What payments are due at the birth of a child?

If you have a new baby in your family, find out about the types of financial assistance from the state for new parents. The state provides:

- monthly payments;

- one-time assistance;

- issuance of a certificate.

The state provides different options for paying benefits to young mothers. Based on his own wishes, a person has the right to choose:

- payments that are issued once;

- assistance for a specific period.

Benefits and certificates

Expectant mothers receive a birth certificate. It consists of three coupons:

- the first is left to the staff of the antenatal clinic;

- the second is needed for the maternity hospital;

- the third is presented to the clinic staff.

If there are two, three or more children in the family, then register for maternity capital. It is equal to about 453,000 rubles. The certificate is issued for maternity capital of regional significance. A woman has the right to use the money received for specific purposes. If a third baby appears, then the family is considered to have many children: the law provides for separate payments, benefits and compensation. If there are newborns born before 2013, parents have the right to apply for additional monthly benefits for children under 3 years of age.

According to Russian legislation, additional funds are paid to women whose husbands are serving in military service. The one-time payment will be approximately 25,900 rubles. If you receive a monthly transfer of funds, the financial assistance will be about 11,100 rubles. You have the right to spend the money received on the maintenance of the baby.

Mothers have the right to claim compensation, which is paid if there is no place for the baby in a child care facility. The allowance is equal to the assistance received for caring for the baby. This compensation is not available everywhere. In order not to encounter difficulties in receiving funds from the state, it is recommended to queue in advance for a place in kindergarten.

It is also worth considering the “Affordable Housing for Young Families” program. Its conditions are as follows:

- Program participants are citizens of the Russian Federation under 35 years of age: spouses or one person (there is a benefit for a single mother).

- The family has a property with an area of up to 15 square meters. m. per person.

- Citizens must present documents on income to the bank, after which a certificate is issued about the possibility of obtaining a housing loan.

The family has the right to spend money under this program at the place where it was received. The money is used to pay for a contract for the construction of a house, a contract for the purchase and sale of real estate on the secondary or primary market, as a down payment when applying for a mortgage loan, to repay debt if there is a housing loan that was issued before January 2011.

Putin's help

By presidential decree, a new benefit was introduced aimed at supporting needy families with children under the age of one and a half years, introduced in 2021. This assistance is paid monthly. It’s good that it doesn’t depend on whether parents have a job

The size must correspond to one child's subsistence level. Each region of Russia has its own minimum subsistence level, so the amount of the benefit depends on the place of residence of the family.

In each region, the cost of living is different, and therefore the amount of benefits varies. For example, in Moscow it is 14,329 rubles, in Astrakhan - about 10.5 thousand rubles.

Expert opinion

Irina Aleshina, analyst (legislation and society)

From 2021, the conditions for the first child will change: the income limit has been increased to two subsistence minimums, and the right to receive money is three years, not one and a half.

How to apply and receive. These payments for the first child are issued through the MFC or social security. Moreover, recently, registration in a specific region is not an important condition. It’s not that difficult to apply: you need to collect several documents and wait a little - the MFC will provide you with a specific list of documents. It's standard.

Money comes into the bank account every month, and the family spends it at its own discretion. The money is allocated from the budget, and not from employer payments.

Federal child benefits in 2021

The Ministry of Labor and Social Protection of the Russian Federation announced that some legislative changes will be made on additional payments. When adopting standards, government officials will become familiar with the financial situation of families. New provisions will be adopted based on the current economic situation. Having complete information about the lives of families, government officials determine whether it is necessary to provide support to citizens and under what circumstances.

Regulations regarding support for families with children are subject to review. Often in large families, parents are unable to provide a full education to their children. To simplify the life of spouses, the Russian government decided to make some legislative changes. They will be effective on February 1, 2021. Study the amounts of benefits (“maternity” and “children’s”), which will be indexed annually taking into account the inflation rate (the indexation coefficient will be approved in January 2021):

| Name of financial assistance | Amounts in 2021 | Amounts taking into account indexation on February 1, 2021. |

| One-time payment to women who registered before the 12th week of pregnancy | 613 rub. | 632 rub. |

| One-time payment at the birth of a baby | 16350 rub. | 16873 rub. |

| Pregnancy and childbirth assistance | 100% of average earnings (at least 34,520 rubles when calculating transfers according to the minimum wage) | 100% of the average salary (not less than 43,652 rubles when calculating transfers according to the minimum wage) |

| Transfers that wives of military personnel will receive | 25892 rub. | RUR 26,720 |

| Help with baby care |

|

|

| Transfers in the presence of conscripted military fathers | 11096 rub. | 11451 rub. |

As mentioned earlier, all benefits are indexed every 12 months. From January 1, 2018, a bill to increase the minimum wage will come into force. The Ministry of Labor decided to gradually increase the existing indicators to the subsistence level. Such changes will be made until 2018. In 2018 government officials increased the minimum wage by 21.7%, subsequently the amount of wages will be equal to 9489 rubles.

One-time benefit for women registered before the 12th week of pregnancy

According to the law, the mother has the right to claim a one-time benefit (when assigning benefits, social security representatives do not get acquainted with the family’s living conditions). Funds are received until the baby is six months old. Transfers of funds are made in the same amount to officially employed and unemployed mothers. If you are not employed, then assistance is processed by the social protection authorities, and the transfer is made from the federal budget. Transfer of funds is carried out for each baby born:

- RUB 16,350.33 from January 1, 2021;

- RUB 16,873.54 from February 1, 2021 (indexation of 3.2% will be taken into account).

If a woman is officially employed, then financial assistance is issued at her place of work. For unemployed or student citizens, the standard for obtaining assistance through social protection at the place of residence or stay will apply. If the family is single-parent, then the procedure for registering a money transfer is greatly simplified. The legal parent does not need to provide a certificate indicating that the other parent has not received money from the state.

For women who have registered, an additional transfer of funds is made. These include a symbolic one-time benefit - 613.14 rubles. (with such one-time compensation you will be able to make some small purchases). From February 1, 2021, this assistance will be equal to 632.76 rubles. To receive money, a woman provides her employer with maternity leave and a certificate of registration for up to 12 weeks. If the woman is not employed, then this transfer is not made.

One-time payment upon birth of a child in 2021

At the birth of a baby, a transfer of funds in the amount of 16,873 rubles is made. Such compensation is issued until the baby is six months old. Guardians are also entitled to receive this assistance. If three or more children were born at the same time, the transfer will be made to the account of the parent or guardian, the amount will be 50,000 rubles. The legislation establishes the deadlines for contacting the authorities, the employer, to obtain assistance. All types of benefits are assigned up to 6 months after the birth of newborns.

Maternity benefit

The size of the transfer that mothers receive depends on what the salary was. The average daily salary for the two previous years is multiplied by 140 calendar days. If you have twins, the number of days increases by 54. Citizens who have not worked anywhere for a long time will be denied the transfer of funds. The argument is that the unemployed woman did not pay taxes for a long time.

Child care allowance

A mother, father, grandmother, grandfather or other relative who will care for the baby up to a certain age can receive benefits. The amount depends on the citizen’s salary and is transferred monthly. If a person is officially employed, then the benefit is calculated based on 40% of the salary received over two years.

What benefits are available to expectant mothers?

According to the law, a woman in a position can count on several types of benefits at once. An important role here is played by the applicant’s availability of a job, since only officially employed citizens can count on receiving maternity benefits and a number of other preferences.

The general list of payments includes the following types of benefits:

- upon registration up to 12 weeks;

- in connection with going on maternity leave;

- one-time, when the baby is born.

All of these payments are provided on the basis of a sick leave certificate issued at the place where the woman is registered. As we have already noted, only employed citizens can receive maternity benefits, since maternity leave is a guarantee of the employee’s safety of work during the birth of the baby.

If the expectant mother does not have a job, then she has nowhere to take maternity leave, which means she is not entitled to such payments. Other types of benefits are paid without fail to all applicants, however, the procedure for registration and the package of documentation for receiving a cash payment differs for different groups of applicants.

Features of payments for children of military personnel

Young mothers and other persons who actually look after the newborn baby have the right to receive money from the state. Compensation is paid when the child’s father performs military service. Below is a list of documents for receiving funds from the state:

- Application for transfer of money.

- A copy of the baby's birth certificate.

- Certificate from the unit where the father serves.

- A copy of the marriage certificate.

The Social Security Service studies the submitted documents for up to 10 days. Subsequently, transfers to citizens are made before the 26th of each month. The money will be transferred to the applicant’s account until the child reaches the age of three or until the end of the child’s father’s military service. The amount of benefits was mentioned above.

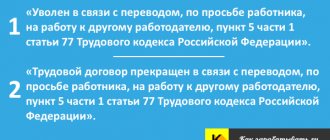

Procedure for obtaining financial aid

An important aspect is receiving the required amount. To apply for funds, a citizen must contact:

- to the employer with whom she is employed;

- to the social welfare service;

- at the place of study.

The largest number of questions arise in the first case, since not every manager conscientiously follows the procedure for paying the due benefit.

In general, the algorithm of actions on the part of the employee should be as follows:

- After receiving sick leave, you must prepare an application and submit it to the head of the company.

- Within 10 days, the accountant is obliged to accrue benefits and familiarize the woman with the results.

- Funds must be transferred to the bank details specified in the application on the first payment of wages at the enterprise or issued at the cash desk.

At this point, the procedure is considered completed, and in the future the employer will need to reimburse the amount of its own funds spent.

Changes in calculating maternity benefits for 2021

Maternity leave is time provided to employees of an enterprise for pregnancy and childbirth. The legislation provides for different types of compensation, which are issued during the specified period. Funds are transferred before and after the birth of the baby. The following changes will be made to the regulations:

- The average salary when applying for maternity leave cannot exceed the maximum base for calculating insurance premiums in case of illness and maternity for two years, divided by 730.

- The 2021 calculation period consists of only the two previous years: 2016-2017.

- Average earnings per day are up to 2021.81 rubles. Maternity benefit is equal to 282,492 rubles.

- Maternity assistance is calculated taking into account the minimum wage, equal to 43,652 rubles.

If you need to calculate the minimum amount due from the state for pregnancy and childbirth, then the calculations are made taking into account the minimum wage. The transfer sizes will be as follows:

- For childbirth without complications, a woman will receive 43,652 rubles in 140 calendar days.

- If there were complications at the birth of the baby, the mother will receive 47,597 rubles. in 156 calendar days.

- In case of multiple pregnancy, a benefit is provided - 56,967 rubles. for 194 days of vacation.

Maximum average earnings

The calculation of maternity benefits is made based on the insurance experience of a woman who is an employee of an enterprise and the size of the base for calculating insurance contributions to the Federal Social Insurance Fund of Russia. The law provides for a limit on annual earnings for calculating compensation. If the income of an employee of an enterprise for the previous 12 months exceeded 755,000 rubles, then the amount of payment is calculated from the maximum amount.

Billing period

As mentioned above, when calculating maternity benefits, the maximum average earnings of a woman working at an enterprise are taken into account. Only two years before the aid is issued are taken into account. The average earnings limit is calculated according to the following formula: (718000 + 755000): 730 calendar days. After making this calculation, you will receive 2021.81 rubles.

Minimum amount of maternity benefit according to the minimum wage

Maternity benefits are calculated based on the average daily earnings, which are determined taking into account the minimum wage. The woman will receive:

- For childbirth without complications within 140 days, 34,520.55 rubles.

- If the birth is complicated - 38,465.75 rubles. in 156 days.

- For multiple pregnancy - 47835.62 rubles. in 194 days.

How much can you expect?

According to the law, an employed woman during her incapacity for work must receive compensation at the level of her average income for the last two calendar years.

The estimated size is determined as follows:

The income for the last two years is added up, the resulting amount is divided by 730 days (two years). Then the identified average daily two-year income is multiplied by the number of maternity days. This is how the size of the B&R benefit is determined .

At the same time, a limit on the amount has been established.

In 2021, a woman can receive the maximum:

• for normal pregnancy and childbirth of one child – 322,190 rubles ;

• birth of two or more children – 417,232 rubles ;

• complicated childbirth requires a maximum payment of RUB 335,506.

In 2021, the minimum size (regular pregnancy) is 55,830 rubles.

Regional payments

Pay attention to transfers for regional programs. Financial assistance is issued only to some Russian citizens, because it is provided in certain regions. However, if a baby or several children are born, it is important to find out in advance what regional transfers are and how such material support is processed.

One-time payments at the birth of a child in Moscow

Many young families live in the center of the country. People living in Moscow can apply for:

- transfer of the amount - 5500 rubles, if the firstborn is born.

- amount 14500 rub. at the birth of children after the firstborn.

Luzhkov payments

Not all citizens of the Russian Federation know what the Luzhkov payments are, which were established in 2004 by a decree of the Moscow Government. Luzhkov payments for the birth of a child in 2021 will be made according to the old rules (the procedure is established in a separate standard). To receive money, you must meet the following criteria:

- spouses under 30 years of age;

- Permanent residence in Moscow;

- Russian citizenship of the father or mother.

Payments upon the birth of the first child in 2021, according to the program, are made in the form of an amount equal to five times the subsistence level. When a second newborn appears, you can claim an amount equal to seven times the minimum subsistence level. The third child receives a benefit equal to ten times the minimum subsistence level. The latter option of assistance is rarely issued, because a third child is rarely born to spouses under 30 years of age. When triplets are born, benefits are accrued for each newborn.

- What foods contain magnesium?

- For what diseases is a disability group given?

- Complivit calcium d3

At the birth of three or more children

Families with three or more children are rare. For exceptional cases, the government of the Russian Federation has made some changes to the legislation. These standards help families live more fully. If you have three newborns, you can count on financial assistance in the form of a one-time benefit in the amount of 50,000 rubles.

Recalculation of defined benefits

Is it worth recalculating previously assigned benefits later than January 1, 2021 - no. According to the rules established by law, the calculation is made once, on the date of the actual start of the citizen’s vacation.

Therefore, people receiving payments accrued in 2018 will continue to receive them in 2019, without changes.

An exception is if the person who took the payment suddenly interrupted his vacation and later, by 2019, resumed it again. The benefit will be calculated again and new values will be taken.

How to apply for a lump sum benefit for the birth of a child

After registration of financial assistance, funds will be transferred to you - 16,873 rubles. This monetary compensation should be issued before the baby turns 6 months old. To receive money, you need to contact the HR department at the enterprise. If a woman is not officially employed, then the social service will handle the registration of financial assistance; female students should contact the dean’s office of the educational institution.

What documents are needed

To obtain assistance, find out about the certificates that need to be prepared. Financial assistance for the birth of a newborn is possible if you have:

- Statements.

- Birth certificates.

- Parents' pension insurance certificate.

- Certificates from the housing department confirming that the applicant lives together with a minor.

- Parents' passports.

- Extracts from the work book.

- Certificates stating that assistance from the state has not been previously provided.

Unemployed citizens additionally provide a copy of their passport and work book. Amount 50,000 rub. obtained from the USZN at the place of residence upon presentation of:

- applications for the purpose of funds;

- passports;

- birth certificates;

- certificates of newborns living together with their parents or guardian.

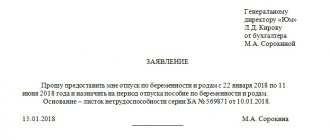

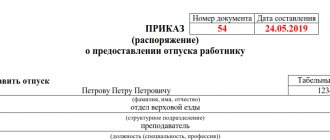

Sample application for maternity leave and benefit payment

There is no unified form for such samples. Each enterprise has its own model, but the meaning of each is approximately the same. The application must contain the following information:

- To: Full name, position of chief, company name;

- From: Full name and the position of the employee;

- By ;

- Statement of the essence of the request - to give leave and pay for it;

- Appendix as the basis of documents;

- Number and signature.

Thus, the state is far from indifferent to children's well-being. Laws establish a wide range of benefits and subsidies for mothers and children.

What is required for child care in 2021

Assistance up to 1.5 years is paid immediately after sick leave for pregnancy and childbirth - maternity leave. If you are officially employed, the funds are transferred by the employer. The money comes to the account 2 months after the birth of the baby. The amount depends on the average earnings of the mother or father (if maternity leave is issued for him). There are separate standards for the payment of funds to unemployed citizens. If children are from 1.5 to 3 years old, parents have the right to claim only compensation benefits.

Up to 1.5 years

The legislation establishes specific payment amounts. Officially employed citizens have the right to claim the amount of 3163 rubles. for the first newborn, for the subsequent baby - 6327 rubles. Transfers can be up to 24,536 rubles. If the organization is liquidated, the mother will receive 40% of her salary for the last 2 years during maternity leave. The benefit is registered with the social protection authority. The limit amount is 12262 rubles.

Officially unemployed citizens of the Russian Federation have the right to apply for financial assistance - 3163 rubles. Payments for the birth of a second child in 2021 will amount to 6,327 rubles. If the mother went on maternity leave in 2014, and in 2021 another baby appeared and maternity leave was issued again, then when calculating the amount of benefits, not 2015 and 2021, but 2012 and 2013 will be taken into account.

Before reaching 3 years of age

If desired, the mother has the right to extend maternity leave until the baby reaches 3 years of age. The employer will pay compensation - 50 rubles. These transfers are made regardless of how many children there are in the family. The specified amount of compensation does not apply to citizens living where radiation has spread or who have a preferential socio-economic status. For example, residents of Chernobyl submit transfers in the amount of 6,000 rubles, military personnel have the right to submit an application in the amount of 10,528 rubles.

Deputies of the State Duma of the Russian Federation in October 2018 proposed to approve legislative changes regarding the monthly transfer of funds to new parents with children from 1.5 to 3 years old who have not received a place in a nursery or kindergarten. Deputies of the State Duma of the Russian Federation offered financial assistance equal to 3,000 rubles.

Procedure for calculating sick leave for pregnancy and childbirth

BiR leave is paid:

- girls students;

- unemployed women at the labor exchange;

- dismissed upon liquidation of the organization;

- women in military service;

- employed employees.

Full-time female students have the right to academic leave and receive benefits from the educational institution. Its size is determined by the scholarship accepted at the given university. They have no right to expel students for absenteeism or poor academic performance. Payment is required even for those who study on a paid basis.

In other cases, the amount of the benefit depends on the length of work experience before pregnancy and the income of the last 2 years.

When an organization is liquidated, for example, due to debts or if an individual entrepreneur declares bankruptcy and ceases operations. It is important to understand that the law in this case is on the side of the woman in labor. The main thing is to immediately be registered with the employment center, thereby officially declaring that you are looking for a new job. Apply for benefits no later than one year after termination of the employment contract.

This type of payment can only be received through social security at the place of registration. This is because contributions from official income no longer go to the social insurance fund. The benefit is significantly less than that of a working mother-to-be.

Federal Law No. 81 of May 19, 1995 establishes a monthly amount of 300 rubles for those registered on the labor exchange. Thanks to the inflation index, this amount increased to 628.47 rubles. One day of sick leave costs (628.47 rubles/30 days) = 20.95 rubles. We get the following gradation:

- 140 days*20.95 rub. = 2,933.0 rub.

- 156 days* 20.95 rub. = 3,268.2 rub.

- 194 days* 20.95 rub. = 4,064.3 rub.

Please keep in mind that this type of government support is indexed starting in February of each year. Thus, the amount in 2019 will be higher.

In the case of maternity leave for an employee whose work experience is less than 6 months or this is her first job, as well as in a situation where maternity leave begins in the current year and there was no income for the last two years, the amount of the benefit will be determined from the minimum wage.

Since February 1 of this year, the minimum wage was 9,489 rubles, since May it was already 11,163 rubles, and in 2021 it will increase to 11,280 rubles.

Keep in mind that there is a minimum amount of sick leave on maternity leave based on the minimum wage, and the calculation is based on the federal value of this indicator, not the regional one.

What is the minimum for one-time financial assistance from the Social Insurance Fund? The following formula is used to obtain the amount of average daily earnings:

Formula for calculating average daily earnings based on the minimum wage

((minimum wage*24 (working days)/730 (sum of 2 calendar years)

If sick leave is open from January 1 to April 30, 2021, the amount will be:

- RUB 9,489 First we multiply by 24, then divide by 730 = 311.97 rubles.

- 140 days of sick leave * 311.97 rub. = 43,675.8 rub.

- 156 days * 311.97 rub. = 48,667.32 rub.

- 194 days * 311.97 rub. = 60,522.18 rub.

From May 01, 2021 After the increase in the minimum wage, the payment increased.

- RUB 11,163 multiply by 24, then divide by 730 = 367 rubles

- normal pregnancy and childbirth 140 * 367 = 51,380 rubles.

- complicated 156 * 367 = 57,252 rub.

- twins/triplets 194*367 = 71,198 rub.

This is almost 20 times more than if a future mother’s job was eliminated.

In a situation where a woman worked for a full 2 years before going on maternity leave and is now actively working, it is necessary to calculate the amount of daily earnings. The woman in labor will be compensated for 100% of her earnings. Use this formula:

Formula for calculating average daily earnings based on income for the previous 2 years

Income for 2 years - amount for sick leave

730 (days in the billing period) – number of days on sick leave

Example 1:

Let's look at a simple case: a girl goes on maternity leave in June 2021. All earnings for 2021 are 750,000 rubles, for 2021 - 820,000 rubles after deducting sick pay. In 2021 I was sick for 12 days, in 2021 – 5 days.

- (750 000 + 820 000)/ 730 – 12 – 5;

- 1,570,000/713 = 2,201.96 rubles.

But the law sets a limit on social insurance contributions. In 2021 it was 718,000, in 2021 - 755,000, in 2021 it will be 815,000 rubles. This means that the numerator cannot be greater than these amounts. And the denominator in case of exceeding the maximum will always be equal to 730 days. We get:

- (718,000 + 755,000) / 730 = 2021.81 rubles.

In total, for the entire hospital stay, the mother in labor will receive:

- 140* 2021.81 = 282,493.4 rubles.

- 156* 2021.81 = 314,778.36 rubles.

- 194* 2021.81 = 391455, 14 rubles.

Features of accrual of sick leave for pregnancy and childbirth

Income from going on maternity leave is not subject to personal income tax, it is transferred on the day of the next salary, after sick leave is received, a maximum of 10 days is given for calculation, the funds are transferred from the social insurance fund.

Another important point is that if regional coefficients work for all the benefits listed above, then the BiR benefits are not multiplied by increasing coefficients. For example, workers in the Far North and residents of the Kuban will receive the same financial support.

According to the norms of the Labor Code of our country, when employing a woman preparing to become a mother in several places, each employer must give leave and pay the due benefits.

An important point is the opportunity for each employee to exercise the right to change years. This concession works if the employee was on maternity leave during the billing period. Thus, when you go on maternity leave again, you can choose the years with the highest earnings.

The unemployed are not entitled to this payment, since the Social Insurance Fund has not been replenished. Women military personnel receive a benefit amount that depends on the amount of their salary. It is calculated in the same way as for an employed mother. Military personnel also have additional social support in the form of:

- early vouchers to kindergarten;

- receiving food;

- payment for children's meals in schools.

There is a unique benefit for the spouse of a military personnel. If their marriage is officially registered, the 6th month of pregnancy has begun, a one-time assistance of 26,539.76 rubles is due. It is also subject to indexing.

The state also supports citizens who have adopted a newborn. The main condition is that the court makes a decision before the baby is 3 months old. You can rest for 70 days after birth or adoption, or 110 days if there are already several children.

Maternal capital

Such material assistance is one of the most discussed and causes a lot of debate. Some government officials are demanding the abolition of such compensation and the redistribution of money to increase transfers to 1.5 and 3 years. Some deputies are in favor of extending the program and propose establishing payments for the birth of a third child in 2018 and benefits for low-income families.

Since the beginning of the program, all families with two or more children were able to receive a certificate. In 2021, the Government decided that parents have the right to receive 25,000 rubles. in cash and spend these funds on personal needs. This change was made to create financial protection for families during an economic crisis in order to improve the demographic situation. Money was transferred regardless of the income level of the spouses. In 2021, it will no longer be possible to cash out money received as maternity capital.

Maximum benefit

There are no restrictions on benefits, but the possible amount of daily income is limited. It is used in calculating the amount (FZ-255).

Calculation of the maximum allowable amount of daily established earnings:

· Maximum value = we need the amounts of the maximum established values of the general base, where all insurance premiums issued to FSS/730 citizens are calculated.

When a citizen’s vacation begins later, in 2019, the maximum values of the general base are used for calculations, which are:

· 2017 – 755,000 rubles;

· 2018 – it was 815,000 rubles.

· 2019 – amount 865 thousand rubles

Calculation example:

· 2150.684931 x (755000 + 815000) : 730 days

You should multiply the daily earnings figure (its average value) by the average monthly period - 30.4:

· 65 380,812917 (2150,684931 * 30,4)

Calculated from average monthly earnings:

· 65380,821917 * 40% = 26152.33 rubles

This is how much the Social Insurance Fund must transfer to employees.

Additional support measures

There are also other types of support for families at the birth of a child.

- Compensation for failure to provide a place in a preschool institution. This program is not available in all regions. It provides financial support to families whose children were not accepted into kindergarten after they reached the age of one and a half years. For example, in Kirov, 2,500 rubles are paid monthly until the child’s third birthday. But in Tomsk they pay 4,000 rubles. When a child reaches 3 years of age, the allowance is also 4,000 rubles and is paid until 5.5 years.

- A program to help young families purchase housing with a mortgage. The program is to reduce the interest rate on your mortgage or provide funds for a down payment. Families who do not have their own home can take advantage of the benefit, provided that the parents are under 35 years of age. The procedure for provision is regulated by the Government Decree under the program “Providing affordable and comfortable housing and utility services to citizens of the Russian Federation.”

- Reduced tax deduction. Each parent can contact the accounting department at the place of employment to submit information about their children. This will reduce the amount of tax deduction that is made monthly from wages. Thus, for the first and second child the tax will not be withheld from the amount of 1,400 rubles, for the third and subsequent – 3,000 rubles, for a disabled child – 12,000 rubles. In this case, the total amount is added up depending on the number of minor children.

- Regional payments for the birth of a third child. The program is established by regional authorities. The average payment amount is 100,000 rubles. Additionally, families in some regions are allocated a plot of land.

- If an adopted child appears in the family, the one-time payment will be 16,759.09 rubles. When adopting a disabled person, a child over 7 years old, or several children at the same time, the amount of compensation will be 128,053.08 rubles.

- Refund for kindergarten fees. 20% is provided for the first child, 50% for the second, 70% of the deposited amount for the third and subsequent ones. Available to everyone, regardless of family status. Transferred to a bank card or account monthly after full payment for kindergarten has been made.

- Nutrition. Low-income families, upon application, are given baby food every month until the child's 3rd birthday. These are adapted milk formulas, cereals, yoghurts and other fermented milk products. The kindergarten provides juices.

- Vouchers to health camps, sanatoriums, resorts. Issued to disabled children and persons accompanying them. Low-income families in some regions are also paid for their children's stay in summer camps.

You should check with the social service of your region about the required payments. This is especially true for large and low-income families, who can count on various benefits.