Any enterprise is required to maintain accounting records. Responsibility for maintaining records rests with the company's chief accountant. What is accounting, why is it needed and who has the right not to do accounting, we will tell you in this article.

Any enterprise is required to maintain accounting records. Responsibility for maintaining records rests with the company's chief accountant. What is accounting, why is it needed and who has the right not to do accounting, we will tell you in this article.

Accounting is an orderly system for collecting, registering and summarizing information in monetary terms about the property, obligations of an organization and their movement through continuous, continuous and documentary accounting of all business transactions.

Any transaction must be reflected in accounting. Buying a pencil, issuing a salary, calculating depreciation or obtaining a loan - all these are types of business transactions that must be recorded and reflected properly.

Each operation must be documented. Documents can be different: contracts, invoices, accounting cards, expense orders, etc.

One of the main principles of accounting is the reflection of all transactions using special accounts. Each transaction must be reflected in the debit and credit of the corresponding accounting accounts.

Accounting is maintained in accordance with the provisions of Federal Law dated December 6, 2011 No. 402-FZ. The law reveals the requirements for record keeping, describes the principles of record keeping, contains a list of persons obliged to maintain accounting, etc.

Most often, accounting is carried out in special programs. The accounting program is selected depending on the needs of the company, its turnover and type of activity. You can conduct accounting online using web services. Automation of accounting greatly simplifies the work of an accountant.

We will select a reliable accountant to serve your company.

More details

Why do you need accounting?

While the business is not large, it seems that it is possible to keep all the information about cash flows and obligations in your head, or it is enough to write down the most important things in a notebook, but keeping accounting is pointless. This is true to some extent: the smaller the business and the number of transactions, the easier it is to track transactions. But competent accounting allows not only to record the facts of economic life. Thanks to him you can:

- Assess the real financial position of the enterprise

- Monitor the company’s performance and identify discrepancies with forecasts

- Find reserves

- Identify profitable and unprofitable transactions

- Monitor compliance of activities with legal norms

- Submit reports on time, following the schedule

According to Law 402-FZ, individual entrepreneurs and branches of foreign companies may not maintain accounting - all other enterprises are required to do this and submit specific reporting forms to the tax office.

Who should do the accounting

All companies must maintain accounting records at all times, with the exception of representative offices (branches) of foreign organizations. Individual entrepreneurs are also exempt from accounting.

For some categories of persons it is possible to keep records using a simplified scheme. There are three categories of persons who are allowed a simplified accounting system:

- small business;

- non-profit organizations;

- organizations that have received the status of project participants to carry out research, development and commercialization of their results.

The head of the company is required to organize accounting. He may assign the responsibility for accounting to the chief accountant or an outsourcing company. In small enterprises, the duties of the chief accountant are often performed directly by the director.

Accounting rules and key concepts

The basis of accounting is the processing of primary documents that correspond to specific business transactions. These are expense reports, invoices, invoices, etc. You can use unified forms of primary documents or those developed independently - the main thing is that they contain all the details specified in paragraph 2 of Art. 9 of Law 402-FZ. For some types of “primary” the use of standard forms is mandatory.

Information from primary documents is recorded in accounting registers - paper or electronic documents in the form of statements, journals, tables, etc. Each enterprise independently chooses which registers to use, using standard ones or ones developed “for itself.”

Information from the “primary” is entered into registers using the double entry , which reflects the receipt and expenditure of material goods. For example, the purchase of raw materials means the receipt of materials for production and at the same time the expenditure of funds. the receipt (debit) is recorded in one column , and the expense (credit) in monetary equivalent is recorded in the second.

The same fact of economic life is “passed” through both columns and marked with two different numerical codes. These numeric codes are called accounting accounts and correspond to specific groups of related business transactions. Each company independently decides which accounts to use, selecting the ones they need from the general plan. Recording debits and credits with accounts is called an accounting entry .

Based on the transactions for each account, a balance - the difference between its debit and credit turnover for a certain period, which can be zero. Accounts are divided into active - reflecting the assets of the enterprise, passive - reflecting the sources and expenditure of funds - and active-passive. If the debit of the account is greater than the credit, the balance is called a debit; if less, it is called a credit; if the debit and credit are equal, then the balance will be zero. The balance of an active account can be debit or zero, the balance of a passive account can be credit or zero, and the balance of an active-passive account can be both debit and credit, and possibly simultaneously.

Data for each account helps to compile a balance sheet , which groups all the assets and liabilities of the company for the reporting period, and a statement of financial results (also known as profit and loss statement). These two documents, as well as the appendices to them, are the financial statements that each enterprise submits to the Tax Service once a year. The list of appendices includes: a statement of changes in capital, a statement of cash flows, a report on the intended use of funds and explanations to the statements.

In a properly prepared balance sheet, assets always equal liabilities.

Personnel records for an entrepreneur

Entrepreneurs who hire employees are required to maintain personnel records for their employees. HR records are as follows:

- Orders on hiring and dismissal;

- Applications for hiring, dismissal;

- Employment contracts;

- Applications for standard tax deductions;

- Consent to the processing of personal data;

- Time sheets;

- Vacation schedules;

- Staffing table;

- Payroll statements;

- Calculations of vacation pay, sick leave, and business trips.

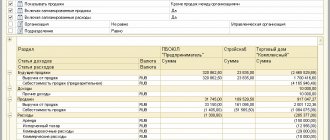

For employees, the entrepreneur is required to submit monthly, quarterly and annual reports. Report forms are presented in the table.

| Frequency of delivery | Reporting name |

| Monthly | SZV-M |

| Quarterly | RSV, 4-FSS, 6-NDFL |

| Annually | 2-NDFL, SZV-Experience, Average number of employees |

What is simplified accounting

Since 2013, according to paragraph 4 of Art. 6 of Law 402-FZ, small enterprises have the right to conduct accounting in a simplified form.

Let us remind you that a business is considered small if its annual income is no more than 800 million rubles, the number of employees is no more than 100 people, the share of participation of the state and funds in the authorized capital is no more than 25%, and the share of other legal entities is no more than 49%.

The essence of simplified accounting was revealed by the Ministry of Finance of Russia in Recommendations for the use of simplified methods of accounting and preparation of accounting reports. The document offers small businesses 3 options for simplified accounting: its full form, its abbreviated form and the simplest one.

The full version of simplified accounting is recommended for enterprises that are faced with a large number of diverse business transactions. It involves the use of an abbreviated chart of accounts, in which related accounts are combined into one. This method also allows you to correct errors in the current reporting period. Register templates that can be used for this form of simplified accounting are given as appendices to the Recommendations.

The abbreviated form of simplified accounting assumes everything that the full form does, but also allows you to keep only one instead of several registers - a journal of accounting facts of economic life. A sample journal is also included in the appendix to the Ministry of Finance document.

The simplest form of simplified accounting is recommended only for micro-enterprises - companies that have no more than 15 employees and an annual income of no more than 120 million rubles. This method of accounting allows you to avoid double entries indicating debit and credit. And keep only a book of accounting facts of economic life according to groups of articles of so-called reporting documents. This accounting method is called cash accounting .

All 3 forms also imply simplified accounting reporting: small businesses are required to provide the tax authorities only with a balance sheet and a statement of financial results - without attachments.

However, not all small businesses can maintain simplified accounting. This is prohibited for:

- organizations whose activities are subject to audit;

- housing construction and credit consumer cooperatives;

- microfinance organizations;

- public sector companies and political parties;

- law offices and notary chambers;

- NPOs performing the functions of foreign agents.

Responsibility of a third party for the state of accounting

The manager can enter into an agreement with a company that provides accounting services within the framework of his right to organize accounting (or similarly with a private person). The contract for the provision of services must be drawn up in such a way that in the event of claims regarding the quality of accounting work, responsibility can be assigned to the actual performers and their rights can be proven in court. Otherwise, the entire burden of guilt according to the law will have to be borne by the manager, as having failed to fulfill the duty properly, in accordance with Art. 7-1 Federal Law No. 402.

How to do without an accountant

If you can’t yet hire an experienced specialist, there are other ways to handle accounting.

If you are an individual entrepreneur, you can not keep accounting records and limit yourself to financial ones, which will allow you to track cash flows.

If you are an LLC that meets the criteria for a small business, try to do the accounting yourself - take short-term accounting courses or use special programs that do not require special economic knowledge. Some services offer a free trial period and business solutions to choose from. For example, the Accounting Department of Sberbank has three of them.

If you apply several tax regimes, accounting will be complex - in this case, qualified assistance is desirable. Hire a trainee operations operator who can process primary documentation, or outsource accounting, or use different software for operations in each mode. The costs of these services will be fully repaid.

How to choose an accounting program

There is no ideal software that would suit both a nut shop and a window factory. When choosing a program, think about what it should be able to do and what needs it should meet. Here is a list of parameters that are worth considering:

- preparation of reports in accordance with the special tax regime and organizational and legal form;

- possibility of synchronization with a cash register;

- ability to run on different devices, including mobile;

- availability of reminders about reporting deadlines;

- ability to generate reports in figures and graphs;

- degree of difficulty in handling;

- price.

Programs designed for non-specialists are easier to use: they provide hints, generate reports based on ready-made schemes, and simplify the analysis of financial data.

How to draw up an accounting policy

Accounting policy is detailed instructions for maintaining accounting and tax records. As a rule, it is compiled by an accountant, and approved and secured by the appropriate order by the head of the company. If the accounting policy is developed correctly, thanks to it, in the event of an accountant’s dismissal, the business can easily be continued by a new specialist or the manager himself.

The list of accounting policy provisions depends on the type of activity of the company, the chosen tax regime and whether simplified or complete accounting is used. But - in terms of accounting - the accounting policy should indicate the following:

- The person responsible for accounting;

- What accounting method has been chosen: simplified, abbreviated or simple, paper or electronic;

- Working chart of accounts;

- Forms of primary documentation and registers;

- The procedure for accounting for income and expenses;

- Regulations on the company's fixed assets and the procedure for their assessment, inventory and recalculation;

- The procedure for recording and evaluating inventory, goods and finished products;

- The procedure for making corrections and error criteria;

- List of regulatory documents: applicable accounting provisions (PBU), Tax Code, Law 402-FZ.

Templates for registers and primary documentation, if they are developed by the company independently and differ from the unified ones, are drawn up as appendices to the policy.

To create an accounting policy that includes accounting and tax sections, you can use paid or free constructors that are easy to find through Internet search engines. As a rule, such services are able to adapt to the applicable tax regime and even a combination of regimes. The main thing is to make sure that the designer used takes into account current legal requirements, and if possible, contact a professional to develop the document.

The accounting policy is the same for all business divisions. As necessary, the document can be supplemented with new provisions, but changes are allowed only once a year. And only in 3 cases: if legislation or business conditions have changed (for example, types of activities), and also if other methods of accounting have been chosen.

Who bears the greatest responsibility

In the event of unlawful demands on the part of the manager in relation to the chief accountant (the responsible person replacing him), the employee is released from liability if he was forced to commit illegal actions. This conclusion follows from the resolution of the plenum of the RF Armed Forces No. 18 dated 10/24/06. At the same time, the courts have not developed an unambiguous position on the issue of the responsibility of a particular leader on the issue we are considering. The chief accountant must keep this in mind to avoid conflict with the law.