A tax period is a code that allows you to quickly and accurately determine the time for which reporting information was submitted. Officials have provided individual designations - a special codification or encoding. We'll tell you how to correctly identify codes when preparing fiscal statements.

For each type of fiscal report, officials have provided individual codification. It is difficult to remember all the values. Therefore, accountants are often confused: what quarter or month is tax period 21? Depending on the type of fiscal declaration, one code has several meanings. But there are ciphers that are identical for several types of declarations.

Main purpose

To indicate the specific period of time for which the fiscal reporting form was compiled, a special codification is provided. The code is a two-digit number, for example, tax period: 22, 34, 50.

This codification is a very convenient grouping of reporting according to the time of its formation. For example, this code allows you to quickly determine for what period of time the taxpayer made the calculation and calculated the tax to the budget.

For each type or tax reporting code (TRR), an individual codification procedure is provided. Let's look at how codes are determined for the main types of reports to the Federal Tax Service.

The category and status of the taxpayer does not matter to determine the coding. That is, the Federal Tax Service approves codes individually for each form or report form, regardless of the type of payer of fees, contributions and taxes. That is, this coding is used by legal entities, individual entrepreneurs, private practices, and ordinary citizens.

VAT declaration

The current VAT reporting form, as well as the procedure for filling it out, was approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] For codification, two-digit numbers are used, in which the first digit is 2, and the second determines the quarter number in chronological order. For example, the tax period code for the 2nd quarter of 2020 for the value added tax return is 22.

And what quarter is tax period 24? For value added tax reporting, this code indicates the 4th quarter. Accordingly, tax period 23 is which quarter? This is the third quarter of the reporting year.

Similar rules are established for fiscal reporting, which must be submitted quarterly. When filling out reporting forms for water tax or UTII, indicate similar codes. For example, use tax period code 24 for the 4th quarter.

Tax period code 21 - what is this in the UTII declaration? This is a report for the first three months of the year (Q1).

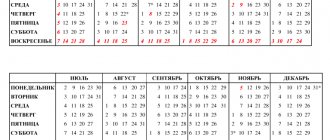

Production calendar for the 4th quarter of 2021 (6-day work week)

The following non-working holidays are established in Russia (Article 112 of the Labor Code of the Russian Federation):

- January 1, 2, 3, 4, 5, 6 and 8 — New Year holidays;

- January 7—Christmas Day;

- February 23 - Defender of the Fatherland Day;

- March 8—International Women's Day;

- May 1 - Spring and Labor Day;

- May 9 - Victory Day;

- June 12—Russia Day;

- November 4 is National Unity Day.

- Weekends may be transferred to other days by federal law or a regulatory legal act of the Government of the Russian Federation (Part 5 of Article 112 of the Labor Code of the Russian Federation).

In 2021, we expect the following postponements of weekends (Government Decree No. 1163 dated October 1, 2018):

- from Saturday 5 January to Thursday 2 May;

- from Sunday 6 January to Friday 3 May;

- from Saturday 23 February to Friday 10 May.

At the same time, Friday February 22, Thursday March 7, Tuesday April 30, Wednesday May 8, Tuesday June 11, and Tuesday December 31 will be shortened by 1 hour according to the “pre-holiday” principle. If, in accordance with a government decision, a day off is transferred to a working day, the duration of work on this day must correspond to the duration of the working day to which the day off was transferred (clause 1 of the Procedure for calculating the norm of working time, approved by order of the Ministry of Health and Social Development of the Russian Federation dated August 13, 2009 No. 588n) .

Taking this into account, we will rest like this:

- The New Year holidays will last 10 days - from December 30, 2021 to January 8, 2019;

- On Defender of the Fatherland Day we will rest for 2 days - February 23 and 24;

- on International Women's Day 3 days - from March 8 to 10;

- in May, we will first rest for 5 days in honor of the Spring and Labor Festival - from May 1 to May 5;

- There will be 4 more days off for Victory Day - from May 9 to May 12;

- Russia Day, June 12 - Wednesday, so there will be one day off;

- On National Unity Day we will have a 3-day holiday - from November 2 to 4.

Calculation of standard working hours

The standard working time for certain periods (month, quarter, year) is calculated as required by Art. 91 of the Labor Code of the Russian Federation and in accordance with Order No. 588n.

So, the norm for a particular month is calculated as follows:

the length of the working week (40, 36, 24, other number of hours) is divided by 5, multiplied by the number of working days according to the calendar of the 5-day working week of this month and from the resulting number of hours the number of hours in this month for which work is carried out is subtracted reduction of working hours on the eve of non-working holidays.

Important! The standard working time calculated in this manner applies to a 6-day working week.

Thus, when drawing up a monthly schedule for a 6-day week, it is necessary to ensure that not only the weekly limit (40-, 36-, 24-hour) is observed, but also that the total number of working hours does not exceed the monthly norm calculated in the specified above order.

Profit reports

The codification of “profitable” reporting is somewhat different from the quarterly forms. Thus, the profit declaration is filled out with an accrual total from the beginning of the year.

Define ciphers as follows:

- for the first quarter, indicate 21;

- tax period code 31 is a report for the 1st half of the year;

- tax period 33 - which quarter is this? This is not a quarter in profit reporting, this is information for the first 9 months of the reporting year;

- tax period code 34 - annual information from January to December.

If a company submits profit reports monthly, then a completely different codification is applied. For example, 35 is the first month of the year, 36 is the second, 37 is the third, and so on.

The key rules for filling out income tax reporting are regulated in the order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected]

Tax period 50 is used in the report if the company was in the process of reorganization or liquidation. That is, use code 50 to reflect the last fiscal period during the reorganization (liquidation) of the organization.

4th quarter

| Object filter |

| |||||||||||||

| Village of Istra. Concept |

| Creating a complex architecture of a suburban residential complex in the Moscow region, the authors dilute the structural “lead environment” with the southern character of dynamic architecture with many terraces, pergolas and a water environment |

| more details |

| Lake Golf Club. Concept |

| Man, especially urban man, always seeks harmony with nature. He dreams of an ideal, hospitable home - and this house is certainly associated with a picturesque place on the shore... |

| more details |

| House in white |

| The artistic concept of the interior was based on the idea of playing different textures of white |

| more details |

| Apartment in Minsk |

| When entrusting the design project of his new home, the customer limited himself to only the most general wishes regarding the functional purpose of the premises... |

| more details |

obstanovka.by

Consolidated group information

Often, information on income tax is generated not for one individual entity, but for several companies or separate divisions at once. Such associations are called a consolidated group.

If a report to the Federal Tax Service is provided by such a consolidated group, then a specific coding is indicated in the income tax return:

- The value 13 is provided to indicate fiscal information generated for 1 quarter. of the year.

- Coding 14 - information provided by a consolidated group of taxpayers for the first half of the year.

- Designation 15 - the report was generated by a group of taxpayers for the first nine months (January-September).

- The numbers 16 indicate that the information in the declaration is provided for the full financial year from January to December for a consolidated group of taxpayers.

Salary reports

Reports on wages, insurance premiums and withholding taxes provide individual coding.

For the 6-NDFL report, a separate reporting period is provided - code 90, which indicates the year before the reorganization and (or) liquidation of the reporting company. Use a similar code to create a single calculation for insurance premiums.

General values for salary reports:

- tax period 21 - the first three months of the year: January, February, March;

- tax period 31 - 1st half of the year or the first 6 months on an accrual basis;

- code 33 - 9 months from the beginning of the year;

- tax period 34 (which quarter is this?) is a full calendar year, or 12 months from January to December.

It is worth noting that tax reporting period 34 in almost all types of reporting forms in the Federal Tax Service denotes a full calendar year (January-December). Moreover, the status and category of the taxpayer does not play any role. That is, organizations (legal entities), individual entrepreneurs, and ordinary citizens are required to use the code when drawing up the 3-NDFL declaration and other forms of fiscal reports and declarations. Please note that tax period 34 in the declaration for transport tax, according to the simplified tax system, unified calculation of insurance premiums, and so on is always a year.

Working time standards 2021

| Period | Amount of days | Working hours (per week) | ||||

| Total | workers | Non-working | 40 hours | 36 hours | 24 hours | |

| January | 31 | 17 | 14 | 136 | 122.4 | 81.6 |

| February | 28 | 19 | 9 | 152 | 136.8 | 91.2 |

| March | 31 | 20 | 11 | 160 | 144.0 | 96.0 |

| I quarter | 90 | 56 | 34 | 448 | 403.2 | 268.8 |

| April | 30 | 21 | 9 | 168 | 151.2 | 100.8 |

| May | 31 | 20 | 11 | 160 | 144.0 | 96.0 |

| June | 30 | 20 | 10 | 160 | 144.0 | 96.0 |

| II quarter | 91 | 61 | 30 | 488 | 439.2 | 292.8 |

| 1st half of the year | 181 | 117 | 64 | 936 | 842.4 | 561.6 |

| July | 31 | 22 | 9 | 176 | 158.4 | 105.6 |

| August | 31 | 23 | 8 | 184 | 165.6 | 110.4 |

| September | 30 | 20 | 10 | 160 | 144.0 | 96.0 |

| III quarter | 92 | 65 | 27 | 520 | 468.0 | 312.0 |

| October | 31 | 23 | 8 | 184 | 165.6 | 110.4 |

| November | 30 | 21 | 9 | 168 | 151.2 | 100.8 |

| December | 31 | 21 | 10 | 168 | 151.2 | 100.8 |

| IV Quarter | 92 | 65 | 27 | 520 | 468.0 | 312.0 |

| 2nd half of the year | 184 | 130 | 54 | 1040 | 936.0 | 624.0 |

| Year | 365 | 247 | 118 | 1976 | 1778.4 | 1185.6 |

According to working hours, it is most profitable to take vacation in August, October and July. It is least profitable to go on vacation in January and February.

Production calendar. Especially for Android. The application is free

Ciphers and codes in payment orders

When preparing payment orders to pay fiscal obligations in favor of the Federal Tax Service, a completely different encoding is used. The payment slip indicates a ten-digit format code: “XX.XX.YYYY”, where XX is the letter and numeric designation of the time period for which the taxpayer transfers the tranche to the state budget, YYYY is the calendar year for which budget payments are calculated.

For example:

- quarterly calculations - “Q.0X.2020”. Payment of VAT for the 3rd quarter - “KV.03.2020”;

- the monthly payment, for example, for September, is designated “MS.09.2020”;

- semi-annual payment: “PL.01.2020” - for the first half of the year and “PL.02.2020” - for the second;

- payment based on the results of the calendar year is designated “GD.00.2020”.

Encoding table

As we noted above, remembering the encodings for each form and type of fiscal declarations and other reporting is quite difficult. An error when filling out a form can be costly for a company. For example, an accountant will indicate an incorrect code in the report, therefore, tax authorities will not take into account the submitted information and will impose a fine for late provision of information.

To eliminate errors when filling out forms and forms in the Federal Tax Service, use a professional guide, which presents all the current encodings for the types of fiscal forms.

Features of submitting reports for the fourth quarter of 2021

Features of reporting for the fourth quarter of 2021 include the following points:

- Starting from 2021, employers do not submit reports on the average number of employees, because... this information is included in the DAM;

- simultaneously with the SZV-STAZH report, you must submit the EDV-1 report to the Pension Fund;

- When hiring or dismissing an employee, the SZV-TD report from 2021 must be submitted no later than the next working day after the personnel event. For other personnel movements, the SZV-TD is submitted before the 15th day of the month following the month of the personnel event.

We will help you set up filling out SZV forms in 1C:ZUP. Call!