Situations often arise when an organization, in order to support its activities or fulfill a third-party order, needs to perform work that is not typical for the profile of such an enterprise. Or there may simply be a shortage of specialists who are busy at other sites at this particular time.

For example, an enterprise needs to prepare an exhibition of its own products, but there is no designer with the appropriate specialization on staff. Or you need to fulfill an urgent order for the installation of a structure, and the team is busy with other work.

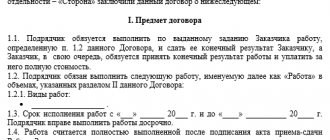

In such cases, it is possible to conclude a fixed-term employment contract to perform certain specific work in accordance with Article 59 of the Labor Code. The unified form T 73 is an act of acceptance of such work and approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. Corresponds to code 0301053 according to the All-Russian Classifier of Management Documentation (OKUD). The act form is filled out by the responsible person appointed by the head of the enterprise or organization. Entering data requires special care. The unified form T 73 refers to primary accounting documents reflecting the facts of the economic and business activities of the enterprise (Clause 1, Article 9 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ). Incorrect documentation of transactions in this case can lead to negative tax consequences for the business entity. Of course, based on information from the Ministry of Finance of Russia No. PZ-10/2012, from January 1, 2013, the unified form T 73 can be replaced by a form of the enterprise’s own design. But, in any case, your form must include all the necessary data for accounting.

Application of the act form T-73

The need to draw up a document arises when documenting the results of work performed once. Hiring an employee to perform one-time work should not bear the characteristics of an employment contract of an indefinite duration. The act is drawn up upon completion of the work or stage under the contract, which has:

- Limited validity period - the date or departure of the absent main employee.

- Characteristics of a fixed-term type of contract.

- A specific list of tasks.

A fixed-term contract is concluded when performing seasonal, temporary work, in the absence of the main employee, or in cases where the work requires certain skills that are not available to the company’s employees. A complete list of works for which a fixed-term type of contract is used is indicated in Art. 59 Labor Code of the Russian Federation.

If the employee violates obligations, the contract may be terminated early at the initiative of the employer. The basis is a violation of labor discipline, routine, labor safety rules, or failure to complete tasks on the part of the employee. Failure to fulfill obligations on the part of the employer is disputed in the labor commission and judicial authorities.

| ★ Collection and directory of all personnel documents (forms and documents in word format) > 1200 books purchased |

To organize personnel records in a company, beginner HR officers and accountants are perfectly suited to the author’s course by Olga Likina (accountant M.Video management) ⇓

| ★ Author's course “Automation of personnel records using 1C Enterprise 8” (more than 30 step-by-step video lessons for beginners with instructions) purchased > 2000 practical courses |

Description of the act

Acceptance of work entrusted to a specific employee in accordance with a fixed-term employment contract presupposes that a corresponding act is drawn up for proper registration and accounting.

This document assigns the following responsibilities to the employer:

- providing the employee with the agreed work;

- ensuring proper working conditions;

- timely and full payment of wages.

The employee’s responsibilities are as follows: personal performance of the labor function provided for by the fixed-term contract, as well as strict adherence to the labor regulations adopted at a particular enterprise.

The conclusion of a fixed-term employment contract, in accordance with the norms of the Labor Code, occurs in the following cases:

- required to perform the duties of a staff member who is temporarily absent;

- when temporary or seasonal work is necessary;

- a person goes to work abroad;

- when it is necessary to perform work that is not part of the company’s traditional activities or is associated with a temporary expansion of production or the list of services provided;

- when employees are accepted into an organization that will operate for a strictly defined time, to carry out clearly defined work;

- the person being hired is required to carry out some work, the completion date of which is unknown;

- when work is performed during practice or internship;

- when a person will hold an elected position or be a member of an elected body for a certain period of time;

- a person registered with the employment service is sent to perform temporary and public works;

- when a citizen undergoes alternative civilian service.

In some cases, it is possible for the parties to sign by mutual agreement a fixed-term employment contract, which does not specify the nature of the future work and the conditions under which it will be implemented.

An act of acceptance of work can be executed during the final or stage-by-stage payment under the employment contract.

This act must certainly contain:

- name of the completed works;

- from the cost provided for by the provisions of the agreement previously signed by the parties;

- the amount to be paid;

- conclusion regarding the volume, level and quality of completed work.

Drawing up the act is the responsibility of the employee who is responsible for accepting the work, after which it is approved by the manager or a person with due authority. It is required to fill out two copies, one of which is given to the person who carried out the work, and the second is sent to the accounting department for payroll calculation.

Form T-73, which is used to draw up an act of acceptance of work performed in accordance with a fixed-term employment contract, serves as the basis for a full or phased payment to be made to the employee. This form can be used by all organizations operating in the Russian Federation, except budget ones.

The act serves as the primary document, in accordance with which salaries are calculated and payments are made under fixed-term contracts, and expenses incurred are also reflected in.

Form of document indicating the completion of the task

Work or tasks performed under a fixed-term contract must be transferred by the performing party and accepted by the ordering party. To confirm the fact of transfer of labor results, an act of form T-73 or another document developed by the enterprise is used.

The unified form was approved by Resolution of the State Statistics Committee dated January 5, 2004 No. 1. The form used in the company must be approved in the annex to the accounting policy as part of working primary documents. Forms developed independently include the mandatory details necessary for maintaining primary accounting records. You must enter the following in the form:

- Data about the enterprise and structural unit.

- Document details – date of preparation and number assigned according to the registration log.

- Information about the contract on the basis of which the work was carried out.

- Information about the person, the task being performed, the deadlines for implementation.

- Information about the parties and persons responsible for the delivery and acceptance of completed work.

Based on the drawn up act, a settlement is made with the employee.

Related documents

- Vacation schedule. Form N T-7

- Payroll register. Form N T-53a

- Travel certificate. Form N T-10

- Employee's personal card. Form N T-2

- Personal card of a state (municipal) employee. Form N T-2GS(MS)

- Payment statement. Form N T-53

- Order (instruction) to send an employee on a business trip. Form N T-9

- Order (instruction) on sending employees on a business trip. Form N T-9a

- An order (instruction) to transfer an employee to another job. Form N T-5

- Order (instruction) on the transfer of employees to another job. Form N T-5a

- Order (instruction) to reward an employee. Form N T-11

- Order (instruction) on incentives for employees. Form N T-11a

- Order (instruction) on granting leave to employees. Form N T-6a

- Order (instruction) on granting leave to an employee. Form N T-6

- Order (instruction) on termination (termination) of an employment contract with employees (dismissal). Form N T-8a

- Order (instruction) on termination (termination) of an employment contract with an employee (dismissal). Form N T-8

- Order (instruction) on hiring an employee. Form N T-1

- Order (instruction) on hiring employees. Form N T-1a

- An official assignment for sending on a business trip and a report on its implementation. Form N T-10a

- Registration card of a scientific, scientific and pedagogical worker. Form N T-4

Deadlines for drawing up an act of form T-73

When registering an employee to perform a specific task, the parties stipulate the deadline for completion and the procedure for accepting the work. The result of the work can be accepted upon completion of the work or in parts, with a report drawn up for each stage of implementation. Stage-by-stage execution of the act is required to make payments to the person. The form is drawn up in 2 copies, one of which is provided to the employee, the second is sent to the accounting department for calculation.

The form is drawn up by a person appointed by the manager to verify compliance with the requirements of the work performed and acceptance of the result. The act is approved by the head of the enterprise or another authorized person (for example, a deputy).

Answers to common reader questions

Question No. 1. Is form T-73 used when accepting work under a GPC agreement?

The act of the unified form T-73 is used only when concluding a fixed-term contract for the acceptance and transfer of the result of work performed.

Question No. 2. Can a proxy sign a deed on behalf of an employee?

The interests of an individual may be represented by a trustee. To create rights, a notarized power of attorney is required.

Question No. 3. Is a T-73 form document the basis for filing claims against the employer, including filing a claim in court?

The T-73 form certificate is a full-fledged document for presenting rights, confirming the fact of work being carried out, subject to the availability of all required information. Additionally, it is necessary to have a contract on the basis of which the work was carried out.

Question No. 4. How is the termination of a fixed-term contract carried out when performing work confirmed by the T-73 act?

The employer notifies the employee of the termination of the fixed-term contract. The fact of termination of the contract or performance of work is not grounds for terminating the labor relations of the parties. After drawing up the act, an order is issued to terminate the contract.

Question No. 5. Is it possible to extend a fixed-term contract with a person if circumstances do not allow the completion of the work specified in the agreement?

The legislation does not contain provisions allowing the extension of fixed-term contracts. There is no direct prohibition on drawing up an additional agreement to the contract, but the best option is to conclude a new contract. Payment under the original contract must be made based on actual results.

Procedure for drawing up form T-73

At the time of drawing up the act, the work under the contract (or part thereof) must be completed. Filling out the form is easy. All data is entered according to the request for each position.

| Procedure | Explanations |

| Filling in details | Enter information about the enterprise, contractor, contract |

| Assigning a number and date | Carried out in the program or according to the journal of registration of general documents |

| Data on types of work | Each type of work is indicated separately with data on quantitative and cost indicators |

| Carrying out acceptance | The act must contain a record of the absence of claims and acceptance of work |

| Signatures and approval | The document is signed by the parties to the contract and approved by the manager |

Next, the document is transferred to the accounting department for payment in accordance with the amount specified in the act. The transfer of the document to the accounting department is carried out by the responsible person who supervises the execution of the assigned task.

Expense cash order (form KO-2) in 2021

In the line "Organization"

the legal form is indicated (LLC, CJSC, etc.) and the name of the organization (for example, LLC “Company”).

In the line “Code according to OKPO”

it is necessary to indicate the OKPO code in accordance with the notification received from Rosstat. If the code has not been assigned, put a dash.

Next, indicate the name of the structural unit

the organization issuing cash settlement services (if the organization has no structural divisions, put a dash).

In the "Document number"

the serial number of the cash register is indicated (the numbering of incoming and outgoing cash documents during the year must be continuous, and start anew from the beginning of the next year).

In the “Date of Compilation”

the date of issue of money from the cash register is indicated in the format DD.MM.YYYY (for example, 03/05/2016). RKO must be issued on the day the money is issued from the cash register, so the date of issue of money and the day the order is generated coincide.

Block "Debit"

:

In the column “Code of structural unit”

indicate the code of the division of the organization issuing cash settlements (if the organization does not have structural divisions, put a dash).

In the column “Corresponding account, sub-account”

the account number is indicated, the debit of which reflects the issuance of money from the cash register in accordance with the chart of accounts:

- 51 – delivery of money to the bank for crediting to the current account;

- 60 – settlements with suppliers and contractors;

- 70 – settlements with employees regarding wages;

- 71 – settlements with accountable persons;

- 73 – settlements with employees for other transactions;

- 75-2 – settlements with founders for payment of income.

Column "Analytical Accounting Code"

filled in only if the corresponding codes are available.

In the "Credit"

the number of the accounting account is indicated, the credit of which reflects the issuance of money from the cash register (as a rule, this is account

50.1 - “cash desk”

).

In the "Amount"

The amount of money dispensed from the cash register is indicated in numbers.

Column “Purpose code”

filled out if the organization uses the appropriate coding system in its activities. In this case, the code for the purpose of using the retired funds is indicated.

In the "Issue"

The full name of the individual is indicated (in the dative case, for example, Ivanov Ivan Ivanovich) or the name of the organization to which funds must be issued.

In the line "Base"

it is necessary to indicate the basis for issuing money from the cash register, for example:

“Issuing financial assistance”

or

“Depositing money to the bank”

, etc.

In the line "Amount"

The amount of money dispensed from the cash register is indicated in words. In this case, rubles are written with a capital letter, and kopecks with numbers. In empty fields you must put a dash.

In the "Application"

the attached primary documents are reflected, indicating their numbers and dates, on the basis of which money is issued from the cash desk (powers of attorney, receipts, orders, statements, etc.).

Next, fill in the details of the head of the organization

(position, signature and signature transcript) and

chief accountant

(signature and signature transcript).

Note

: the manager does not have to sign for the cash register if he makes an authorization inscription on the attached documents to the cash receipt order.

The line "Received"

filled out by the person to whom money is given from the cash register. In it, he indicates the amount of money received (in this case, he must write rubles in words with a capital letter, and kopecks in numbers). Next is his signature and the date of receipt of the money.

When issuing money via cash register, the cashier must check the identity document

recipient (passport or other document). The cashier indicates the name, number, date and place of issue of this document in the corresponding line of the cash register.

Line “Issued by the cashier”

filled in by the cashier only after the cash is issued via cash register. In it he puts his signature with a transcript (last name and initials).

fully filled order remains at the cash desk

enterprise (and not handed over to the recipient of the money) and serves as confirmation that the funds were issued legally.

note

, it is prohibited to make corrections in the cash receipt order.

Recommendations for filling out form T-73

The composition of the act data is determined by the document itself. Filling out the document line by line according to requests ensures the complete composition of the required information. When entering data, important conditions are:

- Filling out the company details in accordance with the constituent documents.

- The persons indicated in the document must have the right established by the order or job description.

- When replacing the responsible person, the details of the employee temporarily performing the duties are indicated.

- The details of the work performer and the signature are entered manually by the person himself.

The act is completed manually or electronically using original or certified signatures of persons.

Use of electronic signatures when approving an act

Primary accounting documents are allowed to be generated electronically using an electronic digital signature, with the exception of information media that require special protection. The organization's records must define the procedure for maintaining electronic document management and the circle of persons entitled to receive an electronic signature.

In internal documents, a simple electronic signature (SES) is often used, confirming the creation of the document by the account owner who has access to the information system. In cases where additional protection of information is necessary to ensure that there are no changes after signing with an electronic signature, an electronic digital signature issued by a certification center is used.

When signing the T-73 act with an electronic digital signature, certain difficulties arise.

| Condition for drawing up the act | Description |

| Availability of an electronic signature (see → How to obtain an electronic signature) | All parties involved in signing the document must have a certain type of key certificate |

| Type of digital signature of the performer | When signing a document, the executor must have a strengthened digital signature obtained from a specialized center |

| Form of the document provided to the contractor | To transfer a sample document to the contractor, a printed document on paper will need to be certified with the original signature of the manager and the seal of the organization |

The document is the basis for settlement with the employee, which is taken into account when ensuring the storage of documents. Forms T-73 relating to employee benefits require preservation for 5 years, and in the absence of personal accounts - 75 years. The duration of archiving is taken into account when creating documents in electronic form. Documents signed with an electronic signature must be stored in electronic document databases along with certificates confirming the authenticity of the signatures.

Errors that occur when filling out the form

The main errors when drawing up an act arise in the absence of the required details of the primary document.

| Document requirement | Required information |

| Company information | Information is entered that allows you to determine the organization, division |

| Details of the act | Documents are assigned a number and date of preparation |

| Information about the employee and the basis for drawing up the act | Provide information about the contract (number, validity period, date of preparation) and the contractor |

| List of works | The types of work performed are reflected, indicating the amounts, and the compliance of the result with the requirements is confirmed |

| Information about responsible persons | The persons confirming the acceptance and approval of the work done are indicated |

The form of the primary document, drawn up in violation of the requirements or completeness of the details, is considered invalid and cannot serve as a basis for including the amount in the confirmed expenses of the enterprise.

Fill out the form

Like all other forms, ours begins to be filled out at the header. It must contain the following information:

- name of the company or enterprise;

- structural subdivision;

- OKVED;

- OKPO;

- details of the employment contract (date and number);

- the duration of this agreement;

- number and date of drawing up the act to be filled out;

- reporting period.

Next, in the main part, indicate the employee’s full name, terms and details of the contract. Then there is a table where the following data is entered:

- Number in order.

- Title of the work.

- The amount for the work.

At the end of the table, they summarize the amounts for all work done by the employee, indicate the amount of the advance and the amount that must be paid.

Then they write a short conclusion about the quality, volume and level of work performed and indicate the amount in words.

At the end of the document, the following people put their signatures: the employee, the employee accepting the work, the head of the structural unit and the chief accountant. After this, the document is approved by the head of the company.

After the act is completed and the employee receives the money, management must issue an order to terminate the contract.

Features of drawing up an act in service programs

When making settlements with an employee hired under a fixed-term contract to carry out a certain amount of work, the fact that the hired person has all the rights along with regular employees is taken into account. The contractor under a fixed-term contract has the right to receive social guarantees, including employer contributions to funds that give the right to insurance. The settlement with the employee is made in the program that accompanies payroll.

Standard configurations of salary programs do not contain an act form. The form is filled out in an office program or the document is included in the forms used. For the program used by the organization, it is necessary to refine the list of available forms by creating an external printed document into which data will be entered from the working configuration. The form is added to the list of forms used through the additional reports function.