What benefits are we talking about?

The law talks about payments from the Social Insurance Fund for disability benefits, pregnancy and child care. But there is no mention of other benefits - in connection with registration in the early stages of pregnancy and the birth of a child - in the legislative norm. Nevertheless, the Ministry of Labor has approved regulations according to which these benefits can be paid directly to the employee. Further we will talk about them.

These are the regulations:

- dated September 14, 2017 No. 677n - to receive benefits on the occasion of the birth of a child;

- dated September 14, 2017 No. 678n - to receive benefits when registering with a medical institution, if the pregnancy is no more than 12 weeks.

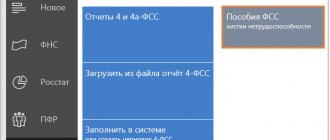

How to calculate sick leave on the FSS website

Calculating sick leave is a rather labor-intensive process, so accountants often make mistakes. To facilitate calculations, a special calculator has been developed for calculating sick leave online. Now it is possible to calculate the amount of the benefit online directly on the Social Insurance Fund website, where you need to:

- Select the calculator, in the benefit line, select the calculation of sick leave for disability;

- Next, enter the period of illness, type of illness, type of treatment and sick leave;

- In the calculation conditions, all the employee’s information is entered, which is taken from certificates and personal accounts. It is necessary to enter the employee's length of service;

- Enter the cause of the disease, for example, pregnancy and childbirth;

- After which you need to enter the date of issue of the sick leave certificate;

- Then click the calculation button, and the calculator will independently calculate the amount of the benefit.

Such an online calculation will enable the employer to avoid errors in calculating sick leave, which means that the tax service and the employee will not make any claims.

However, first you need to provide your employer with a certificate of incapacity for work as proof of your illness. After which the accountant carries out several operations. You need to do:

- Calculation of the average daily wage of an employee. Check this amount and compare it with the limits set by the FSS;

- Based on the employee’s length of service, it is necessary to determine the percentage;

- Then get the amount of sick leave by multiplying the average earnings by the number of sick days. But it is important to understand that payment by the fund will begin only on the fourth day; the employer pays for the first three days.

When can the Social Insurance Fund pay benefits directly?

The provisions of regulations 677n and 678n coincide in terms of the circumstances, upon the occurrence of which you can apply for them to the Fund, namely:

- the employer has ceased to operate;

- bankruptcy proceedings have been initiated against him;

- there are not enough funds in the company’s (IP) accounts;

- the court determined that the employer must pay benefits, but it is impossible to determine the location of him or his property, which can be recovered.

Reimbursement for sick leave from the Social Insurance Fund: deadlines, documents, where to submit

To return funds to the organization, you will need to collect a certain package of documents, and follow the necessary procedure.

Documents required for reimbursement of sick leave benefits:

- An application from the manager, indicating the full name of the company, its address, registration number, and the amount he wants to return;

- Completed form 4-FSS with expenses for social benefits;

- Full calculation of accrued and paid contributions;

- Expense register of all benefits, where you need to indicate the amount that needs to be reimbursed;

- Certified copies of all documents.

The second and third documents must be in duplicate.

For a company that has a small number of employees, it will be easier to return funds to its account rather than accept them for credit.

Upon receipt of all documents, the Social Insurance Fund is obliged to make a decision within ten days. If all the paperwork is correct, the fund transfers the amount to the employer’s account. In case of errors or suspicion of forgery, the decision is postponed for three months and an inspection is scheduled.

The Social Insurance Fund can reimburse funds in two ways:

- The employer will simply stop paying disability insurance premiums to the fund until the sick leave amount is spent; this rule only applies for a year.

- The employer collects a package of papers and submits an application for a refund to his account.

There is no specific statute of limitations for sick leave compensation. As a rule, when debt arises, the fund simply returns the money. A refund can be delayed only when the FSS suspects that the requested compensation is illegal, then the refund will occur after all the necessary checks.

Employees who have recently worked are also entitled to receive sickness benefits. Only they need to provide certificate 182n from their previous place of work. If this is not possible, you must request it from the Pension Fund.

What the employee must submit to the Fund

The set of documents that need to be prepared depends on what benefit the employee is applying for. Most of the documents must be submitted, some are optional.

In connection with early pregnancy registration

To pay the benefit due upon registration before 12 weeks of pregnancy , you need to submit only 2 documents to the Social Insurance Fund:

- application in the prescribed form (Appendix No. 1 to Regulation No. 678n);

- a certificate from a medical institution confirming registration.

In connection with the birth of a child

To receive a lump sum benefit upon the birth of a child , you need to submit to the Social Insurance Fund:

- Application (Appendix No. 1 to Regulation 677n).

- Birth certificate from the civil registry office. If the child was born abroad, other documents will be required (the list is presented below).

- A certificate stating that the second parent did not receive a similar benefit. It is taken from the place of work, study or from social security authorities (for the unemployed).

- If the parents are divorced, a certificate of divorce, as well as a document stating that the parent lives with the child.

- If a guardian, trustee or adoptive parent applies, a document confirming his status (for example, a court decision on adoption).

Documents that confirm the birth of a child abroad are:

- A copy of the birth certificate issued by the consular office of the Russian Federation.

- The original and a copy of the birth document with a translation into Russian - if the birth was registered by the competent authority of a foreign state. In this case, the document must contain:

- for countries participating in the Minsk Convention - official seal (without apostille and legalization);

- for countries participating in the Hague Convention - an apostille stamp;

- for other countries - the requirement of consular legalization.

Optional documents

Both regulations provide the opportunity to submit additional documents. For example, if a company is liquidated or undergoing bankruptcy proceedings, then you can attach documents that confirm this. If they are not attached, the FSS, as part of interdepartmental cooperation, will independently request them from the competent authorities. However, given that it will take time to receive them, it is advisable for the applicant to attach such documents , if available.

Additional features of the “Incapacity Certificate” module

Data from the “Certificate of Incapacity for Work” module allows you not only to generate information on the sick leave certificate, but also to facilitate the filling out of the reporting forms associated with it. For example, the module provides the possibility of 100% automation:

- generation of statistical reports on disability examination;

- filling out a paper log of issued sick leave.

The reporting generated by the system allows you to:

- visually present the current morbidity level in RMIS;

- obtain operational data on issued certificates of incapacity for work.

The log of sick leave sheets generated by the system has a wide range of capabilities:

- quick search for information (by patient’s full name, sheet number, date of issue, doctor’s name, etc.);

- control of cases of long-term stay of patients on sick leave;

- exporting data available in the system into documents of various formats (Excel, Word, HTML, text, Rect);

- obtaining a variety of statistical reports and analyzing data from sick leaves for several periods.

Thanks to the “Certificate of Incapacity for Work” module, the time required to obtain sick leave is not only reduced, but also:

- the labor costs of medical staff for filling out and processing multiple papers is reduced;

- gives doctors the opportunity to spend more time directly with the patient, rather than filling out documents.

What employers need to do so that their employees can use modern medical technologies and receive electronic rather than paper sick leave certificates will be discussed in the next section.

When will the Social Insurance Fund pay benefits?

The Fund must review documents within 10 calendar days . As a result, a decision will be made to pay the individual benefits or refuse. Whatever the outcome, it must be sent to the applicant within 5 days of acceptance.

The regulations state that the payment of benefits must take place no later than 10 calendar days from the date when the Social Insurance Fund body received all the necessary documents. Therefore, as soon as a decision is made, the benefit will be paid. The method of receiving it is indicated by the employee himself in the application.

If the fund refuses to pay benefits, the applicant can appeal its decision to a higher body of the FSS system .

In the 33 regions that participate in the FSS pilot project “Direct Payments,” the interaction between the employer, the Fund and the insured person is structured differently.

We invite you to watch a video about maternity, childbirth and child care benefits that are relevant in 2021:

Results

An electronic sick leave is issued by a medical institution to a patient if electronic information interaction has been established between the Social Insurance Fund, the employer and the hospital.

In this case, the patient must give written consent to the receipt and processing of his personal data. Data from the electronic sick leave record is received by the Social Insurance Fund thanks to regional medical information systems integrated by the Uniform State Health Information System. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to properly certify documents for reimbursement of expenses to the Social Insurance Fund in 2021

Social Insurance does not need to provide original documents confirming the legality of expenses. Certified copies are sufficient. But you need to be prepared for the fact that during the inspection, inspectors may demand to show them the originals of such documents. The originals will be checked against the copies and then returned.

Copies of documents to be submitted to the FSS are certified as follows:

- signature of the head of the organization;

- signature of the individual entrepreneur;

- seal of the organization (if there is one);

- the inscription “Copy is correct.”

It should be borne in mind that the Social Insurance Fund carefully controls the payment of benefits. If the inspection inspectors have suspicions that the employing organization has created an artificial situation in order to obtain funds, Social Insurance will refuse to reimburse expenses.

Where is the “Pilot Project for Direct Payments of Social Security Benefits” being implemented?

A pilot project for the payment of disability benefits directly by the territorial bodies of the Social Insurance Fund of the Russian Federation has existed for seven years.

The full cycle of its implementation is set from 2012 to 2021. Its rules are established by Decree of the Government of the Russian Federation dated April 21, 2011 No. 294. After the project is recognized as successful, it is planned to switch to direct payments of benefits from the Social Insurance Fund throughout the country. Every year new subjects of the Federation join the project (clause 2 of Resolution No. 294).

| Date of entry into the project | Subject of the federation |

| 01.01.2012 | Karachay-Cherkessia Nizhny Novgorod Region |

| 01.07.2012 | Khabarovsk region Regions: Astrakhan, Kurgan, Novgorod, Novosibirsk, Tambov |

| 01.01.2015 | Republic of Crimea, Sevastopol |

| 01.07.2015 | Republic of Tatarstan Regions: Belgorod, Rostov, Samara |

| 01.07.2016 | The Republic of Mordovia Regions: Bryansk, Kaliningrad, Kaluga, Lipetsk, Ulyanovsk |

| 01.07.2017 | Republics: Adygea, Altai, Buryatia, Kalmykia Regions: Altai and Primorsky Regions: Amur, Vologda, Magadan, Omsk, Oryol, Tomsk Jewish Autonomous Region |

Purpose of the interim report

With the help of an interim report to the Social Insurance Fund, the employer has the opportunity to return to the current account the amounts paid to employees through social insurance. Contributions and expenses are reflected in the contribution reporting, which is submitted to the Federal Tax Service. The exception is employers in regions with an active pilot project, where all expenses are paid immediately by the Social Insurance Fund. They cannot avail of the refund.

An interim report is drawn up when such payments are made in the first or second month of the reporting period (quarter). It makes sense to submit a report for reimbursement when, according to preliminary calculations by the policyholder at the end of the quarter, the total amount of contributions payable will be lower than the total amount of benefits paid.

If the payment of benefits from social insurance occurred in the third month of the reporting period, an interim report is not prepared. All expenses can be paid based on the quarterly report.