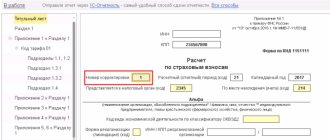

1C:Accounting provides for complete automation of the VAT accounting process. At the same time, there is often a need to introduce taxes manually. In particular, when maintaining a simplified document, or when its cancellation, adjustment or clarification is necessary. It is for this purpose that the option “Reflection of VAT for deduction” is provided in “VAT Operations”. The location of this option is shown in Figure 1.

Display indicating the billing document

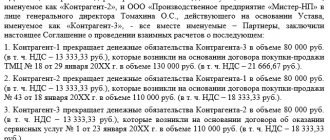

Let's say we need to enter a tax adjustment. Let's create a new document and fill in its details, indicating the document of settlements with the supplier presented earlier.

Fig.2 Creating a new document

Fig.3 Creating a document

- If the first checkbox is not checked, then the tax will be reflected for deduction as in the receipt documents and to display the entry in the purchase book, you will need to additionally enter a generation document.

- Checking the second box means that tax credit transactions will be generated.

- Checking the third box indicates that when posting a document, its entry will be reflected in the additional list for the period specified by the user.

- If you check the fourth box, the settlement document will be reflected in accounting. It is installed when adjustments to the movement of a settlement document are needed.

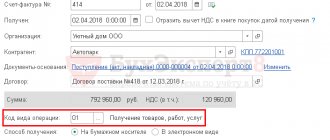

You should carefully look at the “Operation code” field, since its value is selected manually from the proposed list.

Fig.4 Operation code

Let's go to the "Products and Services" tab. By clicking the “Fill” button, select the command we need.

Fig.5 Products and services

In this case, the list of valuables is filled out automatically from the specified primary document, where in the “Type of value” field, simply the type of material assets is indicated, without details. This is enough to display in the purchase book.

Fig.6 Type of value

Having filled out the tabular part, we enter the adjustment amount with a plus or minus. To change the tax rate, two lines are entered - the first reversing entry, the second - indicating the new rate and amount. When updating a document, you do not need to enter an invoice based on it.

Fig.7 Data entry

1C settings

Accounting policy

Basic settings for VAT accounting are set in the Main section – Settings – Taxes and reports – VAT tab.

Study in more detail Accounting policies for tax accounting: VAT tab

Separate VAT accounting

In 1C there are 2 options for separate VAT accounting:

- using the VAT register for indirect costs ;

- using subconto Methods of accounting for VAT on incoming VAT accounts.

Study in more detail separate VAT accounting from 2021 with examples in 1C 8.3 Accounting

VAT account

VAT account for sales in 1C 8.3 - what to set? Both upon receipt and upon sale, the account is set automatically according to the settings in the information register of the Item Accounting Account or depending on the documents used. But if necessary, it can always be adjusted.

If goods and materials are sold, i.e. sales are carried out according to the main type of activity, then account 90.03 “Value added tax” is established. If fixed assets or materials are sold, the income from which is reflected in account 91.01 “Other income”, then the VAT account is set as 91.02 “Other expenses”.

See also an excerpt from the recording of the broadcast on December 24, 2021 “VAT”

What transactions does 1C generate for VAT when registering a bank commission? What document should be used to reflect bank services if they are subject to VAT?

Documents for accounting for bank services in 1C may be different. The following criteria influence the choice of a specific document:

- is the service subject to VAT;

- Is there a need for a client’s order to write off the commission amount or does the agreement with the bank provide for automatic write-off;

- what expenses in NU include bank services.

Let's present options for registering bank services in 1C depending on the criteria considered:

Therefore, if bank services are subject to VAT, then they are formalized in the same way as the receipt of ordinary third-party services with the document Receipt (act, invoice) transaction type Services (act). In this case, the postings in 1C for VAT from the bank commission will be as follows: Dt 19.04 Kt 76.09.

If you are a subscriber to the BukhExpert8 system, then read additional material on the topic:

- Bank commission charged for settlement and cash services

- Bank services, VAT-free

- Setting up item accounting accounts

Display if there is no settlement document

When there are no settlement documents, you can omit them and leave the fourth checkbox unchecked. Then the field “Calculation document” is not required to be filled out. If necessary, the invoice can be registered separately.

Fig.8 Calculation document

An invoice is entered on the basis of reflecting VAT for deduction, for example, in situations where there is no primary receipt. At the same time, in “Goods and Services” the user independently fills in the data, similar to as shown above. If the fourth checkbox is still checked, then instead of the nomenclature, simply indicate the type of value, otherwise it is necessary to detail them, indicating for each item the price, VAT rate and its accounting account. To display payments in the purchase book, they can be specified on the “Payment Documents” tab.

Fig.9 Payment documents

Free transfer

Reflect the accrual of VAT upon gratuitous transfer by posting:

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT is charged on the free transfer of goods (work, services).

When transferring goods (work, services) for your own needs, the costs of which are not taken into account when calculating income tax, reflect the accrual of VAT by posting:

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT is charged on the transfer of goods (work, services) for one’s own needs.

The accrual of VAT when performing construction and installation work for your own consumption is reflected by posting:

Debit 19 Credit 68 subaccount “VAT calculations”

– VAT is charged when performing construction and installation work for one’s own consumption.

This procedure follows from the Instructions for the chart of accounts (accounts 19, 68, 91-2).

Document movement report

Let's carry out the adjustment document and check what postings we have as a result.

Fig. 10 Document movements

We see that, having reflected the adjustment in the document, the program generated the necessary transactions. The document also made entries in the “Purchase VAT” accumulation register.

Fig. 11 VAT purchases

If the “Generate transactions” checkbox is not checked by the user, then when posting, entries will be made only in the “Purchase VAT” accumulation register.

Fig. 12 Generate transactions

Fig. 13 Changing VAT amounts manually

Thus, the program allows the user to make changes to VAT amounts manually. In this case, all changes are reflected in the reporting.

Unconfirmed export

Reflect the accrual of VAT on unconfirmed export supplies by posting:

Debit 19 subaccount “VAT on unconfirmed export supplies” Credit 68 subaccount “VAT calculations”

– VAT is charged on unconfirmed exports.

If the export is subsequently confirmed, then the previously accrued tax is subject to refund (paragraph 2, paragraph 9, article 165 of the Tax Code of the Russian Federation). Reflect this with wiring:

Debit 68 subaccount “Calculations for VAT” Credit 19 subaccount “VAT on unconfirmed export supplies”

– VAT is accepted for deduction, accrued at a rate of 10 or 18 percent on unconfirmed export supplies.

If export is not confirmed within three years after the sale of goods, then previously accrued VAT is written off as expenses and reduces taxable profit (letter of the Ministry of Finance of Russia dated July 27, 2015 No. 03-03-06/1/42961, resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 9, 2013 No. 15047/12):

Debit 91-2 Credit 19 subaccount “VAT on unconfirmed export supplies”

– VAT paid to the budget on an unconfirmed export supply is written off.

For more information on the calculation and refund of VAT on unconfirmed export supplies, see What to do if export VAT has not been confirmed.

Tax agents

If an organization performs the duties of a tax agent for VAT, document the tax withholding from amounts due to the seller (lessor) using the following entries:

Debit 19 Credit 60

– VAT presented by the seller (lessor) is taken into account;

Debit 60 Credit 68 subaccount “VAT calculations”

– VAT is withheld by the tax agent.

If VAT is transferred to the budget at your own expense, make the following entries:

Debit 19 Credit 68 subaccount “VAT calculations”

– reflects the amount of VAT payable by the tax agent at his own expense;

Debit 68 subaccount “VAT calculations” Credit 51

– VAT is transferred at the expense of own funds.

If an organization performs the duties of a tax agent when selling goods (work, services, property rights) to foreign organizations (not registered for tax purposes in Russia) under contracts of agency, commission or agency agreements, make the following entries in accounting:

Debit 62 Credit 76

– goods (work, services, property rights) belonging to a foreign organization are sold;

Debit 51 Credit 62

– payment has been received for goods (work, services, property rights);

Debit 76 Credit 68 subaccount “VAT calculations”

– VAT is withheld from the income of a foreign organization.

This order follows from the Instructions for the chart of accounts (accounts 19, 62, 68, 76).

Tax deductions for VAT

Kinds

Article 171 of the Tax Code contains a detailed list of tax deductions, among which are:

- deductions for purchased goods, services and property rights;

- to return products and terminated contracts;

- for capital construction;

- for construction work;

- for travel/entertainment expenses;

- for advances for upcoming deliveries of products/provision of services or performance of work;

- the VAT rate is 0%;

- on changes in prices for goods shipped and services provided;

- for contribution to the authorized capital;

- for foreign citizens;

- for tax agents.

Documentation

As already noted, deductions are not provided in the absence of documentary evidence of expenses . In order to obtain the right to a tax deduction, the taxpayer must have:

- Invoice received from the counterparty. It has a strictly approved form and must contain a mandatory list of details: the number and date of its issue, details of the counterparty (TIN/KPP), price of goods per unit and cost, etc. The invoice itself does not indicate any business transaction and does not confirms its completion, but serves only as an appendix to the primary documents (thus, no one guarantees that the issued invoice was paid).

- Primary documents that document all business transactions. These include agreements/contracts, certificates of completion of work, advance reports, specifications, payment documents, etc. Primary documentation must be drawn up in the prescribed form (for example, a consignment note has the approved TORG-12 format) or contain the name of the document and organization, date of compilation, content and measures of the operation, list of responsible persons and their signatures.

Drawing up a boundary plan for a land plot has certain requirements, so it is necessary to invite a cadastral engineer. How to correctly pay land tax to an individual? All details are described in our article. You need to start privatizing a plot by collecting documents. Read more about this here.

Self-test

You can check the data and analyze the necessary accounting options using the “Analysis of the state of tax accounting for VAT” (in the “Reports” menu).

Select a quarter and organization. Click “generate” and see how VAT is displayed (for payment or refund). This report directly reflects the amounts from which the VAT amount for + and for - is formed. Grayish-blue fields express the amount of uncalculated VAT, yellow fields reflect calculated VAT. By double-clicking on the field of interest, a transcript of the report will be displayed in the context of each document.

https://olenant.ru

Purchase ledger, sales ledger, invoice ledger

The purchase book, sales book, and invoice journal are implemented in the program in the form of reports.

We will create a purchase book according to Resolution No. 1137, for the 3rd quarter of 2012 (the “Purchase” tab or the menu: “Purchase - Maintaining a purchase book”). It contains 4 entries, 2 of which are for advance payment.

Now let’s create a sales book according to Resolution No. 1137, for the 3rd quarter of 2012 (the “Sales” tab or menu: “Sale – Maintaining a sales book”). It contains 3 entries, 2 of which are for advance payment.

We will create a log of received and issued invoices in accordance with Resolution No. 1137 (it is available both through the “Purchase” and “Sale” tabs, and through the menu: “Purchase – Maintaining a purchase book” and “Sale – Maintaining a sales book”). All invoices are reflected, including advance payments.

VAT and the use of special regimes

As a general rule, taxpayers who have switched to special regimes are not recognized as VAT payers. However, there are exceptions to this rule:

- Issuance of shipping documents with VAT at the request of the counterparty.

- Import of goods into the territory of Russia and other territories located in its jurisdiction.

- Performing the duties of a tax agent.

- Activities within a simple partnership.

When issuing an invoice with an allocated tax, the seller using the special regime must report VAT and pay the invoiced tax to the budget.

A special treatment seller will not be able to accept input VAT on sold goods and services as a deduction.

The procedure for paying tax on goods imported into the territory of the Russian Federation is regulated by the customs legislation of the Russian Federation. It depends on what customs regime the imported goods are placed under.

When selling goods and services within a simple partnership, VAT is recognized by the managing partner.

Read more about VAT exemption.