Documentation

Who are the TC payers? Since the TC-1 form is submitted by trade tax payers, it is necessary

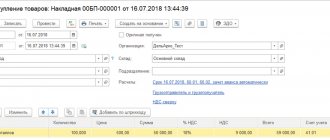

Home — Articles Sales of goods for export are subject to VAT at a rate of 0%. But right

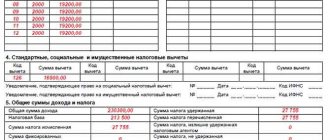

Business lawyer > Accounting > What is deduction code 501: features of reflection in

Many Russian firms prefer to enter into commercial contracts with domestic partners in foreign currency. Legislatively

An employee’s personal file is all his documents collected in one place, and which

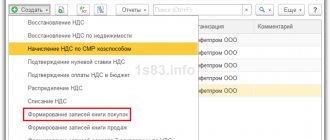

Procedure for submitting a VAT return You must submit a VAT return to the Federal Tax Service at your location

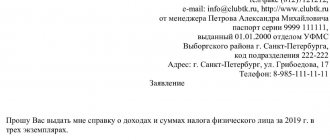

In the taxpayer’s personal account, a citizen can order not only 3- and 4-NDFL certificates, but also

Home / Taxes / What is VAT and when does it increase to 20 percent?

All employers, being tax agents, report annually by April 30 on the income of individuals, which

Home / News and changes Back Published: 07/10/2019 Reading time: 3 min 2