In a taxpayer’s personal account, a citizen can order not only 3- and 4-NDFL certificates, but also a document on income. This article provides information on how to obtain a 2-NDFL certificate through the taxpayer’s personal account for 2021.

Sometimes a Russian citizen may need a certificate in form 2-NDFL (KND 1151078) - a tax document on the income of the payer of the fees. Information is generated in the accounting department of the enterprise where the employee works. If necessary, the documentation can be provided by the employer or accountant.

The document is intended only:

- for working citizens (2-personal income tax is taken at work);

- persons who are registered with the employment center (a certificate is requested from the center’s employees);

- for university students (the form can be completed at the institute’s dean’s office).

Previously, an individual had to visit the accounting office to obtain 2-NDFL. But now the Federal Tax Service of Russia allows individuals to order KND 1151078 on its portal; the government service is provided free of charge.

New functionality of the personal account of an individual taxpayer

According to the official website of the Tax Service www.nalog.ru, now form 2-NDFL is available not only for simply viewing information about the taxpayer, but also for downloading it to your computer. The process of obtaining a 2-NDFL certificate in your personal account is quite simple:

1. You must log in to the official website of the Federal Tax Service of Russia.

2. Go to the “Income Tax and Insurance Contributions” tab.

3. Click with the mouse cursor on the “Upload with electronic signature” tab.

4. Specify the folder on your computer or laptop to download the file.

As a result, the user receives an archived folder with xml, p7s and pdf files.

The personal account provides the income certificate itself in 2 types:

1. PDF with built-in digital signature.

2. XML (in this case, the digital signature comes separately as a p7s file).

If necessary, electronic signatures can be easily verified. So:

- the certificate in XML format is analyzed on the government services website;

- The PDF document requires the installation of additional software on your computer to verify the authenticity of the digital signature.

The option of obtaining a 2-NDFL certificate through a personal account on the website of the Russian Tax Service via the interface has practically not changed since the last time, when the Federal Tax Service only offered information about one’s income. The only difference is that now the document can actually be downloaded to your computer.

Attention!

Formally, it is logical to use the downloaded 2-NDFL certificate only in electronic form. It is not entirely intended to be printed on paper, since it will be almost impossible to verify the authenticity in this form.

How long is a 2-NDFL certificate valid?

The validity period of the 2-NDFL certificate depends on the type of department where the paper is required, as well as on the reason for which the data was requested. For example:

- for banking enterprises when applying for a standard loan or installment plan - up to one calendar month;

- when applying for a mortgage loan - from 10 days to a month;

- preparation of declarations, registration of 3-personal income tax - from one to two calendar months;

- to government agencies (registration of benefits or pensions) - up to two weeks.

But it is worth noting that only certificates for the previous year are reflected on an individual’s personal page, since the tax agent reports to the tax authorities for the past period. And some authorities request a form for the last month, quarter or six months. In this case, 2-NDFL can only be obtained in the accountant’s office and certified by the signature of the manager.

Also, when applying for mortgage loans or performing other serious transactions, the original or its scanned copy in electronic format is required. Then you can request a certificate from management or provide a paper with an electronic signature. Sometimes digital signatures are not enough for departments. Therefore, it is worth clarifying in what form the document is needed, whether the one downloaded from your personal account is suitable, etc.

When contacting any authorities, it is recommended to clarify the expiration dates for a particular situation. But if a citizen is overdue for 2-personal income tax, then it is possible both a second and a third time. There are no restrictions on the number of downloads in your personal account on the tax authorities’ website.

For whom is it important to obtain a certificate online: costs

Considering the fact that the Russian Tax Service website provides the 2-NDFL certificate in electronic form, its scope of use is extremely limited. There is no doubt that this document is a full-fledged analogue of the paper version and has legal force. However, not all taxpayers are comfortable using this format. This can be explained by the inability to independently convert the electronic form into paper form, namely, print it as an equivalent document.

Example No. 1

When applying for a loan, the bank requires a certain package of documents: a passport, a copy of the work book, a 2-NDFL certificate, etc. It is usually impossible to provide the bank with some of the documentation in electronic form and some in paper form. In this case, you must scan all documents or provide paper originals, including 2-NDFL.

Here is another example confirming the irrelevance of an income certificate even in electronic form.

Example No. 2

You can download the 2-NDFL certificate through the taxpayer’s personal account, but the information will only be for the past year. This is explained by the fact that tax agents (employers) provide data on the income of their employees for the reporting period, namely for the past year. Certificates are sometimes needed for the last 3, 6 or 12 months of the current year. But such data cannot be on the Federal Tax Service website, since the employer has not yet sent such annual reports. As a result, you can get a 2-NDFL certificate online, but its relevance for many structures that require it will be zero.

A fair question is why this service is needed if it does not make life easier for taxpayers. For a bank, court or when applying for a visa, you will most likely still have to obtain a paper version of the certificate from your employer.

Also see “Certificate 2-NDFL in the tax office online: how to get it.”

Why do you need an income certificate?

A citizen may need to obtain a certificate of income for personal purposes:

- loan processing;

- concluding a mortgage loan agreement;

- obtaining a visa;

- receiving a tax deduction;

- registration of guardianship or documents for adoption;

- when receiving benefits or government benefits for various reasons.

Not only a working citizen, but also an unemployed person has the right to receive a document reflecting taxable remuneration for the period when he received income from which personal income tax was deducted to the consolidated budget. For example, a certificate is needed by a new landlord to summarize the deductions provided, to calculate temporary disability benefits, etc.

Advantages of the new opportunity for an individual’s personal account

But in fact, the importance of the Federal Tax Service service is that the taxpayer can independently and in the shortest possible time obtain information about his income for previous years. This is very convenient for individual entrepreneurs who have problems with taxation. An entrepreneur can instantly prove the amount of his profit and the fact of paying tax by printing a certificate or submitting it electronically.

Here is an example for individuals.

Example

The company the person worked for went bankrupt and was liquidated. This means that there is no one to request a paper version of the 2-NDFL certificate from. In this case, the new functionality of your personal account will help. Even despite the liquidation of enterprises and individual entrepreneurs, information about tax deductions is stored in the database. A person can easily download a document on income for the selected period and provide it at the place of request.

Please note that obtaining a 2-NDFL certificate online on the Federal Tax Service website is the ONLY legal way. No one else provides such a service, including the government services portal, which does not provide information about taxpayers.

Also see “Electronic services for accountants on the Federal Tax Service website: use wisely.”

Read also

01.05.2018

Another way you can get information about your income

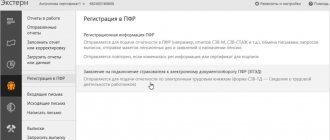

There are cases when information about income is needed for personal reference, and not in order to provide it to established authorities. To get the necessary data, you just need to contact the Pension Fund database. We would like to draw your attention to the fact that only a registered user on the Moscow State Services Internet portal can use this method. Full verification should be carried out. To do this you need:

- log in to the site by entering the required identification data;

- then go to the “Services” section;

- then select the “Pension” subsection;

- after which you need to open the link “Notice on the status of your personal account in the Pension Fund of Russia”.

After all the above steps have been completed, the system will open a window containing information about all income from which transfers are made to the Pension Fund of the Russian Federation.

This is what the procedure for obtaining a certificate in form 2-NDFL looks like.

Information about receipts of funds on gosuslugi.ru

Active users of the portal may notice that the personal account of the State Services, even after confirming your identity, cannot completely replace the account on the Federal Tax Service website. The e-government web resource has poorer functionality; some operations require additional confirmation in the form of a qualified electronic digital signature.

Important! At the beginning of 2021, it is impossible to issue a 2-NDFL certificate at State Services. This function is not available on the web resource.

The service for issuing form 2-NDFL was no exception. Confirming income through the government services portal is currently impossible. Perhaps such a function will appear in the future. We recommend checking the availability of the service on the site using the search bar.

To go to the search service, you need to click on the magnifying glass in the main menu. It is located at the top of the site windows.

After opening the search bar, enter keywords into it. Then click the “Find” button.

Now, when asked “certificate 2 personal income tax”, the portal provides only an information article on this topic.

By clicking on the link, you can find out that information about income is ordered in the Personal Account on the Federal Tax Service portal.

Registration and confirmation of an account on State Services

Since you will order the certificate on the tax website, you can register there too. However, this will not be a faster or more convenient option. Also, registration on the State Services Internet portal provides access not only to 2-NDFL, but also to a number of other services.

Registration is carried out according to the following algorithm:

- We go to the State Services website.

- Click on the “Register” link.

- Fill in your personal information (first and last name, mobile phone number with code, e-mail address). The email address must be current, as it will be used to confirm your actions on this resource.

- We confirm the entry of data by clicking on the “Register” banner.

- We register your account: you indicate your passport and SNILS details.

- We complete the registration by entering a one-time code received as an SMS to your mobile device number.

By completing these steps, you have completed the simplified registration procedure.

Important! To have full access to all functions of the site, you need to confirm your account. To do this, you will need to contact one of the branches of the MFC or the Pension Fund of the Russian Federation.

Having completed the preparatory part, you can begin the procedure of filling out an application for a certificate in form 2-NDFL.

Confirmation of income through State Services

You can get a certificate confirming the amount of earnings for lending or filing a 3-NDFL declaration from the Tax Service database. This is done through the State Services resource. Certificate 2-NDFL is downloaded to your computer as a pdf file. It has a built-in electronic signature that replaces the seal of the employing organization.

Like the paper 2-NDFL certificate, its electronic version is suitable for confirming income information for a loan and contains the following information about earnings:

- employee's annual income with monthly breakdown;

- the amount of tax transferred;

- basic salary taxed at 13%;

- vacation pay;

- premium;

- financial assistance;

- benefits for temporary disability certificate;

- other forms of material payment.

Advantages of obtaining information about income on web resources

Remote services have a number of advantages compared to traditional methods of receiving them:

- There is no need to waste time waiting in queues and preparing the document by the employer’s accounting department. All manipulations on the state website take no more than 15 minutes.

- Personal communication with the employee responsible for providing papers is excluded from the process.

- All actions on the portal are standardized, which minimizes the occurrence of errors due to inattention or lack of knowledge.