09.07.2019

0

61

6 min.

Having worked at one enterprise for more than six months, a person automatically receives the right to leave of at least 28 days. At the request of the employee, this period can be divided into parts and postponed to the time that suits him best. But what happens if a citizen asks his superiors for leave in advance, without serving the required six months in his position? Whether such a circumstance is provided for in the Labor Code, and what restrictions are imposed on it by law, we will consider below.

Definition and features of provision

The Labor Code does not contain wording of such a concept as leave in advance . But in practice, it is generally accepted that this is rest provided to an employee before the end of the working year.

Keep in mind: granting leave in advance is only possible in relation to annual paid leave! Everything else must be provided on time. Also see “When you can take vacations under the Labor Code.”

The manager is obliged to give his employees basic and/or additional rest every year. During the first working year, a subordinate acquires this right after working out half of the working period. The exceptions are certain categories of citizens:

- minors;

- pregnant employees;

- WWII participants;

- part-time workers;

- raising two or more children;

- other persons.

The conditions for granting leave in advance are distinguished from regular leave by the following characteristics:

- You need to know exactly which periods to include in your work experience.

- Registration of this type of vacation is the right, not the responsibility of the manager.

- Minimum duration – 14 days.

- Replacement with cash payment is not acceptable.

For other categories of employees, rest is provided in proportion to the part of the working year worked with the consent of management. To receive it, a person must submit an appropriate application. The date is determined taking into account the approved schedule. Also see "Vacation Schedule".

Basic Concepts

The procedure for registering annual leave, as well as its sequence, is established in accordance with Articles 114 and 115 of the Labor Code of the Russian Federation. But only those employees who have worked at their current place of employment for at least six months (not necessarily in the same position) fall under their regulations. For other citizens who want to go on vacation in debt, Art. 122 of the Labor Code of the Russian Federation, which stipulates the version of the agreement between the parties.

The period of the next rest period itself must be at least 4 weeks, except in cases where the subordinate:

- Works on an irregular schedule (for this category of citizens the minimum period of rest should be 31 days);

- Has health restrictions (for disabled people of groups 1, 2 and 3, the state provides 30 days of legal leave per year);

- Works in conditions that are harmful to health (people working in the Far North, in metros, in the mountains and other dangerous areas can count on at least 35 days of annual rest, in accordance with the Labor Code of the Russian Federation).

In this case, the registration must take place strictly according to the drawn up schedule. An accompanying document for the employee is a written order, which specifies not only the period of time off, but also the date of its official start.

Is it possible to take vacation in advance for the next year?

The right to use this type of vacation is granted without restrictions to employees who have worked at least a few days in the new working period. But taking out vacation for the next year is illegal, since the employee has not worked a single day for it!

For employees whose activities are associated with harmful or dangerous environmental factors, registration of basic or additional rest is possible in advance and for its full duration.

Design rules

The procedure for registering this type of exemption from labor duties almost completely coincides with the ordinary annual one, and only requires the consistent implementation of the following actions :

- A statement written in your own hand.

- Positive decision of the director.

- Writing a corresponding order by a HR specialist.

- The accountant accrues the amount of the required “vacation pay” (the difference lies precisely in this point, since the specified funds have not yet been earned).

Is vacation compensated in advance upon dismissal?

When an employee arranges a vacation in advance, he subsequently undertakes to work the required number of days. But what to do if the employment contract is terminated? Does the employer have the right to compensate for his losses? The answer to these questions depends on the reason for the dismissal.

The employer does not have the right to demand compensation if the employee took his vacation in advance and was dismissed for the following reasons:

- by agreement of the parties;

- when the employment contract expired;

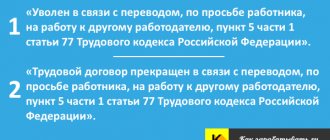

- transfer to another employer;

- staff reduction;

- refusal to cooperate due to changes in working conditions;

- absence from work for more than 4 months due to temporary incapacity for work (exception – maternity leave);

- referral for training;

- retirement;

- other valid reasons.

If the employment contract is terminated for other reasons, the employer has the right to demand compensation from the employee who took vacation in advance . For example, in case of voluntary dismissal or serious disciplinary offense. It can be deducted without the employee’s consent.

There is a limitation established by Art. 138 of the Labor Code of the Russian Federation: the withheld amount should not exceed 20% of the salary. When vacation pay is transferred in a larger amount or wages are not enough to withhold, you need to negotiate with the employee about the return of the money. He can write a statement of his agreement with the decision being made.

Salary deductions

Withholding upon dismissal can be made only in those cases specified by law. To determine which amounts can be deducted and which cannot, you should refer to Article 137 of the Labor Code of the Russian Federation. It contains comprehensive conditions that allow you to deduct overpaid money from your calculated salary. Along with the advance payment issued and not spent, the article establishes that the employer has the right to return the money paid for vacation taken in advance. To return previously paid funds, the accountant is obliged to recalculate the compensation issued and determine which part of it was worked out and which was not.

Along with this, the issue of returning funds previously issued in advance can be resolved on a voluntary basis. Having calculated the amount of the refund, the accountant has the right to invite the employee to deposit the difference in cash. In some cases, only this procedure allows you to return the money, because by law you can forcibly withhold no more than 20% of the accrued amount, and the rest is deducted only at the request of the dismissed person.

How to take a vacation in advance

The registration is carried out by a personnel specialist or accountant, taking into account the norms of the law. It is imperative to comply with the requirements so that if a disagreement arises, there is documentary evidence of the fact that premature rest was granted.

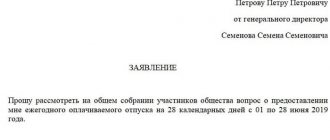

In the situation under consideration, the procedure follows the standard scheme. The employee writes an application for leave in advance , addressed to the manager. In it he states:

- desired duration – at least 14 days;

- date and your signature;

- the reason that influenced the decision (optional).

EXAMPLE On May 16, 2016, Khrustalev was hired as a leading project manager. After working 19 days, the employee urgently needed leave for family reasons from June 13 for 14 days.

He drew up the following document addressed to the director - an application for early annual leave.

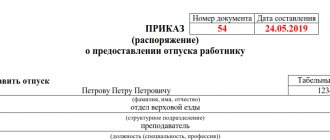

If the employer satisfies the employee’s request and gives leave in advance , an order is issued. The document is filled out according to the unified form T-6. Then both parties sign it. Also see “Sample vacation order”.

Risks for the employer

The employee has the right to terminate the employment relationship, regardless of whether it is fixed-term or indefinite, at his own request. In general cases, it is enough to notify the manager at least two weeks in advance.

Thus, by paying in advance for the vacation provided, there is no guarantee that the person will subsequently work the period when he could take it by law.

It is also possible to write a letter of resignation while already on vacation. If there are more than 14 days left before the end of the vacation after submitting the application, the employee will not start work at all. It turns out that vacation funds paid in advance will not be worked out.

Holiday payment calculation

All amounts due are determined on the basis of average daily earnings and actual time worked. The calculation is carried out in the following order. Also see “Calculating vacation in 2021: examples.”

- We determine the average monthly salary using the formula:

- We calculate the average daily salary:

- We determine the amount of accrued vacation pay (OTPinit.). It will be equal to:

- We withhold income tax (13%) from accrued vacation pay:

- The amount of cash payments will be:

Salary average month – average monthly wage; ZP1, ZP2 – salary for each month of work; N – number of months worked.

ZPsr.d. – average daily salary; 29.3 is the average number of days in one month.

OTPbeg. = ZPsr.d.x D D – duration of rest (days).

Personal income tax = OTPinit. x 13%

HOLIDAY PAY = OTPinit. – Personal income tax

EXAMPLE (CONTINUED) Leading project manager Khrustalev took vacation in advance from June 13, 2021 for 14 calendar days. The average monthly salary is 27,300 rubles. It is necessary to determine the amount of vacation pay to be paid to this employee.

Solution.

- Let's calculate the average daily salary using the formula:

- Let's determine the amount of accrued vacation pay:

- The withheld income tax will be equal to:

OTPbeg. = 932 x 14 days = 13,048 rubles.

13,048 x 13% = 1,696 rubles.

As a result, project manager Khrustalev will receive vacation pay in the amount of 11,352 rubles. (13,048 – 1696).

Let’s assume that the vacation provided in advance was used by the employee, and later he quit due to:

- A) conscription for military service;

- B) at your own request.

Can the head of IMICOR-Sibir LLC receive monetary compensation? If yes, then in what size?

Solution.

- A) Conscription for military service This is a valid reason for termination of the contract, and therefore does not serve as a basis for collecting compensation (Part 1 of Article 83 of the Labor Code of the Russian Federation). After Khrustalev’s dismissal, there is no need to demand a refund.

- B) Interruption of cooperation at the initiative of the employee This is the basis for the return of vacation pay. The company must withhold from the last salary an amount to pay off the debt for unworked vacation days in the amount of: 13,048 x 20% = 2,609 rubles.

When providing an employee with leave in advance, there is a risk of losing the money paid. Therefore, when an organization goes to court, it is necessary to prepare reliable and convincing evidence of the illegality of the employee’s position, since the court often takes his side.

Read also

22.11.2017

What to put in a special chart?

If a worker has already taken the days he is entitled to in advance this year, this is recorded in a special vacation schedule for the next year.

Example:

Romashka LLC is drawing up a schedule for 2021, and employee I.I. Petrov has already taken 28 days off, which he is entitled to by law, and 14 days in advance.

The entry will not be reflected in any way in an existing document (schedule for 2021). But when creating a schedule for 2021, it will definitely be recorded. At the same time, in column 10 a note is made that the employee took 14 days of leave in advance in 2021. Accordingly, in 2021 Petrov will only be able to rest for 14 days.

Below you will see in the photo a sample vacation schedule with an example of advance vacation:

About tax issues

This question causes the most difficulties in accounting work. Especially when it comes to recalculating taxes from one type to another. Let's begin to consider the issue in more detail.

With personal income tax, the object for taxation is the income received by the payer, in any variety.

According to Tax Legislation, a tax base is the name of a characteristic for taxation, with a cost or physical content. When this base is determined, all sources from which funds come are taken into account. The fee base is not reduced due to withholdings, even if they are imposed by a court decision.

Subtleties of taxes

A negative answer will be given to the question of whether it is necessary to recalculate the income portion for the same period as vacation pay received in the form of an advance. When receiving labor remuneration, it is considered that the income was actually received on the last day of the month during which income accruals occur. When vacation pay was determined, the organization had already carried out all the necessary tax transactions.

It turns out that in any situation, personal income tax is already withheld from the employee in advance, using a cumulative total.

Will retention lead to a natural result in the form of a reduction in the unified social tax base? For enterprises in this case, the base is payments and any other transfers related to the labor-type agreement. Article 238 of the Tax Code of the Russian Federation is devoted to a description of the current exceptions to the rule. Of all the points, compensation for vacations that remained unrealized deserves a separate discussion.

Experts express two views. According to one, retention promotes reduction. The second is strictly opposite to the first. Many are inclined towards the first option. In this group, it is generally accepted that the portion of holiday pay retained by employers cannot be considered as payment to employees.

If the unified social tax has already been determined for the money received earlier, it is recommended to recalculate it. The same applies to pension contributions. Initially, UST is paid for the entire amount due to the employee.

What to do with the unified social tax?

If adjustments need to be made, this is done like this:

- First, you need to understand the difference between the tax amount calculated on the basis, using the total and the accrual in the reporting period before the dismissal occurred. And the amount of monthly advance payments already transferred.

- The appearance of a positive difference leads to the need to transfer the corresponding tax amount on time.

- If it is negative, then current payments are offset against the future.

It is this version that most experts lean toward.

The resignation letter is the actions of the accountant

The first thing an accountant should do when terminating an employee is to check all of his vacation days to determine whether he has any unworked days.

To do this you need to calculate:

— how many years and months the employee worked in the company. In this case, the last month is considered as full if it is worked half or more. If less than half of it is worked, the month is not taken into account in the calculation (clause 35 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR on 04/30/30 No. 169);

— the number of vacation days due to the employee for the entire period of his work in the company (earned vacation); the number of vacation days that the employee took during the entire time he worked for the company. Next, you need to compare the number of vacation days used with the number of days earned.