Concept

Overhead costs are additional to the main expenses of the enterprise for the management, organization and maintenance of production. They are not directly related to the main production of goods or provision of services, and are not included in the cost of materials and labor.

Overhead costs thus - without being related to the main production process - ensure the normal functioning of the company or enterprise.

Overhead costs are included in the cost of goods, the costs of their production and circulation, but not directly , but indirectly - in proportion to the cost of materials and raw materials, the amount of wages, and so on.

As a result, estimated overhead costs can be called associated costs that are not directly transferred to the cost of each unit of production, but are subject to distribution.

Also see “Working with Overheads: Order for Approval.”

Under-allocated and over-allocated PNR

In practice, we may encounter two situations that require adjustments to financial accounting data.

- If in the reporting period the amount of distributed commissions is greater than the actual ones, then the resulting difference is redistributed commissions.

- If in the reporting period the actual commissions turned out to be more than the allocated ones, then the resulting difference is underdistributed commissions.

The resulting difference is written off in financial accounting using one of two methods.

- The adjustment amount is written off in full to cost of goods sold.

- The adjustment amount is written off to the following accounts in proportion to their balances: “Cost of goods sold,” “Finished goods,” and “Work in progress.”

Important!

This problem is discussed in more detail in the next section.

Composition of overhead costs

As a general rule, overhead costs include:

- Current repairs of buildings and structures, equipment.

- Salaries, training and maintenance of the administrative and managerial apparatus.

- Expenses for servicing vehicles on the company's balance sheet.

- Rent for office, product warehouse.

- Costs incurred due to downtime and defective products.

- Costs associated with the operation and maintenance of fixed assets.

- Costs of advertising, consulting services.

- Maintenance of the office, payment of utilities.

- Maintenance of main production.

- Expenses for communication services (telephone, Internet), etc.

Distribution of general business expenses. What are production overheads? The basis of their distribution.

Overhead costs can be more broadly grouped into four groups:

- Costs of production and its organization.

- Costs of maintaining the administrative apparatus.

- Staff service.

- Non-production expenses.

KEEP IN MIND

In the Tax Code of the Russian Federation, overhead costs are not designated as such, their structure is not defined. The same applies to accounting - there is no differentiation of overhead costs. Overhead costs are fixed by law only in such areas as construction, science, and medicine. Ordinary companies establish their own list of such costs.

For example, in trade organizations such expenses usually include costs associated with packaging, storage, transportation and marketing of products.

The amount of overhead costs is indicated in budget plans and estimates, as well as in the own budget plans of structural divisions.

Results

The list and methods of distribution of overhead costs will vary depending on the industry of the organization, the number of its personnel, objects of calculation and other factors. If overhead costs are not taken into account correctly, as a result, their overexpenditure occurs, the cost of products or services is overestimated/underestimated, and the level of profit decreases. Rationing and control of expenses allows for their effective planning, and therefore improves the economic position of the company.

How to calculate overhead costs

The company independently determines the parameters in proportion to which overhead costs will be distributed.

When planning overhead costs, several methods are usually used:

1. Determination of overhead costs in proportion to the wage fund of workers employed in the main production, as part of direct costs.

This method is suitable for organizations that have a significant number of primary production workers (primarily manual labor).

EXAMPLE

The company is engaged in cargo transportation. The wage fund is 10 million rubles. in year. In 2021, overhead costs, according to the plan, had a coefficient of 85% and, accordingly, amounted to 8.5 million rubles. That same year, the company reduced its workforce with the goal of reducing overhead costs by up to 60%.

Consequently, in 2021, while maintaining the payroll for workers in the main production, overhead costs will amount to 6 million rubles.

What is a BDD and methods of its formation. How is a time sheet filled out? What does the cost include:

2. If a company's production process is largely automated, it makes more sense to distribute costs in proportion to sales volume or machine hours.

3. If costs not directly related to production are significantly less than direct costs, it is logical to use the ratio of direct costs for the production of 1 unit of output to the total amount as the basis for distribution.

4. Overhead costs can be determined by direct counting for each of the available cost items.

5. In large organizations with a wide range of goods and complex infrastructure, combined methods for calculating overhead costs can be used.

EXAMPLE

The coefficient of general business overhead costs is distributed in proportion to the wage fund, and production costs - in proportion to material costs.

To plan and account for overhead costs, the total amount of costs for the business activities of the organization is calculated. Next, calculate the amount of overhead costs that will be included in the estimate for a unit of manufactured goods of each item.

If, according to the law, there is a planned cost, the amount of overhead costs is calculated in accordance with the standards established by law for specific expense items.

In general, overhead costs are calculated in accordance with the standards established in the company's accounting policies. They are calculated based on data from past periods, taking into account their planned changes.

In this case, the organization independently sets the period for making payments.

KEEP IN MIND

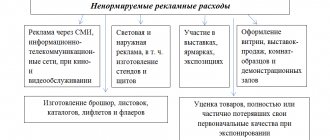

In tax accounting, some types of overhead costs are subject to rationing. And this:

- expenses for voluntary insurance of employees (clause 16, part 2, article 255 of the Tax Code of the Russian Federation);

- entertainment expenses (clause 2 of article 264 of the Tax Code of the Russian Federation);

- advertising expenses (clause 4 of article 264 of the Tax Code of the Russian Federation);

- expenses for the formation of reserves for warranty repairs and maintenance (Article 267 of the Tax Code of the Russian Federation);

- expenses in the form of interest on debt obligations under controlled transactions and controlled debt (Article 269 of the Tax Code of the Russian Federation);

- expenses for the formation of reserves for doubtful debts (paragraph 2, subparagraph 3, paragraph 4, article 266 of the Tax Code of the Russian Federation).

Read also

09.05.2020

Terminology

All expenses of the organization are divided into basic and overhead. The first category includes those associated with the production process: salary of workers, cost of raw materials, etc. Overhead costs are the costs of organizing business processes that support production activities: management, production organization, business trips, employee training, etc. This category includes such non-production costs as compensation for damage from loss and damage to valuables.

You may be interested in: The basic concept of a credit institution: features, types, goals and rights

Maintenance of workers, construction sites

Channel PROGRAMMER'S DIARY

The life of a programmer and interesting reviews of everything. Subscribe so you don't miss new videos.

The first category includes costs for:

- personnel training;

- contributions for social activities of workers employed in construction;

- provision of living conditions: depreciation of household premises;

- wages for cleaners, mechanics, electricians and other service personnel;

- maintenance of freely provided premises, their repair and maintenance, etc.;

- labor protection: repair and washing of workwear, individual equipment;

- purchase of first aid kits, medicines, medical and preventive services;

- purchase of reference books, safety posters;

- contributions for social events;

- for medical examinations, certification of workplaces, purchase of regulatory documents on labor protection, etc.

You may be interested in:Minimum minimum deposit balance: features and calculation

Manufacturing overhead costs also fall into this category.

The costs of organizing construction sites include:

- wear of production tools;

- wear and tear of temporary structures: storerooms, canopies, showers, decking, stairs, structures, temporary wiring of electricity, water, gas networks;

- formation of reserves for all types of repair work;

- maintenance of fire protection, carrying out experimental work, improvement proposals, geodetic work;

- production design, laboratory maintenance;

- improvement of construction sites.

Rate

The cost structure of medical services is different. Some of them do not use consumables. At the same time, laboratory and radiology services are resource-intensive. When choosing a cost classification base, you need to take into account the specifics of service provision. From the examples presented earlier it is clear that the same expenses can be written off to cost in different amounts. If an institution uses materials fully or partially to provide services, then classifying costs by labor intensity is inappropriate. In such situations, it is better to use the distribution method in proportion to direct costs, choosing the volume of materials used as the latter. Their quantity, price and types of services should be taken into account. An alternative way is to classify costs by tariff.

Example

Current price list of medical institution services:

- Service A: 250 rub. - 19.7% (250 / 1270 x 100).

- Service B: 400 rub. - 31.5% (400 / 1270 x 100).

- Service B: 620 rub. - 48.8% (620 / 1270 x 100).

Total: 1270 rub.

The accountant needs to include costs for personnel training in the amount of 32 thousand rubles. in cost:

- Service A: 19.7% - 6300.8 rub.

- Service B: 31.5% - 10,080 rub.

- Service B: 48.8% - 15,619.2 rubles.

Optimization

To reduce direct and overhead costs, you need to plan them in advance. Drawing up a detailed budget and subsequent analysis of deviations of actual costs from planned ones will help management analyze the cost structure and identify bottlenecks. Another way to optimize is to identify hidden reserves and automate routine processes. For example, instead of expanding the accounting staff, you can automate the entry of items and thus relieve the workload of the inventory accountant. It is also possible to outsource the accounting process, that is, service by a third party.

Very often, future cost reductions involve capital investments. For example, in the long run it is more profitable to purchase premises and equipment than to spend money on rent. Optimization methods also include the competent selection of material suppliers and wholesale purchasing, which allows you to take advantage of discounts.

Sometimes department heads simply don't see cost reduction options. In such situations, it is worth considering proposals from lower-ranking employees. For example, issue an order so that during the quarter each employee makes a proposal to reduce costs in his department. This strategy will allow you to identify bottlenecks and hidden reserves in each department.

Labor intensity

This indicator means the cost of working time to produce a unit of product / provide one service. The value is measured in UET (conventional units of labor intensity). In dentistry, the procedure for calculating labor intensity is prescribed in Instruction of the Russian Ministry of Health No. 408 of 2001. For other areas of medical services, the procedure for calculating labor intensity is not established by law. In practice, the method of timing and expert assessments is used for this purpose.

The first method involves calculating the time in minutes for the provision of services. To carry out the experiment, a minimum of three specialists and one assistant are required. An observation card is created for each doctor. It records the time spent on providing the service, taking into account all the necessary elements: from examining the patient to taking an x-ray, from removing a filling to installing a prosthesis, etc. The experiment ends after 10 operations are performed by each doctor: providing first aid, performing a certain operation, making a pin, etc.

Labor intensity is calculated using the formula:

T1 = T / 30 minutes, where:

- T is the total time spent performing all operations.

- T1 is the time required to perform one action.

UET = T1 / 20 minutes.

Additionally, rest time is taken into account (within a 4-hour shift):

- 10 min. - for personal needs;

- 10 min. - to rest;

- 10 min. - to the morning meeting;

- 10 min. - for sanitation work.

Accordingly, if during a shift (six and a half hours) a doctor needs to perform 5 procedures with a labor intensity of 5 UET, then there remains: 2 minutes x 4 = 8 minutes for rest.

The expert assessment method must involve at least 10 specialists who have a certificate for providing certain types of services and knowledge of a specific technology. Each of them must have at least 5 years of work experience in their specialty, and at least 12 months in a specific industry. The essence of the experiment comes down to the following. Doctors are provided with a clear description of the case. They coordinate it with their personal experience of providing assistance and make adjustments. An independent expert, based on these data, calculates the UET using the formulas presented earlier.

Example

Variable overhead costs in a medical institution are transferred to the cost of services provided in the following proportions:

- Service A: 30 UET - 33.3% (30 / 90 x 100).

- Service B: 50 UET - 55.6% (50 / 90 x 100).

- Service B: 10 UET - 11.1% (10 / 90 x 100).

Total: 90 UET.

At the end of the month, the institution received an invoice for water supply services in the amount of 9 thousand rubles. This amount is transferred to the cost of services in the following proportions:

- Service A: 9,000 x 0.333 = 3 thousand rubles.

- Service B: 9,000 x 0.556 = 5 thousand rubles.

- Service B: 9,000 x 0.111 = 1 thousand rubles.

Scope of services

The medical institution provides several types of services. Based on the results of the monthly work, statistics are generated on the volume of work performed for each study (analysis, procedure, etc.) in each department. Although all types of services are equal to each other, their valuation differs significantly.

Example

Data on the volume of services provided by the medical institution for the month:

- Product A: 20 pcs. - 11.1% (20 / 180 x 100).

- Product B: 50 pcs. - 27.8% (50 / 180 x 100).

- Product B: 110 pcs - 61.1% (110 / 180 x 100).

- Total: 180 pcs. goods.

You may be interested in: Tax revenues of local budgets: analysis of the revenue side

At the end of the month, the institution received an invoice for electricity services in the amount of 15,000 rubles. Taking into account the subsidies received, 7,500 rubles. The organization will have to cover it from its own income. Payment of overhead costs will be carried out in the following proportions:

- Service A: 7500 x 0.111 = 832.5 rub.

- Service B: 7500 x 0.278 = 2085 rub.

- Service B: 7500 x 0.611 = 4582.5 rub.

Examples of rationing

Let's analyze the process of rationing the organization's expenses, the volume of which is 16.871 million rubles.

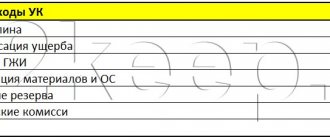

Administrative cost items:

- Salary of administrative staff + insurance premiums - 10 million 258 thousand rubles.

- Communication services - 1 million 124 thousand rubles.

- Consulting, legal services - 560 thousand rubles.

- Stationery — 512 thousand rubles.

Total: 12 million 454 thousand rubles.

General economic cost items:

- Employee training - 210 thousand rubles.

- Labor protection - 78 thousand rubles.

- Hygiene products - 38 thousand rubles.

Total: 326 thousand rubles.

Organization of business processes:

- Security — 1 million 943 thousand rubles.

- Fire safety - 755 thousand rubles.

- Car repair - 515 thousand rubles.

- Fuel - 878 thousand rubles.

Total: 4 million 91 thousand rubles.

Total expenses: 16 million 871 thousand rubles.

At the end of 2021, management will be able to compare actual costs with planned ones, analyze possible excesses and make decisions to minimize costs.