What it is?

According to Article 185 of the Code, a power of attorney is a written permission to transfer powers on behalf of one person (“the Principal”) to another adult and capable individual or legal entity (“the Proxy”).

The Civil Code regulates:

- their characteristics of different types;

- their validity periods;

- re-confidence;

- termination.

One of the types of these acts in legal practice is a power of attorney for the right to sign invoices and invoices. Organizations and individual entrepreneurs can act as principals .

Do I need to sign the invoice on both sides?

Given the large amount of information that needs to be reflected in this document, it may happen that one page is not enough. The Tax Code of the Russian Federation does not contain a prohibition on issuing an invoice on several sheets.

So that the recipient does not have concerns about the reliability of the data, we recommend transferring part of the tabular form to another sheet so that it looks like a continuation of the previous one. In addition, the document originator may be required to endorse each page of the invoice.

For clarity, all information is reflected on separate sheets, stapled and numbered. You can also display the data on the back, but this is inconvenient for accountants processing documents bound for archiving. Details that determine who signs invoices in the organization (“Head of the organization” and “Chief accountant”) are indicated on the last sheet. This arrangement of signatures is not a violation if the continuous numbering is not broken.

In what case is it required?

Enterprise managers are often absent on various matters in order to conduct and develop their business, or, as an option, go on business trips. At this time, processes often occur that require their attention, and issues arise that require reassurance.

A power of attorney for signing invoices and delivery notes is used in order not to harm the functioning of the organization. In order not to stop the work process of the head of the enterprise, if he himself is not able to sign the invoice or invoice, he transfers signing privileges to the company’s accountant.

Results

We looked at who signs the universal transfer document (UTD) on the part of the seller or supplier, how many and where signatures should be.

We studied the nuances and norms that must be followed in order to conduct business correctly. Typically, a company regularly performs the same operations, which means that the primary and financial functions can be automated and templates can be created. This will minimize the likelihood of errors and significantly simplify the work of the company’s specialists. Number of impressions: 3116

Filling rules: step-by-step instructions

- The power of attorney begins with its number.

- Then the place of the act and the date of its commission are written.

- Depending on who issues the document, an organization or an individual entrepreneur, its first part differs.

Step-by-step instructions for filling out a power of attorney for a legal entity:- Name of the grantor organization.

TIN.

- OGRN.

- Checkpoint.

- Location.

- Registration date.

- The name of the body that carried out the registration.

- Information characterizing the authorized person (position, full name, gender, passport data (series, number, issued by, date of issue, department code), place (address) of registration).

- What are the powers of the signatory based on?

Step-by-step instructions for filling out a power of attorney for an individual entrepreneur:

- Full name of the principal.

- Date of Birth.

- Floor.

- Passport data (series, number, who issued it, date of issue, department code).

- Place of registration.

- Number of the certificate of state registration of an individual as an entrepreneur.

- Name of the authority that issued the certificate.

Step-by-step instructions for filling out the second part for a legal entity:

- Name of the representative organization.

TIN.

Step-by-step instructions for filling out the second part for an individual:

- FULL NAME.

- Date of Birth.

- Floor.

- Passport data (series, number, who issued it, date of issue, department code).

- Place of registration.

For an individual entrepreneur it is the same as for an individual, but the number of the certificate of state registration of the individual as an individual entrepreneur is also required.

For a foreign citizen or stateless person:

- An indication of the presence/absence of citizenship is required.

- Details of the identity document.

Read more about what a power of attorney for signing invoices is and how to issue it in a separate article.

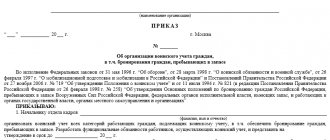

Sample order granting signature rights

The manager can provide the opportunity for signing to the chief accountant, his deputy or another employee acting as the head of the preparation of tax, financial and legal papers. An order for the right to sign primary documents can be issued in free form, since the current legislation does not establish a unified form. However, according to established document management practice, the form should indicate:

- company name, its details;

- form details (number and date);

- the legal basis for the transfer of the right to sign (Articles 7 and 9 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ);

- Full name and position of the employees to whom the right to sign is transferred;

- a list of documents that a person will have the right to sign for a manager;

- sample signature of an authorized person and director.

Sample order on the right to sign invoices

Using the same principle, you can transfer the ability to sign not only primary, but also financial documents. However, such operations entail increased responsibility for the employee, as they can cause serious damage to the organization. It is necessary that the employee has sufficient qualifications and that the new powers correspond to his job description.

Sample order on the right to sign primary documents

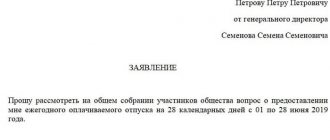

Decor

The document is drawn up by the manager or employees vested with such authority . When drawing up a power of attorney, an organization requires the signatures of the manager and chief accountant, or other persons authorized to do so on behalf of the organization.

If necessary, the same person has the opportunity to sign the document both on behalf of the boss and on behalf of the chief accountant.

The power of attorney must be in written form. The information contained within the document must be complete and comprehensive.

The text of the power of attorney should not contain:

- blots;

- strikethroughs;

- incorrect information about the principal and the trustee.

The power of attorney must indicate the date of its execution, otherwise the document will be declared invalid. The commission is indicated at the top of the document.

Rules for signing all types of UPD from all sides for any standard buyer

The number of signatories from both the client and the seller may vary. Who should sign depends on how powers are distributed in a particular company - who is responsible for the transfer of goods, confirms the correctness of what happened, recalculation in terms of quantity and quality. We suggest you look into this important moment in more detail.

It doesn’t matter what the status is, 2 signatures are recommended:

- Head of the company. In fact, the head of the enterprise has the right to delegate this task to a special authorized person if he is confident in the abilities of the subordinate. Such permissions should be documented by a special internal act, power of attorney or order. Without this, a person should not touch official documentation.

- Chief accountant. The situation is the same. A specialist can delegate this work to another person if this is stipulated in the accounting policy.

Mandatory and recommended signatures in the UPD from management on the part of the supplier

This prop is present in several lines at once:

- in the part separated by a bold frame, the head of the company or division and the chief accountant, or the persons to whom they have officially authorized this, will need to sign;

- there is a place where the employee who sent the goods or performed the service must sign, along with his last name, initials and place of work;

- below are UPD signatories who have the right to draw up forms as primary documentation;

- under it there is a column for the cargo receiver, who is responsible for careful and correct movement between enterprises and within it from the buyer;

- one of the last fields for the employee to assure that everything was done correctly.

To minimize the likelihood of errors, it is worth installing special software on work computers. It optimizes many processes and saves employee time. You can find suitable equipment and software in Cleverence.

Who, how and where has the right to sign the UPD: what happens to the seller when registering according to a pre-drawn up sample

As we said above, it is mandatory to have the signature of the head of the enterprise or division and the chief accountant or the people who legally replace them in the SF section.

When filling out line 10, it is allowed not to sign if the same person has the right to accept the cargo and issue the invoice. Then it is enough to sign in the section for the Federation Council, and in field 10 write the position and full name.

It is realistic not to sign in column 13 if the same citizen will accept and be responsible for the results.

Rules for registration and signing of all UPD, which are recommended to be followed from the side familiar to any buyer

After the block that talks about the seller of the products, there are several lines where data from the client will be useful. In field number 15, the signature of the person responsible for acceptance is required, as well as his position and full name.

In 18 information about the person responsible for the correct formation of the operation is indicated. Here you are allowed not to sign if only one employee accepts and ensures correctness. Then the full name will suffice. and the place it occupies.

You should check how organic everything is, so that later there are no questions from the tax inspectorate. It’s not difficult to create a form using a trading program; all that remains is to provide the appropriate marks in the right places.

Correct execution of the UTD signature on the part of the seller

How large the next inspection by Federal Tax Service specialists will be depends on how accurately the files are prepared.

More signatures will be required from the supplier or distributor if the paper has status “1”. In this case, it acts simultaneously as a primary and an invoice, so at least 3 participants from this counterparty are required - the manager, the chief accountant and the person in charge who checked the shipment. In some fields this may be the same employee, then you can simply indicate your full name. in the fields.

In “2” status it is not necessary to sign in the block that relates to the SF.

Where is the person who ordered the product noted?

Field 15 requires the person who accepts the service or product to sign. Full name is also indicated there. and who this person works for. If the client (the company ordering the work/services) designates a director or other management level, then you can enter only your full name in line 18. and who he serves.

Reflecting the performers

If you are wondering what signatures may be required in the UTD from implementers, then they also have their own fields.

For this form this is block 13. The master who has the right to draw up such papers in the form of primary documents should be noted here. This person necessarily appears and is reflected in the documentation.

These are merchandisers who are responsible for loading and checking the quality of stowage, or an accountant who cleared the loaded vehicle for shipment. It is required to enter the specialist who is directly related to the event in the economic life of the organization. The only caveat is that he needs appropriate access and permission from his superiors.

Where is the signature placed on the UPD and who has this right?

The place where different parties will sign is fixed in the form and does not change from one file to another. The general view is only recommended, but the block containing the details for the invoice cannot be deleted or skipped. It must be filled out in accordance with all the rules. The seller and his representatives will do this first. They record that everything is loaded and prepared, counted, complies with the requirements of the law and is in full compliance with the contract.

When the cargo reaches the buyer, his employees will be required to double-check everything in terms of quantity and quality, and put the appropriate marks. As we said above, all participants in the transaction must have the authority to sign, otherwise the document will lose legal force.

Certification of the document

A power of attorney issued by a legal entity is sometimes valid without notarization, but in some cases it is necessary. When re-trusting, the original deed must also be certified by a notary .

Entrepreneurs without the formation of a legal entity can also issue powers of attorney to a citizen or enterprise. At its core, a power of attorney from an individual entrepreneur differs little from the same act from organizations.

An entrepreneur must have his signature certified by a notary. Without a power of attorney, only the entrepreneur himself is free to act.

Validity

The Civil Code of the Russian Federation does not determine the maximum validity period of a power of attorney. The law does not limit the options for determining the period of its execution. If the validity period of the document is not specified, it is set at one year .

A properly organized procedure for registering and storing invoices will help you pass the verification quickly without losing the necessary forms. Read our other articles about how to correctly fill out and when to submit this document in electronic form, for advance payment, adjustment, correction, under agency agreements, without VAT, for imported and exported goods, as well as what are the rules for canceling an erroneous document.