All employers, being tax agents, report annually by April 30 on the income of individuals that they received from them over the past calendar year. For each employee, a certificate of income is provided to the tax office in form 2-NDFL.

An individual has the right to apply to the employer’s accounting department and receive his 2-NDFL certificate at any time and for any period not exceeding the storage period for tax documents (according to paragraph 8 of paragraph 1 of Article 23 of the Tax Code of the Russian Federation - no more than four years). How to write an application to an employer requesting the issuance of such a certificate will be discussed in this article.

Can an enterprise refuse to issue a document?

By law, an employer (even a former one) is obliged to provide a certificate to his employee upon his first request. Moreover, he must do this even if the employee asks for it orally (a written statement is needed in order to avoid all sorts of problems, delays in time, and other unpleasant phenomena).

Refusal to issue a certificate may serve as a reason to contact the labor inspectorate or even the court, as a result of which an administrative penalty in the form of a fairly large fine (for violating the legitimate interests and rights of the employee) may be imposed on the enterprise and senior officials.

The exception is those situations when an employee of an enterprise asks to issue him a certificate for the period for which the storage period for tax documents has expired (i.e. after four years).

Where to go if your employer has ceased operations

If the organization has already ceased its activities at the time of the need to send a request for a certificate, you should contact the territorial tax office directly. If for some reason it is impossible to contact the tax office, then the employee has the right to submit an application at a new place of work, justifying why obtaining the document is impossible in another way. The organization will send a request to the Pension Fund and provide a certificate based on the information received.

How to make an application

The fact that you are on this page means that you needed to fill out an application for a 2-NDFL certificate, which you have not encountered before. Before giving you detailed information about this particular document, we will provide general information that applies to all such papers.

- Firstly, keep in mind that the law does not provide for any unified form for this application (those for commercial organizations were abolished back in 2013), so you can do it freely. But, if your company has a standard document template developed and approved in the accounting policy, draw up an act according to its type, this will save you from claims from accounting or management.

- Secondly, know that the application can be created on a regular sheet of any format convenient for you (A4 or A5 are most often used) or on company letterhead - again, when such a condition is put forward by the employer.

- The text can be written by hand (but without blots, errors, inaccuracies or edits) or typed on a computer. If you took the electronic registration route, then after you write the application, be sure to print it out - this is necessary so that you can put your signature on it. We recommend that you first check with your employer's representative whether your company accepts printed applications - sometimes organizations only consider handwritten documents.

- Make an application in two identical copies - give one of them to the employer, the second, having previously endorsed the transfer of a copy, keep it for yourself - it will come in handy in case the certificate is not issued to you at the appointed time.

Form and rules for writing an application

An application for the issuance of an income document is submitted at the place of work in writing in any form. It indicates information about the applicant (full name, passport details, registration address), the period for which the document must be produced, and the number of copies. Then the application is certified by the applicant’s personal signature and the date of its preparation is indicated.

IMPORTANT!

The document for 2021 and subsequent years is issued by the employer not in the form of 2-NDFL, but in the form approved by Order of the Federal Tax Service of Russia No. ММВ-7-11/ dated 10/02/2018; It is incorrect to write “2-NDFL” in an application to the accounting department.

The instructions on how to write an application for 2-NDFL are simple:

- indicate the details of the employer;

- enter your own data;

- do not forget to indicate the calendar period for which the document is required and the number of copies.

How to submit to an employer

To submit your completed application, use one of the following methods:

- hand over the paper personally to an authorized employee of the organization;

- send a registered letter with return receipt requested (if there is reason to believe that the employer will refuse to issue or ignore the request, then with a description of the attachment);

- transfer the document through the principal, but for this you must first issue a notarized power of attorney for submitting/receiving the document.

IMPORTANT!

In accordance with Art. 62 of the Labor Code of the Russian Federation, the employer is obliged to provide the employee with copies of the requested documents related to the implementation of activities no later than three working days from the date of receipt of the written request.

Thus, an income certificate is issued to an employee based on a written request within three working days from the date of the request. If an employee is dismissed, the employer will issue a certificate of income directly on the day of dismissal along with the work book.

Sample

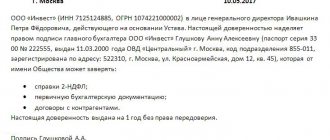

This is what a sample request for a 2-NDFL certificate from an employer looks like in 2020:

Sample application for provision of certificate 2-NDFL

Here we come to the most important part of our article - an example. It must be said that this document, although quite simple, has some nuances that are worth emphasizing. Using our recommendations and based on the sample presented below, you can easily create the application you need.

First, a “header” is drawn up in the document:

- full name of the organization you work for;

- position and full name of the director (or other employee in whose name you are supposed to write such statements);

- your position, the name of the department to which you are assigned and your full name;

- detailed passport data (as necessary);

- your phone number (for communication).

Then, below, in the middle of the line, write the word “Statement.” After this, you can proceed to the actual request for a certificate. Here you need to indicate:

- for what period do you need the document and how many copies are needed;

- it is advisable to refer to the legal norm that states the employer’s obligation to provide such certificates - in this case, this is Article 62 of the Labor Code of the Russian Federation;

- It is not necessary to enter the destination of the certificate - the absence of such information is not a reason for the employer to refuse to issue the document.

If you have any additional papers that you want to add to your application, please indicate their details in the form as a separate item.

Finally, sign and date the application.

Can they refuse and not issue

An employer does not have the right to refuse to provide a subordinate with information about income. Even if the request is submitted by a dismissed or retired employee. The reason for termination of the employment contract does not affect the obligation to submit 2-NDFL to the individual within the prescribed period.

If the employer does not provide information about wages on the established dates, then he may be brought to administrative responsibility for violating the norms of the Labor Code of the Russian Federation (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). For example, if an employee does not receive documents on time, contact the State Labor Inspectorate or the court.

Where can an unemployed person or a pensioner get a certificate?

An unemployed person can receive a certificate of income received in the form of unemployment benefits at the employment center. All you have to do is submit an application and then pick up the completed certificate. But this will not be Form 2-NDFL. If an individual has not worked for more than three years and is not registered with the employment center, then there is simply nowhere for him to get a certificate of income, because officially there was none.

If a non-working person had income from other sources, it is necessary to report them by indicating in the 3-NDFL declaration. In addition, you will need to calculate the tax yourself and transfer it to the budget. In this case, evidence of income received and taxes paid on it will be a copy of the tax return.

Pensioners receiving payments from non-state pension funds can request 2-NDFL from the local branch of their fund. But disabled citizens who receive state pensions will not be able to obtain such a certificate from the Pension Fund of the Russian Federation, since such pensions are not subject to personal income tax.

Is a written request for a document always necessary?

Every working Russian can request and receive a document under the code 2-NDFL, without indicating the reasons why it is needed.

The rules for issuing it are set out in Article 62 of the Labor Code of the Russian Federation and Ch. 23 Tax Code of the Russian Federation.

It is provided upon the first request of the taxpayer, regardless of whether he contacted the employer orally or in writing.

However, the applicant must note that the advantages of a written application are as follows:

- the date of filing the application is indicated, which is the starting point for the three-day period for issuing the certificate;

- allows you to avoid many unpleasant moments, because the employer may deny that the employee contacted him;

- simplifies the employee’s actions when appealing a refusal to issue a certificate through other authorities.

You should always protect yourself with a written request. Although most employers issue a certificate without creating problems for employees at their first request.

And in the event of dismissal of an employee, the management administration is obliged to issue such a document on the day the employee is paid, even without his personal application.

Find out how financial assistance is reflected in the 2-NDFL certificate from our article. What to do if a new job requires a 2-NDFL certificate? Is this legal? Find out here.

Application deadlines

The response time to a received request for work experience should not exceed 30 calendar days.

Of course, sometimes searching for documents can take a long time. After all, the archivist needs to turn over a lot of personal files in order to find the necessary materials certifying the applicant’s work experience. If, after sending a request to the archive, in due time, the archive does not have time to find the required materials, then the archive workers must still send an intermediate response, displaying:

- On the current state of affairs in the search for materials.

- About the reasons that led to the delay.

With regard to the provision of local (state) services, the response time has been reduced to 15 days, with control over the quality of responses at the level of the President of the Russian Federation.

and a sample request to the archive

What to do if the archive does not have the necessary documents?

If the archive does not contain the necessary documents, then the applicant has the right to invite witnesses who are able to provide evidence of work experience. The period of work experience in the Russian Federation before registration by an insured person can be taken on the basis of the testimony of 2 or more witnesses who know the applicant for a pension due to joint work at the same enterprise. This situation may arise if documents disappeared during a natural disaster (earthquake, flood, storm, fire and other similar circumstances) and cannot be restored.

The following materials must be attached to a request for evidence of the gap in work on presenting witnesses:

- A certificate from the state (local) structure in whose territory the disaster occurred, indicating the date of the disaster, location and nature.

- A certificate from an enterprise or state (local) structure certifying the fact of loss of papers on labor functioning and the impossibility of their restoration.

- A certificate from the archive or state (local) structure certifying the absence of archival information about the working hours, according to witness information.

Methods and order

The procedure for certifying the achieved experience is regulated in Art. 14 Federal Law No. 400-FZ dated December 28, 2013 “On insurance pensions.”

As in the previous pension law until 2014, the standards for certification of length of service are directly dependent on the time of working activity:

- Before registration - as an insured employee in pension insurance offices.

- After registering with the same authorities as an insured employee according to the adopted Federal Law No. 27-FZ1 of April 1, 1996.

The time of such registration for the insured person is displayed in the insurance certificate, according to the assigned personal personal account number (SNILS) in the offices of compulsory pension insurance.

In what cases is a certificate needed?

The demand for the document under code 2-NDFL is quite high, because it confirms the receipt of official income by an individual.

Most often, a certificate is asked to provide in the following cases:

- when receiving credit finance from banking institutions;

- for a mortgage (when drawing up an agreement to borrow funds for the purchase of residential premises);

- during employment at a new enterprise;

- when applying for a tax deduction in the following circumstances: payment for studies; acquisition of living space; receiving paid treatment; other expenses.

For all organizations, there are the following grounds for issuing such a certificate for a taxpayer:

| Where is it served? | Legal basis | Procedure for providing a certificate |

| To the tax authorities for each citizen who received profit during the past tax period | Reporting standards are set out in clause 2 of Article 230 of the Tax Code of the Russian Federation | The maximum filing deadline is March 31 (inclusive) of the following year following the end of the reporting period. |

| It is provided to the tax service for those persons from whose income personal income tax was not withheld | According to the text set out in paragraph 5 of Article 226 of the Tax Code of the Russian Federation. | Within a month from the date of occurrence of obligations |

| To the taxpayer at his request | Personal written or oral request from an employee (including former employees) | The document must be issued within 3 working days from the date of receipt of the application |