Income proof is required in many different cases. It is used to apply for a mortgage, tax deductions, calculate pensions, and adopt a child. Most often, to improve your credit history with a new loan.

This document is submitted to social security so that the family is recognized as low-income. In such cases, the state assigns financial assistance due to low or no income of family members.

Low-income families with minor children

Poor citizens with minor children are often in difficult life situations due to a lack of means for subsistence. This circumstance is caused by the fact that after the birth of a child, one of the parents is forced to not work and care for the child. The state tries to maintain a decent standard of living and helps meet the needs of sections of society. The authorities finance targeted assistance, smooth out the inequality of citizens, and take an active part in providing material benefits to those in need.

Attention! In the constituent entities of the Russian Federation, the executive branch sets the subsistence level. For different demographic groups of the population, a different indicator is established, depending on the cost of the minimum set of goods necessary to maintain life (the consumer basket).

The state seeks to help families with children, since their expenses inevitably increase, and incomes may only decrease

When is a certificate needed?

The main purpose of such a document is to provide the social service with information about the financial situation of a family or individual citizen. With its help, the condition is assessed and the degree of need for individual benefits or benefits is determined.

Help may be required upon receipt of:

- Unemployment benefits

Material payments after the birth of a child- State scholarships

- Benefits for utility bills

- Benefits for travel on public transport

- Government subsidies

- Financial assistance to single mothers, persons with disabilities, pensioners, large families

In general, a document can be requested from almost all social services whose activities are related to the provision of certain benefits. The information obtained from it is compared with the cost of living. Based on this, a decision is made on the calculation of social benefits.

Purpose of help

The decision of the social security authority to recognize a person as low-income and to award child care benefits is made only after submitting an application and the necessary set of documents. A certificate (for the past period) of the income of an able-bodied citizen confirms the family income. An application to the social service can be submitted in simple or electronic form. Contact the social service directly or the MFC department. To obtain the status, you must have the following facts:

- the average per capita family income is less than the subsistence level;

- able-bodied family members do not work for good reason;

- adult children are studying full-time in an educational institution;

- Cohabitation.

You must provide proof of income for the previous three months to receive benefits.

Important ! The information presented in the application and confirmed by official documents is checked for purity and accuracy by social security employees.

Legal entities and entrepreneurs are responsible for the production of false documents, and the applicant is responsible for their use (submission to social security authorities).

Forged documents have no legal force. If facts of forgery are revealed in order to acquire rights and obligations, the perpetrators will be prosecuted.

You cannot provide false information - this is fraught with criminal liability

After 10 days, a decision is made on the citizen’s application. In special cases, a commission inspection (additional) may be carried out. Such cases include checking information about the income of a family (person).

Attention! If an inspection is ordered, the applicant must be notified no later than 10 days from the date of filing the application for the assignment of benefits (assistance).

In case of unlawful refusal, the actions of social security employees can be challenged in court.

You can apply for monthly benefits within six months after the child turns one and a half years old, but it is also possible earlier. If the reasons for missing the deadline for applying for benefits are valid, the district social protection department makes a decision on its restoration and calculation of the amount.

It is important to apply for benefits no later than six months after the child turns one and a half years old

The executive authority has approved a list of circumstances confirming the validity of missing the application deadline.

- Illness of a person that prevents treatment (over 6 months).

- Extraordinary circumstances, natural disasters.

- Change of place of residence.

- Death of a family member.

- Facts recognized by the court as valid.

Information from the employer

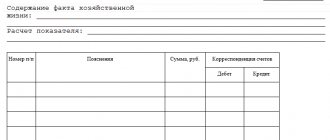

The subsidy certificate form itself has 3 sections, each of which must be completed:

- Employee data . The full name is entered, the SNILS number and the nature of the work are indicated (whether it is the main one or not).

- Employer information . There are two fields here - for legal entities and individual entrepreneurs. The required one is filled in. The name and address of the company and the accountant's telephone number are indicated. The individual entrepreneur enters his full name, place of registration, passport details and telephone number for contact.

- Income data . They are entered into a special table with the columns “month, year”, “amount”. It is necessary to reflect information for the last 6 months. If there were already accruals in the month the request was received, then they should be entered in an additional column.

After filling out all the data, you need to double-check it again, and only then sign the certificate.

One-time allowance for the third child

At the birth of a third child, starting from February 2021, a benefit in the amount of 17,479.73 rubles is accrued. The following documents are submitted along with the application:

- passport;

- child's birth certificate;

- certificate of family composition.

At the birth of children, lump sum benefits are also paid

Attention! The benefit will be paid 10 days after submitting the application with documents attached. In the event of an unmotivated refusal to pay, the decision must be appealed in court.

How to submit documents through the MFC or State Services

Procedure:

| Through MFC | There are no special features to submit an application here. However, there is an electronic queue, which makes making an appointment very simple and convenient. To do this, you can register on the website of this institution or call by phone. |

| Through the State Services website | First of all, you need to log in to the site. You will be able to log into your personal account only after receiving your password. After this you needO:

Registration of the application takes place within one working day. Funds for the lump sum benefit must be transferred within 10 days . |

Sample certificate 2-NDFL

Benefit calculation

SzM = DZ/KdG, where:

SzM - the amount of salary for the month.

DZ - salary income for the year. Bonus payments are not taken into account.

KdG - number of days worked in a year.

P = SzM x KdM, where:

P is the amount of benefit.

SzM - the amount of salary for the month.

KdM - the number of days in three months (worked).

The benefit amount can be calculated using a special formula

Important! The accrued amount of vacation pay is not taken into account.

Features and filling rules

Before entering information into the document, it is recommended to study the explanations for filling out the certificate given in the text of the request. In particular, the following rules are established:

- total indicators are written taking into account taxes paid;

- when an employee pays alimony, their amount is not taken into account in monthly income (and a copy of the writ of execution is attached to the certificate);

- All fields are required to be filled out; if you enter dashes or leave fields blank, explanations must be given for each of them.

The certificate must be filled out carefully and accurately so as not to make a mistake, since corrections and blots are not allowed.

Deadlines and mechanism for obtaining a certificate

For an objective analysis of a person’s financial situation, an official income document will be required. The rules and procedure for drawing up this document were approved by Order No. 182n by the Minister of Labor and Social Protection of Russia on April 30, 2013. In Appendix No. 2 of the Order and in Art. 62 of the Labor Code of the Russian Federation regulates the mechanism for providing information.

The employee (former employee) applies in writing to the organization’s management for official information about wages for the previous three months. An interested person may apply through a representative. The authority must be formalized by a power of attorney (notarized). The power of attorney specifies the authority to contact government and commercial organizations.

A written application for the issuance of a certificate is registered. It is assigned an incoming number. The manager reads the application and checks the representative’s credentials. Then he endorses the document and sends it to the accounting department, to the head of the department.

Attention! By order of the immediate supervisor, the accounting employee is obliged to immediately begin drawing up a certificate.

Certificate of income for 3 months

Information is entered on the basis of reporting data, cash orders and official records. Within three days, the applicant must be given a completed document approved by the chief accountant and head of the organization. Upon termination of the employment relationship, the employer is obliged to issue the specified certificate on the day of dismissal of the employee. If the document has not been served, the employer notifies the person of the possibility of receiving the certificate in person or by mail. Upon receipt of an instruction (in writing), the employer sends a certificate by registered mail to the place of registration of the interested person.

The certificate can be typed on a typewriter or printed out on a printer, filled out manually with a ballpoint pen (ink must be black or blue).

As a rule, the certificate is issued within three days

Important ! Misprints and misprints, corrections, cross-outs and erasures in the certificate are unacceptable. The social security authority will not accept such a document. Endorsing signatures must include a transcript and indicate the person’s position.

The employee is issued a certificate of his income without fail, without request, upon dismissal.

The certificate should not contain errors or corrections

The completed income certificate, approved by management, is certified by the organization’s seal (if any) at the bottom of the certificate in the left corner. A copy of the sample stamp is kept at the tax office.

Important information and signatures are not covered by a seal. If the organization does not have a seal, copies of the documents are issued along with the certificate:

- a document on the right to sign a certificate by a person without a power of attorney;

- power of attorney on behalf of the organization.

- passport, ID;

- document certifying registration as an individual entrepreneur (certificate).

The certificate must have a seal, and it must be placed so that it does not overlap the entries and signature

Important ! All attached documents must be properly certified.

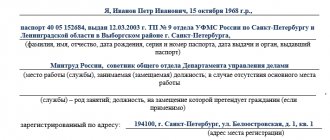

The certificate contains such information.

- Official name of the organization.

- Details, address, telephone numbers.

- Date of preparation.

- Outgoing number.

- Title of the document.

- Information about the person to whom the document is issued. Last name, first name and patronymic, date of birth, identification document number, and person’s registered address (place of residence) must be indicated in full.

- The period of labor or civil law relations.

- Position held, term of the concluded employment contract (period of activity in the organization).

- The amount in figures and words of accrued earnings for the previous three months.

- Explanation of amounts by month, namely year, month and corresponding accrued wages.

- Withholding deductions for each month (amount).

- Number of days worked in each month.

- Where is the certificate provided?

The certificate must contain all the necessary information

An income certificate can be prepared using computer technology using the C1 program.

Filling example:

In the “Operations” menu, go to the “Documents” submenu. In the section “Information on income”, “Transfer to individuals”, “Fill out” - fill out the document form. When the information is entered and the certificate is generated, it must be printed.

An accountant can use the 1C program to prepare such a certificate.

Where to get it?

The document is drawn up by the employer. If the company is liquidated, then information about payments is included in the template based on archival information.

Unemployed people receive a certificate from the Labor Center at their registration address . Data can be obtained based on information from form 2-NDFL.

If on maternity leave

You should contact the employer directly or send the application by mail. Written information is also compiled at the place of operation of the employer's branch or representative office.

The payments include amounts as benefits for a child up to 1.5, 3 years old, and other funds provided for by collective agreements.

IP

The entrepreneur submits Form 3-NDFL to social security. It is needed even if a businessman has zero income.

Information is provided by the tax office on the basis of periodic reporting.

Certificate of income for an individual entrepreneur

The self-employed population conducting individual entrepreneurial activities can apply the taxation system. Depending on the reporting procedure to the tax office, an entrepreneur can confirm his income for the previous year:

- OSN is a general system. A 3NDFL declaration (in a copy) for the previous year is submitted to the social protection department;

- The simplified tax system is a simplified system and the Unified Agricultural Tax is a unified agricultural tax. Providing a copy of the reporting for the previous year.

If a person is an individual entrepreneur, he can issue a certificate to himself

Important ! These documents are not submitted to the social security authority as a certificate of income for the previous three months.

For the previous three months, entrepreneurs operating under a license (patent system) will be able to confirm the amounts received, since they keep monthly records of income in the general ledger.

Important ! An individual entrepreneur issues a certificate of income to himself based on bank account statements.

The certificate states:

- registration information about the entrepreneur, date of origin;

- date of registration with the tax authority;

- period of entrepreneurial activity;

- information on the total amount of income for the three previous months;

- monthly data on personal income amounts (can be displayed in table form: year, month, amount).

The certificate from the individual entrepreneur must indicate registration information, period of activity, as well as the amount of income

The validity period of the received certificate is not determined by the legislator. But in order to analyze the applicant’s income for three months and recognize him as low-income, the document must record the financial situation for the previous period before receiving the certificate. The certificate is valid for one month. Receipt of the document is confirmed by a receipt from the applicant, information about the issuance is entered into the document flow book.

Important ! If the organization has ceased its activities, information about income is obtained from the tax office. A person registered for unemployment requests information from the employment center. Students are at the educational institution. Pensioners - in Pension Fund branches.

The certificate is valid for a month from the date of issue

conclusions

A salary certificate for social protection authorities performs a very important function - it clearly shows the financial situation of a certain person and his degree of social security.

If a person or his family really needs financial assistance from the state, then there is a reason to take advantage of the situation and ensure that budget money is directed to solving personal financial problems.

It is worth understanding that if false data is submitted, the individual who allows this will be forced to pay all financial costs incurred by the state.

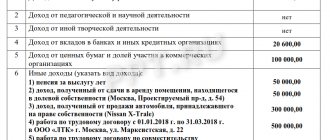

Family income

The rules establish accounting of cash receipts to the family budget for the previous three months.

Family income is formed from the totality of all cash receipts into the applicant’s family budget. Low-income status must be confirmed every three months, so the information in this document is updated every quarter.

Ds = SovD/Kch, where:

Ds - family income (average per capita).

SovD - the total income of all family members for the three previous (before filing the application) months.

Kch - the number of all family members living together.

Ds< PM

PM - subsistence level for the billing period.

Family income is formed from the totality of all cash receipts to the family budget

In accordance with the RF IC (Article 14 of the Family Code of the Russian Federation), close relatives are spouses, parents and children. The remaining persons living together are recognized as family members by court decision.

When determining total income, all receipts of funds (in kind and in monetary terms) are taken into account.

- Payments made under the wage system. Average earnings are calculated based on the recorded data.

- Compensations, allowances, benefits and scholarships.

- Social contributions and assistance.

- Insurance payments.

- Any income from property (sales and rentals).

- Monetary allowance.

- Income from contracts and received from business activities.

- Income received from alimony obligations.

- Interest on deposits in financial institutions.

- Financial resources provided free of charge or by inheritance.

- Benefits and government (including medical) assistance provided as support, expressed in monetary form.

- Income from securities.

When determining total income, all financial income is taken into account, including alimony, compensation, scholarships, etc.

Important ! Resolution of the Government of Russia No. 213 (04/11/2003) has become invalid. The calculation of average earnings is currently carried out on the basis of the Procedure approved by Decree of the Government of Russia No. 922 (December 24, 2007).

The amount of alimony transferred to third parties is excluded from their total family income.

What types of income are taken into account?

When applying for a job, only income received at the place of employment is included in the list. For most citizens, work is the main source of material resources.

However, when issuing certificates and making decisions in social services on the provision of financial assistance, other factors are also taken into account.

Among them:

Family members own real estate- Recent purchases involving large sums of money

- Materials received in the form of an inheritance or gift from relatives

- Traveling abroad

In addition, income certificates often indicate only the official salary stipulated by the employment contract, while information about additional accruals is not included. In this regard, the document becomes unreliable.

Legal and information support

| Law number | Title, notes |

| FZ-255 (December 29, 2006) | “On compulsory social insurance in case of temporary disability and in connection with maternity” |

| Order of the Ministry of Labor of Russia dated April 30, 2013 N 182n | “On approval of the form and procedure for issuing a certificate of the amount of wages, other payments and remunerations for the two calendar years preceding the year of termination of work (service, other activities) or the year of applying for a certificate of the amount of wages, other payments and remunerations...” |

| Decree of the Government of the Russian Federation of August 20, 2003 N 512 | “On the list of types of income taken into account when calculating the average per capita family income and the income of a citizen living alone to provide them with state social assistance.” It approves a list of types of income that are taken into account when recognizing a person as low-income and providing him with social assistance. |

| FZ-44 (04/05/2003) | “On the procedure for recording income and calculating the average per capita income of a family and the income of a citizen living alone in order to recognize them as low-income and provide them with state social assistance” |

| Federal Law-178 (07/17/1999, last edition dated 04/01/2019) | “On state social assistance.” |

In various legislative acts you can find information on issuing a certificate, recognizing persons as low-income, and paying them benefits.

In what case is the form drawn up?

A salary certificate can be drawn up for submission to social security in many life situations.

For example, it is necessary to apply for a pension or subsidy, as well as to open maternity payments and benefits.

Sample certificate for receiving subsidies and assigning a pension.

The employment center also requests from its visitors the original of this document with a wet stamp - a sample for the employment center.

A Russian citizen, in the event of filing a claim in court or when obtaining a visa to travel abroad, will also need to provide certified information about his income.

Even if any funds are taken from the bank for certain needs, the individual is required to present to the financial institution a document that officially reflects the amount of all his official earnings.

ABOUT EGISSO

The information resource was created on the initiative of the Pension Fund, which is the operator. The Pension Fund ensures uninterrupted operation and regulates the process of entering information into the system and exchanging information. The operator determines the amount of data required in the work and the type of electronic media.

In the Unified System (online portal for social security of citizens), the state places all information on decisions made on the provision of assistance and benefits, which can be obtained upon request in electronic form. The system has access to information located in territorial and state databases, to information stored in organizations and structures that provide social assistance.

The unified system performs the following tasks:

- forms a general information database on the services and assistance provided;

- identifies recipients of social support by category;

- provides information and legal services;

- exercises control over the quality and volume of services provided to the population.

On the EGISSO Internet portal you can find information regarding social assistance to the population

Includes information:

- about the person to whom services were provided as part of social assistance;

- personal information about social support measures;

- information about organizations that carried out social charges;

- legal framework within which state social policy is implemented;

- information on social support measures at the regional level;

- about resources where information about assistance provided to citizens is posted.

The functioning and volume of the information resource of the Unified Database is regulated by the Russian Government. Information on requests is provided in accordance with Federal Law No. 152 (07/27/2006) on personal data.

Information is provided in accordance with the law on personal data

Information constituting a secret (state or personal) is not included in the Unified System:

- the mystery of adoption;

- the mystery of medical diagnosis;

- state and commercial secrets.

Attention! New technologies and the introduction of intelligent systems into life significantly increases efficiency, speed of problem solving, and information content of the population.

Filling out 2-NDFL

This is a unified form that reflects the citizen’s income, as well as the amount of contributions to the Tax Service. You can only fill out a ready-made form, which you just need to download from the official Internet resource of the Federal Tax Service.

Typically, 2-NDFL is required not to reflect a citizen’s income, but to determine the amount of deductions in the form of taxes. This is necessary when applying for subsidies and receiving some other types of financial assistance.

FAQ

Question : I worked at Brewery LLC. As of April 21, 2021, I am fired. What period is indicated in the salary certificate?

Answer : The certificate provides information about earnings from January 1 to the last day of March.

The certificate indicates income for the last full three months of work

Question : My son will turn 18 on December 31, 2019. Explain when does adulthood come?

Answer : A child does not become an adult on his birthday, but after it, on the next day.

Question : I belong to the category of low-income citizens. It is necessary to confirm your status and provide a certificate of income. In fact, I live at an address different from my registered address. Should the certificate indicate the place of residence or registration?

Answer : The document indicates the place of registration of the person on the date of preparation. If a citizen is temporarily registered, the address is indicated in brackets. It is necessary to indicate the place of actual residence in the absence of any registration.

The certificate indicates the place of registration of the person

Question : Are the amounts I received while participating in the election commission considered income?

Answer : The specified amounts of money must be included in the family budget income. Additionally, indicate all financial receipts in any form (cash or non-cash).

Question : My husband received his salary in foreign currency. How should the amount be indicated on the certificate? If income information is recorded in rubles, then at what rate should it be converted?

Answer : Income is indicated in Russian rubles as of the date the certificate is prepared. Foreign currency is converted into national currency at the official exchange rate of the Central Bank of the Russian Federation, which is publicly available. Just use the link: https://www.cbr.ru/currency_base/daily/.

Income is indicated in Russian rubles

Question : I have company shares, how are they taken into account in the amount of income?

Answer : Shares belong to the category of issue-grade securities. The section indicates the total market price. If the purchase is in a foreign currency, the equivalent in Russian rubles should be indicated at the official exchange rate of the Central Bank of the Russian Federation.

Question : How are property assets valued?

Answer : To assess the financial situation of a person, all movable and immovable objects are indicated. They are valued at market value.

To assess the financial situation, movable and immovable objects are indicated

Question : My family and I live and are registered together with my wife’s parents. Is it necessary to indicate the size of the mother-in-law's and father-in-law's pension? Will the cost of an apartment owned by the father-in-law be taken into account when defining a family as low-income?

Answer : Your wife's parents are members of your family. The income of all people living together must be indicated. The apartment in monetary terms and parents' pensions will be taken into account.

Question : Registered with my family in my mother’s apartment. Mom also has registration in the apartment. However, we do not live together; we rent an apartment in another area. We have our own family budget, we eat separately from our mother, we do not have common things or household items. How can I prove that my mother is not a member of my family?

Answer : Formally, your mother will be a member of the family as long as there is registration at one place of residence. You can establish in court the legal fact of the absence of family relations. All specified circumstances must be proven. Evidence must be provided in sufficient volume. You can invite witnesses to the court and submit certificates. If it is difficult for you to obtain a particular document from an official body, contact the judge in writing with a request for a judicial request. Justify the request by the fact of refusal to provide you with documents and the impossibility of obtaining evidence yourself in any other way.

If a relative is registered in the same living space as citizens who want to receive an income certificate, his income is also taken into account

Question : Indicate what is the validity period of the income certificate for three months?

Answer : If you need to provide information specifically for the specified period, then the period for submission is unlimited. But a certificate is submitted to the social security department every three months to confirm the person’s security for a specific period and to classify the family as low-income. Therefore, you will need to update all information about your earnings. Certificates for the past three months are valid only for the next month.

Question : Will the fact of payment of alimony to a child from his first marriage be taken into account in the reference data?

Answer : The fact of transferring alimony must be taken into account when determining income for three months. The certificate indicates payments on a separate line and is deducted from the total amount.

Alimony is also taken into account in the income certificate

Question : I was given a maternity benefit in the amount of 45,000 rubles. Maternity leave lasted 140 days. I received my salary for less than a full calendar month (10 days) before maternity leave. I submitted an application to the social protection department with documents, including a certificate of income for three months to receive benefits. What benefit will be paid if the second month has 31 days, and the third month has 30 calendar days?

Answer : The calculation is made in the following order:

For the period worked (10 days of the last month): 45,000/140 x 10 = 3214.28 rubles.

For the second month: 45,000/140 x 31 = 9,964.28 rubles. (31 days).

For the third month: 45,000/140 x 30 = 9642.85 rubles (30 days).

The amount varies depending on the number of calendar days in the month worked.

Question : I submitted an application for payment of benefits and additional documents, two months have passed, and there are no payments. What is the reason for the delay in accrual?

Answer : Contact the organization where you applied for benefits in writing for clarification. It may be necessary to supplement the application package with your application. The benefit must be transferred within ten days from the date of application. If clarifications are not forthcoming from the organization or are provided inappropriately, contact the prosecutor’s office with a complaint.

If payments are not made without any reason, the citizen has the right to contact the prosecutor's office

The state supports vulnerable segments of the population, such as large, low-income families with children. For them, there is a separate type of state support - benefits, one-time payments. Employers are obliged to assist in obtaining this assistance and provide all information as soon as possible.

Content requirements

The certificate must contain information not only about the citizen’s income, but also about the enterprise where he is employed. Otherwise, the document is declared invalid.

Table 1. Main points that are requested by most social security authorities.

| Item name | Classification |

| Information about the place of employment | Name TIN Company details Actual and legal address contact number |

| Information about the citizen to whom the certificate was issued | Full name Passport details Position held Start date of the employment contract |

| Income information | Information on accruals received, taking into account tax payments for the last 3, 6 or 12 months |

| Confirmation marks | Signatures of the manager and chief accountant Organizational stamp (not required for individual entrepreneurs) |

It is recommended to include information regarding income in the form of a table. This simplifies the calculation procedure and eliminates the risk of errors.

Documents for receiving child benefits, watch the video:

Possible mistakes

Often, issuing a certificate of income for social security is accompanied by erroneous actions on the part of the filler. In this case, the form is considered invalid and a new one is required instead. Typically, errors consist of incorrect information about employers or employees.

Among the common mistakes:

Lack of legal status and details of the enterprise- Lack of address, contact information

- Errors when filling out a citizen’s passport data

- Incorrect calculation of average income

The possibility of such errors once again emphasizes that filling out the certificate should be done by an authorized employee, using a ready-made form.

An income certificate is one of the documents required to receive social assistance from the state. The form is filled out in a free or unified form, depending on the requests of the service. When compiling, it is necessary to take into account several aspects and follow the general filling procedure.

Top

Write your question in the form below