Organizations carrying out various types of work are required to record the progress of their implementation in the relevant documents. As such, domestic legislation provides for a formalized act of acceptance of completed work KS-2 and a certificate of their cost KS-3.

If you do not find the document you need on our website, simply leave a comment indicating your email. You will receive the document you need, and it will also be published shortly on our website - certificates of completed work.

- 1 What are KS-2 and KS-3 used for?

- 2 How to correctly fill out KS-2 and KS-3 2.1 Nuances of filling out KS-2

- 2.2 Nuances of filling out KS-3

Purpose of the acceptance certificate for KS-2

The KS-2 acceptance certificate is used to carry out mutual settlements between the contractor and the customer. The document contains an exact list of all construction, installation and other types of work that were performed at the site, as well as the timing and final prices.

The act of acceptance of completed work is used for the subsequent preparation of a certificate of their cost, which also has a unified form - KS-3. These reporting documents are closely related to each other, since they have legal force only in a single bundle. In essence, KS-2 acts as an invoice for payment.

Drawing up KS-2 is the responsibility of the contractor, who must carry out construction and related work in full in accordance with the technical documentation. Therefore, the act is drawn up as an accompaniment to the contract. KS-2 shows that the customer has no complaints about the quality, timing and scope of work, which is confirmed by his signature. But it must be taken into account that, according to the law, the fact that the contractor performed the work can be proven not only by such acts.

The principles for drawing up KS-2 are in many ways similar to those for drawing up KS-3, including regarding the indication of basic data about the parties to the contract, the types and costs of work. Act KS-2 is often also called estimate KS-2 , since, in fact, the document is based on estimated data.

What are approved

These forms were approved by Goskomstat Resolution No. 100 dated November 11, 1999. They are used when recording work in capital construction and repair and construction activities.

Documents can be drawn up both on paper and in electronic form in accordance with the document flow approved by the organization and contractual obligations. How exactly it is necessary to apply and fill out the forms is regulated by the same Resolution No. 100. We will consider the main details of KS-2 and KS-3 and the features in the rules for their registration using an example that can be downloaded for free (KS-2 and KS-3, sample filling 2021, excel). But let’s first find out whether the use of these documents is mandatory.

COMPLETE SCHEDULE OF CONFERENCES AND EXPERT DISCUSSIONS OF “NEW PROSPECT” IN ONE PLACE!

Basic rules for drawing up the acceptance certificate for KS-2

The main document for issuing the KS-2 is the Logbook for the work performed, which is also drawn up in a unified form - KS-6a. The journal is used as a cumulative document in which all work performed during the year is recorded. It must be carried out at any construction site. The absence of a log may be a reason to believe that KS-2 and KS-3 were compiled incorrectly.

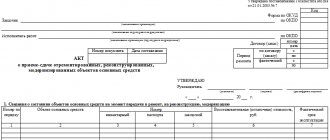

Conventionally, the form of the acceptance certificate for completed work can be divided into 2 parts:

- Title page. The first page of the act contains information about all parties to the contract, as well as information about the facility under construction.

- Table. It indicates basic data on the types of work, their prices, units of measurement, quantity and cost. The table summarizes the results indicating the final cost of the work.

Important nuances of drawing up the KS-2 act

To fill out the KS-2 act, you can use computer programs: Microsoft Excel (the sample is most often presented for editing in this program), “1C: Accounting”, “Kontur”, “Class 365”. This means that the document can be presented not only in paper, but also in electronic form. But then an electronic signature must be used for it. The ability to automate compilation in software products today is of great help to many organizations, as it saves time and reduces the number of errors due to the human factor.

In 2013, a law was adopted according to which the forms of primary accounting documents can be determined by the head of the company. This made uniform forms optional. The company has the right to develop its own forms for such documentation. It must contain details, a list of which can be found in clause 9 of the Federal Law of December 6, 2011 N402-FZ. The code, number and name of the form must be stored in the act. Removing these and other required details is not permitted.

Finalization of the KS-2 form according to the law

The KS-2 form itself can be modified taking into account the needs of the contractor, but without violating current standards. Here it is necessary to take into account the Letter of the Ministry of Finance of the Russian Federation dated 07/08/2011 No. 03-30-06/1/414, according to which rows or columns cannot be deleted from the form, but only new ones can be added, their width can be changed for ease of placement and processing of the necessary data.

Changes made are documented in the relevant organizational and administrative document of the organization. In practice, it is still convenient to use unified forms, since, despite the law passed in 2013, they still remain in demand in most organizations.

Which form to use

The final documentation for the procurement of construction, repair or installation activities is generated using a unified register - OKUD 0322005. Forms of the act and certificate were developed and enshrined in Resolution of the State Statistics Committee No. 100 of November 11, 1999. How to fill out KS-2 - an example of filling out and the content of the act depend on the type of work performed.

Although the form of the act is unified, the executor has the opportunity to modify it depending on his needs without violating current regulations.

How to fill out the cover page of the work acceptance certificate

Filling out the title page of the KS-2 is not difficult, since it is enough to enter data about the organizations and the object. This page has separate lines for all the information:

- Investor. Information about the investor is indicated only if there is one. Typically, an agreement is concluded between the customer and the contractor, and the customer in this case acts as an investor, so there is no need to duplicate information.

- Customer (general contractor). Enter the full name of the organization in accordance with the registration documents, as well as the organizational and legal form, contact information (address, phone number) and OKPO.

- Contractor (subcontractor). Fill in the same way as the line where the customer is indicated.

- Construction and object. You must enter the name and address of the property.

Next, you need to enter the number of the work agreement (contract) concluded between the organizations. The title page also indicates the number and date of the document, as well as the reporting period. The OKUD code for KS-2 is always the same - 0322005. It serves to summarize and systematize information during automated processing of documentation.

How to correctly indicate the reporting period

In our article about the certificate of cost of completed work KS-3, we touched upon the issue of correctly indicating the reporting period. It is better to immediately clarify this information with the customer’s accounting department, since its employees may have certain requirements regarding dates. There are two options for specifying the reporting period.

- By month. For example, the acceptance certificate was drawn up on November 14, 2020, then the reporting period should indicate November 1, 2020-November 30, 2020. The next reporting period will begin on December 1, 2020 and will end on December 31, 2020, respectively.

- With the end of the reporting period on the day of drawing up the acceptance certificate. In this case, if the act was drawn up on November 14, 2020, the reporting period will be from November 1, 2020 to November 14, 2020. The following reporting period will begin on November 14, 2020 and will end on the day the acceptance certificate is drawn up.

Some accounting departments do not have strict requirements for reporting periods. In this case, you should choose one of the methods and adhere to it when drawing up all acts, so that there is no confusion in the deadlines.

The procedure for using primary accounting documents

Currently it is regulated by the accounting law 402-FZ. According to Article 9 of the law, forms of primary documents can be developed and used by a commercial organization independently. The law determines that the forms must be approved by local regulations and have the required details:

- name and date of preparation of the document;

- name of company;

- description of the fact of economic life;

- the value of the natural or monetary meter characterizing this event, indicating the meter;

- position, full name and signatures of persons responsible for the commission and registration of the fact of economic life.

Thus, the use of unified Goskomstat forms is not mandatory. But if these forms are convenient, the organization can decide to use them, having it approved by local regulations.

Want to make a name for yourself at industry conferences? We will prepare for you a special issue with high-quality journalistic materials - turnkey.

Filling out the table in the KS-2 acceptance certificate

The next sheet of the act contains a table where it is necessary to list all the work performed. There is a line in front of the table in which you need to enter the estimated (contractual) cost, which must correspond to that specified in the contract. The amount can be presented in numbers; there is no need to decipher it in words.

The table in the act consists of 8 columns, which indicate the following information about the work:

- serial number (1);

- position number in the estimate (2);

- name (3);

- unit price number (4);

- in what units is it measured (m2, m3, tons, pcs., etc.), (5);

- quantity(6);

- unit price (7);

- total cost (8).

The tabular part reflects the data given in the estimate for construction work. Moreover, the table can accumulate values from several estimates.

Features of filling out the tabular part

To get the total cost of work (8), you need to multiply the values in columns (6) and (7), i.e., multiply the number of works by the unit price. The number in column (6) must in no case be stated as a fraction or percentage of the total to be completed. The price in column (7) is set in accordance with the collections of federal unit prices (FER). If the contract prices are fixed, then a dash is placed in column (7). In this case, column (8) is also indicated based on indicators taken from the FER collections.

It is important to write the title of the work in column (3) as clearly as possible, without abbreviations or combining two types into one. In case of such a violation, the customer has the right not to sign the document and request that the KS-2 again. After filling out all the lines, it remains to calculate how much was spent on all the work. This amount is recorded at the intersection of the column “Cost, rub.” and the “Total” lines.

It is important that in the KS-2 estimate the cost is indicated without VAT. If necessary, the amount including VAT can be added, but usually it is already given in the KS-3 certificate. Here is the amount without VAT (taxable base) and with VAT at the rate regulated by law, i.e. 20%.

Question indicating the cost of work and deduction of VAT

The final cost of the work in the KS-2 certificate and their cost in the KS-3 certificate must match. But in some cases, their divergence is allowed. This is possible in accordance with the Letter of Rosstat of the Russian Federation dated May 31, 2005 No. 01-02-9/381. It says that the cost of work in KS-2 is indicated in accordance with what is provided for in the estimate, and in KS-3 it will be the estimated cost, taking into account price changes, if this is provided for in the contract.

We mentioned this in our article about the KS-3 certificate. There are often cases when construction lasts more than one year, which is why the cost of work and building materials has changed. Therefore, the discrepancy in cost between KS-2 and KS-3 is not a violation.

It is equally important to take into account that if the contract does not provide for phased acceptance of construction work, but interim acts KS-2 are drawn up, the customer may face a refusal to accept VAT for deduction. Intermediate KS-2 are usually used for reporting specifically to the customer. To eliminate problems with VAT deduction, it is worth stipulating in the contract for the phased delivery of work.

Practical application of the KS-3 certificate

Payment for construction and installation work occurs only on the basis of a signed KS-3 . If it is missing, the accounting department of the general contractor (customer) cannot fulfill its payment obligations. It is in such a certificate that a list of all works is given, indicating their cost. The total amount including VAT is the final price of construction and installation work. The data coincides with the preliminary estimate, and also includes previously unaccounted expenses:

- changes in prices for materials and raw materials used;

- increasing wages for contractor employees;

- changes in prices for rental of construction equipment and machinery;

- various allowances (for work in the Far North, hazardous working conditions, the need to travel, etc.);

- penalties accrued by the customer for violations of contractual obligations;

- other expenses incurred that affected the initially declared cost.

Completion of work acceptance certificate KS-2

The tabular part of the act is presented on two sheets, since the list of works usually includes many items. On the second page of the KS-2 form, at the end of the table, the line “Total for the act” has been added, where you need to add the “Total” from both pages. After this, the document must be signed by the contractor (“Passed”) and the customer (“Accepted”). This can be done by their representatives: on the contractor’s side, the person responsible for the work; on the customer’s side, the head of the company or his authorized representative.

The main thing when signing is to indicate the position, sign and indicate its decoding. In addition to signatures, the act must be certified by a seal on both sides. The only exceptions are individual entrepreneurs (IP), who are not required to use their printing activities. The correctness of the preparation of primary documentation is important, since if violations are detected and in the absence of documents in general, the head and accountant of the organization may receive administrative punishment.

Step-by-step instruction

To fill out the certificate correctly, you will need to prepare a contract and other sources of information. First of all, you need to create a title page. It is filled out as follows:

Enter information about the contractor, customer and other construction participants (name of organization, contact details) on the title side of the certificate. Next to the name of the organization, in the appropriate cell, indicate the OKPO code (issued to each company upon registration).- Indicate the location of the construction site and the type of construction ongoing.

- Enter the date and number of the agreement on the basis of which the certificate is created, and the date of creation of the document itself.

- Indicate the dates of the reporting period (start and end dates of the construction manipulation stage).

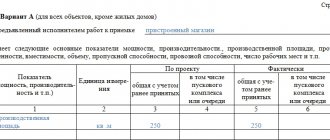

The main part of the document contains a table with 6 columns (see Table 1).

| Column number | Filler actions |

| 1 | indicate serial number |

| 2 | enter the name and type of service provided |

| 3 | indicate the code (if the performed action has a code) |

| 4 | indicate the price on an accrual basis |

| 5 | indicate the planned cost |

| 6 | indicate a specific price for the reporting period |

If the price of work for the reporting period has not changed, and the certificate is issued for the first time, then the same values are indicated in columns 4, 5 and 6.

After specifying all the numbers, the final calculation is carried out. The data is indicated at the very bottom of the table. In the required fields you will need to indicate the price of all work without VAT, the amount of VAT and the amount including VAT.

The last step is signing. On the customer’s side, the signature is carried out by the director or his representative. On the part of the contractor, the director or person responsible for performing the work.

Features of the subsequent use of the KS-2 acceptance certificate

When the contractor fulfills his obligations under the contract and completes construction work, he draws up an acceptance certificate in the KS-2 form. The customer must check and accept these works and, if he is satisfied with everything, sign the document drawn up. After this, and often simultaneously, the customer draws up a certificate of the cost of work performed and expenses KS-3, without which the customer’s accounting department cannot pay for them.

The KS-2 act is usually presented in two copies: one remains with the contractor, and the other is transferred to the customer. If there is a third party to the agreement in the form of an investor, she has the right to demand a separate copy for herself, of which either of the two parties must be notified in writing. According to the storage rules, the KS-2 acceptance certificate, as well as the KS-3 certificate, must be stored for at least 5 years from the date of execution and signing.

Legal basis

The registration form is approved by the Federal State Statistics Service. For future accounting, companies need to use a unified sample certificate. The paper will need to indicate the cost of the work without taking into account the premium cost. VAT is indicated as a separate item.

Among the basic rules for the design of KS-3, which are dictated by legislative acts, there are:

- use only a regulated sample to fill out;

- entering information without using abbreviations;

- mandatory writing of the name of the organization of the customer, contractor and investor (if any) indicating the organizational and legal form.

It is worth remembering that this certificate belongs to the category of documents of strict reporting. The accountant is responsible for incorrect preparation.

Order a work acceptance certificate for KS-2

The ABC-Project company offers services for the preparation of the necessary construction documentation, including primary reporting documents, which include the KS-2 work acceptance certificate. Its correct completion is important, since in the future the data is necessary for the preparation of another mandatory document - the KS-3 certificate. We can competently prepare these and other documents you need, which will allow you to quickly resolve all issues regarding the completed construction.