Home — Articles

Sales of goods for export are subject to VAT at a rate of 0%. But the right to apply such a rate must be confirmed by documents (Subparagraph 1, paragraph 1, Article 164, Article 165 of the Tax Code of the Russian Federation). 180 days are given for collecting documents from the date of placing the goods under customs export procedures (this date is determined by the mark on the customs declaration “Release permitted”) (Clause 9 of Article 165 of the Tax Code of the Russian Federation; Article 204 of the Customs Code of the Customs Union). The procedure for calculating tax depends on the period in which you collected the documents - before the expiration of 180 calendar days or after. And, as a result, the procedure for filling out a VAT return . For exporters, special sections have been allocated in the declaration - section. 4, 5 and 6 . We will talk about in what case it is necessary to fill out this or that section.

Export deduction rules 2021

Currently (from July 1, 2016), the deduction of VAT on exports depends not only on the presence of documents confirming this activity, but also on what type of goods were shipped abroad:

- For non-commodity goods purchased after 01.07.2016, there is the right to deduct tax during the shipment period (paragraph 3, paragraph 3, article 172 of the Tax Code of the Russian Federation), i.e., to receive it, it is not necessary to wait for the collection of the full set of documents provided for in art. 165 Tax Code of the Russian Federation. Such deductions will not be shown in section 4. They should be reflected in section 3 (letter of the Federal Tax Service of Russia dated October 31, 2017 No. SD-4-3/ [email protected] ).

- For raw materials shipped for export, the deduction procedure has not changed; you can still claim it only after receiving the last document confirming the fact of export from the Russian Federation. The list of raw materials is determined by Decree of the Government of the Russian Federation dated April 18, 2018 No. 466.

In the VAT return for taxes related to the export of raw materials that require confirmation, 3 special sections must be completed:

- 4 - for transactions with a confirmed right to apply a 0% rate;

- 5 - for transactions for which documents were collected earlier, but the right to deduction arose only now;

- 6 - for transactions that were found to have an incomplete package of supporting documents at the time of expiration of the period allotted for their collection.

The declaration form for the reporting periods for 2021 and the reporting periods of 2021 contains the order dated October 29, 2014 No. ММВ-7-3 / [email protected] as amended. Order of the Federal Tax Service dated August 19, 2020 No. ED-7-3/ [email protected]

ConsultantPlus experts explained in detail how to correctly fill out a VAT return when exporting. If you do not have access to the K+ system, get a trial online access for free.

A description of possible errors in the declaration can be found here .

General information ↑

In order to correctly fill out all sections of the declaration when exporting services and goods, you need to know the laws that you can rely on.

What documents should I collect in order to easily obtain the right to a rate of 0, when exporting to which countries is this possible and how much time is allocated for submitting the documentation?

Collection of documents

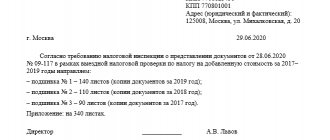

When submitting the declaration, documents must be provided that confirm the export (Article 1, paragraph 2).

This is justified:

- contracts (which take into account all changes, additions and annexes), which are the basis for the export of products;

- a bank statement indicating that the proceeds were credited to the accounts of the manufacturer-exporter;

- an application for the import of products and payment of indirect tax with notes from tax authorities about this;

- shipping documents that confirm that products have been moved from country to country (packing list, shipping specification, etc.);

- other documents listed in legislative acts.

You can submit not originals, but copies of all documentation.

But the tax authorities may require applications for the import of products in the original, although according to the law (Article 165), the taxpayer can also submit a copy.

When?

The deadline is clearly defined by legislative acts - the declaration can be submitted no later than the 20th day of the month, which follows the reporting period.

This point should be taken into account, since the taxes themselves are transferred every month.

In accordance with the law, individual entrepreneurs and legal entities whose amount of revenue excluding VAT exceeds 1 million rubles per quarter are required to report to the tax authorities every month.

Please also take into account the deadlines provided for filing declarations by payers participating in foreign trade activities.

To what country?

When exporting products and providing services, the rules that are valid for the territory of the Customs Union do not apply to other states.

Both when exporting to Ukraine and to foreign countries, such laws that unite the states of the Customs Union are not valid.

But Belarus, the Russian Federation and Kazakhstan are considered a single customs territory. Sales within this zone are regulated by the following acts:

- Agreement (01/25/2008), which describes the principles when indirect taxes are levied when exporting products to the Customs Union.

- Protocol (12/11/2009), which describes the procedure for collecting taxes and exercising control.

- Protocol (12/11/2009), which describes the nuances of the exchange of data in electronic format on paid taxes within the vehicle

For export, the rate is 0, if the entrepreneur confirms it.

When to fill out section 4 and when to fill out section 6 of the VAT declaration

Section 4 is completed if, within 180 days from the date of shipment, they managed to collect a complete package of documents confirming the export. Information about the amount of the tax deduction and the volume of the base with a 0% rate to which it relates is included in the declaration for the period in which the documents are collected, regardless of whether or not this day coincides with the end of the tax period (letters from the Ministry of Finance dated 02/15/2013 No. 03-07-08/4169, dated 02/16/2012 No. 03-07-08/41).

If the deadline for confirming the export has expired and all the necessary supporting documents have not been collected, the taxpayer must fill out section 6 of the VAT return, charging tax payable at the usual rate on the volume of shipment.

NOTE! In this case, the tax is calculated for the period in which the export shipment occurred. Accordingly, section 6 is filled in in the updated declaration for the shipment period.

When collecting late supporting documents in the next reporting period, the taxpayer has the opportunity to reflect these transactions, previously included in section 6, already in section 4 of the current tax return. At the same time, the right to a refund of additional VAT accrued and paid to the budget appears. Its amount is reflected in line 040 of section 4.

Answers to accounting questions

Our organization supplies monuments and steles (ritual items made of gabbro diabase) to Belarus. What transaction code must be indicated in page 010 of Section 4 of the VAT Declaration, is it necessary to fill out line 030 - tax deductions (export confirmed).

Answered by Olga Vekshina, expert When filling out line 010 of section 4, indicate one of the codes (select depending on the situation): - 1010421 - export to the EAEU countries - 1010461 - the same if the buyer is a person residing (registered, tax resident) in an offshore zone - 1010462 - export to the countries of the EAEU, if you and the buyer are interdependent persons - 1010463 - the same if the buyer is a person residing (registered, tax resident) in an offshore zone. Fill in line 030 only if the materials for the manufacture of monuments (or if you trade, then the monuments themselves) were registered until 07/01/2016. Rationale 1.

When to fill out section 5 of the VAT return

If the taxpayer has previously documented the validity of using a zero value added tax rate, but the right to apply VAT deductions for these transactions arose only in the current period, Section 5 of the VAT return is completed.

At the same time, it is no longer necessary to document the right to apply a 0% rate (clause 1 of Article 164 of the Tax Code of the Russian Federation).

ConsultantPlus experts provided a line-by-line algorithm for filling out the VAT return for 2021. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Rules for filling out sections 4–6 of the declaration

How to fill out section 4 of the VAT return? In section 4 of the declaration, the codes of transactions carried out using a 0% rate must be indicated line by line, and for each code - the tax base, the amount of deductions corresponding to it, as well as the amount of tax accepted for deduction with a delay, and the amount of tax previously accepted for deduction, subject to restoration. Moreover, the set of these 5 lines is repeated exactly as many times as required, depending on the number of types of operations.

This section also contains blocks of information:

- for the return of goods (lines 060–080) with information about the transaction code, the size of the tax base and the amount of tax for recovery;

- adjustment of the tax amount due to a change in the sales price (lines 090–110), in which the transaction code and data on the adjustment of the tax base when the price increases/decrease is entered.

Lines 120 and 130 reflect the amount of VAT to be reimbursed/paid based on the results of section 4.

Section 5 states:

- confirmed tax bases and related deductions with a breakdown of this data by transaction codes - in lines 030–050;

- undocumented bases and deductions on them - in lines 060, 070;

- the totals generated according to the section data are in lines 070, 080.

In section 6, regarding the calculation of VAT on transactions with an unconfirmed zero rate, the information is divided into groups of lines 010–040 with information about the transaction code, the size of the tax base, the amount of VAT charged and applicable deductions. The total lines 050, 060 indicate the amounts of calculated tax and deductions. Lines 070–100 display information on goods return transactions, and lines 110–150 display information about tax base adjustments due to changes in product prices. The final lines for the section - 160 and 170 - determine the amount of VAT payable or refundable, respectively.

For a sample of filling out a VAT return for the 4th quarter of 2021, see ConsultantPlus, having received a trial demo access to the K+ system. It's free.

To learn how to organize VAT accounting when exporting, read the article “How is separate VAT accounting carried out when exporting?” .

Results

To reflect data on transactions taxed at a 0% VAT rate and requiring documentary confirmation of the fact of export, sections 4–6 are intended in the declaration. The main volume of data (it relates to confirmed exports) falls into section 4. Section 6 provides information on transactions for which documents have not been collected justifying the right to apply a preferential rate, and section 5 contains information on transactions that have received documentary confirmation in earlier periods, and the right to apply deductions is only in the current period.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Responsibility

Clause 1 of Article 119 of the Tax Code provides for a fine of 1,000 rubles in case of failure to submit a zero declaration for the first time by an organization. The same penalty is imposed for late delivery. Judicial practice shows that the penalty can be reduced if the delay is several days.

Officials also pay an administrative penalty - a fine of up to 500 rubles.

Systematic failure to comply with the obligation to submit a zero declaration to the Federal Tax Service may result in the freezing of the company's bank accounts.