In Russia, the future pension of every working citizen does not depend on the length of service, as it was before, under the USSR, but on the number of pension points (IPC) accumulated by him over a certain period of work.

The IPC is directly formed from employers’ monthly contributions to the Pension Fund, the amount of which depends on the employee’s salary.

However, in practice, it happens that representatives of organizations in which citizens work do not fully fulfill their responsibilities for transferring funds , thereby affecting the quality and volume of pension provision for their employees in the future. How to check the presence of deductions, their amounts, as well as how to deal with employer dishonesty is discussed in detail in this article.

All about checking your pension savings for 2021

The reform carried out in 2015 makes it possible to independently form your own pension with certain savings. The insurance pension, in turn, is divided into the following groups:

- in case of loss of a breadwinner;

- establishing the fact of disability (disability group);

- reaching the age limit for old age pension.

Also, pension savings are divided into 3 categories:

- target;

- urgent;

- one-time

This right is granted as a result of the formation of the required number of points or IC (individual coefficient).

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Points are awarded annually during your career. In the case of the formation of an exclusively insurance benefit, a person adds 10 points .

What payments are subject to insurance premiums?

Contributions for compulsory insurance are subject to most payments under GPC and labor contracts. At the same time, Art. 422 of the Tax Code of the Russian Federation provides for payments from which contributions do not need to be transferred:

- unemployment benefits and other government benefits;

- various compensation payments: compensation for harm to health, payment for rent of an apartment, reimbursement of expenses for lunches, funding for advanced training, etc.;

- financial assistance paid at a time in the event of the birth of a child, a natural disaster, or the death of a family member;

- income, other than wages for work, received by members of communities of small indigenous peoples;

- contributions to funded pension within 12,000 rubles per employee;

- financial assistance up to 4,000 rubles;

- reimbursement of costs for repaying loans and borrowings for the purchase or construction of housing for employees;

- and other types of compensation payments.

Checking savings through government services

If you are not registered on the State Services Portal, you need to register and confirm your Pension Fund account or use Russian Post. For those who have already used this site, you need to visit your Personal Account.

- Select from the catalog and follow this link.

- After that, click on “Notification and personal account status.”

- These actions will be followed by a statement in which all deductions to your individual account will be indicated.

What does this quantity consist of or how does it add up?

The insurance pension is based on contributions that are transferred to the Pension Fund every month during the citizen’s working life.

In other words, this amount is the salary that the insured person earns, which maintains her employment title. In addition, the insurance pension includes a fixed basic amount paid by the state.

If a person has encountered situations during the entire period of his working activity that require him to receive benefits, then individual allowances are added to the pension:

- compensation for difficult working conditions;

- interruption of work for military conscription;

- receiving disability due to an injury in the workplace (read more about pensions for disabled people here);

- length of service.

The funded part will be transformed in two ways from 2021:

- To the insurance department , if there is a desire to leave it at state disposal.

- In deductions from non-state pension funds , based on a document signed in good faith.

Read more about calculating the amount of the insurance portion of your pension in our material.

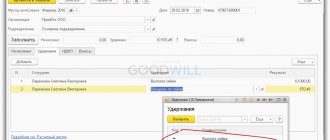

Through your personal account in the pension fund

While on the Pension Fund website, you are also required to register, indicating a valid (working) email for confirmation.

- After the above steps, you need to fill out a form in which you should indicate your passport details and SNILS number.

- Next, to get information about savings, you need to go to the “Pension Fund” section and select the appropriate link there.

If any problems arise, you can contact the Pension Fund staff at the phone number indicated at the top of the page. The hotline operates 24 hours a day and calls are free.

Step-by-step calculation algorithm

The procedure for calculating an old-age pension consists of several stages:

Stage 1. Find out how much PB was accrued before 2002:

- The experience coefficient (SC) is determined. By default it is 0.55. If a man has more than 25 years of experience, and a woman has 20 years, for each year in excess an additional 0.01 must be accrued. The maximum value cannot exceed 0.75.

- The average monthly earnings coefficient (AMC) is calculated. You need to take the average salary for any 60 consecutive months (or for 2001–2002) and divide it by the average monthly salary in Russia for the same period. The limit value cannot exceed 1.2. For persons with “northern experience” it varies between 1.4–1.9.

- The estimated pension (RP) is determined.

If SC is greater than 0.55 . RP = SK × KSZ × 1671 – 450. Regardless of the result, the minimum value is 210 rubles.

If SC is 0.55 . For men, the formula is used: RP = (SC x KSZ x 1671 - 450) x (length of service in years before 2002 / 25). For women - RP = (SC x KSZ x 1671 - 450) x (length of service in years before 2002 / 20). Remember, the minimum value (SC x KSZ x 1671 – 450) is 210.

- Valorization (one-time increase) is applied to the RP amount. If you were not officially employed before 1991, the RP increases by 10%. If you have experience, an additional 1% is added to 10% for each full year.

- To calculate the pension capital, the result obtained is multiplied by 5.6148 - the product of the indexation coefficients for each year from 2002 to 2014.

- Determine how much PB was earned before 2002.

Stage 2. Find out the number of PB accrued from 01/01/2002 to 12/31/2014. (inclusive):

- Receive information about the status of your personal account. This can be done by sending a written request to the Pension Fund, via the Internet on the State Services website, or during a personal visit to the Pension Fund.

- The numbers indicated in the statement must be multiplied by the appropriate indexation coefficient. There is one for each year:

- 2014 – 1,083;

- 2013 – 1,101;

- 2012 – 1,1065;

- 2011 – 1,088;

- 2010 – 1,1427;

- 2009 – 1,269;

- 2008 – 1,204;

- 2007 – 1,16;

- 2006 – 1,127;

- 2005 – 1,114;

- 2004 – 1,177;

- 2003 – 1,307.

- Add up the indexed numbers. Divide the final figure by the survival age determined as of January 1, 2015. It is equal to 228 months.

- The number of PB accumulated from 2002 to 2015 is determined.

Stage 3. Calculate PB accumulated since January 1, 2015.

Stage 4. PB for non-insurance periods is summed up.

Stage 5. IPCtotal is determined.

Stage 6. The amount received is multiplied by the cost of 1 PB (87.24 rubles).

Stage 7. The PV is added to the result. It will be different for each group of applicants. For example, if you are over 80 years old, the base value doubles. If there are dependents, an additional 1/3FV must be charged for each.

If your old-age pension is small and does not reach the subsistence level established in your region of residence, you should be assigned a social supplement:

- From the federal budget , if the PMP in the region is lower than the federal value (8,846 rubles). Payments are made through the Pension Fund.

- From the regional budget, if the PMP is higher than the federal value. Paid through social security authorities.

Pension contributions in Sberbank

All pension contributions occur through various credit organizations, but only through those with which the Pension Fund has an agreement. Among them is Sberbank, to which you can submit an application to receive a statement of savings. As when visiting the Pension Fund, a citizen must have SNILS and passport data with him, which will be used to draw up an application for the provision of services.

What conditions of NPFs must be met in order to cooperate with them?

Work with such organizations is carried out on a voluntary basis. Residents of the Russian Federation who have official work experience can cooperate with them. Funds are accepted into the NPF account within the framework of the agreement. For its conclusion the following documents are needed:

- passport of a citizen of the Russian Federation;

- SNILS;

- TIN.

With these documents you need to contact the branch of the selected NPF and conclude an agreement for the provision of services. After this, you should write an application for the transfer of funds to the selected organization from the fund in which the citizen was previously served. To avoid difficulties in opening a new pension account, you should determine in advance which organization it is located in.

How to check the correctness of pension calculations through State Services?

According to the law, contributions must be made to the Pension Fund from the employer in the form of a 22% tax. There are also organizations in which points for employees are awarded not 22 percent, but 20%. But in companies where employees are engaged in work activities with hazardous and harmful substances, or are in difficult working conditions, the employer charges an additional 4% in excess of the established 22%.

Sometimes employees may feel that it is unfair for the employer to contribute to the account. In this case, it is possible to find out through the accounting department of the organization in which they work. However, not everyone wants to clarify this issue in this way, so you can easily use the same website of State Services, the Pension Fund, banks and the Multifunctional Center.

Where can I find out the amount?

There are quite a few ways to find out the amount of transferred pension savings. The most common of them is a pension fund.

Read in the next article whether pensioners can avoid paying property taxes.

Customer service of territorial bodies

You can request information on the balance of a personalized pension account from the employees of the territorial branch of the Pension Fund .

The appeal must be in writing , with a request to provide you with information (there should be a sample application at the stands in the Pension Fund).

A copy of SNILS (green card) is attached to the application.

From the moment of receiving the application, within ten days , PF employees are required to provide an extract from the applicant’s pension account and hand it over either personally or to the postal address specified in the application by registered mail (the choice of receiving the extract remains with the applicant).

Employer

In addition to quarterly reports to the Pension Fund, which Russian companies are required to provide, at the end of the year, Personalized records for each employee.

This information is stored by the employer electronically and in form, and each employee can request it from the accounting department at any time.

MFC

For the convenience of citizens who find it difficult to understand the operation of websites and obtain information via the Internet, and the nearest Pension Fund branch is located far away, the MFC is ready to provide information on pension savings.

Based on the application, a copy of the passport and a copy of SNILS, within 10 days from the date of application, you will be able to receive the requested document.

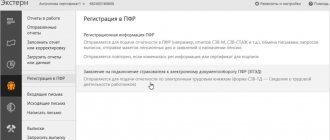

Extract from the Pension Fund through State Services

You can find out your pension savings from the Pension Fund, as mentioned above, by using the State Services Portal.

- First of all, you need to go to your Personal Account by selecting and clicking the link “Receive an extract from the Pension Fund of Russia”.

- After clicking on this section, the system will begin checking your savings online, so this operation will take some time.

- After a couple of minutes, the page will display the result, which can be sent to an email address or downloaded to your PC.

- When saving a document, the system will notify you that this paper can be used for informational purposes only. Then you need to click on the “save” button, selecting the path on your computer. With the support of the browser used at this moment, the online PDF viewing function, the saved file can be displayed in a new window.