Home / Taxes / What is VAT and when does it increase to 20 percent? / Invoice

Back

Published: December 28, 2017

Reading time: 5 min

0

255

An invoice is a universal payment document on the basis of which mutual settlements occur between participants in trade turnover or the market for works and services.

- When and who needs an invoice without VAT?

- How to fill out an invoice without VAT?

Some of these counterparties have the right to fill out this document without indicating value added tax as a result of using the appropriate tax regime or selling goods that are not subject to such tax.

Invoice without VAT: who issues it, registration, filling out

- company tax identification number;

- full name of the organization in Russian;

- subject of the Russian Federation in which the organization is located.

On the seals of branches, in addition to the required data, the name of the structural unit is indicated.

The nuances of the use of seals by officials are recorded in the administrative documents of the organization. The use of reproduction of a print or signature by mechanical copying is not permitted.

According to paragraph 3 of Article 168 of the Tax Code of the Russian Federation, the organization is obliged to issue an invoice to the buyer no later than 5 days from the date of shipment of goods or provision of services.

Structure and filling rules

A zero invoice consists of three main blocks: header, main part, signatures. In the upper part it is necessary to write down the names of the parties and their details, the second block directly concerns the goods or services, their characteristics, the third block consists of affixing signatures by authorized persons. Filling out the form is usually not difficult if you know the matter. Let's dwell on the structure and correct filling of the invoice.

A cap

- First, enter the account number and the date of its issue. In this case, the serial number must be observed.

- Next line for corrections. If they are absent, a dash is placed.

- Salesman. Involves entering accurate data in accordance with the constituent documents of the organization.

- Seller's address. Accurate data is entered in the same way.

- Entering TIN/KPP.

- Shipper. If it matches the seller, you can enter the same one.

- Consignee, indicate the exact name and address.

- A payment and settlement order requires entering the invoice data.

- Next, there are similar lines about the buyer, they must be filled out in accordance with the documents.

- The string is relative to the currency. Indicate in which currency the payment is made.

Main part

- No. 1 product name. The goods must match the data on the invoice receipt.

- No. 1a product type code. This line is intended only for organizations supplying goods to the EAEU countries. In the absence of this activity, you need to put a dash.

- Two lines together. No. 2, write down the code for the classifier. 2a symbol, if absent, put a dash.

- No. 3 quantity, volume. Enter the data according to the invoice receipt.

- No. 4 price per unit of measurement. Enter the data according to the invoice receipt.

- No. 5 cost of goods. Specify the price for the total quantity excluding VAT.

- No. 6 excise tax amount. If not available, indicate without excise tax.

- No. 7 VAT rate. Be sure to indicate “excluding VAT” for all products.

- No. 8 tax amount to the buyer. Be sure to indicate “excluding VAT” for all products.

- No. 9 the cost of goods and services along with tax payments. Indicate the total amount of goods on the invoice.

- The next three tables are for foreign goods. It is necessary to provide information about the country of origin and the customs declaration number.

IMPORTANT: ensure that all invoice lines are filled out correctly. Otherwise, the tax inspectorate will have questions.

Signatures

The document must be legalized with the signatures of authorized persons. For the organization, the signatures of the chief accountant and the manager are required. Instead of the head of a legal entity, a zero invoice can be signed by an authorized representative.

An individual entrepreneur signs a document without the participation of an accountant. He can also authorize another person to sign the document. In addition to the signature, surname and initials, the entrepreneur must write down the details of his certificate.

Features of an invoice without VAT in 2017-2018 (sample)

If an entrepreneur changes the external form of the paper, this should not violate the existing sequence of data and indicators. To minimize the likelihood of errors, it is recommended to use an approved document form. Not all fields of the invoice are filled in in each specific case. If the necessary information to be entered in the appropriate fields is not available, dashes are placed in them. For example, column 6 is filled in only by organizations that pay excise taxes on these transactions. If the company does not fall under this concept, a dash is placed in the column.

Do I need to issue an invoice without VAT?

Wrong actions can lead to the fact that the company will be obliged to pay VAT even in cases where it could have avoided additional expenses. For this reason, experts advise studying in advance a number of relevant information that will help the entrepreneur minimize the likelihood of errors. Application by law To become familiar with the nuances of using an invoice when calculating VAT, you need to study Letter of the Ministry of Taxes of the Russian Federation No. VG-6-03/404. It states that an invoice is a document that serves as the basis for accepting the presented tax amounts for deduction or reimbursement. The paper has an approved form. In addition, there are rules for maintaining invoice journals. If a document was drawn up or issued in violation of the established rules, it cannot be used to obtain a deduction or refund of tax.

Answers to common questions

Question: A simplified company, at the request of the buyer, issued an invoice, highlighting VAT. After that, in accordance with the requirements of the law, I paid this tax to the budget and filed a VAT return. When calculating the simplified tax system, will VAT be included in the tax base? (click to expand)

Answer: The tax base for simplifiers is income, which must first of all be economically profitable. Paid VAT is not a benefit for the company, and therefore should not be included in the base for calculating the simplified tax system. Accordingly, when calculating the tax, the simplified tax system does not need to be included in the VAT base.

Features of an invoice for VAT calculations

The forms of extracts of these documents are not regulated by legislators. You can transfer the indicated documents by visiting the tax service in person. You can also transfer the documentation through Russian Post by issuing a registered letter with an inventory and notification of delivery. If all the listed actions and conditions are met by the taxpayer, then he can enjoy the right to tax exemption for 1 year (or until the conditions are violated). Throughout this period, the obligation to issue VAT-free invoices to customers remains. If at the end of the year the company can still take advantage of the VAT exemption, then it must again inform the tax authority of its right - no later than the twentieth day of the next month. The list of documents is similar to the primary notification.

How to display?

In paragraph 6 of Article 169 of the Tax Code of the Russian Federation it is stated that when issuing an invoice, an individual entrepreneur must personally sign it and indicate his own details of state registration of himself as an individual entrepreneur. Details mean a certificate of state registration of an individual entrepreneur to identify the taxpayer. Unlike an LLC, an entrepreneur cannot delegate this responsibility to a trustee.

Note! Although the right to participate in relations of an authorized representative is confirmed by paragraph 1 of Article 26 of the Tax Code of the Russian Federation, it also states that it may be limited by other legislative acts.

Therefore, the legal representative can conduct the transaction, but cannot sign the invoice on behalf of the individual entrepreneur.

If sales are without VAT, do I need to issue an invoice?

Answers to questions on the topic: invoices and other VAT documents. You can also transfer the documentation through Russian Post by issuing a registered letter with an inventory and receipt of receipt. If all the listed actions and conditions are met by the taxpayer, then he can enjoy the right to tax exemption for 1 year (or until the conditions are violated). Throughout this period, the obligation to issue VAT-free invoices to customers remains.

Advance invoice: when issued This situation arises, for example, in relation to the supply of electricity, payments for which are carried out at unregulated prices. When the supplier knows the final cost, he needs to draw up an adjustment invoice3. But in another, at first glance, seemingly similar situation, officials decided differently. Content:

- In what cases is it necessary to issue an invoice to the buyer?

- Who is obliged to pay VAT?

- The supplier issued an invoice with VAT

- Invoice without VAT: who issues it, registration, filling out

- Answers to questions on the topic: invoices and other VAT documents

- Advance invoice: when is it issued?

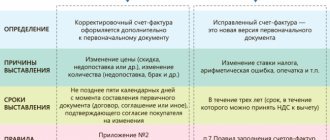

- Invoices: adjustment or correction?

- VAT: the most special and complex tax

In what cases is it necessary to issue an invoice to the buyer? When an advance payment is received for the supply of goods (performance of work, provision of services), the sale of which is subject to VAT at a zero rate, there is no need to pay VAT on the advance received (Clause 1 of Article 154 of the Tax Code of the Russian Federation) . With regard to export operations, paragraph 1 of Art. 164 of the Tax Code of the Russian Federation establishes a VAT rate of 0 percent.

Principle of compilation The object of VAT taxation is the transfer of property rights and the sale of goods and services in the domestic market of the Russian Federation. When selling them, the seller is obliged to present the buyer with the amount of tax to be paid. Manipulation is carried out by issuing an invoice.

The order in which the document is drawn up depends on a whole list of factors. The following nuances are taken into account:

- whether the seller is a VAT payer;

- agreement conditions;

- type of contract;

- payment procedure.

An invoice is a document that serves as the basis for the buyer to accept the goods (works, services) presented by the seller, property rights of VAT amounts for deduction (clause 1 of Article 169 of the Tax Code of the Russian Federation). We will tell you in which case an invoice is issued without VAT and how it is filled out in our consultation.

Book of purchases

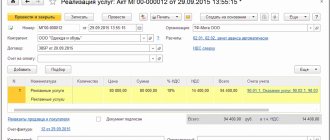

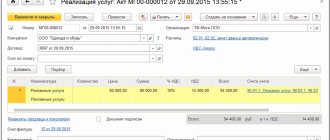

To fill out the purchase book, we will create the document “Creating purchase book entries.” It is on the list of VAT regulated operations.

Check the box “Submitted for deduction of VAT 0%” and fill out the document. We check that the “Status” field is set to “0% implementation confirmed” and save the document.

In the postings we see that VAT is accepted for deduction.

When is an invoice issued without VAT?

Let us remind you that in general, organizations and individual entrepreneurs have the right to be exempt from fulfilling VAT obligations as a taxpayer if, over the three previous consecutive calendar months, the amount of revenue from the sale of goods (work, services) excluding VAT did not exceed a total of 2 million rubles (p 1 Article 145 of the Tax Code of the Russian Federation). We talked in more detail about VAT exemption in a separate consultation.

An individual entrepreneur invoice is a document that allows you to receive a VAT deduction from the Federal Tax Service. According to current regulations, document flow must be carried out with a minimum number of errors during registration. An entrepreneur, according to the area of activity regulated in the Tax Code of the Russian Federation, can work both with and without VAT. It is necessary to determine whether the absence of a tax amount in the invoice is allowed or if VAT is not paid, it is not necessary to issue it.

Confirmation of zero VAT rate

To perform this operation, go to the menu “Operations - Closing the month - Regular VAT operations”.

And we will create the corresponding document.

We fill out the document automatically using the “Fill” button.

Our implementation is included in the document. Then, in the “Event” field, select whether the 0% rate is confirmed or not confirmed.

Save the changes. The document does not make postings, but generates movements in VAT registers.

The essence and role of an invoice

An invoice is drawn up by the seller and transferred to the buyer no later than 5 days after the transaction and is confirmation of the provision of services or the supply of goods.

According to Decree No. 1137 of December 26, 2011, an invoice can be presented on electronic or paper media with equal legal force. Invoices generated digitally must be certified with an electronic digital signature (EDS). It is possible to draw up a corrective document, both separately for the advance payment for delivery and the total paid invoice when releasing goods on prepayment.

Based on its purpose, an invoice must be prepared by all legal entities and individual entrepreneurs who pay VAT to the state budget in the amounts prescribed by law.

Regulatory support for the procedure for generating invoices for an entrepreneur and reflecting the facts of economic activity is provided in the Tax Code of the Russian Federation:

- Articles 168-169, which provide information on the rules of compilation, types, including the legality of creating an electronic version and types of business activities exempt from VAT.

- Paragraphs 11 and 26 of Article 346 determine the obligation to issue documents or its absence under different taxation regimes;

Additionally, the Order of the Federal Tax Service No. ММВ-7-69/3 dated February 27, 2014 defines the procedure for drawing up invoices of all types and formats.

Please note that starting from the 1st quarter of 2021, an invoice must be provided using a new form.

If the individual entrepreneur is on the general taxation system, then invoices must be issued, regardless of the type of activity, within 5 days.

All generated documents are reflected in the Purchase and Sales Books. The purchase book is a register of invoices received from third-party market counterparties for which the tax was paid. The sales book reflects the individual entrepreneur's accounting of all issued documents, on the basis of which the VAT deduction is calculated.

Exposure deadlines

According to clause 3 of Article 168 of the NKRF, the invoice must be provided within five days from the date of payment (goods, services), or five days from the date of shipment, or five days of transfer of property rights.

There are times when organizations need to quickly receive an invoice. The law does not prohibit issuing an invoice before payment for the goods (services) and its shipment. Practice shows that such situations do not entail the invalidity of the document. If necessary and with the consent of the counterparties, this method can be used in practice.

The document can be exhibited in conventional written form and in digital format. The form of the invoice is determined by mutual agreement of the parties. If an electronic format is chosen, the parties must have the equipment to read and process the document. This provision is specified in clause 2, part 1, article 169 of the NKRF.

The provisions regarding the electronic form are defined in the order of the Ministry of Finance of the Russian Federation under the number ММВ-7-6/93 dated 03/04/2015.

In this case, several transactions carried out previously are included in one document. In this case, the deadline of five days from the date of first shipment cannot be violated.

In one account you can combine transactions for VAT-taxable and non-VAT-taxable transactions. In this situation, in lines (No. 7, where there will be transactions without taxation, you should indicate without VAT, and in taxable transactions, indicate the percentage of taxation.

where there will be transactions without taxation, you should indicate without VAT, and in taxable transactions, indicate the percentage of taxation.

REFERENCE: taking into account the peculiarities of certain types of commercial activities associated with the uninterrupted or intensive supply of goods, it is allowed to draw up a consolidated invoice for a certain period.

Finally, let us briefly recap the main points. A zero invoice represents reporting to the tax office. For commercial entities registered under the simplified taxation system, issuing an invoice is optional. If it is issued, it is important to indicate in lines No. 7 and 8 without VAT. These and other nuances mentioned above allow you to carry out activities more confidently and correctly.

Procedure for filling out an invoice without VAT

In 2021, there have been many changes in the regulatory framework of accounting and tax accounting that need to be applied.

Starting from January 1, 2021, individual entrepreneurs on OSN and special regimes are exempt from maintaining registers that duplicate the information reflected in the Book of Purchases and Sales. However, as before, all registration books are provided by those, regardless of the taxation system, who provide intermediary and audit services or are developers, and also enter into commission and agency agreements.

This obligation is specified in Article 174 of the Tax Code of the Russian Federation.

Detailed filling procedure, which regulates the content of the following information:

- serial number and date of invoices;

- full name and tax identification number of the supplier and buyer;

- name and quantity of goods supplied or services provided;

- cost, in Russian rubles, for one unit and the entire batch;

- the tax rate in effect on the date of the transaction;

- the amount of tax to be transferred to the budget;

- information about the sender and recipient of the cargo;

- if the vacation was made on an advance payment, you must indicate the date and number of the payment document;

- unit of measurement of goods. Not specified when providing services.

Information in accordance with Article 169 of the Tax Code of the Russian Federation must be contained in electronic and paper format. When generating a paper invoice, it is necessary to generate 2 copies, one is received by the seller, the second is given to its customers.

Who may not issue an invoice?

According to the Tax Code of the Russian Federation, tax is not paid:

- working in retail trade;

- employed in public catering;

- providing services for cash only;

- operating in the securities market and selling shares and bonds;

- selling goods to consumers who use preferential tax regimes.

Details are provided in Articles 168 and 169 of the Tax Code, which reflect nuances depending on the chosen taxation system.

Under the special regime, tax is not paid, which is reflected in the reporting provided. Special regimes include simplified taxation system, UTII, unified agricultural tax.

However, according to paragraphs 11 and 26 of Article 346, individual entrepreneurs can generate and issue invoices without indicating the amount of value added tax.

If an invoice is generated incorrectly, namely indicating VAT in it, if the individual entrepreneur is not a tax payer, it will be necessary to pay it and report to the Federal Tax Service.

Differences between the Federation Council if there is no taxation on products

To create a document, use the form approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, with amendments dated August 19, 2017 No. 981, which came into force on October 1, 2017.

An invoice without VAT is issued on the same form and according to the same rules as an invoice with VAT. The only difference is that in columns 7 and 8, where the tax rate and amount are indicated, “Without VAT” must be written.

If all shipped products are exempt from tax, when registering the SF, in all lines in which the names are listed, in columns 7 and 8, you must indicate “Without VAT.” The same entry is made in the line “Total payable” in column 8. If in a sold batch one part of the product is subject to VAT, the other is not subject to tax, the entry “Without VAT” is entered only opposite the corresponding items.

The lines where taxable goods are listed indicate the rate and amount of VAT. In the “Total payable” field in column 8, enter the total tax amount, including only taxable items. Invoices for received advances are issued in compliance with the same rules.

For more information about what an invoice is and when it is used, read our article.

Consequences of errors in invoices

Paragraph 2 of Article 169 of the Tax Code of the Russian Federation clearly defines on the basis of which errors a VAT refund can be refused, and which are not recognized as significant and do occur.

The task of the tax authorities is to control the timely receipt of taxes to the budget, increase their amount, prevent non-payment and reduce the amounts subject to deduction. If a specialist from the department identifies inaccuracies or typos, he will form a negative conclusion and no VAT deduction will be made.

If an employee of the Federal Tax Service was able to identify the participants in the transaction by name or tax identification number, type of product or service and their cost, amount and amount of tax, then I have no right to refuse a VAT deduction.

The signature on the documents must be affixed with your own hand; the use of a facsimile may be regarded as an error in the preparation of the document. Judicial practice proves the opposite; however, to save time on communicating with the tax service, endorse the documents yourself or by third parties, if they have the authority.

Of course, subsequently, after identifying any errors, it will be necessary to make changes to the counterparty’s registration card in order to avoid misunderstandings and controversial situations with government agencies in the future.

Customs declaration

The program allows you to create a customs declaration. Based on it, the report “VAT Register: Appendix 05” is filled out.

To do this, go to the menu “Sales - Customs declarations (export)”.

We select our implementation as the basis document and fill out the document manually.

Now, in the list of regulated reports, we create the report “VAT Register: Appendix 05”.

The report is filled out automatically based on the customs declaration data.