Payers of this tax must submit a declaration on mineral extraction tax.

Draw up the declaration in the form approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197. The same order approved the Procedure for filling out and electronic format for submitting a tax return.

Situation: is it necessary to file mineral extraction tax declarations if an organization has suspended the use of a subsoil plot?

Yes need.

If an organization is recognized as a payer of mineral extraction tax, declarations must be submitted starting from the month in which actual mining began (clause 1 of Article 345 of the Tax Code of the Russian Federation). Until this point, the organization is not required to submit declarations. However, the legislation does not provide for such an exemption if the organization has suspended the use of a subsoil plot. Therefore, if an organization began actual mining of mineral resources at a subsoil site, but then suspended it, continue to submit declarations.

This procedure is confirmed by letters of the Ministry of Finance of Russia dated November 22, 2011 No. 03-06-05-01/117 and the Federal Tax Service of Russia dated December 19, 2011 No. ED-4-3/21564.

New report form

The Federal Tax Service of Russia, by order dated December 8, 2020 No. KCh-7-3/ [email protected], updated the form and procedure for submitting a tax return for mineral extraction tax.

The amendments were required in connection with significant changes to the Tax Code on mineral extraction tax, which entered into force on 01/01/2021. Along with the report form, completion rules and electronic format were approved. Among the significant changes:

- A new procedure for transferring mineral extraction tax to the budget and determining the tax base for natural diamonds weighing more than 10.80 carats. The tax base for such stones is determined based on their sales prices excluding VAT, but not lower than their initial assessment.

- If the status of a participant in a regional investment project is terminated by a court decision, the taxpayer loses the right to apply a coefficient Ktd less than 1 from the tax period in which it was first applied.

- The value of mined precious stones is assessed on the basis of the taxpayer’s weighted average sales price in the tax period excluding VAT, but not lower than their initial assessment carried out in accordance with the legislation on precious metals and precious stones. If there are no sales in the tax period, the data of the nearest 12 previous months are taken into account.

IMPORTANT!

The order will come into force two months after publication - 03/15/2021. The declaration in the new form must be submitted for the tax period following the month the document entered into force - April 2021. Therefore, for January-March 2021 it is necessary to report on the previous declaration form. The deadline for submitting the mineral extraction tax for December 2021 is until 02/01/2021 (January 31, 2021 - Sunday).

Section 1

In section 1 “Amount of tax to be paid to the budget” of the declaration, indicate:

- KBC for mineral extraction tax;

- OKTMO (based on notification in form 9-NDPI-1 or based on the All-Russian Classifier approved by Rosstat Order No. 159-st dated June 14, 2013);

- the amount of mineral extraction tax payable under this BCC and each OKTMO.

This is stated in paragraphs 4.1–4.4 of the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197.

If a mineral is mined on the territory of several constituent entities of the Russian Federation, then the amount of tax for each OKTMO is calculated in proportion to the share of the mineral mined in a certain subsoil area in the total amount of mined minerals (clause 4.5 of the Procedure approved by the order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197).

If an organization extracts different minerals in different regions, section 1 of the declaration may not have enough lines to list all the necessary indicators. In this case, make Section 1 over several pages. This is stated in paragraph 4.5 of the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197.

Who is obliged to take

Mineral miners and subsoil users are required to report on their mining activities. The category of accountable persons includes all payers of this tax: both organizations and individual entrepreneurs. Such taxpayers require a license allowing the use of subsoil.

From the moment of registration as a mineral miner and after receiving a license, monthly reporting must be generated. Until registration as a MET taxpayer, a report is not submitted. The Tax Code of the Russian Federation specifies whether it is necessary to submit a tax return for mineral extraction tax if the use of subsoil is temporarily suspended - yes, you will still have to report on the production tax (Chapter 26 of the Tax Code of the Russian Federation).

Composition of the declaration

The mineral extraction tax declaration includes:

- title page;

- Section 1 “Amount of tax to be paid to the budget”;

- Section 2 “Data serving as the basis for the calculation and payment of tax for the production of dehydrated, desalted and stabilized oil, with the exception of production at a new offshore hydrocarbon field”;

- Section 3 “Data serving as the basis for the calculation and payment of tax for the production of combustible natural gas and gas condensate, with the exception of production at a new offshore hydrocarbon field”;

- Section 4 “Data serving as the basis for the calculation and payment of tax when extracting hydrocarbons from a new offshore hydrocarbon field”;

- Section 5 “Data serving as the basis for the calculation and payment of tax, with the exception of hydrocarbons (except associated gas) and coal”;

- Section 6 “Determination of the cost of a unit of extracted mineral resources based on the estimated cost”;

- Section 7 “Data serving as the basis for the calculation and payment of tax when mining coal on a subsoil site.”

Due dates

All subsoil users have a single deadline for submitting declarations for subsoil use - monthly, on the last day of the month following the reporting period. That is, submit the declaration for January by February 28 (in 2021 - by March 1), the report for February - by March 31, and so on until the end of the year. If the last day of the month falls on a non-working day, the deadline is transferred to the first working day.

| Reporting period | Deadlines for submitting subsoil reports to the tax office in 2021 |

| For December 2020 | February 1 (01/31 - Sunday) |

| For January 2021 | March 1 (28.02 - Sunday) |

| For February | March 31 |

| For March | April 30 |

| For April | May 31 |

| For May | 30 June |

| For June | August 2 (July 31 - Saturday) |

| For July | August 31 |

| For August | September 30th |

| For September | November 1 (October 31 - Sunday) |

| For October | November 30th |

| For November | January 10, 2021 (December 31 is a non-working day) |

| For December 2021 | January 31, 2022 |

Section 2

Section 2 “Data serving as the basis for the calculation and payment of tax for the production of dehydrated, desalted and stabilized oil, with the exception of production at a new offshore hydrocarbon field,” fill out separately for oil produced at each subsoil plot provided to the organization for use.

When filling out section 2, please indicate:

- on line 020 – BCC for mineral extraction tax on oil;

- on line 030 – code of the unit of measurement of the amount of oil produced “168” according to OKEI, in accordance with Appendix 4 to the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197;

- on line 040 – OKTMO, on the territory the organization pays the mineral extraction tax on the oil produced;

- on line 050 – series, number and type of license for the use of subsoil. For example, STV 12345 NE;

- on line 060 – the value of the indicator that characterizes the features of oil production (Dm);

- on line 070 – the value of the Kndpi indicator;

- on line 080 – the value of the coefficient characterizing the dynamics of world oil prices (Kts);

- on line 090 – the value of the coefficient characterizing the degree of depletion of reserves of the subsoil site (Kv);

- on line 100 - the degree of depletion of reserves of the subsoil area (Sv), calculated in order to determine the coefficient Kv;

- on line 110 – the value of the coefficient characterizing the amount of reserves of a specific subsoil plot (Kz);

- on line 115 – the value of the coefficient characterizing the degree of depletion of a specific hydrocarbon deposit (Kdv);

- on line 120 – the value of the coefficient characterizing the region of production and the properties of oil (Kkan);

- on line 130 – the amount of mineral extraction tax on oil extracted at the subsoil site, calculated in accordance with subclause 5.5.11 of clause 5.5 of the Procedure;

- on line 130 – the amount of mineral extraction tax calculated in accordance with subclause 5.5.11 of clause 5.5 of the Procedure;

- on line 140 – the amount of tax deduction (if there is none, then zero);

- on line 150, indicate the amount of tax calculated as the difference between lines 130 and 140.

Fill out subsections 2.1.1 and 2.1.2 of section 2 of the declaration in accordance with clauses 5.6 and 5.7 of the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197.

Such rules are established by clauses 5.1–5.8 of the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197.

Where to take it

Taxpayers submit a declaration on the use of subsoil to the territorial offices of the tax inspectorate. Here's where to submit your mineral extraction tax declaration in 2021:

- for institutions that are large taxpayers (code 213 on the title page) - to the interdistrict tax office;

- for other taxpayers (code 214 on the title page) - to the Federal Tax Service at the place of registration;

- for foreign enterprises operating through Russian representative offices - at the place of operation.

A number of organizations enter into production sharing agreements. Participants in such an agreement are not provided with the opportunity to submit a mineral extraction tax declaration.

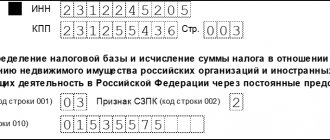

Title page

On the title page please indicate:

- TIN (if the TIN is 10 digits, then in the first two cells of the line reserved for the TIN, zeros (“00”) should be entered);

- Checkpoint (indicate the checkpoint assigned to the organization by the inspectorate at the place of filing the declaration).

If an organization provides a declaration at the location of the organization, then use the TIN and KPP values from the certificate of registration in Form No. 1-1-Accounting (the largest taxpayers - from the notification in Form No. 9-KNU, foreign organizations - from the certificate in Form No. 11SV -Accounting;

- adjustment number (when preparing the initial declaration, indicate “0—”, when submitting an updated declaration, indicate the serial number of the adjustment – “1—”, “2—”, “3—”);

- code of the tax period for which the declaration is submitted, in accordance with Appendix 1 to the Procedure approved by Order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197;

- code of the tax office to which the declaration is submitted;

- full name of the organization in accordance with the constituent documents, including its Latin transcription (if available);

- code of the type of economic activity according to the OKVED classifier;

- code of the form of reorganization (liquidation) in accordance with Appendix 1 to the Procedure, approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197, as well as the TIN and KPP of the reorganized organization;

- contact phone number of the organization;

- the number of pages on which the declaration is drawn up;

- number of sheets of supporting documents or their copies.

The title page must contain the date the reporting was completed, as well as the seal of the organization and the signature of the person certifying the accuracy and completeness of the information specified in the declaration. If the accuracy and completeness of the information is confirmed by a representative of the organization, then attach a power of attorney confirming his authority to the declaration.

This procedure is provided for in clause 2.6 and section III of the Procedure, approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197.

How to take it

As with any other report to the Federal Tax Service, the declaration on mining has two options for submission: on paper or electronically. The method of provision depends on the number of employees. If the institution employs up to 100 people, the report is submitted at the request of the taxpayer. This is a personal application to the Federal Tax Service or transfer of the register via telecommunication channels.

If a mining organization employs more than 100 people, it has no choice. The only available form of delivery is electronic.

Section 3

Section 3 “Data serving as the basis for the calculation and payment of tax for the production of gas, combustible natural gas and gas condensate, with the exception of production at a new offshore hydrocarbon deposit”, fill out separately for the BCC and separately for gas and gas condensate produced at the subsoil site provided organizations for use.

When filling out section 3, please indicate:

- on line 010, indicate the code of the type of extracted mineral: “03200” (for gas condensate) or “03300” (for gas), according to Appendix 2 to the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. MMV-7-3/ 197;

- on line 020 – BCC for mineral extraction tax on gas or gas condensate;

- on line 030 - code of the unit of measurement of the amount of extracted minerals according to OKEI in accordance with Appendix 4 to the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197: for gas “114”, for gas condensate “168” ;

- on line 040 – the amount of mineral extraction tax on gas (gas condensate), which is determined as the sum of the values indicated on line 190 of all subsections 3.1.1 for all deposits related to the subsoil area, the details of the license for the right to use which are indicated in line 090 of subsection 3.1;

- on line 050 - the value of the indicator characterizing the costs of gas transportation (Tg), which is determined in accordance with paragraph 14 of Article 342.4 of the Tax Code of the Russian Federation. When filling out Section 3 on gas condensate, put a dash in the line;

- on line 060 - the value of the coefficient characterizing the share of gas sales to Russian consumers in the total volume of gas sold (G), which is determined in accordance with paragraph 5 of Article 342.4 of the Tax Code of the Russian Federation;

- on line 070 – the value of the coefficient characterizing the share of produced gas in the total volume of produced hydrocarbons (Kgpn), determined in accordance with paragraph 6 of Article 342.4 of the Tax Code of the Russian Federation;

- on line 080 – OKTMO, on the territory of which the organization pays the mineral extraction tax on extracted minerals.

Fill out subsections 3.1 and 3.1.1 of section 3 of the declaration in accordance with paragraphs 6.9 and 6.10 of the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197.

Such rules are established by clauses 6.1–6.10 of the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197.

How to fill

Mining reports include a title page and eight sections. Each paragraph corresponds to a separate type of extracted resource, therefore, the filling rules for each mineral are different. When entering information into report sections, follow a number of uniform rules. Here are general instructions for filling out in 2021 (the form is valid until April 2021):

- The report is completed for each period (month) separately. Factual information is provided for each month, rather than cumulative information.

- The declaration must only fill out sections with those minerals to which the enterprise is directly related to the extraction. If the taxpayer produces oil, then he generates information under section 2, if oil and gas, then the information is submitted under sections 2 and 3 of the mineral extraction tax. The remaining chapters are not completed.

- The report is provided only for minerals for which the production cycle has been completed. If a resource is under development, it is not reflected in the report.

- In each declaration, the title page and section 1, which accumulates data on mineral extraction tax, must be completed.

- Fill out all digital values and cost indicators according to the rules of the Federal Tax Service. Each cell contains separate information.

- All pages used are numbered in order. Leaving the field is unacceptable.

- Do not use correction fluid or correct errors manually.

When filling out the content of the mineral extraction tax, you must use the rules set out in Appendix No. 2 to Order No. MMV-7-3/827 and letters of the Federal Tax Service of Russia No. SD-4-3 / [ email protected] , SD-4-3 / [email protected] from 04/18/2019.

General filling procedure

Mandatory inclusion in the declaration are the title page and sections for which the organization has the appropriate indicators to fill out. If the organization did not carry out transactions for which data should be reflected in one section or another, these sections do not need to be submitted (clause 2.3 of the Procedure).

For example, fill out section 6 only if, when determining the tax base, the value of the extracted mineral resource was assessed using a calculation method, and section 7 - if the organization calculates the mineral extraction tax for coal mining and uses a tax deduction.

This is stated in paragraphs 1.1 and 2.3 of the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197.

Reflect the cost indicators in the declaration taking into account the established format of the cells. If the lines provide for division into whole and fractional parts, enter the indicators in rubles and kopecks. If there is no such division, indicate the values of cost indicators in full rubles. Indicator values are less than 50 kopecks. throw it away, and 50 kopecks. or more, round up to the full ruble.

The fields of the declaration must be filled out from left to right, starting from the first (left) acquaintance. For negative numbers, indicate the “-” (minus) sign in the first sign on the left. If the declaration is filled out using software, then the values of the numerical indicators are aligned to the right (last) space.

Regardless of the number of sections to be filled out, the declaration uses continuous page numbering (starting from the title page). The page serial number is indicated from left to right starting from the first (left) character (for example, “033” for the thirty-third page).

Each declaration indicator corresponds to one field intended for a certain number of characters.

The return may not correct errors by correction or other similar means. In addition, double-sided printing of the declaration and binding of sheets, which leads to damage to the paper medium, are prohibited.

Such rules are established by clauses 2.2 and 2.3 of the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197.

Coefficients for calculating oil tax

When calculating the NDIP for oil in 2021, certain indicators are used, namely:

- All global price fluctuations are taken into account and determined monthly by the Government of the Russian Federation;

- The degree of complexity of production and taking on a certain value depending on the specific characteristics of the deposit and the year the development began;

- reflecting the degree of depletion of the field; depending on the value of the previous coefficient, it can take either a specific value or become a calculated value;

- characterizing the characteristics of oil production and calculated using a formula that includes several coefficients, both calculated and taking a certain digital value depending on the year of application.

Mineral extraction tax rates in 2020-2021

All rates for calculating the mineral extraction tax, which is a federal-level tax, in 2020-2021 are reflected in the Tax Code of the Russian Federation (Article 342). They are divided into 2 types:

- expressed as a percentage;

- set in rubles.

Many of them provide for the use of coefficients that take into account:

- fluctuations in consumer prices;

- extraction method;

- characteristics of the territory of the developed field;

- fluctuations in world prices;

- mining difficulty level;

- degree of depletion of the deposit.

Some of the applied coefficients are relevant only to a certain type of fossil, others are valid for several types, and a number of coefficients for some of the fossils are applied in combination. The latter type of minerals includes oil and gas, which makes calculating taxes on them quite complex.

Example from ConsultantPlus: calculation of mineral extraction tax on minerals mined for sale: In March, the organization extracted 12,000 tons of construction sand and sold 8,000 tons for 8,000,000 rubles. (excluding VAT). The cost of delivering sand to the buyer is 1,000,000 rubles. (excluding VAT)…. If you do not have access to the K+ system, get a trial online access and proceed to the calculation example for free.

Odds may have a specific meaning or be calculated. However, the specific value may vary depending on the year the indicator was applied. The latter, for example, refers to the coefficient characterizing the export profitability of a unit of standard fuel and involved in gas calculations (Article 342.4 of the Tax Code of the Russian Federation).

In certain situations, taxpayers are entitled to rate reductions:

- by 30% if they carry out search and exploration of deposits at their own expense;

- by 40%, when mining minerals (but not hydrocarbons or common ones) in a special zone of the Magadan region.

To learn about the specifics of determining the object of taxation, read the article “What is the object of taxation under the mineral extraction tax?”

Section 4

Section 4 “Data serving as the basis for the calculation and payment of tax when extracting hydrocarbon raw materials from a new offshore hydrocarbon raw material field” should be filled out separately for each type of mineral extracted from each new offshore hydrocarbon raw material field.

When filling out section 4, please indicate:

- on line 010 – code of the type of mineral extracted: “03100” (oil), “03200” (gas condensate), “03300” (gas) or “03401” (associated gas extracted from new offshore hydrocarbon deposits), according to the appendix 2 to the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197;

- on line 020 - BCC, in accordance with which the mineral extraction tax is paid. For associated gas, enter zeros in the line;

- on line 030 - code of the unit of measurement of the amount of extracted minerals according to OKEI in accordance with Appendix 4 to the Procedure, approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197;

- on line 040 – OKTMO, in the territory of which the organization pays the mineral extraction tax on extracted minerals;

- on line 050 – series, number and type of license for the right to use subsoil. For example, ShBM 12345 NE;

- on line 060 - the name of the new offshore hydrocarbon deposit in accordance with the license for the right to use subsoil;

- on line 070 – month and year of the start of industrial production of hydrocarbons;

- in column 1 - code of the basis for taxation of extracted minerals in accordance with Appendix 3 to the Procedure, approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197;

- in column 2 - the amount of extracted minerals, taxed at the tax rate that corresponds to the code entered in column 1;

- on line 070 – month and year of the start of industrial production of hydrocarbons;

- on line 080 – the cost of a unit of extracted minerals;

- on line 090 – the minimum marginal cost of a unit of hydrocarbon raw materials;

- on line 100 – the amount of sold extracted minerals;

- on line 110 – revenue from the sale of extracted minerals;

- on line 120 - adjusted revenue from the sale of extracted minerals based on paragraph 6 of Article 105.3 of the Tax Code of the Russian Federation. If there is no such revenue, then put a dash;

- on line 130 - the tax base for the extracted minerals. The procedure for its determination is specified in paragraph 7.16 of the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197;

- on line 140 - the amount of mineral extraction tax, calculated as the product of the tax base (line 130) and the tax rate. For associated gas, enter zero in the line;

- on line 150 - the adjusted tax amount in accordance with paragraph 6 of Article 105.3 of the Tax Code of the Russian Federation. If there is no adjusted amount, put a dash.

Such rules are established by clauses 7.1–7.18 of the Procedure approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197.

Types of extracted minerals

For tax purposes, extracted mineral resources are recognized as products of the mining industry and quarrying, contained in mineral raw materials (rock, liquid and other mixtures) actually extracted from the subsoil (waste, losses), the first in quality corresponding to the national standard, regional standard, international standard, and in case of their absence - to the organization’s standard.

The types of extracted minerals are:

- oil shale;

- coal (anthracite, etc.);

- peat;

- hydrocarbon raw materials (including oil, gas, gas condensate, methane);

- marketable ores of ferrous, non-ferrous and rare metals;

- multicomponent complex ores;

- useful components of multicomponent complex ore, extracted during further processing;

- mining chemical non-metallic raw materials (apatite-nepheline and phosphorite ores, potassium, magnesium and rock salts, boron ores, sodium sulfate, sulfur, barites, asbestos, iodine, bromine, fluorspar, earth paints (mineral pigments), carbonate rocks and others );

- mining non-metallic raw materials (abrasive rocks, vein quartz, quartzites, carbonate rocks for metallurgy, quartz-feldspathic and siliceous raw materials, glass sands, natural graphite, talc (steatite), magnesite, talc-magnesite, pyrophyllite, mica-oscovite, mica-phlogopite , vermiculite, refractory clays for the production of drilling fluids and sorbents, others);

- bituminous rocks;

- raw materials of rare metals (scattered elements) - in particular, indium, cadmium, tellurium, thallium, gallium;

- non-metallic raw materials used mainly in the construction industry (gypsum, anhydrite, natural chalk, dolomite, limestone flux, limestone, limestone, natural building sand, pebbles, gravel, sand-gravel mixtures, building stone, facing stones, marls, clays, other);

- qualified product of piezo-optical raw materials, especially pure quartz raw materials and semi-precious stone raw materials (topaz, jade, jadeite, rhodonite, lapis lazuli, amethyst, turquoise, agates, jasper and others);

- natural diamonds, other precious stones from primary, alluvial and man-made deposits, including rough, sorted and classified stones (natural diamonds, emerald, ruby, sapphire, alexandrite, amber);

- concentrates and other intermediate products containing precious metals (gold, silver, platinum, palladium, iridium, rhodium, ruthenium, osmium) obtained during the extraction of precious metals:

- natural salt and pure sodium chloride;

- underground waters containing minerals (industrial waters) and (or) natural healing resources (mineral waters), as well as thermal waters;

- raw materials of radioactive metals (in particular, uranium and thorium).

More details (clause 2 of article 337 of the Tax Code of the Russian Federation)

The tax amount is calculated based on the results of each tax period (month) for each mineral extracted.

On the 25th day of the month following the expired tax period The amount of tax payable at the end of the tax period is paid no later than the 25th day of the month following the expired tax period.

The tax is payable to the budget at the location of each subsoil plot provided to the taxpayer for use.

The amount of tax calculated for minerals mined outside the territory of the Russian Federation is subject to payment to the budget at the location of the organization or the place of residence of the individual entrepreneur.

Budget revenue classification codes