Certificate 2-NDFL discloses information about the salary and other income of an employee of the organization. It also indicates the amount of personal income tax withheld and not withheld. Such a certificate is issued for each employee and submitted to the Federal Tax Service. Sometimes the employees themselves ask for it, for example, to get a loan from a bank.

Each type of income is assigned its own code. Their list was approved in the Order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated 09.10.2015. The directory of numbers was last updated by the Order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated 22.11.2016. Next we will tell you , what codes are indicated in 2-NDFL.

Income codes that are always subject to personal income tax

Income code 2000 is wages, including additional payments and allowances (for harmful and dangerous work, for night work or combined work).

Income code 2002 is a bonus for production and similar results that are provided for in employment contracts, collective agreements or legal norms.

Income code 2003 - remunerations paid from the organization’s profits, special-purpose funds or targeted revenues.

Income code 2010 - income from civil contracts, excluding copyright contracts.

Income code 2012 - vacation pay.

Income code 2013 - to compensate for unused vacation.

Income code 2014 - severance pay, compensation payments in the form of average monthly earnings for the period of employment after dismissal, compensation to managers, deputy managers, chief accountants in excess of earnings for 3 or 6 months (regions of the Far North and equivalent areas).

Income code 2300 - sick leave benefit. It is subject to personal income tax, so the amount is included in the certificate. At the same time, maternity and child benefits are not subject to income tax, and they do not need to be indicated in the certificate.

Income code 2301 - fines and penalties paid by the company by court decision for failure to voluntarily satisfy consumer demands.

Income code 2610 - denotes the employee’s material benefit received from savings on interest on loans.

Income code 2001 is remuneration of directors and other similar payments received by members of the organization's governing body (board of directors, etc.).

Income code 1400 - an individual’s income from leasing or other use of property (if it is not transport, communications or computer networks).

Income code 2400 - an individual’s income from leasing vehicles for transportation, pipelines, power lines and other means of communication, including computer networks.

Income code 2520 - income in kind received in the form of full or partial payment for goods, work, services performed in the interests of the taxpayer.

Code 2530 - remuneration in kind.

Income code 2611 - bad debts written off from the balance sheet..

Income code 1010 - transfer of dividends.

Income code 3020 - interest on bank deposits.

Income code 3023 - income in the form of interest (coupon) received by taxpayers from ruble bonds of domestic organizations issued after January 1, 2017.

Income code 4800 is a “universal” code for other employee income that is not assigned special codes. For example, daily allowances in excess of the tax-free limit, additional sick pay, stipends.

See the full list of income and deduction codes for the 2-NDFL reference.

Are all sick leave reflected in 2-NDFL?

All employee earnings are subject to income tax.

The Tax Code of the Russian Federation indicates whether sick leave is reflected in 2-NDFL - yes, temporary disability benefits are the employee’s income regardless of the source of payments (clause 1 of Article 217 of the Tax Code of the Russian Federation). Transfers for sick leave are indicated in the income statement of an individual. But there are also exceptions. In the same paragraph 1 of Art. 217 of the Tax Code of the Russian Federation and in the letter of the Ministry of Finance of the Russian Federation No. 03-04-06/8-118 dated April 18, 2012, it is explained whether sick leave is included in the 2-NDFL certificate - the document reflects only payments for temporary disability. Maternity and child benefits are not subject to personal income tax and are not included in the certificate.

From December 14, you need to work with sick leave in a new way! The rules were changed by Order of the Ministry of Health No. 925n dated September 1, 2020.

ConsultantPlus experts have prepared an overview of the amendments and new instructions. Use it for free.

Codes of income that are subject to personal income tax when the limit is exceeded

Income code 2720 - cash gifts to the employee. If the amount exceeds 4,000 rubles, then tax is charged on the excess. In the certificate, the amount of the gift is shown with income code 2720 and at the same time with deduction code 501 .

Income code 2760 - financial assistance to an employee or former employee who retired due to disability or age. If the amount of assistance exceeds 4,000 rubles, then a tax is levied on the excess. In the certificate, the amount of financial assistance is shown with the income code 2760 and at the same time the deduction code 503 .

Income code 2762 is a one-time payment in connection with the birth or adoption of a child. If the amount exceeds 50,000 for each child, but for both parents, then tax is charged on the excess amount. In the certificate, this amount is shown with income code 2762 and deduction code 504 .

What should be the sick leave income code in the 2-NDFL certificate for 2018?

A document in Form 2-NDFL may be required by an ordinary taxpayer in a number of situations. Among them:

- change of place of work . If a citizen gets a new job and claims to receive standard deductions, the employer will definitely require a document of this kind from him. In addition, the paper must be provided to the employer if the change of workplace does not occur at the beginning of the calendar year. The thing is that basic deductions for the employee himself, as well as his family members, will be paid until the total amount of funds earned since the beginning of the year does not exceed 350 thousand rubles. That is why the new employer will need information about all income of the new employee starting from January 1 of the current year;

- obtaining a loan . Almost all banking institutions always ask their clients to confirm the presence of a permanent source of income. A universal way to do this is to provide a 2-NDFL certificate;

- receiving social deductions . In this case, a certificate in form 2-NDFL is used to confirm the amount of tax paid, which is subsequently subject to refund;

- receiving a property deduction as part of the purchase of real estate . In such situations, a certificate of funds earned and taxes paid for the specified period is an addition to the tax return (document in form 3-NDFL).

- Codes in the 2-NDFL certificate

- Reflection of the sick leave code in the 2-NDFL certificate

Codes in the 2-NDFL certificate

The certificate in Form 2-NDFL indicates not only the amount of funds received, but also the method in which these funds were received. Thus, sick leave, salaries, vacation pay, etc. are indicated differently in the document.

A complete list of all current codes is as follows:

- 2000 – all types of wages, as well as bonuses and other funds that were paid for the direct performance of labor duties;

- 2012 – all types of vacation benefits;

- 2300 – funds received as compensation for sick leave. Can be paid only if the employee provides sick leave;

- 2010 – all funds paid under civil contracts with the exception of royalties;

- 2350 – all funds received as part of wages, issued in kind;

- 2400 – funds received from the rental of vehicles (all types). In addition, this includes all fines for demurrage and delay, as well as funds received for the rental of pipelines, power lines and fiber optic and wireless communications;

- 1400 – all funds received from the rental of any property (except for what is specified in the previous paragraph);

- 1540 – any income from the sale of shares in the authorized capital of legal entities;

- 2760 – all types of financial assistance intended for persons who have retired;

- 2762 – one-time financial assistance to all parents, which is paid in connection with the birth of a child (also applies to persons who adopted a child or took guardianship over him);

- 2720 – the total cost of all gifts that were received during the reporting period;

- 2740 – the total value of all prizes that were won by the taxpayer during promotional events of legal entities;

- 1010 – the total volume of dividends received of all types;

- 2510 – all the money that was spent by the employer on the maintenance and satisfaction of the citizen’s needs (food, training, payment of utilities, and so on);

- 2610 – compensation for savings resulting from the use of a loan issued by a legal entity;

- 2001 – all types of remuneration received by directors and other persons directly involved in management activities in organizations;

- 2201 – royalties received by the creators of literary works;

- 2202 – royalties received by the creators of objects of architectural, design, artistic or graphic creativity;

- 4800 – all other types of financial income.

Reflection of the sick leave code in the 2-NDFL certificate

Due to the fact that temporary disability benefits are taxable income, the corresponding code must be entered in a special table, which is in the 2-NDFL form.

When filling out the document, you need to make sure that the standard form is used, and that the sick leave code is current (as of 2021, its value is “2300”).

The fact is that many accountants use special software that enters all the necessary data automatically. This is very convenient, however, it needs to be constantly updated due to the fact that at the legislative level the values of certain codes are regularly subject to adjustments.

Loading…

Source: https://pravo.team/trudovoe/bolnichnyj/spravka-2-ndfl.html

What changed

At first glance, the changes to the new form of the 2-NDFL form in 2018 are not immediately obvious, but they exist.

Reorganization or liquidation and surrender by successor

Firstly, in the new form of the 2-NDFL certificate from 2021, new fields have appeared in case it is submitted by the legal successor of the reorganized entity:

New clause 5 of Art. No. 230 of the Tax Code of the Russian Federation specifies that, regardless of the type of reorganization or liquidation - affiliation \ division \ transformation \ merger \ division - the legal successor will be obliged to submit forms 2-NDFL and 6-NDFL for the reorganized structure to the Federal Tax Service at the place of its registration. This is relevant provided that the reorganized company did not do this. A similar obligation applies to the submission of updated information.

According to the new version of Appendix No. 2 “Codes of forms of reorganization and liquidation of an organization / separate division” to the rules for filling out form 2-NDFL, the following codes are established:

- “0” – liquidation;

- “1” – transformation;

- “2” – merger;

- “3” – separation;

- “5” – accession;

- “6” – separation with simultaneous joining.

According to the new rules, the legal successor indicates the OKTMO code precisely at the location of the reorganized structure or its separate division. In the “Tax Agent” line, the successor also indicates the name of the reorganized company.

There are no more address data of individuals in 2-NDFL

It is also worth noting that the 2-personal income tax form in 2021 has decreased by a whole series. As a result, Section 2 of the certificate became 2 times smaller.

Secondly, the new 2-NDFL declaration form was approved in 2021 without the lines where previously it was necessary to indicate the exact address of each individual income recipient:

Thus, now you no longer need to indicate either your place of residence in Russia or the code and address of your country of residence.

Investment deductions excluded

Section 4 of the new 2-NDFL certificate 2021 no longer contains investment deductions.

Payment of personal income tax on temporary disability benefits (sick leave): features and deadlines

A sick leave certificate is not only a confirming document about the employee’s actual disability, but also the basis for the correct calculation of wages, and, consequently, the payment of mandatory taxes on it. In order to avoid mistakes, it is necessary to have the most complete knowledge about the taxation of payment for sick leave.

Federal legislation states that maternity benefits fall into a category that is not subject to personal income tax. Sick leave is usually issued for 140 days and is paid for by the company. Subsequently, the entire amount is compensated from the Social Insurance Fund budget. In labor law, there are often situations when an employer, at his own expense, makes an additional payment to the basic payment under the BiR. This amount is not a benefit, and therefore is subject to personal income tax. This step is usually a consequence of the fact that the benefit amount does not reach the average minimum.

What do banks pay attention to when checking a certificate in form 2-NDFL?

Certificate form 2-NDFL (hereinafter referred to as the certificate) was approved by Order of the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-3/ [email protected] “On approval of the form of information on the income of individuals and recommendations for filling it out, the format of information on the income of individuals in electronic form, reference books."

In the upper right corner of the certificate it should be indicated: Appendix No. 1 to Order of the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-3/ [email protected]

The certificate is filled out (printed) on a laser, matrix, inkjet printer, on a typewriter, or in handwritten text in legible handwriting.

If any sections (items) of the certificate are not filled out, then the names of these sections (items) may not be printed. In this case, the numbering of sections does not change.

The title of the certificate indicates its serial number, the date of preparation and the Federal Tax Service number, consisting of 4 digits (tax office number).

Section 1 reflects information about the tax agent (employing company) indicating its name, OKATO code, INN, KPP. The telephone number is indicated if available.

Section 2 contains information about the individual - the recipient of the income: full name without abbreviations, status (1 - resident, 2 - non-resident), date of birth, country code (Russia - 643), identification document code (21 - Russian passport) , passport details, residence address.

The “TIN” column is filled in if the income recipient has one.

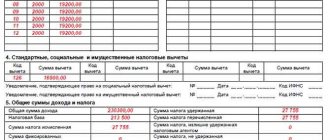

Section 3 reflects income (excluding taxes), professional tax deductions or those that are not subject to full taxation and the tax rate.

To calculate solvency, income that is of a permanent nature (paid no less than quarterly), expressed in monetary form and not a reimbursement for previously incurred expenses of the taxpayer, is taken into account.

Main income codes: 2000, 2010, 2012, 2300, 2760.

Payments under code 2012 are not subject to accounting if vacation pay was paid in addition to the basic salary.

For example, if the salary for the first 6 months of the year was the same, and for the seventh, in addition to the salary, the Client received vacation pay. Most likely, this means that next month the amount of vacation pay will be deducted from the client's basic salary. Section 4 reflects standard and property tax deductions. The tax base is reduced by the amount of the deduction.

Section 5 - the total amount of income and income tax based on the results of the tax period. The amount of income is always indicated in kopecks, but in the amount of calculated tax, kopecks are rounded to the nearest ruble.

The 2-NDFL certificate must be signed by an authorized employee of the employing organization and affixed with the seal of the employing organization.

The validity period of the certificate in form 2-NDFL is 30 days.

The advantages when checking 2-NDFL banks include:

- The certificate is issued fully in accordance with the current legislation of the Russian Federation.

- The serial number of the Certificate is at least not equal to 1. This indicates that the accounting department of the employing organization keeps records of issued certificates.

- In addition to code 2000, income contains a code for vacation payments, sick leave, etc.

- Income amounts vary (slightly) and are not circular.

The disadvantages when checking 2-NDFL banks include:

- The header of the certificate does not contain a link to the authority that approved this Certificate form.

- The certificate was issued with deviations from the form approved by the Federal Tax Service of the Russian Federation.

- The serial number of the Help is 1.

- There are discrepancies in sections 1 and 2 with the data of the employer - a legal entity and the client - an individual, respectively.

- In section 3, only code 2000 appears (especially if the certificate was issued for more than six months), while the amounts of income are round and identical from month to month.

- Section 4 does not indicate any deductions due (if any).

- In section 5, the calculated tax amount is indicated in kopecks.

- The certificate was prepared using the Consultant Plus system.

Our recommendations boil down to the fact that you should not buy a 2-personal income tax certificate because you can get a loan without a 2-personal income tax certificate.

Encoding purposes

Numerical designations are entered for various reports. 2-NDFL certificates are no exception. The full name of each income would take up a lot of space on the report form, and also complicate the automated processing of certificates. The income code in the 2-NDFL certificate has become a necessary tool for compressing the information indicated, but at the same time containing the amount of data necessary for control.

The law provides for different withholding tax rates for different types of income. The income code in 2-NDFL is important for monitoring the correctness of the withholding of personal income tax. Tax deductions are also tied to a certain income - for example, a non-taxable part of a material benefit or a share of the cost of gifts. Different sources of payments may not have complete information on one recipient, and the Federal Tax Service checks and charges additional tax if the non-taxable amount in the income of each taxpayer is exceeded. It is important to accurately enter the income code in the 2-NDFL 2021 certificate - it is associated with the tax obligations of the persons for whom the information is submitted.

What is income coding?

Hiring organizations, individual entrepreneurs and persons engaged in private practice are required to calculate and withhold income tax from citizens. As tax agents, legal entities and individual entrepreneurs issue reporting forms in person or send them to the tax authorities - including 2-NDFL certificates. In order to correctly fill out the declaration, it is necessary to comply with all the requirements of the Federal Tax Service of Russia: this also applies to the encodings adopted to indicate the income received by an employee for the past year.

Accounting employees enter income codes in the third section of form 2-NDFL. They consist of four digits: the first two indicate the income group, and the other two specify the type of financial receipt. There are many such codes, but they are all used equally often. We will try to briefly describe the main groups of codes, and will dwell on the most used values in detail.

Revenue code 4800: decryption

For the correct calculation of personal income tax, the citizenship of an individual does not matter, the only important thing is whether he is a resident or not. This is determined by how many days this person spends in a year (the calendar year is the tax period for personal income tax) within the borders of Russia. If a person stays in the country for more than 183 days, he is considered a resident; otherwise, he is considered a non-resident. A resident individual is subject to taxation on all income in accordance with the law. A non-resident pays only on the income he received from a Russian-based source.

We recommend reading: Responsibility for driving a car without insurance

Article 217 exempts these payments from taxation in an amount not exceeding three times the average monthly salary, or six times the amount in the case when employees leave an enterprise located in the Far North or equivalent areas. Payments to these employees exceeding the non-taxable maximum are taxable income and will be indicated in the 2-NDFL certificate by income code 4800 and in decoding.

Payment source

When calculating income tax on temporary disability benefits, the source of payments does not play a role. Social benefits are fully taxed, with some exceptions (maternity leave, parental leave, etc.). That is, the amount paid at the expense of the employer is taxed according to the general rules, as well as the amount paid at the expense of the Social Insurance Fund.

Consequently, when filling out annual reports to the Federal Tax Service, the personal income tax code for sick leave at the expense of the employer and at the expense of the Social Insurance Fund does not differ. This is a standard cipher 2300, approved by Appendix No. 1 to the Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated 09/10/2015 (as amended on 10/24/2017).

Sample filling

Let's look at a sample of filling out a certificate form for individuals and tax authorities.

Let's say Savelyeva A.P. provided sick leave issued from November 5, 2019 to November 15, 2019 to her employer on November 16, 2019. She was awarded temporary disability benefits in the same month. But the amount was paid in December, along with the salary for November and financial assistance.

We recommend additional reading: Income code 2002 in NFDL certificate 2

When issuing a certificate for an employee, this type of remuneration must be reflected in section 3, which records information on income accrued and received by individuals in cash and in kind (in value terms) and types of material benefits in chronological order by month of the tax period using the provisions deductions.

In the first column, denoting “month,” the months from January to December are indicated chronologically in digital values. We are interested in November and December. Which field is the correct one to show income in?

According to Art. 223 of the Tax Code of the Russian Federation, the date of actual receipt of benefits for personal injury is considered to be the moment of payment, therefore it is correct to indicate in the certificate the amount accrued for sick leave in December.

Therefore, in the form, in the line corresponding to the 12th month, we enter the income code “2300” and indicate the amount accrued according to the LN - 3000 rubles.

Let's consider how to correctly reflect “carrying-over personal income” if payments were accrued in December, and actual receipt took place in January. According to the letter of the Federal Tax Service R No. BS-3-11 / [email protected] dated October 21, 2016, the amount must be paid in the month when it is directly paid.

For example, Ivashov V.I. was on sick leave from December 10, 2019 to December 16, 2019. LN was provided to the HR department on the first working day. Calculations were made in the accounting department, and on December 27, 2019, temporary disability benefits were accrued in the amount of 5,456 rubles. 50 kopecks for 7 days. The personal income tax amount was 709.3 rubles. But to receive money is 4747.2 rubles. Ivashov V.I. will be able only on January 10, 2020, because payments in December have already taken place. Consequently, this type of remuneration will be included in the certificate for 2021.

By analogy, Appendix to Personal Income Tax Certificate 2 for the tax office is filled out.

Another nuance that is worth paying attention to is how to correctly reflect in the reporting the additional payment up to the average earnings under code 4800. The question is whether it is worth breaking the accrued benefit into 2 parts - separately the amount paid at the expense of the Social Insurance Fund and separately the additional payment by the employer itself.

Due to the fact that the tax is calculated on the total amount, it should not be divided into two indicators and recorded in the reporting as total income.

We recommend additional reading: Taxpayer category code for tax in the 3rd personal income tax return

What are the 2-NDFL form codes for?

At the end of each tax period, the employer - both an organization and an entrepreneur - is obliged to submit reporting documentation to the Federal Tax Service in form 2-NDFL. It is submitted to the inspection annually and must be issued to the employee upon request.

Attention! Starting with reporting for 2021, different forms of 2-NDFL certificate are used for issuance to an individual and transfer to the tax office. See here for details.

Due to the large-scale introduction of computer technology in accounting, 2-NDFL has not been filled out manually for a long time. For these purposes, specialized computer programs are used for accounting and payroll.

Each type of income received by an employee is subject to taxation at the appropriate rate. However, to reduce the amount of information required to be disclosed, a code system was developed that represents each source of income in encrypted form.

Features of registration of certificate 2 personal income tax

If we are talking about those benefits that, in principle, are not taxed, then they do not need to be included in the certificate at all. However, if the amount of income is subject to tax, then the certificate indicates a clearly defined code and the amount of income received.

Today, accountants use special programs that calculate the amount of deductions independently. You indicate the income code, the amount of income and the deduction code. Thus, a quick calculation of the required amount is made.

If you made certain mistakes during the process of obtaining the certificate, you should not worry too much. In fact, there is no liability as such for errors in filling out the document. But, if any contradictions are found in the document, the tax agent will be asked for clarification. But, if the certificate is not submitted on time, then there are certain penalties by law in the form of 200 rubles for each employee.

What data is contained in the document?

The document in form 2-NDFL is filled out on a unified form. This form was approved by Order of the Federal Tax Service of the Russian Federation dated November 17, 2010 No. ММВ-7-3/611. Changes were made as amended on December 6, 2011 under No. ММВ-7-3/909. Its fields contain:

- information about the tax agent - the employer. This is the name of the organization, TIN and KPP;

- information about an individual. Enter first name, last name, patronymic, address, citizenship, passport details, TIN;

- columns for writing the amount of income by month with codes and columns for the amounts of tax deductions. Income received is taken into account for a certain period - six months, a year or the last four months;

- the amount of property, social and other deductions made, indicating the notice numbers. The 2-NDFL certificate is endorsed by the seal of the organization and the signature of the head.