An application for reimbursement of labor safety costs to the insurer in 2021 is the main document for receiving money from the Social Insurance Fund (SIF) spent on measures to reduce injuries. It must be submitted before 08/01/2020 on an approved form with a package of supporting papers.

All employers have the right to credit money spent during the year on preventive measures to reduce injuries in the organization. Financing is provided by the Federal Social Insurance Fund of Russia on the basis of Order No. 764n of the Ministry of Labor of Russia dated December 3, 2018. Among the activities financed by the fund:

- special assessment of jobs;

- purchase of workwear and personal protective equipment (PPE);

- organizing a medical post and conducting medical examinations;

- occupational safety training;

- sanatorium-resort treatment of pre-retirement people and workers with harmful and dangerous working conditions.

Initially, the organization spends its own funds for these purposes, but once a year the Social Insurance Fund is allowed to submit an application for a refund from the Social Insurance Fund in order to receive the money spent back.

Application for reimbursement of FSS expenses

Employers are responsible for transferring insurance contributions to the Social Insurance Fund. If the amount of expenses exceeds the contribution amount, the organization can apply for reimbursement. This right does not depend on the taxation system, and is also available in any billing period.

In order to apply for reimbursement of funds from the Social Insurance Fund, you must fill out a special form. There is a strict template, which is indicated in the letter of the Social Insurance Fund dated December 7, 2016. You can fill out applications either manually or on a computer.

Remember! The document must contain the following information:

- the head of the territorial body of the Social Insurance Fund to which the request is sent;

- title of the application;

- all information about the employer. The application must indicate registration numbers, address, and name of the organization;

- amount of reimbursed expenses. It is important to indicate the exact amount including kopecks;

- details of the bank account to which the transferred funds must be received;

- name and details of the financial institution where the applicant’s account is maintained.

The application form is signed by the head of the organization, enterprise and the chief accountant, and then stamped.

ATTENTION! Look at the completed sample application for reimbursement of FSS expenses:

Features of filling out an application

To return overpaid funds, fill out an application in Form 23-FSS. It is important not to miss important points:

- close attention should be paid to correctly filling out the organization’s details, since errors in them can lead to unpleasant consequences;

- in the line “OKTMO code” you need to enter the OKTMO code, information on which is available on the tax service website;

- When returning funds, you must indicate their purpose. The amount is entered in the cell to which it relates;

- if the application is submitted by a representative of the applicant, then in a special section you need to fill out information about him.

Form 23-FSS of the Russian Federation can be downloaded from the link.

How to fill out a calculation certificate

When applying for the allocation of money to pay insurance coverage, you must provide a certificate of calculation.

It should contain the following information taken for the reporting period:

- the amount that the FSS policyholder owes for the entire reporting period. Here both the beginning and the end of the period are considered;

- the amount of accrued insurance premiums, the amount must be indicated for the last three months;

- insurance premiums listed additionally;

- funds that were spent but not accepted for offset;

- the amount of financial resources that were accrued by the territorial bodies of the Social Insurance Fund as reimbursement of expenses;

- contributions that were overpaid by the organization and returned in the future;

- the amount of funds that were allocated for compulsory insurance over the past three months;

- all insurance premiums that were transferred by the organization over the past three months;

- the amount of the policyholder's debt that has been written off.

online lawyer for free and around the clock.

How to get financial assistance for the birth of a child, read here.

How incentive payments are assigned, read the link:

For the policyholder, there is nothing new in the procedure for filling out the calculation certificate compared to previous forms.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Temporary disability benefit

To be reimbursed for sick leave expenses, you must provide:

- a certificate of incapacity for work, filled out in the prescribed manner with the benefit calculated;

- certificate(s) about the amount of earnings from another policyholder(s) 182n;

- documents confirming insurance experience;

- cards for individual accounting of the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums to verify the correctness of determining the taxable base and the calculation of insurance premiums;

- a certificate (certificates) from the place of work (service, other activity) with another policyholder (other policyholders) stating that the appointment and payment of benefits by this policyholder are not carried out if the insured person at the time of the insured event is employed by several policyholders, and in two in previous calendar years was occupied by other policyholders, or by both these and other policyholders (another policyholder).

What expenses will the FSS of the Russian Federation reimburse in 2021 according to a certificate?

Attention! The organization has the right to apply to the Social Insurance Fund for reimbursement of expenses incurred if they were higher than the contributions.

In 2021, the Social Insurance Fund will reimburse companies for the following payments:

- payments for employee disability that occurred temporarily due to illness;

- benefits for pregnancy and childbirth, as well as for child care up to 1.5 years;

- funeral benefit.

It is important to remember that not all benefits are fully compensated by the Social Insurance Fund. For example, maternity benefits are returned to the employer in full, but when calculating sickness benefits, the first three days are paid by the employer.

What documents will be required?

When applying to the FSS, you must present a completed application in accordance with the requirements and some documents listed below:

- the applicant's identity card;

- calculation of paid contributions (form 4-FSS);

- power of attorney (if the applicant acts through a representative);

- documentary evidence of the correctness of calculations and payments (for example, a photocopy of a child’s birth certificate, sick leave, death certificate of an employee from the registry office).

The exact list of papers depends on the specific situation (type of benefit, payment deadline, etc.). It is recommended to check the list with a fund employee. In some cases, an application is also submitted with a request for the assignment of benefits (for example, in relation to a monthly child care allowance).

The completed application and prepared documents are submitted by the interested party to the FSS branch at the place of registration of the individual entrepreneur or enterprise.

In some cases, fund employees may request additional papers to confirm the legality of the applicant’s claim or carry out a more thorough check by visiting the company or office of the individual entrepreneur.

Filling out the simplified taxation system declaration when closing an individual entrepreneur. You can find out how to close an individual entrepreneur with debts to the Pension Fund and the tax office here.

If you want to find out how to register an individual entrepreneur, read here.

Reduction of insurance premiums for benefits

The organization may reduce the amount of monthly contributions. This is provided for in Article 431 of the Tax Code. When making a payment to the Social Insurance Fund, the employer can independently deduct from the amount the costs incurred to pay benefits to its employees.

Please note! Such benefits will include:

- for pregnancy and childbirth;

- with early registration for pregnancy (up to 12 weeks);

- at the birth of children;

- maternity benefits for women with children under 1.5 years of age;

- in case of temporary disability due to illness;

- for burial.

This simplifies the process of an organization receiving compensation from the Social Insurance Fund by deducting this amount from the next insurance premium. But, if the amount of payments exceeds the amount of the required contribution, then the manager must contact the Social Insurance Fund.

Refunds after January 1, 2021

If the policyholder's application to the Social Insurance Fund is related to expenses incurred for periods starting from 01/01/2017, then the list of documents to be submitted changes. The package includes:

Upon receipt of the application, the Social Insurance Fund department carries out a desk check of the submitted information about expenses. Can carry out on-site unscheduled inspections. During the consideration of the application, the fund requests from the Federal Tax Service the information from the unified reporting form provided by the policyholder. This is how a counter-check of data on social security expenditures takes place.

Based on the results of the audit, the fund department sends the result of the decision to the tax office in the form of:

After this, the Federal Tax Service fills out an application for a refund and submits it to the appropriate territorial body of the Federal Treasury. After processing the documents, funds are transferred to the policyholder's account (within three working days).

In the case of crediting funds against future periods, the tax officer uses an internal document to reflect the resulting overpayment in the client’s card. When subsequent contributions are calculated, the amounts will be offset automatically (if necessary, with the possible formation of an underpayment of the current contribution).

It is important for the policyholder to remember that if the amount accepted for offset does not coincide with the amount of the contribution, it will be necessary to pay the difference within the period established by law.

It is worth noting that within the framework of the new procedure for interaction between the taxpayer, the FSS department and the tax policyholder, the insurer can apply for compensation to the relevant Federal Tax Service inspectorate. In this case, the Federal Tax Service Inspectorate transfers information about the received application to the Social Insurance Fund department. On this basis, the fund carries out the same control actions as in the case of personal receipt of a package of documents. In this case, the on-site inspection may be joint with representatives of the tax authorities.

Along with information about the policyholder’s need to return the funds, the Federal Tax Service Inspectorate transfers the relevant data from the unified reporting form to the Social Insurance Fund department for making a decision. The subsequent stages of action coincide with the case when the policyholder applies to the Social Insurance Fund.

The Federal Tax Service has the right to make decisions on holding the taxpayer accountable for the offense committed. This information is also brought to the attention of the FSS.

In fact, it now does not matter to the policyholder which body to submit an application for reimbursement of social security expenses incurred. The developed procedure for interaction between the two structures established a clear flow of documents and exchange of information between them.

In the era of electronic interaction, one must assume that such data exchange can occur almost instantly. But the future will tell.

If the amount of benefits exceeds accrued contributions

The situation when the amounts paid for employee benefits exceed the contribution amount can be resolved in two ways:

- if the billing period allows, the amount of the overpayment can be taken into account against the future contribution;

- The head of the organization can contact the territorial department of the Social Insurance Fund with an application for a refund.

Note! The new legislation determined that the tax authority is responsible for insurance premiums. But despite this, managers must apply for a refund to the Social Security Fund.

Deadlines for refunding overpayments

It is established by law that it is possible to return overpaid funds only for a period of up to 3 years. If the application is submitted on time and all data is checked for reality, then the return of overpaid amounts occurs within a month from the date the fund receives the application.

In case of violation of the terms for the return of the overpayment, a statement is written demanding payment for each day of delay in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation. If the issue is not resolved peacefully, you can file a claim in court.

It is worth noting that the period for returning the overpayment is considered from the date of signing the reconciliation report, if the fact of overpaid amounts was revealed during the reconciliation.

Reimbursement of sick leave from the Social Insurance Fund in 2021: documents

The procedure for receiving compensation can be initiated by employers in regions where a pilot project to pay temporary disability benefits directly to insured persons has not been introduced.

After calculating the funds required to pay benefits, their amount is compared with the contributions accrued for the reporting period. Next, the policyholder has two options for reimbursement of spent funds (clause 9 of Article 431 of the Tax Code of the Russian Federation):

The amount of excess of accrued benefits over the amount of insurance premiums is reflected in line 120 “Calculations for insurance premiums” for the corresponding reporting period, and expenses in Appendix 3 to Section 1 of the Calculation, which is submitted to the Federal Tax Service by the due date. The tax authority transfers the received information to the Social Insurance Fund. Based on the written request and data from the Federal Tax Service, the Fund’s specialists begin a desk audit, and the results of the verification activities are sent to the Federal Tax Service.

Although the movement of insurance premiums paid by employers is controlled by the Federal Tax Service, the amounts of compensation to policyholders are transferred by the FSS, therefore documents for reimbursement of expenses should be submitted to the Fund.

The Social Insurance Fund will reimburse expenses in 2021 subject to the provision of the following set of documentation:

The list was approved by order of the Ministry of Health and Social Development dated December 4, 2009 No. 951n. If a set of documentation is submitted through a representative, then this person must have the original power of attorney with him.

Set of documents 2021

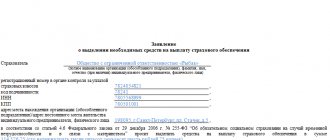

In order for the FSS to allocate funds for the payment of insurance coverage (benefits), it is necessary to submit the required documents to the territorial body of the FSS at the end of the quarter or any month of 2021 (Order of the Ministry of Health and Social Development dated December 4, 2009 No. 951n):

You can reference the calculations in Excel format.