What is a work completion certificate?

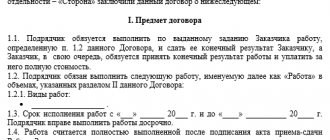

In essence, the certificate of work performed and services provided is a bilateral document that confirms the fulfillment of certain obligations or provision of services that are specified in the agreement between two counterparties. The title (this can be an act of completed work, an act of acceptance of completed work, an act of acceptance and delivery of completed work, etc.) is specified at the stage of signing the contract, and then the chosen wording must appear in all documents.

The document must display all work performed, its volume, cost, start and end dates. This is very important, since this is a kind of report from the contractor to the customer and is filed with the contract. Such “paper” is today the most common way of confirming fulfilled contractual obligations.

Why is this necessary?

This document is primary; it provides confirmation of the fact that the obligations provided for under the terms of the agreement are 100% fulfilled. The act is a bilateral document; it is signed by both parties, called the contractor and the customer, respectively. The document will have a certain legal force even in the situation where the signing was carried out by one party. However, in this case, it is necessary to confirm the fact of refusal of the other participant, including using the signatures of witnesses.

With the help of a certificate of completed work, it will not be difficult to protect yourself from the formation of disagreements that may arise between contractors. If a conflict situation does arise, the document will constitute the main evidence in the judicial body. If the customer is not satisfied with the result obtained, all his claims will be reflected in this paper.

Act and accounting of the organization

The certificate of completion of work refers to the primary accounting documents on the basis of which payment is made. In addition, this document, together with the contract, can be used during legal proceedings or to calculate the statute of limitations. This is clearly stated by Federal Law-129 “On Accounting”, which states that all business transactions carried out by an organization of any form of ownership must be reflected in accounting.

Not everyone knows that for incorrect execution of the act, fines (or additional taxes) may be imposed on the organization, and the tax authorities may exclude the costs indicated in such acts from the costs when calculating income tax, and this is already quite serious.

The dates indicated in such documents are of great importance for attributing them to a specific reporting period, and untimely submission of acts may lead to a violation in the attribution of costs. Consequently, the income tax for a specific period will be underestimated or overestimated. In addition, expenses to reduce tax must be related to the activities of the organization. Article 9 of the Accounting Law lists all the details that are of decisive importance during registration. Therefore, before drawing up an act, you should carefully study this law.

How to compose it

Employment contract between individual entrepreneurs and individual entrepreneurs - sample completed document

The form must be filled out strictly according to the model, even if the company has its own form. There are mandatory items that must be specified. Key points:

- the act must have a number. It is reflected in the accounting program and is indicated when preparing the monthly report;

- date of preparation and date of provision of services. These positions may vary. For example, if transportation is ordered in advance;

- company name and customer information. The official name is written without abbreviations;

- number of the contract on the basis of which the act is drawn up;

- bank details, where funds for the service will then be transferred;

- transfer amount for each item and the total cost of services;

- order fulfillment time;

- signatures of both parties and seal of the organization. If the order is carried out by a private person and not an entrepreneur, then the passport details of the performer are recorded.

Note! The person who provides the services is not required to put his signature on the paper if he is an ordinary worker. Most often, such documentation is signed by the bosses who organize this process.

The concept of “works” and “services”

It would be appropriate to talk about what is meant by the concepts of “works” and “services”. Civil legislation does not provide direct definitions, but Chapter 39 of Part 2 of the Civil Code of the Russian Federation “Paid provision of services” states that a contract for paid provision of services is used in the provision of communication services, auditing, veterinary, information, consulting, training or tourism services. As for contracts providing for the performance of certain works, they take place during transportation, maintaining bank accounts, storage, transport expeditions, performing research, technological or development work, as well as when drawing up a contract.

Legal regulation

The basic documents on this issue include the following provisions of the Civil Code of the Russian Federation:

- Art. 753 - it states that it is necessary to draw up an act used as evidence of the fact of the activities carried out;

- Art. 752 – disclosure of the main nuances, provision of information to prevent misunderstandings with the tax authorities.

Along with this, it is worth taking into account the norms of Federal Law No. 402 of December 6, 2011. This provision states that the act in question is a primary document.

How to draw up a work completion report?

To date, there is no unified form provided by law. But it is worth noting that there are forms KS-2 and KS-3, which are used to reflect the actions performed during construction. This means that organizations have the right to independently develop a form that will be most convenient in a particular case.

Regardless of the design, the paper must contain the following information:

- name (it is determined by the contract);

- Date of preparation;

- names of the customer and contractor (this data is entered in accordance with the official constituent documents; all names must correspond to the names that appear in the contract);

- the name of the operations performed (this is done, as a rule, in the form of a list or table);

- volume of work performed (if several types of work provided for in the contract have been completed, then the volume is indicated separately for each type of work in one act, or several acts are drawn up, one for each type of work);

- units of measurement of performed operations;

- total cost (it must be indicated including VAT);

- timing of activities;

- number and date of the agreement under which cooperation is carried out;

- the invoice number that was provided to the customer for payment;

- clear imprints of the seals of both parties (if one of the parties is an individual, then there should be only one imprint of the seal);

- signatures of the contractor and the customer with a transcript (the act can also be signed by authorized representatives of the customer and the contractor, who are indicated in the contract).

Data “name”, “units of measurement”, “price”, “cost” are usually indicated in table format. In this case, each separate line contains a specific service or type of work performed and all the necessary parameters. Such a table ends with the “Total” line, which summarizes the cost, and the “Total” line is filled in taking into account VAT (the amount from the “Total” line + tax). In this case, it is necessary to indicate the amount in words, and kopecks in numbers.

As for acceptance, the signatures of the parties can be formalized with the words “passed the work” (signed by the contractor) and “accepted the work” (signed by the customer).

A copy of the work completion certificate: .

Certificate of completed work and capital construction

Speaking about the capital construction of any objects, which include both residential and industrial buildings, it is worth returning again to the unified forms KS-2 (this is a “construction and installation form”) and KS-3 (this is a certificate of the cost of construction services and expenses) . These documents are compiled on the basis of data from the “Journal of work performed” (form KS-6a).

The work performed in KS-2 is indicated based on the contract value, including both the direct cost of construction and installation processes, which are provided for in the estimate, and other costs that are not included in the unit prices. These may be tariffs, an increase in the cost of materials, the cost of operating machinery, equipment, mechanisms, the cost of wages of personnel who carry out construction, the cost of winter increases in prices, changes in the conditions of construction organization, the traveling nature of work, allowances for being in difficult conditions (for example , in the regions of the Far North) and so on.

If, according to the contract, the provision of construction materials is at the expense of the customer, then the price of the materials cannot influence the increase in price and, accordingly, are not included in the certificates of completed work and the certificate in the KS-3 form. In this case, the contractor is obliged to report to the customer after completion of construction about the materials consumed and return their remains (if any).

If the contractor carries out repairs, reconstruction or modernization of facilities, then an additional “Acceptance and Delivery Certificate of Repaired, Reconstructed, Modernized Fixed Assets” must be drawn up (this is form OS-3). It should be compiled by a permanent commission within the organization, which is entrusted with the responsibility for processing the receipt and transfer of fixed assets. The document must reflect information about the costs incurred by business or contract methods that are associated with the actions performed, as well as information about the completeness and quality of the work. The document must be signed by all members of the commission, headed by the chairman, and it must be approved by the head of the organization. As for the contractor, he also signs this document, confirming the transfer of the repaired facility. Expenses for modernization, reconstruction and repair should be attributed to an increase in the initial cost of the facility, since as a result of restoration work, the performance indicators of the facility increase.

In practice, at capital construction projects, all this is drawn up after the customer and contractor inspect and accept the finished object within the time frame established by the contract. If defects or deviations from the terms of the contract are discovered, the customer must notify the contractor about this and indicate the defects in the report. All of them are subject to removal by the contractor. If everything has already been signed, and after that hidden defects are discovered, the contractor must still eliminate them.

Why do accounting departments need non-binding acts on the execution of contracts?

For accounting, the absence of a certificate of completion of work under almost any contract is a disaster. At the same time, lawyers are well aware that civil law requires the drawing up of acts in isolated cases. Is it worth dissuading accountants from the need for acts?

Alexey Kapitanov

In most cases, acts are not mandatory...

The cases when civil law requires drawing up an act on the execution of a contract can be counted on one hand. These are mainly transactions involving real estate. Thus, the act must be drawn up when transferring to the buyer buildings, structures (clause 1 of Article 556 of the Civil Code of the Russian Federation) or an enterprise (clause 1 of Article 563 of the Civil Code of the Russian Federation), as well as when transferring these objects for rent (clause 1 of Article 655 of the Civil Code RF; Article 659 of the Civil Code of the Russian Federation). Of transactions not related to the transfer of things, drawing up an act or a similar document is required when accepting work under a construction contract (clause 4 of Article 753 of the Civil Code of the Russian Federation). It is not forbidden to prepare such an act under a “regular” contract (clause 2 of Article 720 of the Civil Code of the Russian Federation), but this is entirely at the discretion of the parties. In other cases, by default it is not necessary to draw up any documents on the fulfillment of obligations.