Accountant calendar for March 2021

In 2021, companies report not only on current activities, but also on the results of 2015. For some taxes, reporting deadlines last until the May holidays. However, we do not recommend delaying, since in April you need to submit declarations based on the results of the first quarter of 2021. Therefore, we consider it appropriate to report to the budget no later than March 2016.

So, look at our accountant calendar for 2015 - what needs to be submitted to the Federal Tax Service for 2015 in March 2016:

| Tax | Period | Deadline | Reporting | Payment |

| Personal income tax - message about the impossibility of withholding tax for 2015 | 2015 | 01.03.2015 | 2-NDFL | |

| Income tax | 2015 | 28.03.2016 | Declaration | V |

| Property tax | 2015 | 30.03.2016 | Declaration | V |

| Accounting statements (including in a simplified form for the simplified tax system and unified agricultural tax) | 2015 | 31.03.2016 | Forms 1, 2, 3, 4, 6 and attachments to them (STS and Unified Agricultural Tax can be submitted without attachments) | |

| simplified tax system | 2015 | 31.03.2016 | Declaration | V |

| Unified agricultural tax | 2015 | 31.03.2016 | Declaration | V |

Composition of financial statements

If the organization is a small business, then it can prepare financial statements in a simplified form. In this case, the entire set will consist of only two forms: a balance sheet and a statement of financial results. All other companies submit financial statements in the following forms:

- balance;

- financial results report;

- statement of changes in capital;

- cash flow statement;

- explanatory note.

Accountant calendar 2015–2016: OSN

The specificity of OSN is that, unlike special regime companies, a company on OSN pays and reports VAT, income tax and property tax, regardless of whether their property is included in the cadastral list.

For information on the form that will need to be used when drawing up a property tax return for 2021, read the material “Corporate Property Tax Declaration 2016.”

Plus, companies on OSN report for employees and submit declarations and transfer taxes depending on the specifics of their activities: alcohol producers declare production volumes and pay excise taxes, trading companies in Moscow are required to pay a trade tax, etc.

Below in the firm's accountant's calendar on OSN, we have provided a list of general basic reports, taxes and fees that must be submitted to government agencies and paid in 2021:

Date of submission of the report and sanctions for violation of the deadline

We remind you that regardless of the date of receipt of documents by the tax office, the filing date is considered the day of departure. In the case of electronic reporting, this date is indicated in the confirmation of the electronic data exchange system with the Federal Tax Service.

If the report is filed after the due date, the taxpayer may be subject to penalties in the form of a fine. Its size, according to Article 119 of the Tax Code of the Russian Federation, will be 5% of the amount that must be paid on the basis of this report, but not less than 1000 rubles. If the taxpayer delayed filing the report for a long period of time, the Federal Tax Service may charge a fine in the specified amount for each full or partial month of delay, but not more than 30% of the amount payable under this declaration.

A penalty in the form of a fine can also be received for non-compliance with the reporting form. So, if a company was obliged to submit a declaration electronically, but sent its “paper” version, on the basis of Article 119.1 of the Tax Code of the Russian Federation, it faces a fine of 200 rubles. However, VAT also stands apart here - sending a return for this tax on paper is pointless, since the Federal Tax Service will not consider such a report submitted.

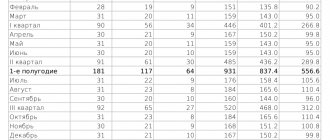

Accountant calendar for 2021 (table)

| Month | date | Tax/fee | Period | Reporting | Payment | |

| January | 15.01.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | December 2015 | V | ||

| 20.01.2016 | Reporting to the Social Insurance Fund in paper form (for companies with less than 25 employees) | 2015 | 4-FSS | |||

| 20.01.2016 | Average number of employees | 2015 | According to KND form 1110018 | |||

| 20.01.2016 | Single declaration in the absence of activity and transactions on the current account | 2015 | Single (simplified) declaration | |||

| 25.01.2016 | VAT | IV quarter 2015 | VAT declaration | V | ||

| 25.01.2016 | Trade tax (for Moscow taxpayers) | IV quarter 2015 | V | |||

| 25.01.2016 | Reporting to the Social Insurance Fund in electronic form (for companies with more than 25 employees) | 2015 | 4-FSS | |||

| 28.01.2016 | Income tax | Advance for January 2021 | V | |||

| 31.01.2016 | Personal income tax on certificates of incapacity for work and vacation pay | January 2021 | V | |||

| February | 01.02.2016 | Transport tax | 2015 | Transport tax declaration | The payment deadline is determined by the law of the subject of the Russian Federation | |

| 01.02.2016 | Land tax | 2015 | Land tax declaration | The payment deadline is determined by the law of the subject of the Russian Federation | ||

| 15.02.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | January 2021 | V | |||

| 15.02.2016 | Reporting to the Pension Fund in paper form (for companies with less than 25 employees) | 2015 | RSV-1 | |||

| 20.02.2016 | Reporting to the Pension Fund in electronic form (for companies with more than 25 employees) | 2015 | RSV-1 | |||

| 29.02.2016 | Income tax | Advance for February 2021 | V | |||

| 29.02.2016 | Personal income tax on certificates of incapacity for work and vacation pay | February 2021 | V | |||

| March | 15.03.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | February 2021 | V | ||

| 28.03.2016 | Income tax | Advance for March 2021 | V | |||

| 31.03.2016 | Personal income tax on certificates of incapacity for work and vacation pay | March 2021 | V | |||

| ATTENTION! Taxes and contributions for 2015, which must be reported in March 2016, are indicated in the previous section “ Accountant Calendar for March 2021”. | ||||||

| April | 01.04.2016 | Personal income tax | 2015 | 2-NDFL | ||

| 15.04.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | March 2021 | V | |||

| 20.04.2016 | Reporting to the Social Insurance Fund in paper form (for companies with less than 25 employees) | I quarter 2021 | 4-FSS | |||

| 25.04.2016 | Reporting to the Social Insurance Fund in electronic form (for companies with more than 25 employees) | I quarter 2021 | 4-FSS | |||

| 25.04.2016 | VAT | I quarter 2021 | VAT declaration | V | ||

| 25.04.2016 | Trade fee | I quarter 2021 | V | |||

| 28.04.2016 | Income tax | I quarter 2021 | Income tax return | V | ||

| 28.04.2016 | Income tax | Advance for April 2021 | V | |||

| 30.04.2016 | Personal income tax on certificates of incapacity for work and vacation pay | April 2021 | V | |||

| May | 04.05.2016 | Personal income tax | I quarter 2021 | 6-NDFL | ||

| 04.05.2016 | Property tax | Advance for the first quarter of 2021 | The payment deadline is determined by the law of the subject of the Russian Federation | |||

| 10.05.2016 | Monthly reporting to the Pension Fund | April 2021 | SZV-M | |||

| 15.05.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | April 2021 | V | |||

| 16.05.2016 | Reporting to the PRF in paper form (for companies with less than 25 employees) | I quarter 2021 | RSV-1 | |||

| 20.05.2016 | Reporting to the PRF in electronic form (for companies with more than 25 employees) | I quarter 2021 | RSV-1 | |||

| 28.05.2016 | Income tax | Advance for May 2021 | V | |||

| 31.05.2016 | Personal income tax on certificates of incapacity for work and vacation pay | May 2021 | V | |||

| June | 10.06.2016 | Monthly reporting to the Pension Fund | May 2021 | SZV-M | ||

| 15.06.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | May 2021 | V | |||

| 28.06.2016 | Income tax | Advance for June 2021 | V | |||

| 30.06.2016 | Personal income tax on certificates of incapacity for work and vacation pay | June 2021 | V | |||

| July | 11.07.2016 | Monthly reporting to the Pension Fund | June 2021 | SZV-M | ||

| 15.07.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | June 2021 | V | |||

| 20.07.2016 | Reporting to the Social Insurance Fund in paper form (for companies with less than 25 employees) | 1st half of 2021 | 4-FSS | |||

| 25.07.2016 | Reporting to the Social Insurance Fund in electronic form (for companies with more than 25 employees) | 1st half of 2021 | 4-FSS | |||

| 25.07.2016 | Trade fee | II quarter 2021 | V | |||

| 25.07.2016 | VAT | II quarter 2021 | VAT declaration | V | ||

| 28.07.2016 | Income tax | Advance for July 2021 | V | |||

| 28.07.2016 | Income tax | 1st half of 2021 | Income tax return | V | ||

| 31.07.2016 | Personal income tax on certificates of incapacity for work and vacation pay | July 2021 | V | |||

| August | 01.08.2016 | Personal income tax | 1st half of 2021 | 6-NDFL | ||

| 01.08.2016 | Property tax | 1st half of 2021 | Property tax declaration | The payment deadline is determined by the law of the subject of the Russian Federation | ||

| 10.08.2016 | Monthly reporting to the Pension Fund | July 2021 | SZV-M | |||

| 15.08.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | July 2021 | V | |||

| 15.08.2016 | Reporting to the Pension Fund in paper form (for companies with less than 25 employees) | 1st half of 2021 | RSV-1 | |||

| 20.08.2016 | Reporting to the Pension Fund in electronic form (for companies with more than 25 employees) | 1st half of 2021 | RSV-1 | |||

| 29.08.2016 | Income tax | Advance for August 2021 | V | |||

| 31.08.2016 | Personal income tax on certificates of incapacity for work and vacation pay | August 2021 | V | |||

| September | 10.09.2016 | Monthly reporting to the Pension Fund | August 2021 | SZV-M | ||

| 15.09.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | August 2021 | V | |||

| 28.09.2016 | Income tax | Advance for September 2021 | V | |||

| 30.09.2016 | Personal income tax on certificates of incapacity for work and vacation pay | September 2021 | V | |||

| October | 10.10.2016 | Monthly reporting to the Pension Fund | September 2021 | SZV-M | ||

| 15.10.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | September 2021 | V | |||

| 20.10.2016 | Reporting to the Social Insurance Fund in paper form (for companies with less than 25 employees) | 9 months of 2021 | 4-FSS | |||

| 25.10.2016 | Reporting to the Social Insurance Fund in electronic form (for companies with more than 25 employees) | 9 months of 2021 | 4-FSS | |||

| 25.10.2016 | Trade fee | III quarter 2021 | V | |||

| 25.10.2016 | VAT | III quarter 2021 | VAT declaration | V | ||

| 28.10.2016 | Income tax | Advance for October 2021 | V | |||

| 28.10.2016 | Income tax | 9 months of 2021 | Income tax return | V | ||

| 31.10.2016 | Personal income tax | 9 months of 2021 | 6-NDFL | |||

| 31.10.2016 | Property tax | 9 months of 2021 | Property tax declaration | The payment deadline is determined by the law of the subject of the Russian Federation | ||

| 31.10.2016 | Personal income tax on certificates of incapacity for work and vacation pay | October 2021 | V | |||

| November | 10.11.2016 | Monthly reporting to the Pension Fund | October 2021 | SZV-M | ||

| 15.11.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | October 2021 | V | |||

| 15.11.2016 | Reporting to the Pension Fund in paper form (for companies with less than 25 employees) | 9 months of 2021 | RSV-1 | |||

| 21.11.2016 | Reporting to the Pension Fund in electronic form (for companies with more than 25 employees) | 9 months of 2021 | RSV-1 | |||

| 28.11.2016 | Income tax | Advance for November 2021 | V | |||

| 30.11.2016 | Personal income tax on certificates of incapacity for work and vacation pay | November 2021 | V | |||

| December | 10.12.2016 | Monthly reporting to the Pension Fund | November 2021 | SZV-M | ||

| 15.12.2016 | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance | November 2021 | V | |||

| 28.12.2016 | Income tax | Advance for December 2021 | V | |||

You can study such specific payments to the budget as water tax , gambling tax , excise taxes

ATTENTION! Starting from 2021, the deadlines for transferring “environmental” payments have changed. Now the reporting period is a calendar year, and fees must be transferred before March 1 of the year following the reporting year.

Therefore, for 2021, you need to report for negative impacts on the environment before 03/01/2017 (Law “On Amendments to the Federal Law “On Environmental Protection”” dated 07/21/2014 No. 219-FZ). For the fourth quarter of 2015, the fee in accordance with the new legal acts must be paid by 03/01/2016.

For information about who should charge pollution charges and how, read the article “Calculation of charges for environmental pollution - 2016.”

Where to deposit your balance

The balance sheet for 2021 should be sent (part 2 of article 18 of the Law of December 6, 2011 No. 402-FZ, subparagraph 5 of paragraph 1 of article 23 of the Tax Code of the Russian Federation).

- to the Federal Tax Service;

- founders (participants, shareholders);

- to the territorial statistical office (a division of Rosstat).

The balance sheet for 2021 must be approved (Part 9 of Article 13 of the Law of December 6, 2011 No. 402-FZ). The decision on this is made by the general meeting of shareholders (participants). Document this decision in the minutes of the general meeting.

Accountant calendar 2021: USN, UTII, PSN, Unified Agricultural Tax

Special tax regimes are designed to make tax accounting easier for companies and reduce the tax burden, so such companies pay less taxes than if they used SST.

Accountant calendar 2021 and for special regime employees:

| date | Tax | Period | Reporting | Payment |

| 20.01.2016 | Single declaration in the absence of activity and transactions on the current account | 2015 | Single (simplified) declaration | |

| ATTENTION! Taxes and contributions for 2015, which must be reported in March 2016, are indicated in the section “ Accountant Calendar for March 2021”. | ||||

| 25.04.2016 | simplified tax system | Advance for the first quarter of 2021 | V | |

| 25.04.2016 | UTII | I quarter 2021 | Declaration | V |

| 04.05.2016 | Property tax on objects included in the cadastral list | I quarter 2021 | Property tax declaration | The payment deadline is determined by the law of the subject of the Russian Federation |

| 25.07.2016 | simplified tax system | Advance for the 1st half of 2021 | V | |

| 25.07.2016 | UTII | II quarter 2021 | Declaration | V |

| 25.07.2016 | Unified agricultural tax | 1st half of 2021 | V | |

| 01.08.2016 | Property tax on objects included in the cadastral list | 1st half of 2021 | Property tax declaration | The payment deadline is determined by the law of the subject of the Russian Federation |

| 25.10.2016 | simplified tax system | Advance for 9 months of 2021 | V | |

| 25.10.2016 | UTII | III quarter 2021 | Declaration | V |

| 31.10.2016 | Property tax on objects included in the cadastral list | 9 months of 2021 | Property tax declaration | The payment deadline is determined by the law of the subject of the Russian Federation |

ATTENTION! The table does not contain deadlines for paying tax under PSN. The fact is that a businessman buys a patent for any period from 1 to 12 months, but within a calendar year.

For information about what kind of reporting may take place under PSN, read the material “Reporting of individual entrepreneurs on PSN - pros and cons”.

The above accountant’s calendar for 2016 lists reports and payments to the budget that are typical specifically for special regime employees. They also pay other taxes and fees if there are employees or certain activities that are subject to appropriate taxes, regardless of the special regime.