 No. BG-3-02/729). At the moment, this document has lost force (order of the Federal Tax Service of Russia dated April 21, 2005 No. SAE-3-02/173). However, in private clarifications, tax officials prescribe to follow the same approach at the present time.

Situation: is it possible to take into account insurance premiums (contributions) under voluntary property insurance contracts with foreign insurance companies when calculating income tax? The contracts provide for payment for services performed outside of Russia.

No you can not.

Tax legislation provides for the possibility of taking into account insurance costs when calculating income tax (Article 263 of the Tax Code of the Russian Federation). At the same time, since the concept of “insurance” is not defined in the Tax Code of the Russian Federation, it is necessary to be guided by the regulations of other branches of law (clause 1 of Article 11 of the Tax Code of the Russian Federation). In particular, the provisions of the Law of November 27, 1992 No. 4015-1. Insurance activity is the activity of insurers, which means insurance organizations and mutual insurance companies that have received a license for insurance activities (clause 2 of article 2, clause 1 of article 6 of the Law of November 27, 1992 No. 4015-1).

Thus, insurance premiums (contributions) paid to a foreign organization cannot be taken into account in expenses. The fact that insurance contracts provide for payment for services provided outside the Russian Federation does not matter for the inclusion of insurance premiums in expenses that reduce taxable profit.

The financial department and some courts support this position - a mandatory condition for accounting for insurance costs in tax expenses is that the insurance organization has a license to operate in Russia (see, for example, letter of the Ministry of Finance of Russia dated February 12, 2008 No. 03-03-06 /1/90, resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated February 26, 2004 No. A43-8610/2003-16-381, West Siberian District dated July 10, 2007 No. F04-4571/2007(36105-A46-40 )).

Tax accounting for insurance costs (both voluntary and compulsory) depends on the frequency of payment of the insurance premium and on the method of recognition of income and expenses that the organization uses.

If an organization uses the accrual method, then in general, include insurance costs in expenses when calculating income tax evenly:

- during the term of the contract in proportion to the number of calendar days in the reporting period - if the organization pays insurance premiums in a one-time payment;

- during the period for which part of the insurance premium is paid (year, half-year, quarter, month) in proportion to the number of calendar days in the reporting period - if the organization pays insurance premiums in installments.

Do this if the agreement is concluded for a period exceeding one reporting period for income tax (i.e. a month or quarter).

If the contract term does not exceed one income tax reporting period, then include insurance costs as expenses when calculating income tax at the time of payment.

This procedure is provided for in paragraph 6 of Article 272 of the Tax Code of the Russian Federation.

The exact moment at which expenses are recognized under the accrual method depends on whether they are direct or indirect. For more information, see How to keep tax records of direct and indirect expenses.

If an organization uses the cash method, then, regardless of the method of settlement with the insurer, insurance premiums (contributions) reduce taxable profit at the time of payment (clause 3 of Article 273 of the Tax Code of the Russian Federation).

If an organization recognizes insurance costs differently in accounting and tax accounting, temporary differences will arise in accounting (clause 10 of PBU 18/02).

An example of how expenses for voluntary property insurance are reflected in accounting and taxation when purchasing fixed assets. The organization uses the accrual method

In February, CJSC Alpha acquired a fixed asset worth RUB 200,000. (excluding VAT) and insured the risks of loss and damage during transportation of property to the company’s division. The amount of the insurance premium under the contract was 4,000 rubles, transportation costs were 20,000 rubles. (without VAT). In February, the fixed asset was capitalized and put into operation. The useful life of the fixed asset is 4 years.

The Alpha accountant reflected in the accounting the formation of the initial cost of the fixed asset.

In February:

Debit 76-1 Credit 51 – 4000 rub. – the insurance premium is transferred;

Debit 08 Credit 76-1, 60 – 224,000 rub. (RUB 200,000 + RUB 20,000 + RUB 4,000) – expenses associated with its acquisition are included in the initial cost;

Debit 60 Credit 51 – 220,000 rub. (RUB 200,000 + RUB 20,000) – the cost of the fixed asset and transportation has been paid.

In tax accounting, the accountant took into account the amount of the insurance premium as an expense in February. In accounting, he reflected the occurrence of a deferred tax liability.

Debit 68 subaccount “Calculations for income tax” Credit 77 – 800 rub. (RUB 4,000 × 20%) – a deferred tax liability is reflected from the difference between accounting and tax accounting due to differences in the reflection of the insurance premium.

An example of how expenses for voluntary insurance of material assets are reflected in accounting and taxation. The organization uses the cash method of accounting for income and expenses

ZAO Alfa accepted for storage material assets worth 500,000 rubles. and insured the risks of loss and damage. The contract was concluded for 1 year (from February 1, 2021 to January 31, 2021). The reporting period for income tax is a month.

The amount of the annual insurance premium under the contract was 4,000 rubles. It was paid in a lump sum on February 1, 2021.

The accounting policy for accounting purposes establishes that insurance costs are taken into account evenly over the insurance period. This takes into account the number of calendar days in each month.

Alpha's accountant reflected insurance expenses in his accounting.

In February 2021:

Debit 76-1 Credit 51 – 4000 rub. – the insurance premium is transferred.

Every month, starting from February 2021 to January 2021 (inclusive), the accountant writes off part of the insurance costs as expenses, taking into account the number of calendar days in each month.

February 28, 2021:

Debit 26 Credit 76-1 – 307 rub. (4000 rubles: 365 days × 28 days) – part of the insurance premium for February 2021 is included in the costs.

In tax accounting, the accountant took into account the entire amount of the insurance premium in February 2021. In this regard, a taxable temporary difference and a deferred tax liability arise in accounting. In February 2021, Alpha’s accountant reflected it with the following posting:

Debit 68 subaccount “Calculations for income tax” Credit 77 – 739 rub. ((4000 rub. – 307 rub.) × 20%) – the deferred tax liability is reflected from the difference between accounting and tax accounting.

As expenses are recognized in accounting, the amount of deferred tax liability is written off. The deferred tax liability will be fully settled in January 2021.

Situation: how to take into account the receipt of part of the insurance premium from the insurer upon termination of the property insurance contract when calculating income tax? The organization uses the accrual method.

The answer to this question depends on the procedure for recognizing the insurance premium in income tax expenses.

The premium received from the insurer does not need to be included in income if the insurance premium was taken into account in expenses evenly throughout the term of the contract or the period for which part of the insurance premium was paid. This is due to the fact that during the period when the contract terminated, the insurance premium was not taken into account in expenses (clause 6 of Article 272 of the Tax Code of the Russian Federation). This conclusion is confirmed by the Ministry of Finance of Russia in letters dated March 18, 2010 No. 03-03-06/3/6, dated March 15, 2010 No. 03-03-06/1/133.

If the entire insurance premium paid to the insurer was included in expenses at a time at the time of payment, then its returned part must be recognized as non-operating income (Article 250 of the Tax Code of the Russian Federation). Include this income in the calculation of the tax base on the date of termination of the insurance contract (clause 1 of Article 271 of the Tax Code of the Russian Federation). A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated March 29, 2006 No. 03-11-04/2/72. Despite the fact that this letter is addressed to single tax payers under simplification, the conclusions contained in it can be extended to organizations that apply the general taxation system (clause 1 of Article 346.15 of the Tax Code of the Russian Federation).

Attention: in practice, tax inspectors often recommend following another option for forming the tax base in the case under consideration (see, for example, letter of the Federal Tax Service of Russia for Moscow dated October 31, 2007 No. 20-12/104304). Regardless of the procedure for recognizing the insurance premium as expenses (at a time or evenly), include in income the entire amount of the returned part of the insurance premium (as of the date of termination of the insurance contract) (Article 250, paragraph 1 of Article 271 of the Tax Code of the Russian Federation). At the same time, with equal accounting of the insurance premium, taxable profit can be reduced by the amount of insurance that was not written off as expenses during the term of the contract (clause 2 of Article 263, clause 6 of Article 272 of the Tax Code of the Russian Federation).

For example, the amount of insurance premiums is 100,000 rubles, the contract was terminated in the middle of its validity period. Thus, at the time of termination of the contract, with equal accounting of costs, taxable profit should be reduced by 50,000 rubles.

In accordance with the option, which is based on the position of the Russian Ministry of Finance, in this case there is no need to make further adjustments to the tax base. As a result, taxable profit will be reduced by an amount of 50,000 rubles.

In accordance with the option that the inspectors recommend, the financial result from this operation will remain the same, but will be achieved differently. At the time of termination of the contract, income must include the amount received from the insurance company - 50,000 rubles, as well as the unfinished portion of insurance costs - 50,000 rubles. As a result, the tax base from this transaction will also be 50,000 rubles. expenses (50,000 rubles – 100,000 rubles).

Thus, both options for forming the tax base in the case under consideration will lead to the same result. The organization has the right to make its choice regarding one of them independently (taking into account the provisions of Article 34.2 of the Tax Code of the Russian Federation).

Situation: how to reflect the receipt of part of the insurance premium from the insurer upon termination of the property insurance contract when calculating income tax? The organization uses the cash method.

Include the amount of the returned insurance premium as part of non-operating income (Article 250 of the Tax Code of the Russian Federation). This is due to the fact that previously the entire amount of the insurance premium was taken into account as expenses (clause 3 of Article 273 of the Tax Code of the Russian Federation). A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated March 29, 2006 No. 03-11-04/2/72. Despite the fact that this letter is addressed to single tax payers under simplification, the conclusions contained in it can be extended to organizations that apply the general taxation system (clause 1 of Article 346.15 of the Tax Code of the Russian Federation).

Situation: can an organization that has paid an insurance premium (contributions) under a voluntary property insurance contract not directly to an insurance company, but through an insurance broker, take such expenses into account when calculating income tax?

Yes maybe.

Insurance brokers provide services related to the conclusion and execution of insurance (reinsurance) contracts. That is, they are intermediaries between the organization and the insurance company. Insurance brokers can be entrepreneurs or organizations (clause 6 of article 8 of the Law of November 27, 1992 No. 4015-1).

The Tax Code of the Russian Federation does not establish any specifics for accounting for property insurance costs in cases where the insurance contract provides for the payment of insurance premiums through an insurance broker. Thus, if an organization paid an insurance premium (contributions) under a voluntary property insurance agreement not directly to an insurance company, but through an insurance broker, it can take such expenses into account when calculating income tax.

A similar point of view is reflected, in particular, in the letter of the Federal Tax Service for Moscow dated August 16, 2006 No. 20-12/72993.

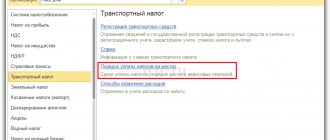

How to register expenses for compulsory motor liability insurance in 1C: Accounting 8?

Send this article to my email Organizations, individual entrepreneurs, and any individual located on the territory of the Russian Federation and owning vehicles must purchase an OSAGO insurance policy (compulsory motor third party liability insurance). In this article we will tell you how to program 1C Enterprise Accounting 3.0 to formalize the purchase and payment of such a policy with the inclusion of the amount of costs incurred as deferred expenses for the purpose of further write-off to the main cost accounts. After the vehicle has been purchased, it is necessary to conclude a compulsory civil liability insurance agreement and pay the corresponding insurance premium .

The insurance premium means the amount of money that the policyholder undertakes to pay to the insurer in accordance with the terms of the insurance contract concluded between them. Payment of the insurance premium under the MTPL agreement in 1C is formalized using documents such as Payment order and Debit from the current account.

First, an order is created, and then, on its basis, a write-off is issued. In the order, indicate the counterparty - the insurer, the agreement with him and the amount of the insurance premium to be paid. To enter a write-off document in the Payment order, use the Create based on command. As a result of posting the document, a posting is generated Dt 76.01.1 Kt 51. Some organizations, when accounting for motor insurance, resort to using account 97, i.e.

Accounting for the costs of purchasing an OSAGO and CASCO policy in 1C: Accounting 8

Enterprises in their economic life can use various vehicles, in particular cars.

After purchasing a car, the organization must first enter into a compulsory civil liability insurance agreement (MTPL); also, in addition to MTPL, a CASCO contract can be concluded. OSAGO and CASCO agreements are usually concluded for one year and come into force from the moment the policy is paid for.

In accounting, the costs of purchasing MTPL and CASCO policies are recognized as expenses for ordinary activities (clause

5 PBU 10/99). The purchase of a policy does not result in the occurrence of future expenses in the accounting records of the insured organization. Payment for the policy by the policyholder is accounted for as an advance payment for services (advances for services), which is recognized as an expense of the organization as insurance services are consumed, i.e., as the insurance period expires.

The specified prepayment is reflected in the account for settlements with insurers. To account for prepayment amounts under MTPL and CASCO contracts in 1C: Accounting 8, subaccount 76.01.9 “Payments (contributions) for other types of insurance” is intended. Before the expiration of the paid insurance period, the corresponding amounts are reflected in the balance sheet depending on their materiality under an independent item or are included in the aggregate item “Other current assets” or “Other non-current assets” (if paid for a period of more than a year).

In tax

Posting insurance premiums in accounting

> > > September 28, 2021 The insurance premium in accounting - we will consider the entries for its reflection in this article - has a number of features related to both the nature of this payment and the validity period of the insurance, as well as the frequency of payments made. Let's figure out how these features affect the accounting of insurance premiums.

The insurance premium is a fee for insurance (Article 954 of the Civil Code of the Russian Federation), which the policyholder (a legal entity or individual who decides to insure life, health, property, liability or risks) pays to the insurer (a legal entity authorized to conduct insurance activities) upon concluding an agreement insurance. Insurance occurs in relation to the occurrence of any specific cases, can be carried out both in the interests of the policyholder himself and in favor of third parties and can be either mandatory (provided for by one of the laws of the Russian Federation) or voluntary.

The amount of the insurance premium is indicated in the insurance contract and is determined according to the tariffs developed by the insurer itself or the insurance supervisory authorities. There are many types of insurance: personal - related to life and health; property, designed to reduce losses from loss, shortage or damage to any property; various types of risks - such as, for example, technical, financial (including those associated with non-receipt of payment from buyers or goods from suppliers), legal; responsibility