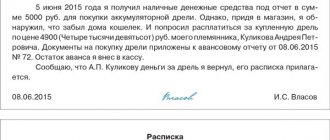

Checking the status of settlements with personnel is an integral part of the inventory carried out before drawing up annual reports. During the inventory, the actual state of settlements is revealed, which is compared with the data of the accounting registers. Taking into account the specifics of our magazine, we will tell you what you should pay attention to when conducting an inventory of calculations for the accrual and payment of wages and benefits, settlements with accountable persons, settlements for loans issued to employees, as well as settlements with the budget for personal income tax and extra-budgetary funds for insurance premiums.

In accordance with paragraph 3 of Art. 11 of Federal Law No. 402-FZ, the cases, timing and procedure for conducting an inventory, as well as the list of objects subject to inventory, are determined by the economic entity, with the exception of the mandatory inventory. Mandatory inventory is established by the legislation of the Russian Federation, federal and industry standards. In connection with the entry into force of this law on January 1, 2013, many organizations raised the question of the need to conduct an inventory of obligations before drawing up annual financial statements, because there is no direct indication of its implementation in the text of the document.