As a general rule, processed primary documents that relate to a specific accounting register (for example, cash, bank documents) are filed in separate folders in chronological order.

Documents received by the accounting service, created and accumulated in it, and having various purposes must be stored in accordance with the provisions of Article 29 of Law No. 402-FZ.

These are the norms.

- Primary accounting documents, accounting registers, accounting (financial) statements, and audit reports on them are subject to storage by an economic entity for periods established in accordance with the rules of the state archival company, but not less than five years after the reporting year.

- Documents of accounting policies, standards of an economic entity, other documents related to the organization and maintenance of accounting, including tools that ensure the reproduction of electronic documents, as well as verification of the authenticity of an electronic signature, are subject to storage by an economic entity for at least five years after the year in which they used to prepare accounting (financial) statements for the last time.

- An economic entity must ensure safe storage conditions for accounting documents and their protection from changes.

- When there is a change in the head of the company, the transfer of accounting documents must be ensured. The procedure for transferring accounting documents is determined by the company independently.

Primary documents, accounting registers, accounting reports and balances, before transferring them to the archive, must be stored in the accounting department in special rooms or locked cabinets under the responsibility of persons authorized by the chief accountant.

Strict reporting forms must be stored in safes, metal cabinets or special rooms to ensure their safety.

Cash orders, advance reports, bank statements with related documents must be collected in chronological order and bound.

Certain types of documents (work orders, shift reports) can be stored unbound, but filed in folders to avoid their loss or misuse.

The safety of primary documents, accounting registers, accounting reports and balance sheets, their execution and transfer to the archive is ensured by the chief accountant of the company.

Depending on the period of storage of documents, there are different types of storage:

- current (temporary);

- archival.

Current (temporary) storage means that the documents have been executed, but in certain circumstances they may be needed again for study, clarification or re-examination. The storage of documents removed from current accounting is called archival storage.

Receipt of materials

In accordance with paragraph 2 of section. 2 guidelines for accounting of inventories, approved by Order of the Ministry of Finance dated December 28, 2001 No. 119n, the concept of “materials” includes a wide range of enterprise inventories with a useful life of less than a year. Materials include:

- raw materials necessary for the production of semi-finished or finished products;

- auxiliary materials that are not included in the finished product, but are used to ensure the operability of the equipment, as well as any technological needs;

- fuels and lubricants;

- spare parts;

- container;

- purchased semi-finished products;

- waste production;

- others.

In an organization that has warehouses, the manager’s order approves a list of materially responsible persons (MRPs) responsible for the safety and maintenance of warehouse records of materials for each warehouse.

Inventory and materials received from suppliers have a set of shipping documentation, represented by an invoice (form TORG-12, M-15 or another accepted by the supplier), an invoice, a waybill, and a specification. Of these, the invoice serves as the basis for capitalization. In the absence of shipping documents, materials can also be capitalized.

Read about the rules for such posting in the article “How to post goods without accompanying documents.”

Upon acceptance, materials must be checked for compliance of the actual quantity, quality and assortment with the data stated in the supplier’s accompanying documents.

If no discrepancies were identified during the verification process, the MOL issues a receipt order in Form M-4. It is allowed to put a stamp on the supplier's documents instead of receipt orders. The stamp must reflect all M-4 details.

If, after the inspection, discrepancies are still identified, it is necessary to issue a statement of discrepancies in the TORG-2 form.

For the form and sample of filling out this form, see the material “Unified form TORG-2 - form and sample” .

Another way of receiving materials is their purchase by accountable persons at retail outlets. In this case, the primary source is invoices or sales receipts attached to the expense report.

ConsultantPlus draws your attention to the fact that starting from 2021, materials must be taken into account strictly in accordance with the new Federal Accounting Standards 5/2019 “Inventories”. The new rules were explained in detail by legal experts. To see the recommendations, get trial access to K+ for free and go to the ready-made solution.

Technical documentation for an apartment building: composition, storage and transfer procedure

This document can be either an agreement with the contractor or an internal document of the management organization (salary sheet or staffing table, for example). If such a decision is made by the owners at the general meeting and further agreed with the management company, the document will become one of the elements of the technical documentation. Consequently, the owners will have the right to familiarize themselves with it.

The technical documentation is owned by the owners of the premises of an apartment building. They receive documents, the names of which were listed above, from the developer, the previous management authority or the owners (if the house was under direct management). instructions for using the MKD and technical documentation only if they are lost. This usually happens with old houses, commissioned in the 20th century and even earlier.

Organization of warehouse accounting of materials

Accounting for inventory items in the accounting department and in the warehouse can be carried out using the quantitative-total and balance method.

When using the first option, both in warehouses and in accounting, inventory records are kept by quantity and amount simultaneously.

If the accounting policy has approved the balance method, then in the warehouse inventory items are taken into account by quantity, and in the accounting department - in total terms.

Keeping inventory records of materials is possible in two ways: batch and grade.

- Batch method.

In this case, each batch of inventory items is stored separately. A batch is a homogeneous material received according to one document. For each batch, MOL issues a batch card in two copies: 1st - for the warehouse, 2nd - for the accounting department. The form is approved by the company independently, depending on the type of inventory.

In the incoming part of the document, data is entered according to the primary document received from the supplier, in the outgoing part - data on the fact of write-off of materials. After the complete release of the entire batch of goods and materials, the batch card is closed, the MOL draws up an act of consumption of goods and materials and transfers the entire package of documents to the accounting department for verification.

- Varietal method.

Warehouse accounting of materials in this way is carried out by names and grades of goods and materials, regardless of the date of receipt and price. For each name of material, a materials accounting card (form M-17) is created, which is registered in a special accounting register. This card is maintained throughout the year.

When maintaining warehouse records using the sort method, warehouse space is used economically and material balances are easily managed. However, it is not possible to track the price of receipt of goods and materials, and the material is written off at the average cost using the FIFO method or at the unit price (clause 73 of order No. 119n).

Read more about the M-17 form in the article “Material Warehouse Card - Form and Sample.”

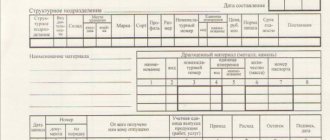

APPENDIX 2 Recommended

FRONT SIDE OF A MACHINE READABLE DOCUMENT ACCOUNT CARD

| Name of the organization holding the document | Mark of authenticity (original, duplicate, copy, control copy) | Document registration number | |||||||||

| MACHINE READABLE DOCUMENT ACCOUNT CARD | date of creation | Shelf life | Date and number of the cancellation certificate | ||||||||

| Document name and code | Note | ||||||||||

| Summary | Storage | ||||||||||

| Document Creator Organization | The medium on which the document is recorded | Availability of copies of the document | |||||||||

| Name and code Location and its code | Type of media (PC, PL, ML, MD) | Qty | Inv. number (ML, MD) | Type of media (PC, PL, ML, MD) | Qty | Reg. number (ML, MD) | |||||

| Person responsible for recording | |||||||||||

| Code | Personal signature | Full name | |||||||||

A5 format

REVERSE SIDE OF THE MACHINE READABLE DOCUMENT ACCOUNT CARD

| CHANGES IN INFORMATION | |||||

| date | Person responsible for production changes | Major changes | Contents of the change | ||

| code | personal signature | full name | |||

APPENDIX 2

(Introduced additionally, Amendment No. 2 ).

Intra-warehouse movement of goods and materials

Some accountants or merchandisers may ask, “What is movement?” In the course of business activities, an enterprise needs to move materials between warehouses or structural divisions. The primary document in this case is the demand invoice (form M-11). It is issued by the MOL of the sending party in 2 copies: the 1st remains with the transferring party and serves as the basis for writing off materials from the register, the 2nd is transferred to the MOL of the receiving party and is the basis for accepting the goods and materials for registration.

For information on filling out a demand invoice, read the material “Procedure for filling out form M-11 demand invoice.”

Technical documentation

Analysis of the design of tapered trousers, design requirements. Scientific information, patent documentation, analogue models. Technical and economic requirements, quality indicators of product design, stages of development, composition of design documentation.

Development of technological documentation for the production of men's jackets in mass production. Selection of promising models. Selection and characteristics of materials. Regulatory and technical documentation for the product. Methods for processing main parts and assemblies.

Inventory

In order to identify the actual availability of inventory items listed in accounting records, the organization conducts a warehouse inventory. It can be carried out as necessary by order of the manager, and also without fail in the following cases (clause 22 of order No. 119n):

- when selling materials;

- when changing MOL;

- when identifying cases of damage or theft of inventory items;

- in the 4th quarter before the preparation of annual accounting reports;

- in case of emergency (fire, flood, etc.);

- upon liquidation of the company.

The frequency of the audit may also be reflected in the accounting policy of the enterprise.

The audit procedure is regulated by methodological guidelines for inventory of property, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49.

First of all, the enterprise issues an order to conduct an inventory indicating the persons - members of the commission (at least 3 people) and is endorsed by the manager (INV-22 form). Such a commission has the right to conduct an audit only in full force in the presence of the MOL. Before carrying out the inspection, the MOL writes a receipt in any form stating that all inventory items have been taken into account and the documents have been transferred to the accounting department.

Inspectors check the actual availability of materials with a list called the inventory list (INV-3 form).

Read about the inventory list used when checking the availability of materials in the article “Unified form INV-3 - form and sample” .

Such a document contains a column with data on the amount of materials accounted for in accounting, and an empty column in which inspectors can reflect the actual presence of inventory items. After a complete recalculation of values, the commission signs this statement. The MOL records on the last page that the inspection was carried out in its presence and that there are no complaints against the commission.

If, as a result, discrepancies are identified between the accounting and actual quantities, a document is drawn up - a matching statement, in which all such discrepancies are recorded (form INV-18).

Read about the specifics of filling out this statement in the material “Unified Form INV-18 - Form and Sample” .

If a surplus is identified, it must be taken into account. It is considered the income of the enterprise and is recorded in the credit of the 91st account.

If misgrading of inventory items is detected, the result can be offset against each other. Such an offset is possible only for 1 MOL for 1 audited period and only for similar types of products in equal quantities (clause 32 of Order No. 119n).

If a shortage is identified, first of all it is necessary to find out whether there was a natural loss (for example, shrinkage, shrinkage). The shortfall within the limit is considered an expense of the enterprise and is written off as a debit to the 26th (44th) account; the excess limit and the actual shortfall must be reimbursed by the MOL. To reflect the identified discrepancies, the INV-26 form can be used.

For the procedure for filling out this form, see the article “Unified Form No. INV-26 - Form and Sample” .

ConsultantPlus experts spoke in detail about the nuances of conducting an inventory. Study the material by getting trial access to the K+ legal reference system for free.

APPENDIX 1 Reference

EXAMPLES OF COMPLETING DOCUMENT RECORDING CARDS

Example 1 (front side). Accounting of the original, duplicate transferred to organization 023028; registered copies - to organization 022959

Example 1 (reverse side)

Example 2 (front side). Accounting for a duplicate in a duplicate organization

Example 2 (back side)

Example 3 (front side). Accounting for a copy of a document developed by another organization

Example 3 (reverse side)

ANNEX 1

(Changed edition, Amendment No. 2).

Disposal of materials

The write-off of materials from the warehouse must be accompanied by one of the documents: a limit card (Form M-8), an invoice for the release of materials to the third party (Form M-15), a demand invoice (Form M-11) or a consignment note (Form TORG- 12).

- Limit-receipt card is a document intended for the release of one item of materials to another warehouse of the enterprise or to a third party. For example, baking bread requires flour. Form M-8 reflects the daily write-off of flour from the storage warehouse to production. This document is maintained for a month in 2 copies: one each for the releasing and receiving parties. The card contains data on the quantity of materials issued, which are endorsed by the signatures of the person who issued and accepted the MOL. At the end of the period, the cards are handed over to the accounting department.

- The demand invoice is issued once for each release of goods and materials in 2 copies: one for each of the parties.

- An invoice for the release of materials to a third party is issued as a result of the disposal of materials to a third-party legal entity (when selling or, for example, transferring materials as customer-supplied raw materials) or to a geographically remote division of the company. The document is issued in 2 copies. If the release was made to a third-party organization, a power of attorney from the recipient of the goods and materials must be attached to Form M-15.

The form M-15 can be found in the material “Unified form M-15 - form and sample” .

- When selling materials to a third party, an invoice is issued in the TORG-12 form in 2 copies: the 1st remains with the seller’s company, the 2nd is transferred to the buyer. If inventory items are transported by road, it is also necessary to draw up a TTN (Form 1-T).

For information about the documents drawn up during transportation, read the article “Confirmation of transportation expenses - with what documents.”

Liability and fines

For failure to comply with legal requirements regarding the safety of documentation, significant penalties are provided. Article 120 of the Tax Code of the Russian Federation establishes the following fines if the rules and terms of storage of primary documentation have been violated:

- 10,000 rubles if the company did not provide accounting and tax documents relating to one tax period, that is, a fine is issued for the fact that the company did not keep accounting and tax records during the tax period;

- 30,000 rubles if a similar violation was detected in several reporting periods at once;

- 40,000 rubles (minimum) or 20% of the amount of unpaid tax, if missing documentation led to an understatement of the tax base.

In addition to fines for a legal entity, tax authorities can also fine the manager. For example, a fine of 2,000 to 3,000 rubles for the director of an organization in which the rules and terms of storage of primary data were violated (Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

Storage

An organization can create a warehouse designed to store materials from third-party organizations and receive a certain remuneration for storage services. This activity is regulated by Art. 909 of the Civil Code of the Russian Federation.

In this case, a public agreement is concluded between the counterparties. That is, anyone has the right to deposit their inventory items. Acceptance of materials based on quality, quantity and assortment is carried out by the storage warehouse's MOL. The depositor has the opportunity to inspect or check, as well as pick up his valuables at any time in the presence of the MOL.

The entire storage procedure is documented with primary documents. Let's look at the main ones.

Acceptance of goods and materials for storage is accompanied by an act of acceptance and transfer of goods and materials (form MX-1), which is issued in 2 copies: one for each party. The MOL records the receipt of inventory items for storage in a special journal (form MX-2).

Upon expiration of the storage period, as well as if the depositor wishes in writing, the storage warehouse returns the materials. This procedure is accompanied by a certificate of return of goods (form MX-3).

All data on the quantity and movement of inventory items are recorded by the MOL in special journals (MX-4, -5, -6, -7, -8).

Forms for forms MX-1 and MX-3 and the procedure for filling them out can be found in the materials:

- ,

- “Unified form No. MX-3 - form and sample”.

WHAT DO WE STORE DOCUMENTS IN?

Our industry produces a great variety of different binders, archival folders and boxes.

Before being placed in archival storage, it is convenient to store documents with long and permanent storage periods immediately formed into files, filed and laced in direct chronological order (latest at the end) in cardboard folders.

In such folders, files are stitched with string using a hole punch or drilling machine, and it is no longer possible to remove or insert a document without reformatting the entire file.

Cases with storage periods of up to 10 years can be kept in operational storage in file registrars or other binders, which are convenient to place vertically in cabinets and where it is convenient to file documents without unstitching the entire file.

In such folders, documents are usually filed in reverse chronological order (latest on top).

Results

For efficient and uninterrupted operation of the company, it is necessary to properly organize the work of warehouses.

In order to track the movement of inventory and materials in warehouses, it is very important to issue accompanying and primary documents in a timely manner, the circulation of which should be recorded in the document flow schedule in the accounting policy of the enterprise. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Basic rules for working with scientific and technical documentation in organizations and enterprises

9.1.1. The work of the organization's SNTD to prepare scientific and technical documentation for transfer to state storage is carried out on the basis of the industry plan-schedule for streamlining and transfer of scientific and technical documentation for state storage to the state archives and the five-year work plan of the SNTD.

The archival fund may include: management, research, design, technological, design, cartographic documentation, documents on computer media, film documents, microforms, photographic documents, video phonograms, phonograms. Each archival collection is assigned the official name of the corresponding organization, and renamings are indicated in chronological order.