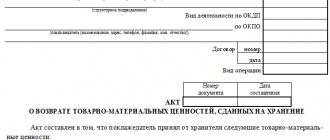

Source/official document: Approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78

Document title: Standard interindustry form No. 1-T Format: .xls Size: 83 kb

Print Preview Bookmark

Save to yourself:

TTN is a document form of a consignment note , required when moving goods and other valuables using a vehicle. The invoice is filled out by the sender of the goods, but upon agreement between the parties, it can also be filled out by the carrier himself. This document is the main part for further write-off of goods from the sender himself.

The technical specification must be drawn up for almost any transported cargo. Thus, documentation must be kept by each carrier of goods. Typically, the TTN form is drawn up in three copies at once:

- For the sender;

- Carrier;

- Recipient of the goods.

The forms must be filled out anew each time as soon as the goods are sent on a new flight. Thus, the invoice is filled out for the client as a whole. If the buyer uses self-pickup, then it is not necessary to prepare an invoice. This document has a basic standard form created by TTN in form T-1 , also approved by the Federal Service of the State No. 78 dated November 28, 1997 ( free download of the consignment note form ).

In addition to all this, the manufacturer of the invoice will have to write off the goods from his list. During transportation, carriers are always required to have the appropriate document, which also authorizes the transportation of goods.

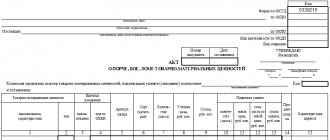

The invoice itself consists of two parts:

- The main section is included in the product section, and is intended only for the seller and the client ();

- The other part is necessary for transport.

As previously mentioned, forms () will have to be filled out for each new flight, and an invoice will also be generated before each start of transportation, taking into account the availability of an additional copy for the buyer. But only work done correctly can have positive aspects, so it is recommended to ensure that all documentation is available.

Concept and application in accounting

This documentation contains basic information about the cargo. Weight parameters, dimensions, distance traveled. Provides information about the sender and the company, employees performing transportation. Accordingly, it is on the basis of paper that settlement takes place between the parties to the transaction. That is, this is a kind of confirmation of expenses that go into the accounting department as a separate line. And they help the tax service form a correct picture of production costs.

But at the same time, the TTN will not become the basis specifically for creating an accounting entry. This is a kind of evidence base, a way of confirmation. But this is not the basis for making an accounting entry in the financial statements.

The consignment note is a confirmation that the terms of the transaction have been fulfilled. This means that they are distributed on several sides. It is often customary to use 4 copies so that everyone has their own evidence base. The sender, the customer, persons authorized to accept the cargo and carry out posting, as well as the intermediary himself. That is, a private carrier or a logistics company.

It's hard not to understand the value of this documentation. In case of any deviation of the material component of the cargo from the order, a reconciliation is immediately carried out with the specification specification. Therefore, filling it out must always be correct, strictly according to the model, without liberties or amateur performances. Registration with deviations from existing norms and rules, with violations on forms - will automatically deprive the paper of legal force.

The order of filling out the sections

The preparation of the document must be approached responsibly. Do not forget to enter the registration numbers of the vehicle, the actual addresses of the places of loading and delivery of cargo, as well as other significant data. All information must be current and verified. If the information provided is unreliable, misunderstandings and unpleasant situations with regulatory services may arise.

Filling begins by indicating the serial number:

- document;

- instance;

- application on the basis of which the delivery will be made.

Correction of information in the delivery note in December 2021 approved 17 sections in the document that should be filled out in accordance with the rules.

- The section contains information about the sender of the goods (name of the organization or full name of the entrepreneur, telephone numbers and other contact information).

- This part includes similar information about the buyer (recipient).

- Information about the cargo, its dimensions, as well as other characteristics of the goods transported are indicated.

- The section includes a list of documents accompanying the cargo (quality certificates, safety certificates, etc.)

- Special requirements for transportation. Temperature, speed limit, declared cost of the batch, etc.

- Information about the acceptance of cargo for transportation is reflected (signatures and seals of the sender and carrier, address of the loading place, signature of the driver/forwarder).

- Information about delivery/receipt of cargo at the destination. To be completed by the driver and the recipient. Signatures and seals of the delivering and receiving parties are required.

- The clause contains data on the peculiarities of transportation and storage of goods, penalties for vehicle downtime, failure to meet delivery deadlines, etc.

- The section includes a note indicating acceptance of the application for execution.

- Carrier information is filled in when the cargo is delivered by a third-party transport organization.

- Information about the vehicle used for delivery (numbers, dimensions, quantity, make of vehicles).

- In this column, the intermediary can indicate complaints about the accepted cargo, its condition and shipping containers.

- When using large or heavy vehicles, indicate a route that is safe for surrounding objects.

- This section is filled out when changing the address (moving) of the destination.

- The paragraph includes information on the cost of transporting the cargo being transported in the case of using a large or heavy vehicle.

- Date of preparation of the TN. The section must be signed by the sender and the carrier.

- The section contains information about fines and violations that occurred while following the route. This also includes information in case of claims from any counterparty.

If, for some reason, there is no information in a particular section, it is necessary to put dashes. Dash marks must be placed in the same sections in all copies of the delivery note.

Varieties

The question often arises whether the TTN is a primary accounting document. There is also confusion with related certificates. Some citizens mistakenly believe that these are all varieties of the same form. But no, there are fundamental differences to check. The invoice serves only for reporting purposes to the tax service. And specifically for VAT calculations. Whereas the documentation just confirms the fact of the enterprise’s expenses for the purchase of products. When it was accepted, after posting. But the hero of our review does not have such powers. It simply serves as proof that funds were spent on the delivery of these products. Not a purchase, not settlements with the shipper, but with the company that delivers. The difference is quite obvious.

Therefore, the accounting certificate does not become the main one for postings. But there are still varieties, and they are as follows:

- SP-31. It is used specifically for the supply of grain and cereal crops in any volume.

- SP-32. Transportation of animals. And not carcasses or meat, but exclusively living individuals that have value only in this form.

- SP-33. When working with dairy products of any type. From regular milk to curd products or cheeses.

- 1-T. But this type is used in all remaining cases. And, as one can easily assume, there are more than 90%. Accordingly, a universal form, which, most likely, will be used in the enterprise.

As we can see, although there are several different variations (we will indicate more later), in fact one option is used. Of course, if you are not a representative of an enterprise involved in the sale of grain, animals or dairy products. In all other cases, you will need 1-T. Now let's go through each point in detail.

International format (IFR)

The only option that is distributed only in triplicate. And also signed by the shipper and transporter. The fact is that this type is used when cargo crosses the border of a country. And delivery by car is also an important condition. Trucks or cars, it doesn't matter. But not sea, air or rail communications. Strictly motor transport. In addition, the country should, in principle, work in the IDA format. And the last condition is payment. Thus, humanitarian missions will have a completely different form of documentation. And they no longer apply here.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

For grain crops

Actually, the waybill for the tax office is in the SP-31 form. It is used quite often, because grain is supplied not only in huge volumes. And also in local batches for retail sale at points of sale in small stores or retail outlets. Packaged cereals do not qualify here, but bulk grain does.

For transporting animals

Often the SP-32 format will be needed when collaborating with farmers as individual entrepreneurs. And now it's getting bigger. They are actively occupying the niche of large holding companies, and our country is moving into such a direction of agriculture following the example of the United States.

Therefore, checking the application of the format becomes quite frequent.

When sending dairy products

In this case, an important aspect is compliance with all standards and characteristics. If it is not particularly possible to judge the quality of grain, weight parameters and volume are sufficient. When working with milk, the fat content, acidity, and temperature parameters are taken into account (increasing the temperature to the maximum level is a violation of storage conditions, which means that the shelf life immediately drops to zero).

Therefore, the SP-33 form is considered one of the most complex.

Transportation of fruits, berries, vegetables

SP-34, waybill is a document that helps to send and receive goods from a farm. But already plant products. Mostly vegetables, of course. But also seasonal berries and even fruits. Moreover, many of the crops are brought to us from neighboring countries. This means that it is no longer this form that will be needed, but an international one. Which we reported at the beginning of our impromptu list.

Shipment of wool

Commodity TN in the form SP-35 is even more complex in detail than all those described above. Indeed, in this case, many parameters are used for calculation. And more specifically:

- Weight parameters by type net and gross.

- Methodology for identifying the final mass of objects.

- Quantitative factor kip.

- Product packaging method.

- The results of the tests performed before shipment in the laboratory.

Accordingly, paperwork increases significantly. But, in reality, the number of items to take into account is not the most important part. Not the factor that sets him apart. Much more important is the correct filling. After all, if there are obvious errors, the certificate will cease to have legal force. But it turns out that transportation occurs without it. And this is a violation of the current legislation of the Russian Federation. We will talk about the consequences of such an action further.

Having a TTN for tax deduction is not always necessary

Legislation and examples of court decisions

Organizations transporting goods using their own and rented vehicles (hereinafter referred to as transport organizations) are required to issue a TTN. This is the requirement of paragraph 2 of the Instruction “On the procedure for payments for the transportation of goods by road” (Instruction of the USSR Ministry of Finance N 156, USSR State Bank N 30, USSR Central Statistical Office N 354/7, RSFSR Ministry of Autotransport N 10/998 dated November 30, 1983). And clause 6 of the specified document establishes that the TTN is the only document used for writing off inventory items from shippers and posting them to consignees, as well as for warehouse, operational and accounting.

The need to write out a TTN when delivering goods by road is indicated both in the Methodological Recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations (clause 2.1.2) and in the Methodological Guidelines for accounting of inventories (clause 49).

In accordance with Art. 8 of the Charter of Road Transport and Urban Ground Electric Transport, the conclusion of a contract for the carriage of goods is confirmed by the waybill. Cargo for which a consignment note has not been issued will not be accepted by the carrier for transportation.

Based on these documents, we conclude: TTN (Form N 1-T) is mandatory for use by senders and recipients of goods. In other words, this document is drawn up by the shipper when he delivers cargo according to the buyer's order . It serves as the basis for settlements between the parties to the contract of carriage. In addition, on the basis of the consignment note, compiled, as a rule, in four copies, commodity assets are written off and capitalized.

For your information. The first copy of the specification form remains with the shipper and is intended for writing off inventory items; the second, third and fourth copies, certified by the signatures and seals (stamps) of the shipper and the signature of the driver, are handed to the driver; the second - is handed over by the driver to the consignee and is intended for capitalization of goods and materials from the consignee; the third and fourth copies, certified by the signatures and seals (stamps) of the consignee, are handed over to the organization that owns the vehicle.

If the buyer is not the customer of the transportation, he is not required to have a TTN. In this case, registration of goods and materials is also possible on the basis of other documents, in particular the consignment note in form N TORG-12.

For your information. The delivery note is drawn up in two copies, the first of which remains with the organization handing over the goods and materials, being the basis for their write-off, and the second is transferred to a third party (buyer) and is the basis for recording these values.

A similar point of view, by the way, is expressed in Letters of the Ministry of Finance of Russia dated 01/31/2011 N 03-03-06/1/42, dated 06/15/2010 N 03-03-06/1/413 (Indicated Letters, financiers say (referring to the Letter Ministry of Finance of Russia dated 07.08.2007 N 03-02-07/2-138), are of an informational and explanatory nature and do not prevent one from following the norms of legislation on taxes and fees in an understanding that differs from the interpretation set out in them): if the purchasing organization does not pays for the transportation of goods, then for capitalization and recording of the cost of purchased goods, a completed TTN (Form N 1-T) or a consignment note (Form N TORG-12) can be used, as well as in the Letter dated 08.18.2009 N ShS-20-3 /1195, in which the main tax department of the country indicated: the currently valid form of consignment note N 1-T is mandatory for use by legal entities who are senders and recipients of goods. At the same time, it serves as the basis for settlements between the customer of transport transportation and the carrier. If the buyer is not the customer of the transportation, then the current procedure for the presence of a consignment note for the recipient of the goods (buyer) does not provide for it.

It would seem that everything is logical and no questions should arise. Nevertheless, local inspectors are alarmed by the absence of technical specifications (including for the reasons listed above). And it is not a fact that during the inspection they will not consider this a basis for refusing a tax deduction (they say that a mandatory condition has been violated - documentary evidence of acceptance of goods for registration). Examples from arbitration practice abound. There are both positive (in favor of the taxpayer) and negative (ending in victory for the tax authorities) decisions. Thus, the FAS ZSO in its Resolution dated March 11, 2011 in case No. A27-6755/2010 indicated: the case materials do not confirm that the taxpayer acted as the customer of the transportation, therefore, the absence of his TTN is not a violation of the law, entailing the recognition of expenses for the purchase of goods and tax deductions are unjustified. The primary accounting document serving as the basis for recording the goods received by the company was the consignment note of form N TORG-12. Consequently, the company rightfully included the costs of transactions with the counterparties in question in income tax expenses and applied VAT deductions. Another example is Resolution of the Federal Antimonopoly Service of the Moscow Region dated February 21, 2011 N KA-A40/316-11. Since, under the terms of the contract, the delivery of the equipment to the buyer’s warehouse was carried out by the seller, the courts did not accept the tax authority’s reference to the company’s failure to submit the TTN in Form No. 1-T, despite the fact that the applicant presented delivery notes of Form No. TORG-12 confirming the delivery of the equipment. Based on the study of these documents, the arbitrators came to the conclusion that VAT deductions were documented. In the Resolution dated September 16, 2010 in case No. A55-30158/2009, FAS PO indicated: due to the fact that in the case under consideration the buyer does not participate in the relationship for the transportation of goods, the presence or absence of the technical specification as supporting documents has no legal significance for him. Submission of the TTN in the presence of invoices in form N TORG-12 is not mandatory due to the fact that in this case the validity of VAT deductions in connection with the transportation of goods is not assessed. We also note: in this decision, the arbitrators referred to Letter N ШС-20-3/1195, in which, as noted above, it was concluded that registration of inventory items is also possible on the basis of a consignment note in form N TORG-12.

Conclusion of the Presidium of the Supreme Arbitration Court of the Russian Federation

I would especially like to dwell on one more, the most significant, court decision, in which the Presidium of the Supreme Arbitration Court of the Russian Federation assessed this problem. We are talking about Resolution No. 8835/10 dated December 9, 2010.

And the matter began very unfavorably for the taxpayer. One after another, tax authorities took the side of the tax authorities, emphasizing that the TTN is the only document that serves as the basis not only for writing off inventory items by the consignor and capitalizing them by the consignee, but also for accepting goods for registration in order to exercise the right to apply a tax deduction in accordance with Art. . Art. 171, 172 of the Tax Code of the Russian Federation. But the taxpayer, confident that he was right, did not give up - the matter reached the highest authority. The Presidium of the Supreme Arbitration Court of the Russian Federation pointed out that when considering the case, the courts did not take into account the following points. Tax deductions provided for in Art. 171 of the Tax Code of the Russian Federation, are made on the basis of invoices issued by sellers when the taxpayer purchases goods (work, services), after the said goods (work, services) have been accepted for registration and in the presence of relevant primary documents. Primary documents are accepted for accounting if they are drawn up in accordance with the form contained in the albums of unified forms of primary accounting documentation; otherwise (when submitting a document not provided for in the unified form), the “primary” accounting document must contain certain clauses 2 of Art. 9 of the Accounting Law, mandatory details.

The consignment note (form N TORG-12) , contained in the Album of unified forms of primary accounting documentation for recording trade operations, is used to register the sale (issue) of goods and materials to a third party. The invoices submitted by the applicant in form N TORG-12 contain information about the shipper, consignee, supplier, payer, name of the goods, its quantity and price, as well as an indication of the positions of the persons who released and accepted the goods, their signatures and thereby confirm the fact of shipment of the goods . Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132 established the requirements for filling out and maintaining the consignment note in form N TORG-12, while the presence of a TTN in form N 1-T for recording trade operations is not provided. By the way, the consignment note is a document that defines the relationship for the transportation of goods and serves to record transport work and settlements with organizations that own vehicles for the services provided to them for the transportation of goods. In this case, the company carried out operations to purchase goods without acting as a customer under the contract of carriage . In such circumstances, the conclusion of the courts that the failure to submit invoices by the company indicates the absence of legal grounds for applying a tax deduction for the transaction of purchasing goods is not based on the current legislation and does not correspond to the circumstances established by the court.

What if the document is missing

Loss, incorrect registration, errors on the part of the shipper, planned scams, banal human irresponsibility. And the consequences will be unfavorable in any case.

This:

- Lack of records of costs associated with product delivery. As a result, unclosed holes appear in the accounting department, which will negatively affect the correct development of financial policy.

- Problems with tax authorities. After all, there will be no deductions for this expense item; the money, it turns out, simply disappeared from the balance sheet without explanation. This always raises reasonable questions.

- Imposition of penalties. Again, from the Federal Tax Service. The specific amount depends on the severity of the offense. And also on the number of unaccounted expenses.

Do not forget that in some cases the tax service has the right to directly demand confirmation of costs associated with transportation. Many people believe that the consignment note, consignment note, is the primary document. Actually no, but next to them it is also necessary for reporting.

As an example:

- Transportation for subsequent sale of alcohol-containing products. Here the extract will be strictly necessary so that the services can, in principle, check the legal basis of the turnover.

- When combining articles aimed at purchasing products and their delivery.

- At the request of the service, if there are still controversial issues and dark spots on the reporting. Just to clarify the situation.

TTN or TORG – 12

The first allows you to move property from one point to another. This paper is used to write off the goods from the shipper's balance sheet to the account of the new owner. The key point is the presence of a vehicle in this scheme. This action may not take place in the form of a transaction between two parties, but as a transfer of goods and materials between branches of one organization.

TN (the second of those presented) is necessary specifically when making a sale and transferring ownership of property. It doesn’t matter whether transport is involved here or not.

Functions

There are a number of them provided.

- Confirmation of the conclusion of the transaction. A kind of transfer and acceptance certificate, only not for material assets, but for the fact of provision of transportation services.

- A way to clarify settlement details with an agent.

- Accompanying document to confirm the legality of the act.

- Reporting. Accordingly, it is intended for the tax service.

- The ability to accurately check the quality of cargo transportation, the absence of thefts and losses, damage to material objects, deadlines and related factors.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

conclusions

The inspection may recognize the transaction as fictitious

by challenging the transportation of goods.

Cargo transportation is an operation that leaves a documentary trail and in which the driver participates

. This gives the inspection the opportunity to analyze the technical specification and interrogate the driver, looking for contradictions in order to cast doubt on the deal.

During interrogations, inspectors ask questions

so as to achieve an answer that can be interpreted as “the company is unfamiliar to me, I did not transport the cargo.”

It happens that businessmen, creating fictitious TTN

, make ridiculous mistakes, due to which the fictitiousness of the TTN becomes obvious.

TTN: what kind of document is this and why is it needed?

In principle, the main purpose is to pay for transportation services. All related functions are in fact additional. And even tax officials have to present paper in rare moments. It is mandatory, it should exist in any case, but its only integral task is calculation. Availability check is a bill of lading, acts of capitalization; our accounting department contacts the Federal Tax Service using an invoice. All this is primary documentation, the accompanying documentation does not apply to it. But in view of this massive number of additional tasks, the value of the sheet increases and you definitely won’t be able to do without it. And then the legality of cargo transportation disappears; in principle, inspection or customs authorities are quite capable of turning the truck back to the sender.

Sample

A moment arises when an organization wants to make its own bill of lading form. To do this, you will need a template approved by Government Decree in April 2011. To create your own version of TN you will need to observe some nuances:

- the document must comply with the basic provisions of the Transportation Rules;

- indicate the route of the vehicle with the cargo;

- enter the declared cost of intermediary services and the payment procedure.

The model form is freely available free of charge. All that remains is to enter the information and print the required number of invoices.

Consignment note (Bill of Lading) - sample filling download.

Who needs the document

There are four subjects who will definitely need their own copy.

- Shipper. At a minimum, prove that all terms of the deal have been met on his part. And there will be no complaints, even if something happens to the cargo along the way.

- Persons authorized to accept the product. For reporting, as well as capitalization.

- Customer. As already said, there are a lot of functions for it.

- Carrier. To receive the payment due. This is his estimate, where it is written in black and white that he coped with his task, and the work costs N amount.

And although all entities have different goals, they all need an identical form. After all, the purpose of the consignment note does not differ depending on which specific party it is intended for.

How is it different from TN?

The concept of TORG-12 was mentioned above. This is a form of T-waybill (namely “commodity bill”). It is standardized at the state level. There are also columns and rows with values that should be filled in. Private information about participants is provided and nationwide coding is used.

A TT invoice is issued if transport is used for delivery (with its full description), but with the above one you can do without it. The first one is allowed to be used when making sales and when simply moving cargo. And the second is required exclusively in the presence of commodity-money relations. It is more extensive and includes a lot of information (including terms of the transaction, quantity of goods and materials, cost, VAT).

In addition, there is another concept of TN (“transport”). Designed for road freight transportation.

Features of filling out form 1-T

We have already clarified that this format is the most popular. And it is used in the vast majority of cases. The nuances are that the form is divided into two parts. The first is commodity. It is filled out by the seller, because it is he who must provide a certain quantity of the product under the order, supply or purchase agreement. But the second part, the transport part, is already compiled by both the shipper and the carrier. The first one issues an order for logistics activities, the second one carries them out, and, if necessary, makes adjustments.

Product section

It is based on the quantity, volume, quality of goods and materials. This is kind of the central part of the deal. And after listing all the characteristics, a mandatory aspect is the stamp or seal of the company. You will also need the signature of the responsible person, otherwise the certificate will be invalid.

Do not forget that it is through this section that capitalization occurs. Any violations will be identified at this point.

Transport section

We already understand how the TTN works and what kind of document it is. And since he is solely responsible for transportation, this section becomes dominant for his purpose. After all, payment of delivery costs depends not on the quantity and quality of the cargo, but on the performance of transportation functions. Also, the clauses must indicate who will pay the company and in what share. This is usually the buyer's responsibility, but there are exceptions. Also, the driver and the forwarder, in principle, can be part of the company receiving the cargo; accordingly, the section will not become a payment grant, but proof of performance of official duties. And the forwarder already signs here.

When to draw up a TTN

Its registration occurs during the transportation of goods and materials from one owner to another. The delivery itself is carried out independently by the sending company or with the assistance of the carrier company (third party). The one who sends the cargo also issues a waybill (its original owner for the alienation of the right or one of the divisions of the owner company to another). When using commercial transportation services, a contract for them can be drawn up by the sender or the recipient. Then the document under discussion can be signed by one or the other party.

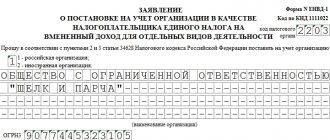

Registration in EGAIS

This is the only case when a document becomes reportable at all stages. It is entered into the system at the time of sending. According to the law, all participants in the process must be in the database. Therefore, at each point of cargo transfer, as well as during capitalization, it is necessary to check the Unified State Automated Information System. Conduct a complete product check.

In principle, to post goods with automatic accounting of the invoice, it is better to use a single operating system. Suitable software can be found in Cleverence. We offer:

- Solutions for any type of business.

- Manage all operations from a single device.

- Fast pace of execution of work processes.

We looked at how to work with a consignment note, what it is in accounting, what types and functions this document has, and found out that the invoice becomes vital in many cases.

Especially with increased interest from the Federal Tax Service. Number of impressions: 1746

Bill of lading form

It can be unified, that is, uniform for use. You can use a format that is standard for everyone in order to certainly avoid claims from the tax authorities for arbitrariness in maintaining documentation. All information fits on one A4 sheet with compact placement of information and horizontal arrangement. The codes used here can be viewed in the all-Russian classifier.

When using a specialized program, the document is generated automatically if all the data is entered correctly. But today it is allowed to develop a convenient form yourself, shortening it, which greatly facilitates the work.