What is the reason for introducing encoding?

The changes are related to the entry into force of Law No. 12-FZ dated February 21, 2019, clarifying the procedure for collecting amounts under enforcement documents. The encoding was developed by the Central Bank in order to recognize income from which debt cannot be withheld or partial collection is allowed. The following notations have been introduced:

- “1” - for amounts with restrictions on the amount of recovery (Article of Law No. 229-FZ of October 2, 2007);

- “2” - funds to which recovery does not apply (Article 101 of Law No. 229-FZ);

- “3” - in respect of which restrictions do not apply in accordance with Part 2 of Art. 101 of Law No. 229-FZ.

The assignment of credited funds to one type or another should occur automatically, according to the code entered in field 20.

How long does sick leave last?

The duration of temporary disability depends on the cause:

- contact persons who did not develop suspicious respiratory symptoms during their stay in quarantine will be issued a document for 14 days;

- patients with active coronavirus infection are given sick leave for the entire period of home and/or hospital treatment until the doctor declares the person healthy, which takes on average 3-6 weeks;

- The parent is issued a certificate of incapacity for work for the entire period of caring for the sick child.

Income code: sick leave

Benefits for the period of temporary disability are calculated on the basis of a sick leave issued by a medical organization. In general, the first 3 days are paid by the employer, the remaining part is compensated from the Social Insurance Fund, or paid directly by the Fund (in the regions where the pilot project operates).

According to clause 9, part 1, art. 101 of Law No. 229-FZ of October 2, 2007, the penalty applies to disability benefits, the amount of deduction is determined by Art. 99 of the said law:

- up to 70% - for alimony for minor children, for compensation for harm to health, in connection with the death of the breadwinner, or for compensation for damage caused by a crime;

- in other cases – no more than 50%.

The amount of recovery is determined after personal income tax is deducted from the amount of the hospital benefit. The employer assigns the benefit within 10 calendar days after receiving sick leave, and pays it (the benefit in full or its part remaining after deduction according to the claimants) - on the nearest day established for settlement of salaries with employees.

When paying for sick leave non-cash, the income code in the payment order, as well as when transferring salaries, must be entered in field 20 “Name. pl.": the employer must indicate "1" - income for which restrictions on the amount of deductions apply.

An example of filling out a payment slip for sick leave with income code “1”, when no deductions were made from the employee under writs of execution:

Reflection of income type codes in “1C: Salaries and Personnel Management 8”

The 1C: Salaries and Personnel Management 8 program, edition 3, implements all the necessary functionality for organizing payments to individuals in accordance with current legislation.

Setting up income types for enforcement proceedings

In the Accruals card on the Taxes, contributions, accounting tab, a new field Type of income for enforcement proceedings has been added (Fig. 1).

Rice. 1. Setting up the “Type of income” for enforcement proceedings

The values of the Type of Income for enforcement proceedings correspond to the Directive of the Central Bank of the Russian Federation dated October 14, 2019 No. 5286-U:

- Wages and other income with restrictions on recovery corresponds to code “1” when transferring funds that are wages and (or) other income for which restrictions are established by Article 99 of Law No. 229-FZ. This type of income is indicated for all accruals included in the calculation base of the deduction under the writ of execution: salary, bonus, sick leave for disability, etc.;

- Income that cannot be levied (without reservations) corresponds to code “2”: when transferring funds that are income, which, in accordance with Article 101 of Law No. 229-FZ, cannot be levied, with the exception of income, to which, in accordance with Part 2 of Article 101 of Law No. 229-FZ, restrictions on foreclosure do not apply. This type of income is established for accruals that are not included in the calculation base of the withholding under the writ of execution: child care benefits, maternity benefits, compensation payments, daily allowances, etc.;

- Income that cannot be foreclosed on (with reservations) corresponds to code “3”: when transferring funds that are income to which, in accordance with Part 2 of Article 101 of Law No. 229-FZ, restrictions on foreclosure do not apply. Only alimony can be withheld from such income. For example, income with code “3” includes compensation for harm caused to health, some other income not related to wages;

- Income without limitation of penalties (code not specified) corresponds to the case when the type of income code is not specified. Namely, the payment type code is not indicated for amounts that cannot be collected. At first glance, the name does not correspond to the content of the mentioned paragraph 2 of the Directive of the Central Bank of the Russian Federation. In the program, the name of the type of transfer for enforcement proceedings states “without limitation of penalties,” and in the Directive of the Central Bank of the Russian Federation it is stated that “collection cannot be levied.” The fact is that paragraph 4 of the Order of the Ministry of Justice obliges banks to include in the calculation of the amount for which collection of funds can be applied, those funds in respect of which Article 99 of Law No. 229-FZ establishes restrictions on the amount of withholding and which cannot be recovered . Thus, for a transfer without specifying a code, it turned out that the names in the program “Income without limitation of collections” and in the legislation “payments that cannot be collected” mean the same thing. Firstly, this transfer is not necessarily income (for example, reimbursement of expenses, transfer of own income from business activities). Secondly, the bank should foreclose on this amount.

From all of the above, it is clear that banks will not collect only from income with code “2”.

For existing accruals in the program, the value is set automatically in accordance with the specified Accrual Purpose on the Main tab. Next, be sure to check the autofill result. If the Type of income in the accruals used was automatically determined incorrectly, then it should be adjusted.

When setting up accruals and deductions, additional control is performed. Accrual with the established Type of income for enforcement proceedings. Income that cannot be recovered (without reservations) cannot be included in the calculation base of deductions for writs of execution.

When conducting accrual documents, all amounts are recorded taking into account the established Types of income for enforcement proceedings. Therefore, it is important to perform the correct settings before performing calculations in the program. Otherwise, after changing the settings, the accrual documents will have to be reposted.

Registration of deductions made

The information letter of the Bank of Russia dated February 27, 2020 No. IN-05-45/10 “On indicating the amount collected in the settlement document” clarifies that the obligation to indicate in the settlement document the amount collected under the writ of execution rests with the persons transferring to the debtor’s account in bank or other credit organization wages and (or) other income.

In the program "1C: Salary and Personnel Management 8" edition 3, a new column Collected has been added to non-cash statements (Statement to the bank, Statement to accounts) (Fig. 2).

Rice. 2. Statement to the bank

The Collected column is filled in with amounts calculated in accordance with registered executive documents.

In the 1C: Salaries and Personnel Management 8 program, edition 3, alimony and other enforcement documents are registered with the document Writ of Execution. The Worksheet document is available if in the salary calculation settings (section Settings - Payroll calculation - link Setting up the composition of accruals and deductions) on the Deductions tab, the Deductions by executive documents flag is selected.

The Collected field in non-cash statements is filled in with the amount calculated on the Deductions tab in the documents Accrual of salaries and contributions and Accrual under contracts. The calculation in the document Accrual for the first half of the month currently does not affect the calculation of deduction for the month and is not displayed in the statements.

It should be understood that manual correction of the collection amount in the advance payment statement will entail the need for continued monitoring and subsequent manual correction in the monthly payroll statement.

In addition, at the moment, when filling out the Collected field, the data recorded in the Limitation of Collections document is not taken into account. Changes in amounts made manually in the Collected column are not taken into account in subsequent entries.

Version 3.6 of the standard for exchange with a bank

The standard for exchange files with a bank for a salary project is not regulated by law and may be different for each bank.

Together with Sberbank of Russia, a standard for electronic information exchange based on XML technology has been developed, which is supported by many other banks (more about the format). File generation in the program is implemented according to this standard.

The requirements for transmitting information to the bank about the types of income under enforcement proceedings and the amounts withheld under enforcement documents are implemented in the new EBI Standard with the bank version 3.6.

To interact directly from the program with a bank that, for some reason, does not support the standard, but the exchange of electronic documents with which is generally possible (according to the bank’s standard), will require its modification, which can be done in different ways.

Without modification, you can obtain the required information about employees and amounts from the program and manually transfer it to the program of such a bank.

In the program “1C: Salary and Personnel Management 8” edition 3, the Standard EPO with a bank (version 3.6) is indicated in the Salary Project card in the File Format field (Fig. 3).

Rice. 3. Selecting the payroll project file format

Statements to banks

From 06/01/2020, bank statements must be maintained by type of income for enforcement proceedings. The Type of income field has been added to the documents Statement to the bank and Statement to accounts. The statements are filled in with the results of accruals registered with the specified Type of income. All accruals registered with documents before the program update are considered Salaries and other income.

Therefore, if before updating the program, accruals with another type of income were registered but not paid (for example, sick leave for pregnancy and childbirth), then the accrual documents must be re-posted. Only after this will it be possible to automatically fill out a statement with the appropriate Type of income. If the Type of income in the statement is not selected, then accruals with all types of income are filled in. However, starting from 01.06.2020, it is impossible to fill out non-cash statements without indicating the type of income. In the program, the payment date is checked against the Payment Date from the accrual document, which by default coincides with the Document Date.

A payment order is used to create one register of a salary project for several statements. The Type of Income field has been added to the Payment Order document, as well as to non-cash statements (Fig. 4).

Rice. 4. Payment order

Payment is formed on the basis of statements. The payment order must indicate the income code for enforcement proceedings. To do this, fill in the Type of income field. You can collect only one type of payment in one payment. By clicking the Add button in the Payment Order document, you can select the documents Statement to the Bank and Statement to Accounts only of the same Type of Income specified in the Payment Order.

Filling out instructions when withholding debt under a writ of execution

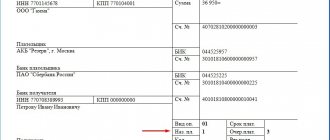

If the employer independently makes deductions according to the writ of execution, then along with the code for the type of sick leave income in the paragraph, field 24 of the document must be correctly filled out - “Purpose of payment”. How to do this is indicated in the information letter of the Central Bank of the Russian Federation dated February 27, 2020 No. IN-05-45/10:

- First, the type of income is indicated, for example, “Payment for sick leave to Vitaly Semenovich Smirnov”;

- then put the symbol “//”, indicate the code “VZS” (short for “collected amount”), again “//”;

- The withheld amount is entered in numbers (after rubles, kopecks are written with a hyphen, for example, 1000-00).

Such a record will allow the financial institution to recognize that the deduction from income has already been made. In such cases, it is not possible to re-collect the transferred amount.

Here is a sample payment slip for hospital payments from which a recovery in the amount of 1210 rubles was made:

What is written on a sick leave certificate for coronavirus?

When issuing a certificate of incapacity for work, medical confidentiality is maintained, so the full name of the diagnosis is not indicated on the form. It is being replaced with special codes (according to ICD-10), which were urgently introduced by WHO to take into account the characteristics of the course of the disease:

- U07.1 - laboratory confirmed diagnosis of COVID-19;

- U07.2 - covid diagnosis based on clinical and epidemiological data;

- Z03.8 - suspected coronavirus infection;

- Z22.8 - asymptomatic virus carriage;

- Z20.8 - contact with someone infected with coronavirus;

- Z11.5 - screening for diagnostics of COVID-19;

- B34.2 is an unspecified coronavirus infection (caused by other strains of coronavirus).

A correctly completed sick leave must indicate the name of the issuing medical institution, the full name and address of the organization where the person works, all passport data and periods of temporary disability. It is forbidden to make corrections while on sick leave; special attention must be paid to this.

Payment of maternity benefits

The sick leave income code in the payment order for the transfer of maternity benefits (maternity benefits) differs from regular disability benefits. This is due to the wording of clause 12, part 1, art. 101 of Federal Law No. 229-FZ, which prohibits the collection of child benefits paid from the budget. Maternity benefits fall into this category of payments. Therefore, when paying for such sick leave, the income code in the payment slip is “2”, that is, the amount from which it is prohibited to withhold debt under writs of execution. Personal income tax is also not withheld from such payments - by virtue of clause 1 of Art. 217 Tax Code of the Russian Federation.

Current legal framework 2020-2021.

Thus, the legal basis is as follows:

- FZ-255;

- new order of the Ministry of Health No. 925n.;

- temporary rules for persons over 65 years of age, approved by Resolution No. 402.

These are current laws, but they may be amended or no longer in force.

Payment is made from the state budget of the Social Insurance Fund. In this case, the payment is first calculated and the payment itself is carried out by the employer, then compensation for this amount is made by the Social Insurance Fund.

Deadline for payment of vacation pay in 2021, taking into account the latest changes to the Labor Code of the Russian Federation - what is important to know?

Advice from doctors when receiving sick leave

To receive timely payment for sick leave, doctors recommend seeing a doctor at the first signs of illness and not self-medicating so that the therapist can issue sick leave from the first day of Covid. Clinic workers emphasize that infected patients should not leave home to receive the document—it will be brought by a doctor or nurse during their next visit to the patient. It is also now possible to receive an electronic sick leave, which saves the patient from unnecessary hassle.

Doctors advise people who have become infected to prepare a list of contact persons before calling doctors, after which contacts will be contacted to clarify information and apply for sick leave for self-isolation.

Recalculation of benefits in 6-NDFL and 2-NDFL

In Part 2.1 of Art. 15 of Federal Law No. 255-FZ states that if the employer does not have complete data for calculating benefits (the employee has not submitted a certificate of earnings in Form 182-n), then the employer calculates the amount of benefits based on the data available to him, and then If the insured person provides a certificate, the amount of benefits for the previous period must be recalculated.

Example.

10/23/2018 Barannikov E.M. benefits were paid for three days of illness in the amount of 1362.67 rubles. After submitting a certificate of income from the previous place of work in form 182-n and the corresponding recalculation, the amount of the benefit increased and amounted to 1893.52 rubles. The remaining amount of the unpaid benefit is 530.85 rubles. Date of payment to Barannikov E.M. part of the recalculation in the amount of 530.85 rubles. – November 12, 2018. On the same day, personal income tax was withheld and transferred.

Accordingly, the 6-NDFL reporting for the fourth quarter of 2021 will reflect the amount of additional benefits and tax on lines 020, 040, 070 of section 1 and in section 2 on lines 100 - the date of receipt of income is indicated as November 12, 2018, 110 - the date of withholding of personal income tax 11/12/2018, 120 – transfer deadline 11/30/2018, 130 – amount of benefits received 530.85 rubles, 140 – amount of personal income tax withheld 69.00 rubles.