The legislation of the Russian Federation guarantees every woman maternity leave or maternity leave to restore her ability to work after pregnancy and childbirth, as well as to raise a young child.

Officially, maternity leave is issued as a sick leave during a period of incapacity and is paid by the employer in one hundred percent amount or by the social insurance fund as a benefit for state social insurance of citizens of the Russian Federation. Maternity leave is issued for the prenatal period for 70 or 84 calendar days and 70,86 or 110 calendar days postpartum. In total, on average, maternity leave ranges from 140 to 19 calendar days. Duration of maternity payments by law According to Article 15 of the Law of the Russian Federation No. 255 213-FZ of December 29, 2006, the period for assigning maternity benefits is made within ten calendar days from the date of filing the application, which is supported by a package of necessary documents.

One-time maternity payments are given to women who:

- Those working with official employment.

- Students in higher, vocational and secondary educational institutions.

- Those who were subject to staff reduction or subsequent liquidation of the enterprise were left without a job.

The benefit is paid depending on the social status of the recipient. Payments are made from the budget of the educational institution, by enterprises from the Social Insurance Fund (SIF) or by the Departments of Social Protection of the Population.

In order to be able to submit documents for the appointment and payment of benefits as early as possible, a woman must contact her gynecologist in advance to register her for pregnancy. It is also worth considering that if registered before the 12th week of pregnancy, the woman will receive additional payments from the state. In this case, the timing of payments will not depend on the timing of the provision of medical documents that will be needed to obtain benefits.

The gynecologist determines the approximate date of birth, on the basis of which maternity leave will then be issued upon reaching the 13th week of pregnancy. Then the procedure for issuing a sick leave certificate is carried out, which records the start and end date of the vacation. On the basis of which the appointment and then payment of benefits will be made.

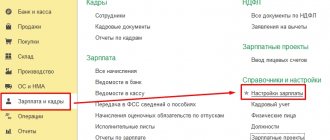

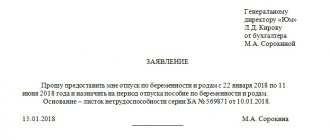

The woman submits a certificate of incapacity for work to the human resources department of the employer. The management of the enterprise, based on the sick leave received from the employee, issues an appropriate order, which affects the immediate timing of calculation and issuance of benefits. The employee is obliged to provide the employer, in addition to the certificate of incapacity for work, with a statement written by her.

Although not all employers require such a statement, it is worth playing it safe and submitting it along with other documents to avoid problems.

When do you need to provide a certificate of incapacity for work?

The terms of payment of maternity benefits that apply in a particular case depend on the moment when the woman provided the administration of the employing company with a certificate of incapacity for work. According to 255-FZ, the expectant mother is obliged to present the document to the employer no later than six months from the end of the vacation.

To receive sick leave, the employee goes to the medical institution where her pregnancy is being managed. According to current legislation, only documents from hospitals and clinics operating under license are accepted.

The second piece of paper required to receive benefits is an application from the employee. It is prepared in free form and contains the following information;

- company name, full name of the manager;

- Full name and position of the employee;

- dates of maternity leave;

- Number of certificate of incapacity for work.

The application is certified by the signature of the originator.

Based on the documents submitted, personnel officers will determine how long maternity leave must be paid. An internal order will be issued to transfer benefits to the woman. It will be issued in an amount calculated on the basis of average earnings.

If the employer violates the terms of payment of maternity leave

As mentioned above, all payments of maternity benefits are transferred to the woman on maternity leave from the social insurance fund, the funds are transferred to the account of enterprises on whose staff the woman is on maternity leave, and from the employer’s accounts are transferred to the account of the woman who received maternity benefits.

There are situations when the Social Insurance Fund delays transferring the required amount to the company’s accounts; in this case, the employer is obliged to pay benefits from his own funds or funds prescribed in the enterprise’s budget for force majeure situations; all funds will subsequently be compensated by the social insurance fund. In case of untimely payment of funds by the employer, the employee has the right to file a complaint against him with the labor commission.

When are funds transferred?

The current legislation does not stipulate in what form the employing company sends the amount due to the expectant mother. Money can be transferred to a card or issued by cash registers if it is convenient for both parties.

Federal Law 255 strictly regulates the period during which maternity benefits are paid. According to the text of the regulatory act, the amount is calculated within a ten-day period from the moment the employee brought the certificate of incapacity and application to the personnel department. The funds must be transferred with the next paycheck.

Example

Petrova A. brought a certificate of incapacity for work to the employer’s accounting department on April 7. The company pays salaries twice: on the 5th and 20th. How long should a pregnant woman be paid maternity benefits?

In this situation, the company accountant is obliged to accrue benefits to Petrova no later than April 15th. The next payment of wages will occur on April 20, on this date the company will pay the employee benefits.

Amounts to be given to the expectant mother are not subject to income tax. Insurance premiums are not calculated or paid from them.

There is no universal answer to the question of when maternity benefits are paid: before or after childbirth. The date when the woman receives the amount due depends on the moment the certificate of incapacity for work is submitted to the personnel department of the employing company. If she decides to bring the document after the baby is born, the organization does not have the right to refuse to transfer the benefit.

Responsibility of the company for delays in payments under the BiR

Current legislation strictly regulates when maternity pay is paid at work in order to eliminate possible abuses on the part of employing companies. If an organization does not follow the norms of 255-FZ, it is subject to liability under Art. 236 Labor Code of the Russian Federation.

An employee going on maternity leave is entitled to compensation in addition to the accrued amount, calculated as 1/150 of the refinancing rate of the Central Bank of the Russian Federation in force at the moment for each day of delay. The countdown begins from the date following the “deadline” for payment, up to and including the time of settlement.

Responsibility for violating the terms of how much maternity workers pay can be increased by internal acts of the company, for example, a collective agreement. To collect penalties from an unscrupulous employer, a woman goes to the labor inspectorate or court.

In addition to the obligation to transfer compensation for late benefits under the BiR, administrative liability is provided under Art. 5.27 Code of Administrative Offenses of the Russian Federation. In accordance with the regulatory act, the amount of the penalty is:

- 1-5 thousand rubles. – for an official or individual entrepreneur;

- 30-50 thousand rubles. - For the company.

Violation of the provisions of the law regarding the period in which maternity benefits must be paid, associated with a delay of three months or more, entails criminal liability for the director of the company under Art. 145.1 of the Criminal Code of the Russian Federation. The most severe punishment is imprisonment for a year.

Nuances you need to know about

To begin with, we will talk about important points regarding registration of maternity leave and receipt of maternity benefits (B&B).

In this case, only the woman has the right to leave and payment. No one else can apply for money. In this case, a woman can be (see Federal Law No. 81-FZ of May 19, 1995):

- officially employed;

- dismissed during the previous 12 months of pregnancy due to the liquidation of the organization or closure of the individual entrepreneur;

- full-time student;

- contract soldier.

Also, women who did not give birth to a child themselves, but are adopting one, can apply for paid leave under the BiR.

The benefit is paid only if the woman takes maternity leave. If an employee has adopted (gave birth to) a baby, but has not taken leave, that is, continues to work, she will not be paid anything other than wages.

In their pure form, such situations rarely occur. But it often happens that a woman takes maternity leave later for a certain period - several days or weeks. This is done, for example, so that sick leave “costs” more in the future.

To make it clearer, let's show it with an example. It is known that the average earnings for the previous 2 years are used for benefits. Let's say maternity leave starts in December 2021, then salaries for 2021 and 2021 will be taken into account. But this may not be profitable for the employee, for example, because her salary was increased in 2021. Therefore, she takes out maternity leave not from the date indicated on the sick leave, but from 01/01/2019. In this case, the calculation is made based on data for 2021 and 2021.

But here you need to understand that the maternity leave itself will end on the date indicated by the gynecologist, that is, it will be shorter. This means that benefits will be paid less over time. Therefore, it is advisable to calculate everything in advance and determine what is more profitable: take a vacation of 140 calendar days or less, but with higher pay.

A similar situation may arise if a woman decides to go to work before the end of her maternity leave. In theory, in this case, a woman should not receive wages, since the law prohibits receiving both B&R benefits and wages at the same time. Therefore, if an employer needs an employee to leave, he must either withhold the money paid earlier from her salary, or not show that the person is working, and register payments to him as another type of income.

It often happens that while on maternity leave and receiving child care benefits, a woman becomes pregnant again. In this case, she will have to choose what benefit she will receive: for caring for her older child or maternity leave for 140 days. Mothers cannot receive both types of financial assistance at the same time.

Expectant mothers who officially worked simultaneously for several employers over the previous 2 years have the right to apply for payments in connection with maternity leave at all places of work (see Decree of the Government of the Russian Federation of June 15, 2007 No. 375). But if a woman has worked simultaneously in several different companies over the past 2 years, then she can only turn to one of the last employers of her choice for money.

Regardless of who actually issues maternity benefits, the funds are paid from the Social Insurance Fund budget. The woman receives the entire amount at once. Payment in installments is not acceptable.

It doesn’t matter what the applicant’s salary was in the previous 2 years, labor and social legislation stipulate certain limits of financial assistance provided to women. The maximum benefit amount for 140 days of maternity leave will be 301,095.89 rubles. The minimum amount that must be paid to a woman is 51,918.9 rubles.

Features of transferring maternity benefits

The legislation provides for situations when an expectant mother needs to apply for benefits directly to the Social Insurance Fund. This is possible if:

- at the time of pregnancy, the woman is not working and is registered with the employment center;

- the employer does not have money to pay;

- the employing company is declared bankrupt.

In the listed situations, the sick leave and completed application are submitted directly to the territorial office of the Social Insurance Fund at the place of registration of the expectant mother. When is maternity pay paid in this case? According to 255-FZ, the Fund has 10 calendar days to transfer them from the moment it receives a package of documents from the woman.

Which parents can get help?

Any citizen of the Russian Federation with a newborn child is entitled to payment, regardless of income and place of residence.

Having confirmed their status with documents, the following may also apply for a positive decision:

- Foreigners permanently living in the Russian Federation or temporarily residing in Russia as of December 31, 2006;

- Stateless persons permanently living in the Russian Federation or temporarily residing on the territory of Russia as of December 31, 2006;

- Refugees.

Both the child’s mother and father, or an individual replacing them—a representative by proxy or the child’s guardian—can apply for benefits.

The following categories of citizens will not be able to receive the payment::

- those parents whose children for some reason are fully provided for by the state, for example, in orphanages;

- parents deprived of rights to a child;

- citizens of the Russian Federation who permanently live abroad;

- parents whose child was born dead.

If the benefit was issued incorrectly due to the fault of a citizen who provided false information to the social protection department, then the funds paid are subject to seizure.

In the event that the amount is transferred due to the negligence of OSZN employees, the payment is not withheld.

The child's parents are entitled to benefits, regardless of whether they are married or not.

If the marriage is not registered, then the applicant submits a certificate confirming the establishment of paternity of the child in the set of documents.

Divorcing couples make payments to the parent with whom the child lives (this fact is confirmed by a certificate of cohabitation).

A parent has the right to apply for a one-time child benefit at his place of residence, regardless of his place of registration or even in its absence.

This is due to the fact that the payment is made from the state budget, and not from regional budgets.

Conclusions for 2021

Here are the main conclusions about the timing of maternity payments in 2021:

- In order to receive maternity leave, a woman must not miss the deadline for applying for it. You must apply for maternity benefits no later than 6 months from the date of the end of your leave under the BiR (Part 2, Article 12 of the Federal Law of December 29, 2006 N 255-FZ).

- The employer assigns maternity benefits within 10 calendar days from the date the employee applies for such benefits. And the employer must pay maternity benefits on the day closest to the date established for payment of wages (Part 1, Article 15 of Federal Law No. 255-FZ of December 29, 2006).

- As a general rule, maternity benefits are paid by the employer, but in some cases, the Social Insurance Fund pays benefits under the BiR, for example, if the employer is bankrupt.

- The territorial branch of the Social Insurance Fund must pay maternity benefits within 10 calendar days from the day the woman submitted the application and the necessary package of documents (Part 2 of Article 15 of the Federal Law of December 29, 2006 N 255-FZ).

Read also

10.01.2018

Advance amount

But how can we determine the amount of payment for that part of the income that needs to be transferred to the employee for half the month? When determining the amount, you need to remember that the payment should include not only part of the employee’s salary (tariff), but also his permanent bonuses, the calculation of which does not depend on the results of work for the month or on the fulfillment of the monthly quota.

When calculating the advance, you should include part of the permanent remuneration for work performed and allowances in the form of compensation. For example, an employee works in shifts and his earnings include additional payments for night work (Article 154 of the Labor Code), and there may also be allowances for combining professions or length of service.

Allowances, which depend on the results of work for the month, are accrued to the employee when the payment for the entire month is formed. These include incentive payments (bonuses), which are accrued based on the results of completing work for the month, additional payments for overtime work, for work on weekends and non-working holidays (Articles 152, 153 of the Labor Code of the Russian Federation), regional coefficients, northern allowances, etc. d. The listed payments are not taken into account when calculating earnings for the first half of the month.