Mistake #1. Calculation of contributions for SMEs in case of exceeding the maximum base value (corrected)

For organizations that have established a preferential tariff for SMEs since April 2021, if the maximum value of the contribution base is exceeded, the amount of contributions is calculated incorrectly.

For more details, see - “Error” in 1C programs when calculating insurance premiums at a preferential rate for small and medium-sized businesses

The error was fixed in ZUP versions 3.1.10.491 and 3.1.14.97.

After updating the program to correctly account for the amounts of contributions to the DAM , they should be recalculated in a special way.

For more details, see - Attention! Rules for recalculating contributions after updating to ZUP 3.1.10.491/3.1.14.97 at a preferential rate for SMEs in case of exceeding the maximum value of the contribution base

When are they renting out?

Cases when an adjustment to the DAM is submitted in 2021 and for previous periods (Article 81 of the Tax Code of the Russian Federation, clause 1.2 of Appendix No. 2 to Order No. MMV-7-11/):

- Errors in the original calculation form. Errors due to which the total amount of insurance premiums to be transferred decreased are taken into account: inaccuracies in calculations, mechanical errors, typos.

- Lack of mandatory information. An error is the failure to mention the insured person in section 3 of the calculation, or inaccuracies in the personal information of the insured person.

IMPORTANT!

Errors that do not underestimate the amount of insurance premiums payable in the calculation do not need to be corrected. The exception is violations of the procedure for filling out information about insured persons.

Mistake #2. Adjustment of the DAM not related to changes in personal data (corrected)

When submitting adjustments on the DAM that are not related to changes in personal data, namely the combination of “SNILS”, “Last Name, First Name, Patronymic”, a negative protocol is received with the error that “In p.3 there cannot be two sheets with the same values of SNILS indicators and full name.

For more details, see - Erroneous filling of the corrective RSV in ZUP 3.1

Error logged - Error 10223005.

The error was fixed in ZUP versions 3.1.10.511 and 3.1.14.129

In what cases may an updated report be needed?

The grounds for filing an adjustment are contained in the provisions of the Tax Code of the Russian Federation. So, according to Art. 81 of the Tax Code of the Russian Federation , an adjustment is required if the calculation itself understates the amount that must be paid for a certain period.

It should be noted that the corrective document in this case is not new, but is directly related to the previous one.

However, it is important to take into account that in some situations, some errors lead to the fact that the report is not considered submitted at all. This means that the organization can face very impressive sanctions for violating the reporting procedure.

Such errors include:

- inaccuracies when filling out sections containing personalized accounting information;

- inaccuracies in determining the base, amount of payments and amount of contributions;

- discrepancies in calculating the amount of contributions for specific employees in relation to the total amount of contributions for the organization as a whole.

In all these cases, the organization is required to submit a new DAM form.

Reference! Submitting corrective reporting documentation in cases where a new report is required does not make any sense, since the previous DAM is considered not submitted at all.

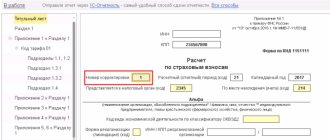

Mistake #4. Control ratios in the DAM for the SME tariff (corrected)

When using the SME preferential tariff, an error occurs when checking control ratios in the DAM:

“Check of subsection 3.2.1 to Section 3 (KS 1.197)

If in Subsection 3.2.1 R.3 for an individual (set of SNILS + full name indicators) line 130 = MS, then line 130 = NR line 150 = minimum wage for each value line 120"

Error logged - Error 10223815.

It arises due to an incorrect CS prescribed in the Letter of the Federal Tax Service dated 05/29/2020 N BS-4-11/ [email protected] The correct CS was published in the Letter dated 06/23/2020 N BS-4-11/ [email protected]

The error was fixed in ZUP versions 3.1.10.511 and 3.1.14.129

How to correct the information provided

Instructions on how to submit the DAM adjustment without section 3 in 2021 or for the previous period:

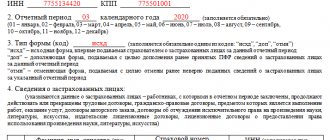

- Fill out the clarification form using the same form as the original one. If you are correcting information for 2021, use the form from Order No. ММВ-7-11/. And if you need to adjust previous periods, then fill out the form from order No. ММВ-7-11/.

- Transfer all the correct information from the original RSV to the clarification form.

- On the title page in the “Adjustment number” section, enter the value 1 for the first clarification, 2 for the second, etc.

- In sections 1 and 2, enter all the indicators - both correct and corrected. You will get the same RSV, but with the correct values.

- If you must take Section 3, fill out only the information that needs to be confirmed. Do not transfer the remaining information from the original form. Indicate the serial number of the insured person as in the first DAM (letter of the Federal Tax Service No. BS-4-11/ dated January 10, 2017).

Here’s a step-by-step guide on how to make an updated calculation of insurance premiums and send it to the Federal Tax Service:

Step 1. Fill out the adjustment form according to the specified rules.

Step 2. Send to the Federal Tax Service. If the number of employees is more than 25 people, then the report is submitted electronically. If less, then at the discretion of the taxpayer: electronic or paper.

Error in employee personal data

Inaccuracies in personalized information are filled out according to special rules. We have collected in a table how to make an adjustment to the daily allowance for one employee in different situations:

| Correction of information, except full name. and SNILS | Correction of full name and SNILS, if you indicated an incorrect but real insurance number |

|

|

And this is an example of an adjustment to the DAM for the 3rd quarter of 2021 in section 3 of the form:

Error in Section 3 amounts

Instructions on how to fill out a corrective RSV in 2021 if the amounts for a specific employee are incorrectly indicated:

- We create a report for one employee. Sections 1 and 2 are transferred from the original RSV.

- In section 3 we put the correction number 010.

- In subsection 3.2 we indicate the correct amount.

- Double-check the total amount on the report.

- If there is an underpayment, pay the arrear before submitting the report to the Federal Tax Service.

Extra employees

Here’s how to fill out the adjustment calculation for insurance premiums if an extra employee was included in the primary DAM:

- We put the correction number on the title page.

- Sections 1 and 2 are transferred from the primary form.

- We fill out section 3 as follows: in line 010 - the clarification number, and in subsection 3.2, instead of amounts, we indicate zero values.

- We recheck the RSV and recalculate the total amount of insurance premiums payable.

- We check the results (they will change automatically) and send them to the Federal Tax Service.

By analogy, a clarification is filled out if you forgot to indicate an employee in the calculation. Only in section 3, instead of zeros, real figures of accrued insurance premiums are put. The amount payable to the Federal Tax Service will increase, so do not forget to pay the arrears and penalties before sending the report.

Mistake #9. Erroneous distribution between the basic and SME tariffs for UTII

When using a preferential SME tariff, in some cases in the DAM , an erroneous distribution of contributions between the basic and preferential tariff may occur if the UTII regime is present.

As a workaround, you can perform the following steps:

- Temporarily delete % UTII Payroll and contributions

- Enter Recalculation of insurance premiums (Taxes and contributions - Recalculation of insurance premiums) in the same month as Calculation of salaries and contributions . It will transfer the amount of contributions from UTII to the general regime.

- Fill out the RSV .

- Return % of UTII in the document Calculation of salaries and contributions .

- Delete Recalculation of insurance premiums .

Deadlines for submitting updated calculations

If errors are discovered by the reporting person, the clarification must be submitted as soon as possible. This is done so that the Federal Tax Service does not detect these errors on its own. It should be noted that before submitting the clarification, you need to pay the arrears of contributions and penalties (calculated independently). If you do everything according to the specified scheme, the Federal Tax Service will not issue fines.

If the Federal Tax Service itself finds errors, the policyholder will receive a corresponding demand. You must submit the updated calculation and pay off the arrears and penalties within the time limits specified in the request.

Error for disabled organizations (fixed)

If an organization that previously had an insurance premium rate - Organizations of Disabled Persons - establishes a preferential rate for SMEs, then for non-disabled employees, contributions for “injuries” will no longer be calculated at a preferential rate.

Error logged - Error 60000883

The error was fixed in ZUP versions 3.1.10.511 and 3.1.14.129.

After updating to a release in which the error is corrected, in the organization’s accounting policy ( Organization - Accounting policy tab and other settings - Accounting policy ), in addition to the tariff For small or medium-sized businesses, the Organization of disabled people checkbox

Next, you will need to create separate documents Recalculation of insurance premiums (Taxes and contributions - Recalculation of insurance premiums) for each month of the second quarter and calculate them. Negative amounts for contributions “for injuries” should appear. For example, this is what the recount for April 2021 will look like:

The changes made will require reformation of the documents Reflecting wages in accounting (Salary - Reflecting wages in accounting) for the second quarter of 2021 or making manual adjustments to the amounts of contributions “for injuries” (reductions by the amount of recalculations) in the June Reflection of wages in accounting .

How to submit updated data

The corrective form must be submitted in the same form as the main calculation. In this case, existing legislative requirements on this issue must be taken into account.

So, in 2021, in most cases, an electronic document is submitted. This applies to all those organizations in which the number of full-time employees exceeds 10 people. If the organization or enterprise has fewer employees, then the organization’s management has a choice between electronic document management and sending documents in traditional paper form.

Important! Failure to comply with the required form for submitting documentation leads to the fact that the DAM is recognized as not submitted, which is fraught with the imposition of additional penalties on the organization.

The reporting itself is submitted directly to the tax office, with which the organization is registered as a taxpayer.

It should be noted that according to similar rules, not only calculations are submitted in the DAM form, that is, related to the deduction of insurance premiums, but also tax returns. Adjustments to tax returns are permitted if an erroneous calculation of the amount of tax being calculated has led to the fact that it is actually less than it should be.