According to current regulations, vehicle owners have tax obligations to the state. For socially vulnerable groups of taxpayers, certain benefits are provided, up to the possibility of complete exemption from payment. The Autoconsultation magazine figured out who does not pay transport tax in Russia, what differences exist in individual regions, and how to get a preferential tax rate.

What is specified in the legislation?

The tax that is levied on vehicle owners is considered regional according to its category.

Its main aspects at the legislative level are regulated by the tax system code, as well as generally accepted laws in the region.

It is in this Code that it is explained in detail which categories of citizens are exempt from tax, in what amount of benefits are accrued, and also in what time frame the required transport tax must be paid.

Transport tax benefits and interest rates are also set at the regional level. From time to time, these legislative acts are amended and supplemented in special ways.

The latest changes to vehicle tax rates occurred not long ago and are considered generally accepted for 2021.

What is transport tax?

Transport tax is a mandatory fee that all owners, that is, owners of vehicles, are obliged to pay. This includes not only ordinary cars, but also snowmobiles, buses, motorcycles, helicopters, boats and other equipment.

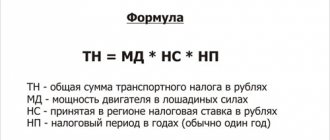

The transport tax is set in a fixed monetary amount, however, it is individual for each citizen. The tax amount is calculated depending on the category of the vehicle, as well as engine power.

Vehicles for which tax relief can be issued

Transport tax benefits are provided only for certain types of vehicles (Article 358 of the Tax Code of the Russian Federation):

- Boats that are propelled by oars.

- Passenger cars designed for disabled people.

- Ships carrying people or goods along rivers and seas.

- Agricultural machinery.

- Air transport owned by medical institutions.

- Operational transport.

Procedure and deadlines for paying car tax

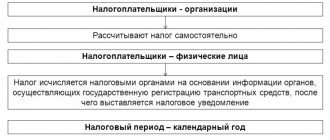

The legislation of the Russian Federation establishes certain deadlines for payment of transport tax for individuals and legal entities.

Legal entities must pay this amount no later than February 1. The amount itself must be paid in full, taking into account rubles. It is recommended to round kopecks to whole rubles.

Payment must be made only after the Federal Tax Service has sent a corresponding notification to your name. If this does not happen, it is possible that the tax office does not yet have information that you own a vehicle.

Therefore, it is the citizen’s responsibility to notify the tax office of the vehicle’s ownership.

As for the payment deadline, transport tax is paid by individuals until December 1, which follows the expired tax period.

Categories of citizens to receive benefits

Are pensioners and various categories of disabled people exempt from tax, as well as who has the direct right and opportunity to receive benefits - these are the most common questions, answers to which can be obtained from tax organizations assigned to a particular region.

These amendments are adopted on the basis of relevant local laws.

If you are interested in the question of whether a group 2 disabled person is exempt from paying transport tax, it can be noted that despite some differences in the field of transport taxes, in the majority of regions of the Russian Federation the following categories of citizens are completely exempt from paying them:

- Disabled people and WWII veterans, prisoners of fascist ghettos and camps, as well as labor veterans.

- Heroes of the Russian Federation and the USSR and persons who were awarded Orders of Glory of any degree.

- Combat veterans and war invalids.

- Disabled people belonging to groups 1 and 2, regardless of the type and method of injury received.

- Pensioners aged 55-60 years who receive a pension from the state on the most legal basis. The exception here is pensioners who previously worked in the far north. For them, an age reduction of 5-10 years is provided.

- Persons who were exposed due to radiation at Chernobyl.

- Citizens who took part in testing thermonuclear and nuclear weapons, as well as those who eliminate the consequences of emergency situations.

- One of the parents of a disabled child, as well as a father or mother who has a large family.

- In some regions, a group 3 disabled person and a labor veteran are exempt from transport tax.

A transport tax benefit may consist of complete exemption from it..

Disabled people, large families and pensioners receive a full tax exemption if they own a car whose engine power does not exceed 100 hp. If this indicator is slightly higher, the transport tax will be calculated strictly for the power that exceeds this limiting indicator.

For example, if the tax rate is 5 rubles per hp, and you have a car with a power of 115 hp, you will have to pay a tax, the amount of which is calculated using the formula 15 * 5 = 75 rubles.

And to be exempt from another part of the basic tax, military pensioners must provide documents established by law.

Full tax exemption for preferential citizens is provided for only one car. If you have two or more vehicles at your disposal, and not necessarily a car, but a car and a boat, the tax will be charged on the second vehicle in the general manner.

Speaking about the category of citizens who are completely exempt from paying tax on vehicles, we can note those people who have at their disposal a car whose power is less than 70 hp.

Information regarding the vehicle's engine power can be found on the vehicle's registration certificate. Persons whose car has been stolen are also exempt from paying the tax.

Regardless of whether pensioners are exempt from paying transport tax or disabled people, in order to receive a full exemption from transport tax, a certain package of documents and special certificates will need to be provided to the tax authority.

A complete list of them will be presented below; as a rule, it is standard. If the car is stolen, the package of documents will need to be supplemented with a document about the ongoing criminal investigation.

Video: Who is exempt from paying transport tax

Exemption from payments in case of theft

Another category of persons who are not beneficiaries, but are completely exempt from paying tax, at least for a while, are citizens whose car was stolen. Because, in fact, after the vehicle is stolen, the owners cannot use it, and there is nothing to pay tax for. In this case, it is very important to formalize everything correctly from a legal point of view by contacting the traffic police for official confirmation of the misfortune that happened to you.

Provided that the package of documents submitted for tax exemption is supplemented with a certificate of the ongoing investigation and search for the car, you will be released from payments as quickly as possible until the issue is resolved.

Required documents

To receive cash tax benefits, you will need to provide the following documents and certificates to the tax office:

- passport and its copy of the pages containing information about the person, that is, photo and personal data, as well as social status and place of registration;

- TIN;

- PTS, as well as a certificate, confirms the registration of the vehicle;

- papers confirming the right to benefits - a veteran’s certificate, a pension certificate, as well as a certificate from the hospital about disability.

This is a common package of documents for all beneficiaries . It can be supplemented depending on the category of beneficiaries to which the citizen is classified.

For example, a parent of a large family needs to obtain a certificate from social security; for veterans, it is mandatory to obtain a certificate obtained from the military registration and enlistment office.

You can obtain an exact list of documents that may be required to receive benefits from your local tax organization or on the official website of the Federal Tax Service of the Russian Federation.

The collected documents for registration and receipt of tax benefits or its complete exemption will need to be submitted to the local regional organization where the person is registered. The addresses of all organizations can also be found on the website with official information from the Federal Tax Service .

Benefits for organizations in Moscow

Transport benefits are also provided to a number of organizations that carry out socially significant activities.

The category of beneficiaries includes:

- organizations engaged in the transportation of passengers on urban and suburban routes, with the exception of taxis;

- residents of special economic zones;

- public organizations of disabled people;

- enterprises employing disabled people;

- educational institutions, including additional ones.

Individuals registered as individual entrepreneurs are also entitled to enjoy benefits in connection with a socially significant area of activity.

Registration of benefits - procedure

The package of collected documents is accompanied by a statement, which is written on behalf of the beneficiary . Another person can carry out registration only with a notarized power of attorney.

In the application, the person indicates information about himself, about the vehicle he owns, and also indicates the grounds for receiving benefits.

This document is drawn up in an individual form or filled out on a special form, which can be obtained from a tax organization.

The application must be submitted strictly in two copies. One remains with the tax office for three years and a decision is made on its basis. The second will need to be endorsed by a representative of the inspection, and then given to the applicant for safe keeping.

This is required to avoid various misunderstandings and possible loss of documents. It may take tax officials approximately 10 days to review the application and make a decision.

The applicant is informed about the decision made, as a rule, by means of a registered letter sent to the address.

If after three weeks the applicant has not learned anything about the result of his application, he will need to contact the tax inspection organization again and provide the representative with an application and documents again.

If the inspectorate has not sent a notification to pay the tax...

If the inspectorate has not sent a notification to pay the tax, then it is still better to pay it by finding out the amount of the transport tax in person or by sending a written request to the inspection. Firstly, it happens that the notice is sent to the former owner, or to the wrong person, or the document is simply thrown into a neighbor's box. Secondly, it is worth remembering that if a taxpayer’s personal account is open on the Federal Tax Service website, then he will not receive paper notifications.

The Federal Tax Service Inspectorate very rarely “forgets” about taxpayers, and if it does, then since 2015 individuals must themselves report to the tax service about their movable or immovable property, and therefore pay taxes on time, also in the interests of the owner. Therefore, if a citizen does not receive a tax notice, while his car has been registered for more than a year, this is a reason to contact the tax office to find out whether the owner is a debtor. Subsequently, a situation may arise that the owner of the car will be sent a tax notice for several years with penalties and fines, and judicial practice on such issues is controversial. Of course, you can wait until the statute of limitations for tax collection expires (three years), but even in this situation, before you become a law-abiding payer, you will have to pay the transport fee for three years.

Sample of a completed TN declaration (title page)

Sample of a completed declaration on TN (section 1)

Sample of a completed declaration on TN (section 2)

Temporary terms of the grace period

You can receive benefits or complete tax exemption for a maximum period of three years. After this, you will need to carry out the procedure again. This extension can be carried out an unlimited number of times.

The benefit may terminate in the following cases:

- The vehicle has been sold.

- The car was donated to another owner.

- Loss or complete wear and tear of the machine.

The tax inspectorate must be notified immediately about this factor. If you do not do this, the act, on completely legal grounds, can be regarded as fraud aimed at the state.

In the process of purchasing a new car, a person who is entitled to benefits or a complete exemption from tax is also required to submit to the tax office a newly completed application and the entire package of documents important for registration.

Benefits for pensioners

There is no direct tax exemption for pensioners at the national level, but is often fixed at the regional government level.

It is for this reason that you can find out about the availability of transport tax benefits in a particular area at your place of residence.

For example, elderly residents of St. Petersburg and the region are completely exempt from paying taxes, but in Moscow there is no such tax.

In Samara and the region, drivers of retirement age pay only 50% of the preliminary calculated tax. In Yaroslavl, all pensioners whose power does not exceed 100 hp can be exempted from paying the tax.

In this case, you will need to pay extra for exceeding indicators . Regional tax authorities may provide tax relief in the form of a reduction in the tax rate or payment of a certain part of it.

More detailed information on benefits can be found on the official tax website or by contacting qualified lawyers.

Federal legislation: complete list of beneficiaries

Transport tax (TN) is included in the regional group, and all funds received from this type of payment are sent to the budget of the subject of the Federation at the place of payment. This distribution is quite logical, because in the future this money is spent on the development of road infrastructure in a particular region. In this regard, the tax rate, as well as the main list of beneficiaries, is regulated by local authorities.

Nevertheless, the state has determined a list of those who may not pay transport tax in any region of our country, based on federal legislation, without regard to local legal norms:

- Passenger vehicles intended for people with disabilities, subject to their receipt through contacting social services. protection.

- Passenger vehicles issued by social authorities. protection in a manner regulated by law, provided that its power is less than 100 hp.

- Motor boats equipped with an engine less than 5 hp. Also, rightfully so, the owners of rowing boats do not pay anything here.

- Vehicles whose owners determine the main type of activity is cargo transportation or passenger transportation. We are talking about watercraft and aircraft.

- Agricultural machinery and special vehicles (vehicles equipped for transporting livestock, poultry, milk tankers, etc.), owned by agricultural producing enterprises.

- Owners of river and sea fishing vessels are also not tax payers.

- Vehicles listed as stolen, which has documentary evidence.

- Aircraft used for transporting patients and belonging to the medical service.

- Water vehicles that are listed in a special international register of ships.

Owners of all of these types of transport receive a 100% benefit from the state, and any tax questions regarding the payment of technical tax are illegal.

Which organizations do not pay tax?

Not only pensioners, but also organizations can be exempt from paying transport tax.

Vehicles intended for the activities of modern agricultural organizations and enterprises are not subject to tax, regardless of the form of ownership of the transport.

The categories of this technology include:

- all types of combines;

- tractors;

- specialized machines;

- means for transporting livestock and poultry;

- devices for applying fertilizers;

- mechanized means for providing veterinary care to animals.

All other issues regarding organizations and enterprises are regulated at the regional level . These can be various non-profit organizations, special city services - fire, ambulance and police.

Various budget organizations that provide services to boarding schools, schools and kindergartens. Road service equipment, transport investment projects and so on.

A more accurate list of organizations can be obtained from the tax office or on the official website of a particular company or enterprise.

Let's sum it up

Monetary revenues from the transport tax are directed by the state to meet the needs of drivers and improve the quality of driving, and with it the lives of citizens. For example, taxes are used to restore road surfaces and build new highways. However, there are social categories for whom it is difficult to pay due to objective circumstances, despite the fact that they own a car. Such citizens, as well as companies working for the benefit of the country, are exempt from paying funds to the state treasury for the required type of tax, for the sake of maintaining justice and providing them with state support.

Find out more about the categories of beneficiaries that are relevant for your city on the official website of the tax service