Who are the payers of the vehicle?

Since the TS-1 form is submitted by trade tax payers, it is necessary to highlight a list of those who belong to them.

The vehicle is regulated by Chapter 33 of the Tax Code of the Russian Federation. In 2021, the vehicle, as before, is paid only in the city of Moscow (Moscow Law No. 62 dated December 17, 2014).

TC must be paid by those who conduct trading activities at trading facilities.

Let us note that such economic entities include both organizations and individual entrepreneurs (clause 1 of Article 411 of the Tax Code of the Russian Federation). And trading activities include both retail and wholesale trade (subclause 2, clause 4, article 413 of the Tax Code of the Russian Federation).

Now let's decipher the basic concepts:

The law provided benefits for vehicle payers. Thus, individual entrepreneurs who are patent holders (use the PSN) and payers of the unified agricultural tax (Clause 2 of Article 411 of the Tax Code of the Russian Federation) exempt

In addition, there are benefits for certain types of activities that Moscow provided (Article 3 of the Moscow Law of December 17, 2014 No. 62). That is, these benefits are not valid for other regions if the CU is ever introduced there too.

Let us note some of the preferential categories:

Where applicable in 2021

The Tax Code of the Russian Federation establishes that a trade tax should be introduced in three regions of Russia, which are cities of federal significance. These are Moscow, St. Petersburg, Sevastopol.

In order for local authorities to levy a trade tax on the territory of these subjects, they must prepare and approve a number of regulatory documents.

Currently, the corresponding law has been adopted only by the Moscow authorities. Therefore, today the trade tax is paid by business entities operating in the field of trade in the capital. The rest of the federal cities are still engaged in preparatory work.

Important! In this case, the business entity may not be registered in Moscow. It is enough that he uses a trade facility located on the territory of a given city. Before starting activities, he needs to submit a notification to the Federal Tax Service at the location of this facility.

Declare yourself as a vehicle payer

To register as a TS payer, you must submit a tax notification in the TS-1 form: within 5 days from the date of commencement of trading activities.

Cheating - not filing a notice and not paying the vehicle - will not work. The Department of Economic Policy and Development of the City of Moscow will identify the defaulter and report this to the tax office. forced to register with the tax authority . He will also be subject to fines, which we will discuss below.

You must register as a vehicle payer in any case , regardless of other registration records existing at the tax office.

Registration with OKVED, related to retail trade, is not enough to be considered a payer of the vehicle! It is necessary to notify the tax office about this in a special manner by submitting TS-1.

On what form should I submit TS-1?

Form TS-1 was approved by order of the Federal Tax Service of Russia dated June 22, 2015 No. ММВ-7-14/249. In the same order you can find explanations for filling out the form, as well as the format for submitting data in electronic form.

Next, from our website you can download the TS-1 form for free using a direct link:

NOTIFICATION FORM TS-1

Trade fee: notification (sample and form)

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form or sample you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Get a sample for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form or sample you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

To which regulatory body is the TS-1 submitted?

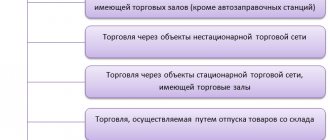

To which tax office should a notification in form TS-1 be submitted? The answer to this question depends on what type of trading activity will be subject to the fee:

You must submit as many notifications as the number of trade objects used by the payer of the vehicle. At the same time, there is a nuance: if several retail objects are located in the same municipality, but under the authority of different Federal Tax Service Inspectors, one registration with any tax office is sufficient.

Information about the taxable object

The number of pages containing information about properties depends on the number of properties for which the trade fee is charged. The notice must contain a separate page for each of them.

Section 1 indicates the date when the trade item arose, changed, or ceased and the trade type code. The code for the type of trading activity assumes stationary, non-stationary trade, trade from a warehouse, on the market and through trading floors. It is determined in accordance with Appendix No. 2 to the Filling Out Procedure.

Section 2. The OKTMO code is indicated in accordance with the classifier and may contain 8 or 11 characters; with 8-digit OKTMO, dashes are placed in the empty cells of the TS-1 form.

The object code is indicated in accordance with Appendix No. 3 to the Procedure and means a store, pavilion, kiosk, market, etc. If the place of trade has its own name, it is indicated in the corresponding field of the notification, and its address is also indicated.

The basis for using the object is indicated by the code:

- – if it is owned by the payer of the fee,

- – when renting,

- - in other cases.

If there is no permission to place a non-stationary retail space, zeros are entered in the field for the number of such permission.

Depending on the type of object, the cadastral number of the building, premises or land plot is indicated, as well as the area of the trading floor or market where trade is carried out.

Section 3 calculates the trade fee based on physical indicators and current fee rates. The basis for calculation is the type or area of the object. The trading fee is calculated for the quarter; if there are benefits, it is reduced by their amount.

Cases when you need to submit TS-1 to the tax office

Form TS-1 is submitted to the Federal Tax Service not only during registration, but also for other reasons. The reason code is reflected on the title page of the application form. We will describe the rules for entering data into this form below. Now we will give a list of reasons why a businessman must report to the tax filing form TS-1.

The legislation allows that if a TS-1 notification is submitted incorrectly, it can be canceled. To do this, write a free-form tax application with explanations (letter of the Federal Tax Service dated August 20, 2015 No. GD-4-3/14721).

Tax calculation example

Stolitsa LLC owns three kiosks in the Central Administrative District of Moscow, as well as a store with an area of 76 square meters. m. on the territory of the Southern Administrative District.

The rate for a kiosk on the territory of the Central Administrative District is 81,000 rubles per object. The rate for a store in the Southern Administrative District is 600 rubles for the first 50 square meters. m, and 50 rubles for all subsequent ones.

Collection amount for the store: 600 x 50 + 26 x 50 = 31,300 rubles.

Collection amount for kiosks: 81,000 x 3 = 243,000 rubles.

Total fee per quarter: 31,300 + 243,000 = 274,300 rubles.

We enter data into the TS-1 form correctly

The notification form for the trade fee is the same for individual entrepreneurs and organizations. It consists of 2 (or more if necessary) sheets.

Title page

As usual, on the title we indicate general information about the fee payer:

Sheet with data about the object of trade

If the notification is submitted to several objects, then the appropriate number of sheets should be filled out.

When filling out the notification, special attention should be paid to calculating the amount of the fee in order to enter the correct data in the document:

How is the title page of a document filled out?

There are two fields on the header: TIN and KPP. All legal entities that have a certificate that they are registered with the tax office put a dash in the last two cells of the TIN. Foreign organizations that have registered a separate division on the territory of our country also do the same. But the individual entrepreneur, on the contrary, indicates the TIN, according to his place of residence, but the checkpoint cells are filled in with dashes.

The box for submission to the tax office with the code must contain a four-digit number of the code value, in accordance with the territorial number of the tax office. To avoid unwanted errors, it is better to check the meaning of the corresponding code using the official website of the tax office, where a special service is offered. Using information about the address of the retail outlet, you can determine the code designation.

Next comes a column indicating the type of document. Here you should explain the reason that underlies the filing of papers, and this must be done by indicating one corresponding number. 1 is used to characterize a document that is submitted due to the emergence of a new outlet.

An entrepreneur who ceases his activities in the market as a whole, closing all retail outlets, must submit Form TS-2. If the notice of trade fee has characteristic 2 or 3, then it should include only those data that relate to retail outlets undergoing innovations and changes in operation.

In the next column you must indicate the full name of the organization (legal entity) or individual enterprise that was included in the registration documents of the enterprise, as well as the first name, patronymic and last name of the individual entrepreneur identical to the passport data.

In the column OGRN and OGRNIP it is necessary to indicate the registration codes that are specified in the constituent papers. Organizations contribute OGRN, and individual entrepreneurs - OGRNIP. If the document is printed on a computer, then unfilled cells are left empty, and when filling it out manually, dashes should be added.

In the cells for page numbering, you must indicate how many sheets the finished form contains, as well as how many there are in the applications. Applications most often contain information that confirms the legality of the powers that the person representing the taxpayer has.

There are several parts in the column about the accuracy and completeness of the data that the notification contains. The first part is for individual entrepreneurs, the second is for persons representing individual entrepreneurs, the third is for the head of organizations, the fourth is for a person representing this organization.

The TIN column and the surname, patronymic and first name of the boss or representatives indicate the personal data of the owner or the person representing him. Only organization owners or representatives provide information here.

Email addresses and phone numbers must be entered without spaces or dashes. These are methods of communication with taxpayers, by which they should always be available in the event that inspectorate employees need to get in touch with those who transferred money via electronic channels or other means.

The next column indicates the date, month and year of submission of the document, and also the signature of the person who provides the information data.

If the data was submitted by representatives of the organization, you must fill out the following column. This confirms the accuracy of the documentation regarding his right to represent a legal entity.

Further columns must be filled out by tax office employees; the taxpayer does not indicate any information here.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

The form type requires the indication of one of three characteristics:

- – if the notification is submitted in connection with the emergence of an object subject to trade tax,

- – when the indicators of an existing trade object change, as well as when errors are detected that may lead to incorrect calculation of the amount of the trade fee,

- – if the number of taxable items of trade has decreased; when all trading facilities have ceased operations, another form of notification is submitted - TS-2;

Notification TS-1 with features 2 and 3 reflects only those objects for which changes or termination have occurred.

Company name, or full name. entrepreneur are indicated in full without abbreviations.

Organizations indicate their OGRN, and the individual entrepreneur's OGRNIP number.

Example of filling out TS-1

Let Principle LLC begin trading activities from 04/01/2020 through a stationary retail chain facility with a sales area of 45 sq. m in the Eastern Administrative District of Moscow. The accountant must fill out and submit to the tax office a notice of registration as a vehicle payer.

Next, using the direct link, you can view and fill out the TS-1 form for trade tax for free:

EXAMPLE OF COMPLETING TS-1 NOTIFICATION

The procedure for filling out the recommended forms “Notification of registration (amending the indicators of the object of trade, termination of the object of taxation) of an organization or individual entrepreneur as a payer of the trade tax with the tax authority for the object of the type of business activity in respect of which the trade tax is established”, “Notification of deregistration of an organization or individual entrepreneur as a payer of a trade fee with the tax authority for the object of the type of business activity in respect of which a trade fee is established”

- I. General requirements for the procedure for filling out the recommended forms “Notification of registration (amending the indicators of the object of trade, termination of the object of taxation) of an organization or individual entrepreneur as a payer of the trade tax with the tax authority for the object of the type of entrepreneurial activity in respect of which a trade tax has been established" (hereinafter - form No. TS-1), "Notification of deregistration of an organization or individual entrepreneur as a payer of a trade fee with the tax authority for the object of the type of business activity in respect of which a trade fee has been established" (hereinafter - form No. TS-2)

- Forms No. TS-1, No. TS-2 are filled out handwritten in black or blue ink or using the appropriate software in one copy.

All sections and fields of forms No. TS-1, No. TS-2 are subject to mandatory completion, except for cases established by this Procedure.

It is not allowed to correct errors using a corrective or other similar means, double-sided printing of a document on paper, or fastening sheets of documents that lead to damage to the paper.

Each indicator corresponds to one field, consisting of a certain number of familiarities. Each field contains only one indicator.

The exception is for indicators where one of the values is date.

The date has three fields: day, month and year, separated by "." (dot).

Example of filling in the date: 07/01/2015.

The pages of form No. TS-1 are numbered consecutively, starting from the first sheet. The page number indicator of form No. TS-1 (field “Page”), which has three familiar places, is written in the field specified for numbering, from left to right, starting from the first (left) familiar place.

For example, for the first page - “001”; for the tenth page – “010”.

- Features of the handwritten method of filling out forms No. TS-1, No. TS-2:

1) filling the fields with the values of text, numeric, code indicators is carried out from left to right, starting from the first (left) familiarity;

2) text fields are filled in in capital block letters;

3) if there is no data to fill out the indicator or incomplete filling, a dash is placed on the acquaintance. In this case, the dash is a straight line drawn in the middle of the empty spaces.

- When printing on a printer forms No. TS-1, No. TS-2, filled out using the appropriate software, it is allowed that there is no framing of familiar places and dashes for unfilled familiar places; the location and size of indicator value zones should not be changed. Signs must be printed in Courier New font with a height of 16-18 points.

- II. The procedure for filling out page 001 of forms No. TS-1, No. TS-2

- In the “TIN” and “KPP” fields at the top of each page of forms No. TS-1, No. TS-2, indicate:

by a Russian organization - the taxpayer identification number (hereinafter referred to as the TIN) and the reason for registration code (hereinafter referred to as the KPP) assigned to it upon registration with the tax authority at its location;

foreign organization - INN and KPP assigned to a foreign organization at the place of activity in the territory of a municipal district (urban district, federal city of Moscow, St. Petersburg or Sevastopol) through a separate division of the foreign organization;

individual entrepreneur - TIN assigned to him by the tax authority at his place of residence.

When filling out the TIN field, for which twelve acquaintance spaces are allocated, by a Russian or foreign organization, the free acquaintance spaces to the right of the TIN value are not subject to filling in with additional symbols (filled in with dashes).

- In the field “Submitted to the tax authority (code)” of forms No. TS-1, No. TS-2, the code of the tax authority to which the Notification is submitted is indicated.

- When specifying the type of form No. TS-1, the corresponding number is entered in the field consisting of one acquaintance:

“1” – the emergence of an object of taxation;

“2” – change in indicators of the trading object;

“3” – termination of the object of taxation.

Sign “2” is added if the indicators of the trading object change or errors are detected that lead to incorrect calculation of the amount of the fee.

When changing the indicators of the object of trade (sign “2”), or the number of objects subject to trade tax (sign “3”), the Notification indicates only those objects of taxation in respect of which the change (cessation) occurred.

In case of termination of all types of trading activities using trade objects in respect of which a trade fee has been established, form No. TS-2 is submitted.

- In the field “Date of termination of business activity in respect of which a trade fee is established” of form No. TS-2, the date of termination by the payer of the trade fee of all types of activities in respect of which a trade fee is established is indicated.

- In the “Organization/individual entrepreneur” field of forms No. TS-1, No. TS-2, when filling out the name of the organization, indicate the full name of the organization corresponding to the name specified in its constituent documents.

The last name, first name and patronymic (if any) of the individual entrepreneur are indicated in full.

- In the “OGRN” field of forms No. TS-1, No. TS-2, the main state registration number of the organization (OGRN) is indicated.

- In the “OGRNIP” field of forms No. TS-1, No. TS-2, the main state number of the individual entrepreneur (OGRNIP) is indicated.

- In the field, consisting of three characters, the number of pages of the submitted form No. TS-1 is indicated. In the field “with the attachment of supporting documents or their copies on” forms No. TS-1, No. TS-2, the number of sheets of the document (copy of the document) confirming the authority of the representative of the organization is indicated.

- In the section “I confirm the accuracy and completeness of the information specified in this message” of forms No. TS-1, No. TS-2:

1) when indicating a person confirming the accuracy and completeness of the information specified in the message, the corresponding number is entered in the field consisting of one acquaintance:

“1” - individual entrepreneur;

“2” - representative of an individual entrepreneur;

“3” - head of the organization;

“4” - representative of the organization;

2) in the field “last name, first name, patronymic of the head of the organization or representative in full” the last name, first name and patronymic (if any) (in full) of the head of the organization or representative are indicated line by line, confirming the accuracy and completeness of the information specified in forms No. TS-1, No. TS-2;

3) in the “TIN” field, the TIN of the individual specified in subparagraph 2 of this paragraph is indicated, if he has a document confirming registration with the tax authority (Certificate of registration with the tax authority, marks in the passport of a citizen of the Russian Federation), and using the TIN along with personal data;

4) in the “Contact telephone number” field, indicate the contact telephone number by which you can contact the person confirming the accuracy and completeness of the information in forms No. TS-1, No. TS-2 (indicating the telephone codes required to ensure telephone communication). The telephone number is indicated without spaces or dashes;

5) in the “E-mail” field, indicate the email address for interaction between the tax authorities and the person confirming the accuracy and completeness of the information specified in forms No. TS-1, No. TS-2, in electronic form;

6) in the place reserved for signature, the signature of the person confirming the accuracy and completeness of the information specified in forms No. TS-1, No. TS-2 is affixed;

7) in the “Date” field the date of signing of forms No. TS-1, No. TS-2 is indicated;

in the field “Name of the document confirming the authority of the representative” the name of the document confirming the authority of the representative is indicated.

in the field “Name of the document confirming the authority of the representative” the name of the document confirming the authority of the representative is indicated.

- The section “To be completed by a tax authority employee” of forms No. TS-1, No. TS-2 contains information about the code for the method of submitting forms No. TS-1, No. TS-2 (according to Appendix No. 1 to this Procedure), the number of pages of these forms, the number of sheets a copy of the document attached to forms No. TS-1, No. TS-2, the date of its submission (reception), registration number of forms No. TS-1, No. TS-2, surname and initials of the name and patronymic (if any) of the tax authority employee, who accepted forms No. TS-1 or No. TS-2, his signature.

III. The procedure for filling out the page “Information about the object subject to trade tax” of form No. TS-1

- If form No. TS-1 simultaneously indicates the emergence (change, termination) of several objects subject to trade tax, a separate page is filled out for each of them, containing information about the object subject to trade tax.

- In field 1.1 “Date of origin (termination) of the object of taxation, changes in the indicators of the object of taxation” of form No. TS-1, the date of origin (termination) of the object of taxation, changes in the indicators of the object of taxation are indicated.

- In field 1.2 “Code of type of trading activity” of form No. TS-1, consisting of two characters, the corresponding code is entered in accordance with Appendix No. 2 to this Procedure.

- In field 2.1 “OKTMO code” of form No. TS-1, the code of the municipality on whose territory trading activities are carried out is indicated. Codes OK OK 033-2013 (OKTMO). When filling out the “OKTMO Code” indicator, for which eleven familiar spaces are allocated, the free familiar spaces to the right of the code value if the OKTMO code has eight characters are not subject to filling with additional symbols (filled with dashes).

- In field 2.2 “Trading object code” of form No. TS-1, consisting of two characters, the corresponding code is indicated in accordance with Appendix No. 3 to this Procedure.

- In field 2.3 “Name of the object of trade” of form No. TS-1, the name of the object of trade in which business activities are carried out is indicated. If there is no name of the trade object, this field is not filled in.

- When filling out field 2.4 “Address of the object of trade” of form No. TS-1, indicate: postal code, region code, district, city, locality, street (avenue, alley, etc.), house (possession) number, building (building) number ), office number. The digital code of the region is indicated in accordance with the directory “Subjects of the Russian Federation” in accordance with Appendix No. 4 to this Procedure.

- In field 2.5 “Grounds for using the object of trade” of form No. TS-1, consisting of one acquaintance, the corresponding figure is entered:

“1” – property;

“2” – rent;

“3” is a different basis.

- In field 2.6 “Permit number for placement of a non-stationary trade facility” of form No. TS-1, the number of the permit to locate a non-stationary trade facility is indicated. If there is no permit number for placing a non-stationary trade object, zeros are entered in all familiar places in this field.

- In field 2.7 “Cadastral number of the building” of form No. TS-1, the cadastral number of the building (structure, structure) is indicated in the case of carrying out trading activities using codes “01”, “03” specified in Appendix No. 2 of this Procedure. This field is not filled in when carrying out trading activities using a trading object that has a cadastral number of the premises.

- In field 2.8 “Cadastral number of premises” of form No. TS-1, the cadastral number of the premises (if available) is indicated in the case of carrying out trading activities using codes “01”, “03” specified in Appendix No. 2 of this Procedure.

- In field 2.9 “Cadastral number of the land plot (indicated in the case of activities related to the organization of retail markets)” of form No. TS-1, the cadastral number of the land plot on which business activities related to the activities of organizing retail markets are carried out is indicated.

- In field 2.10 “Area of the trading floor (retail market) of the trade facility (sq. m)” of form No. TS-1, the area of the trade facility or the area of the retail market for which the fee rate is applied is indicated.

- In field 3.1 “Fee rate for an object, trade (in rubles)” of form No. TS-1, the trade levy rate established by the regulatory legal acts of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol) is indicated in rubles for the quarter in based on the object of trade.

- In field 3.2 “Fee rate established in sq. m (in rubles)" form No. TS-1 indicates the rate of trade tax established by the regulatory legal acts of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol) in rubles per quarter based on the area of the trade facility.

If the regulatory legal acts of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol) establish differentiated tax rates, then the specified sales tax rate is indicated by calculation by calculating the average sales tax rate.

For example, a regulatory legal act of a municipality establishes differentiated rates for 1 square meter of sales area in the amount of 1,200 rubles for each square meter of sales area not exceeding 50 square meters, and 50 rubles for each full (incomplete) square meter of sales area over 50 square meters. Trading activities are carried out through a store with a sales area of 120 square meters. The rate for 1 square meter is calculated as follows: ((50 square meters * 1200 rubles) + ((120 square meters - 50 square meters)* 50 rubles)) / 120 square meters = 529.17 rubles.

- In field 3.3 “Calculated amount of the fee for the quarter (in rubles)” of form No. TS-1, the amount of the trade fee for each object subject to the trade fee is indicated as the product of the rate of the trade fee in relation to the corresponding type of business activity and the actual value of the physical characteristics of the corresponding object of trade.

If the regulatory legal acts of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol) establish differentiated rates of trade tax, then the amount of the trade tax is calculated taking into account the specifics of the adopted regulatory legal act.

- In field 3.4 “Amount of benefit provided for the object of trade (in rubles)” of form No. TS-1, the amount of benefit established by regulatory legal acts of representative bodies of municipalities (laws of federal cities of Moscow, St. Petersburg or Sevastopol) is indicated. The indicator of field 3.4 cannot exceed the value of field 3.3 “Calculated amount of the fee for the quarter (in rubles).”

- In field 3.5 “Tax benefit code” of form No. TS-1, the paragraph and subparagraph of the article of the regulatory legal act of the representative body of the municipality (the law of the federal cities of Moscow, St. Petersburg or Sevastopol) are sequentially indicated, in accordance with which the corresponding benefit is provided (for each of the indicated positions, four familiar spaces are allocated, while this part of the indicator is filled in from left to right, and if the corresponding attribute has less than four characters, the free familiar spaces to the left of the value are filled with zeros).

For example, if the corresponding benefit is established by subclause 1.1 of clause 2 of Article 3 of a regulatory legal act, then the line indicates:

| 0 | 0 | 0 | 3 | 0 | 0 | 0 | 2 | 0 | 1 | . | 1 |

- In field 3.6 “Amount of fee for the quarter (in rubles) (page 3.3. – page 3.4.)” of form No. TS-1, the difference between the calculated amount of the trading fee for the quarter and the amount of the benefit provided to the object of trade is indicated.

- 33. Numerical values of the indicator of the amount of the trade fee are indicated in full rubles. Indicator values less than 50 kopecks are discarded, and 50 kopecks or more are rounded to the full ruble.

Appendix No. 1

to the Procedure for filling out forms

“Notification of registration (amending the indicators of the object of trade, termination of the object of taxation) of an organization or individual entrepreneur as a payer of the trade tax with the tax authority for the object of the type of entrepreneurial activity in respect of which the trade tax is established”, “Notice of withdrawal from registering an organization or individual entrepreneur as a payer of a trade tax with the tax authority for the object of carrying out the type of entrepreneurial activity in respect of which a trade tax is established,”

Codes that determine the method of submitting a Notification of registration (amending the indicators of an object of trade, termination of an object of taxation) of an organization or individual entrepreneur as a payer of a trade tax with the tax authority for the object of carrying out a type of business activity in respect of which a trade tax is established, Notifications on deregistration of an organization or individual entrepreneur as a payer of a trade fee with the tax authority for the object of carrying out the type of business activity in respect of which a trade fee is established

| Code | Name |

| 01 | on paper (by mail) |

| 02 | on paper (in person) |

| 03 | on paper with duplication on removable media (personal) |

| 04 | via telecommunication channels |

| 05 | other |

| 08 | on paper with duplication on removable media (by mail) |

| 09 | on paper using a barcode (in person) |

| 10 | on paper using a barcode (by mail) |

Appendix No. 2

to the Procedure for filling out forms

“Notification of registration (amending the indicators of the object of trade, termination of the object of taxation) of an organization or individual entrepreneur as a payer of the trade tax with the tax authority for the object of the type of entrepreneurial activity in respect of which the trade tax is established”, “Notice of withdrawal from registering an organization or individual entrepreneur as a payer of a trade tax with the tax authority for the object of carrying out the type of entrepreneurial activity in respect of which a trade tax is established,”

Trade activity type codes

| Trade activity type code | Types of trading activities |

| 01 | Trade through stationary retail chain facilities that do not have trading floors (with the exception of stationary retail chain facilities that do not have trading floors, which are gas stations) |

| 02 | Trade through objects of a non-stationary trading network |

| 03 | Trade through the facilities of a stationary retail chain with trading floors |

| 04 | Trade carried out by releasing goods from a warehouse |

| 05 | Activities for organizing retail markets |

Appendix No. 3

to the Procedure for filling out forms

“Notification of registration (amending the indicators of the object of trade, termination of the object of taxation) of an organization or individual entrepreneur as a payer of the trade tax with the tax authority for the object of the type of entrepreneurial activity in respect of which the trade tax is established”, “Notice of withdrawal from registering an organization or individual entrepreneur as a payer of a trade tax with the tax authority for the object of carrying out the type of business activity in respect of which a trade tax is established"

Trade object codes

| Trade object code | |

| 01 | Shop |

| 02 | Pavilion |

| 03 | Retail market |

| 04 | Kiosk |

| 05 | Trade tent |

| 06 | Vending machine (vending machine) |

| 07 | Delivery trade objects |

| 08 | other |

Appendix No. 4

to the Procedure for filling out forms

“Notification of registration (amending the indicators of the object of trade, termination of the object of taxation) of an organization or individual entrepreneur as a payer of the trade tax with the tax authority for the object of the type of entrepreneurial activity in respect of which the trade tax is established”, “Notice of withdrawal from registering an organization or individual entrepreneur as a payer of a trade tax with the tax authority for the object of carrying out the type of business activity in respect of which a trade tax is established"

Directory “Subjects of the Russian Federation”

| 01 | Republic of Adygea (Adygea) |

| 02 | Republic of Bashkortostan |

| 03 | The Republic of Buryatia |

| 04 | Altai Republic |

| 05 | The Republic of Dagestan |

| 06 | The Republic of Ingushetia |

| 07 | Kabardino-Balkarian Republic |

| 08 | Republic of Kalmykia |

| 09 | Karachay-Cherkess Republic |

| 10 | Republic of Karelia |

| 11 | Komi Republic |

| 12 | Mari El Republic |

| 13 | The Republic of Mordovia |

| 14 | The Republic of Sakha (Yakutia) |

| 15 | Republic of North Ossetia-Alania |

| 16 | Republic of Tatarstan (Tatarstan) |

| 17 | Tyva Republic |

| 18 | Udmurt republic |

| 19 | The Republic of Khakassia |

| 20 | Chechen Republic |

| 21 | Chuvash Republic - Chuvashia |

| 22 | Altai region |

| 23 | Krasnodar region |

| 24 | Krasnoyarsk region |

| 25 | Primorsky Krai |

| 26 | Stavropol region |

| 27 | Khabarovsk region |

| 28 | Amur region |

| 29 | Arkhangelsk region and Nenets Autonomous Okrug |

| 30 | Astrakhan region |

| 31 | Belgorod region |

| 32 | Bryansk region |

| 33 | Vladimir region |

| 34 | Volgograd region |

| 35 | Vologda Region |

| 36 | Voronezh region |

| 37 | Ivanovo region |

| 38 | Irkutsk region |

| 39 | Kaliningrad region |

| 40 | Kaluga region |

| 41 | Kamchatka Krai |

| 42 | Kemerovo region |

| 43 | Kirov region |

| 44 | Kostroma region |

| 45 | Kurgan region |

| 46 | Kursk region |

| 47 | Leningrad region |

| 48 | Lipetsk region |

| 49 | Magadan Region |

| 50 | Moscow region |

| 51 | Murmansk region |

| 52 | Nizhny Novgorod Region |

| 53 | Novgorod region |

| 54 | Novosibirsk region |

| 55 | Omsk region |

| 56 | Orenburg region |

| 57 | Oryol Region |

| 58 | Penza region |

| 59 | Perm region |

| 60 | Pskov region |

| 61 | Rostov region |

| 62 | Ryazan Oblast |

| 63 | Samara Region |

| 64 | Saratov region |

| 65 | Sakhalin region |

| 66 | Sverdlovsk region |

| 67 | Smolensk region |

| 68 | Tambov Region |

| 69 | Tver region |

| 70 | Tomsk region |

| 71 | Tula region |

| 72 | Tyumen region |

| 73 | Ulyanovsk region |

| 74 | Chelyabinsk region |

| 75 | Transbaikal region |

| 76 | Yaroslavl region |

| 77 | Moscow |

| 78 | Saint Petersburg |

| 79 | Jewish Autonomous Region |

| 86 | Khanty-Mansiysk Autonomous Okrug - Ugra |

| 87 | Chukotka Autonomous Okrug |

| 89 | Yamalo-Nenets Autonomous Okrug |

| 91 | Republic of Crimea |

| 92 | Sevastopol |

| 99 | Other territories, including the city and Baikonur cosmodrome |

Has the deadline for submitting the TS-1 form and paying the TC in Moscow been extended?

In connection with measures taken to combat coronavirus, the Moscow Government issued Resolution No. 212-PP dated March 24, 2020. In accordance with it, the deadline for payment of the trade fee for the 1st quarter of 2021 has been extended until 12/31/2020 inclusive. It is expected that payment deadlines for vehicle payments will be extended for the 2nd quarter of 2021.

The general procedure for registering a vehicle as a payer has not been changed. Thus, forms TS-1 and TS-2 should be submitted in the order described in the article.

Please note that deregistration as a vehicle payer in April-May 2021 does not make practical sense. Since TC is paid even if an organization or individual entrepreneur worked as a TC payer for at least 1 day in a quarter (Article 412, Article 414 of the Tax Code of the Russian Federation).

If the “coronavirus” restrictions continue until the 3rd quarter of 2021, and it becomes clear to the business owner that his retail facility will most likely not be open in July-September, then you can deregister as a vehicle payer until 07/01/2020.

Who pays it

Determining the need to pay a trade tax depends on two indicators.

Tax system

The law establishes a trade fee for individual entrepreneurs using the simplified tax system and OSNO, as well as companies using the same regimes. If a business entity applies an agricultural tax or a patent system, then they are exempt from paying the fee.

A special situation has been established for those who apply UTII. The law determines that it is impossible to pay imputation and trade fees at the same time. Therefore, it is necessary to withdraw from UTII, switch to a different system, and depending on this, determine the need to use the trade tax.

Activities

By law, all business entities that trade in retail, small wholesale or wholesale are required to make payments when using the following facilities:

- Stationary facilities with a sales area;

- Stationary facilities without a sales area;

- Non-stationary objects;

- Warehouses.

However, this type of activity must additionally be specified in local law. Thus, on the territory of Moscow, trade from warehouses is not subject to trade tax, since this type of activity is not prescribed in the adopted legal act.

Attention! The activities of retail markets are also subject to the trading tax. However, in this case, payment is made not from each trading place, but from the area of the entire market.