Legislative regulation of the issue

Legislative regulation of the issue is carried out by such legal acts as:

- Federal Law of April 24, 1995, number 81, regulating state benefits for citizens with a child;

- Federal Law of December 29, 2006 with number 255, which describes the procedures for social insurance of citizens;

- Government Resolution No. 375 dated June 15, 2007, which approved the regulations on the procedure for calculating benefits and other regulations of the Russian Federation.

Types of voluntary social insurance

Voluntary insurance contracts are often included in the social package of managers and employees of various enterprises in hazardous production conditions. Insurance is issued for workers who ensure continuity of production, as well as for interns and interns who do not have sufficient work experience.

Main types of voluntary insurance:

- Movable and immovable property owned by a person, material assets, securities.

- Vehicle. Risks are insured with full or partial payment.

- Animals - exotic, domestic, agricultural, including thoroughbred horses.

- Mortgages.

- Medical - covers the costs of outpatient/inpatient treatment, rehabilitation measures in the postoperative period, dental services, and pregnancy management for women.

- Personal liability of the policyholder to third parties.

- Personal voluntary social insurance. It includes property interests relating to a person’s life, harm to his health, loss of ability to work after accidents at work.

Insurance premiums for voluntary social insurance can be paid in different ways - once a year or once in a certain period (quarter, half-year).

The amount of payments depends on various factors - the insurance contract, the income of the policyholder, etc.

There is the concept of compulsory insurance on a free basis, which differs from voluntary social insurance and is regulated by the law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

In accordance with the law, the following categories of the population can enter into an agreement of their own free will: notaries in private practice, lawyers, farmers, individual entrepreneurs and others.

How to submit an application to the FSS

In order to submit an application to the Social Insurance Fund for voluntary insurance, you need to prepare the following documents:

- The applicant's passport and its copy;

- The insurance application itself;

- Documents confirming registration as an individual entrepreneur.

You can submit documents in two ways:

- The first and easiest way is to submit an application through the State Services portal. If you are registered on this portal, then submitting an application will not take you more than 10 minutes. You just need to fill out the application form and attach scanned copies of your passport and tax registration certificate. Based on the results of consideration of the application, the fund will generate a Notice of Registration; at the request of the applicant, this notice can be sent to the home address according to registration, or the applicant can receive it during a personal visit to the FSS.

- The second way is to submit an application during a personal visit to the FSS. You need to have the same documents with you as when filing an application electronically.

Important! The fund is obliged to register an entrepreneur within three days from the date of receipt of the application.

Forms of voluntary social insurance

In Russia there are individual and collective forms of insurance. Individual contracts include contracts concluded with a private person who has the right to sign. If you need to insure a child, then one of his parents must be the policyholder. The collective form means that an agreement is concluded under which several persons are insured at once. This approach is often used to insure employees at enterprises against any risks. For example, if this is a hazardous production, then accident prevention programs are used. As a rule, such contracts are concluded for a period of one year.

When and where to pay contributions

The entrepreneur must pay insurance premiums by December 31 of the current year. Moreover, it does not matter in what order the contributions are paid, the main thing is that they are paid in full by December 31. They are paid according to the following BCC.

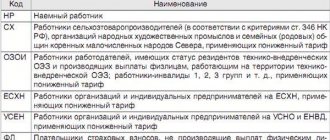

| Budget code. classifications | Category |

| 182 1 0 2 02090071010 160 | Contributions for temporary net work and maternity |

| 182 1 0 2 02090072110 160 | Penalty on contributions |

| 182 1 0 2 02090073010 160 | Penalty on contributions |

We draw your attention to the fact that the amounts of contributions must be paid not to the social insurance fund, but to the tax office, in which the entrepreneur is registered at his place of residence (that is, at his place of registration).

Results

Voluntary payments under insurance programs can be transferred by individual entrepreneurs for themselves to the Social Insurance Fund, and by citizens and their employers - to the Pension Fund of the Russian Federation in the order of paying voluntary contributions to a funded pension. The relevant state funds are responsible for collecting both types of payments - in contrast to mandatory payments, the bulk of which is now administered by the Federal Tax Service.

You can learn more about the relationship between insurance premium payers and government agencies that administer these premiums in the articles:

- “Where should I pay insurance premiums in 2020?”;

- “Insurance premiums accrued (accounting entry)”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Contribution rate

The rate of insurance premiums is the same throughout Russia and is equal to 5.1%. Contributions for the year that an entrepreneur must pay are calculated based on the minimum wage. From January 1, the federal minimum wage was set at 9,489 rubles. Thus, the amount of contributions payable is equal to:

9489*12*5.1%=3302.17 rubles.

This amount must be paid by December 31, 2021 in order to be eligible to receive benefits from the budget next year.

Important! The date of registration of an individual as an individual entrepreneur does not affect the amount of the contribution. It is a constant value throughout the year and does not depend on whether you worked as an individual entrepreneur all year or registered on December 30.

BCC for voluntary insurance contributions in 2020-2021 to the Pension Fund of the Russian Federation

Another type of voluntary insurance payments is additional contributions to the funded pension to the Pension Fund. At the same time, the fund collects these payments directly - the reform on transferring the powers of the Pension Fund to the Federal Tax Service did not affect the procedure for administering such contributions.

Voluntary pension contributions can be paid to the Pension Fund:

1. The insured person (including individual entrepreneurs) independently.

In this case, the document for payments in 2020-2021 must contain KBK 392 (the code reflects the fact that the payment is received by the Pension Fund) 10202041061100160.

2. The employer of the insured person - at the expense of this person (funds for the contribution are deducted from the salary).

The employer indicates in the payment slip for the contribution in 2020-2021 the same BCC that is used when transferring a voluntary payment by a citizen independently.

3. By the employer - at his own expense.

In this case, a different BCC is indicated in the payment in 2020-2021 - 39210202041061200160.

The given BCC values are also used in calculations for state pension co-financing programs (since the main condition of this program is the transfer by a citizen or employer in his favor of additional contributions to a funded pension).

If voluntary contributions are transferred to a non-state pension fund, then the KBK indications in payments are not expected (since non-state pension funds are not part of the budget system).

What benefits is an individual entrepreneur entitled to?

An individual entrepreneur with voluntary insurance has the right to receive the following types of benefits from the fund:

- For temporary disability;

- For maternity - one-time at birth and for early registration and also monthly for child care until he is 18 months old.

Important! All benefits due to the insured individual entrepreneur are calculated based on the minimum wage.

Child care benefits are paid based on 100% of the minimum wage, but for disability they are differentiated depending on the length of service of the entrepreneur and amount to 100% for more than eight years of experience, 80% for five to eight years of experience and 60% for less than five years of experience.

Is the activity of an individual entrepreneur counted towards seniority?

When forming an entrepreneur’s pension, both his work experience and the amount of contributions to the Pension Fund, including those made by him for himself during the period of entrepreneurial activity, will be taken into account.

All this will contribute to the calculation of the pension points due to him and the individual pension coefficient, which will determine the size of his future pension.

As for the length of service, all the time during which the future pensioner had the status of an individual entrepreneur and made contributions for himself is definitely counted.

In the current pension legislation, the term “length of service” is no longer used in relation to the current work of an individual entrepreneur; instead, the concept of “insurance period” is used.

Video: a few words about the experience of an entrepreneur

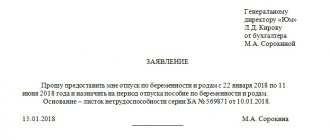

What documents are needed to confirm the occurrence of an insured event?

The list of documents confirming the entrepreneur’s right to receive payments from the fund is established by the fund. Mandatory documents may be:

- Application for payment to an entrepreneur;

- Certificate of incapacity for work;

- Child's birth certificate;

- A certificate from the other parent’s place of employment stating that the other parent did not receive payments from his employer;

- Certificate from a medical institution confirming the deadline for registration;

- Birth certificate of the child and/or previous child.

Basic principles of voluntary social insurance

This type of insurance is based on the free decision of the policyholder (individual or organization) and the insurer to enter into an agreement.

The distinctive features of additional insurance are the democratism of fund management, the implementation of the principle of self-government, and the social partnership of employers and employees.

The voluntary social insurance agreement is based on the provisions of the current legislation. The specific terms and details of the contract are developed by the insurer.

Choosing this type of insurance does not cancel mandatory insurance premiums, that is, compulsory and voluntary insurance are not mutually exclusive, but complementary.

Voluntary social insurance is carried out through:

- insurance premiums;

- citizens' own income;

- employers who insure employees from company income.

Let's consider the main features of voluntary social insurance:

- existence of legal grounds, wishes of the policyholder;

- making one-time or periodic contributions;

- the presence in the contract of restrictions on the insurance period;

- voluntary choice of the type of insurance policy;

- the amount of payment for an insurance event is established by agreement of the parties and is specified in the contract.

Voluntary social insurance is based on the principles of solidarity and mutual assistance. This type of insurance is common in hazardous and hazardous industries. A person who makes all payments on time can count on receiving payment when an insured event occurs.