The legislation provides for the need to conduct preliminary (before hiring), periodic and extraordinary medical examinations, paid for from the employer’s funds. But if for any reason the employee underwent such a medical examination at his own expense, the enterprise must pay him appropriate compensation to reimburse the expenses incurred. This article discusses how insurance premiums are calculated from compensation for a medical examination, whether such compensation is subject to taxes, and other related issues.

Procedure for conducting a medical examination

The legislation establishes the need for the following types of medical examinations:

- preliminary - carried out with the aim of checking the health of the future employee during the process of his registration at the enterprise, for compliance with the expected job duties;

- periodic – carried out at various intervals (from a year or more), depending on the harmfulness of production and the characteristics of the employee’s workplace;

- extraordinary - the need for such a medical examination may be due to a change in health status; it can be carried out at the initiative of the employee or the enterprise.

Any of the listed medical examinations must be carried out at the expense of the enterprise where the employee is employed. For certain categories of personnel, a pre-trip medical examination is provided. This applies to vehicle drivers, representatives of the catering system and other employees on whose physical condition the lives of other people directly depend.

Medical examinations are carried out by an accredited medical organization with which the company has entered into a corresponding agreement. The company must pay the employee for the time spent undergoing a medical examination.

Who needs to undergo a medical examination when applying for employment?

There are certain categories of employees for whom undergoing a medical examination is predetermined by current legislation, for example, for the following:

- Drivers must undergo a drug addiction treatment and a psychologist;

- personnel employed in enterprises with harmful and dangerous working conditions (Part 1 of Article 213 of the Labor Code of the Russian Federation) - the harmfulness factor is determined by a special assessment. At the same time, the lists of harmful and dangerous work are indicated in the Order of the Ministry of Health and Social Development of Russia dated April 12, 2011 No. 302n;

- office workers forced to spend more than half of their working time at the computer - annually;

- employees of catering establishments - registration of a medical book (Part 2 of Article 213 of the Labor Code of the Russian Federation);

- employees of food enterprises - registration of a medical book (Part 2 of Article 213 of the Labor Code of the Russian Federation);

- personnel working in direct contact with children - teaching staff of preschool and school institutions, including temporary groups (Part 2 of Article 213 of the Labor Code of the Russian Federation);

- employees of consumer services - bath and laundry complexes, hairdressers, beauty salons, etc. (Part 2 of Article 213 of the Labor Code of the Russian Federation);

- medical staff - clinics, laboratories, hospitals (Part 2 of Article 213 of the Labor Code of the Russian Federation).

In addition, minor employees and personnel seconded to the Far North and areas with similar conditions undergo medical examinations.

Important! Territorial self-government bodies may establish additional conditions for undergoing a medical examination for certain categories of employees. If an applicant refuses to undergo a medical examination, the employer has the right to refuse employment, because

a medical examination is preliminary and is carried out upon concluding an employment contract (Article 69 of the Labor Code of the Russian Federation)

If an applicant refuses to undergo a medical examination, the employer has the right to refuse employment, because The medical examination is preliminary and is carried out upon concluding an employment contract (Article 69 of the Labor Code of the Russian Federation).

To refer an applicant for a preliminary medical examination, the organization issues an individual referral in a form approved by the organization itself. The referral contains the following data: full name of the person, place of work, place in the list of places and professions for which a medical examination is required, if necessary, harmful and hazardous production factors are indicated.

Insurance premiums for medical examinations of employees

If an enterprise pays for the services of a medical organization under a direct contract, these deductions should not be subject to insurance premiums. Such clarifications were provided by the leadership of the tax department of the Russian Federation.

Related article: Who is the payer of insurance premiums

Is compensation for a medical examination subject to insurance premiums?

If an employer pays compensation to an employee for a self-paid medical examination (such situations often arise when applying for a job), the Ministry of Finance and the Tax Service believe that this compensation should be subject to insurance premiums.

This is explained by the fact that the list of exceptions for the imposition of insurance premiums is compiled with an exhaustive indication of the positions, but this compensation is not included in it.

But the position taken by these government agencies regarding whether the said compensation should be subject to contributions is quite controversial.

Before the repeal of Law No. 212-FZ, when insurance contributions were the prerogative of the Pension Fund of Russia, courts often agreed with the claims of employers who demanded that these payments not be subject to deductions.

But representatives of the tax service now do not take into account the results of judicial practice of past years. Therefore, if such an issue is not disputed in court, there is no point in taking risks and not taking compensation into account when calculating insurance premiums.

An organization has the right to file a lawsuit to defend its own interests. But you should not count on a positive result of the consideration of the case, since after changes in legislation, such issues are usually considered not in favor of employers.

Additional difficulties during judicial review are also associated with the complexity of the procedure, which can drag on for quite a long time. Therefore, it is easier to pay insurance premiums, and only after that decide on the advisability of going to court.

Opinions are divided

Despite innovations in legislation, the courts did not change their decision. The decisions of the Arbitration Court of the Volga District dated January 27, 2016 No. F06-4898/2015 in case No. A65-11279/2015, the Arbitration Court of the Ural District dated September 23, 2014 No. F09-6044/14 in case No. A07-16620/2013 confirm the position that There is no need to pay insurance premiums for medical examinations.

However, officials from the Federal Tax Service do not take into account court decisions on the imposition of insurance premiums for medical examinations. The position of the tax authorities is simple: these court decisions were adopted on the basis of laws that lost their force due to the introduction of Chapter 34 of the Tax Code of the Russian Federation. Consequently, payments are subject to taxation in full. The position of the Federal Tax Service is reflected in the letter dated 09/03/2018 No. BS-4-11/ [email protected]

A similar opinion was expressed by the Russian Ministry of Finance (letter dated 02/08/2018 No. 03-15-06/7527). Officials of the Russian department do not consider these payments to be compensation; they cannot be classified as non-taxable amounts, which means that compensation for medical examination expenses is subject to insurance premiums.

Example of taxation of compensation for medical examination by insurance premiums

Whether compensation for a medical examination should be subject to insurance premiums can be considered using several specific examples.

In the first of these situations, the administration of the enterprise directly paid for the medical examination with the relevant healthcare organization.

In this case, the costs are classified as production costs, since they are caused by the need to ensure the technological process. Taking into account this circumstance and the requirements of the law, the employer is obliged to pay these expenses, and during the process of going through this procedure, the staff retain their positions and assigned earnings.

Related article: Features of zero calculation for insurance premiums and how to fill it out

In the following example, the employee underwent a medical examination on his own, and the company subsequently compensated him for the expenses incurred for this.

In this situation, the compensation payment should be subject to insurance contributions for deduction to the state budget. This is explained by the fact that compensation payments are not included in the list of exceptions for withholding insurance premiums.

Answers to frequently asked questions

Question No. 1: What are the fines for failure to pay the required compensation for a medical examination?

The penalty is imposed in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation.

| Responsible persons | Amount of fine for violation |

| Official or individual entrepreneur | From 1,000 to 5,000 rubles. |

| Legal entity | 30,000 - 50,000 rub. |

Question No. 2: When hiring a potential employee, the employer sent him for a medical examination, but this is not required by law. Should the employer reimburse expenses for a medical examination completed under such circumstances?

Yes, the employee must be reimbursed at work for all expenses related to the medical examination, since the initiative to undergo it comes from the employer.

An applicant applying for a job must undergo a medical examination even when local regulations of the organization provide for this, despite the fact that the law does not oblige this. Well, in such situations, the employer is obliged to reimburse him for all expenses associated with the medical examination.

Medical examination and personal income tax

Regarding whether compensation for a medical examination is subject to personal income tax, the following must be taken into account:

- Only those receipts that are associated with the receipt of income by citizens or organizations can be taxed;

- if the employee received compensation for previously incurred expenses for undergoing a medical examination, such receipts cannot be considered income, since they compensate for losses that were previously present.

When analyzing the above, it becomes clear that compensation payments cannot be subject to personal income tax, since they are not income, but compensate for losses incurred by the citizen.

But it should be understood that a situation in which a future employee is forced to pay for the services of a medical organization himself upon entering work is a direct violation of legal norms. Indeed, in this case, the estimated tax base will be less by the specified amount.

From the analysis discussed in the material, it becomes clear that compensation paid to an employee for independently undergoing a medical examination should be subject to insurance contributions, but is not included in the number of payments from which personal income tax is withheld.

Hiring expenses

The costs of medical examination of candidates are taken into account in accounting as normal expenses for core activities, in the corresponding accounting accounts:

D 20 (26,23,25,44) K 76(60)

In tax accounting (for the purposes of calculating income tax or single tax under the simplified tax system), expenses are also accepted (see paragraphs 7 and 8, paragraph 1, Article 264 of the Tax Code of the Russian Federation and paragraph 5, paragraph 1, Article 346.16 of the Tax Code of the Russian Federation). In particular, according to the simplified tax system, according to the explanations of the Ministry of Finance, these costs are included in material costs, as part of the production process.

It doesn’t matter whether the candidate was selected or not, even if the results of the medical examination turned out to be unacceptable for hiring, they can be taken into account. Although some controversy is caused by the situation when a potential employee independently enters into an agreement for a medical examination and then presents documents to reimburse him for such costs

In most cases, tax authorities and courts recognize that the employer is required by law to bear these costs, so reimbursing the employee for expenses does not lead to the formation of income subject to personal income tax and contributions. I note that compensation is possible if the employee himself applies for it. The main thing is that the organization conducting the medical examination has a license, and the employee provides an agreement, documents on payment and provision of services. For an organization, expenses can be accepted into accounting on the basis of acts of services rendered, but for tax accounting using the simplified tax system, the fact of payment is important.

Note! From July 1, 2021, the cash receipt must indicate the name of the buyer (customer), his TIN and some other details (clause 6.1 of Art.

4.7 of Law 54-FZ), if the settlement is made with an organization (IP), including through an accountable person.

Another reason not to pay fees for a candidate is the lack of an employment relationship. Since an individual is not an insured person, there is no need to pay contributions.

Reimbursement through compensation

In the event that an applicant for a position independently pays for examination, diagnostics and tests at the clinic, he is obliged to provide supporting and payment documents to the organization for reimbursement of expenses. An applicant for a vacant position contacts the accounting department, regardless of the result of the inspection, with the following list:

- an application addressed to the director with a request to compensate for expenses;

- referral for a medical examination;

- agreement with a medical institution;

- receipts, checks, payment orders for payment for medical services;

- conclusion of the medical commission;

- passport;

- employment history;

- details for transferring funds.

After reviewing the documents and the management’s approval visa, the accounting department transfers the money to the specified details. Although the payment period is not regulated by law, it is recommended to make transfers to the next salary or advance payment to avoid labor conflicts.

The employee has every right to sue the employer if the latter refuses to reimburse the costs of the medical examination. At the same time, the management of the organization does not have the right to refer to a lack of funds in the budget. The injured party has the right to sue 3 months after the refusal to pay or at any time when it becomes obvious that labor rights have been violated.

Who pays

To answer this question, you need to refer to the provisions of Article 212 of the Labor Code of the Russian Federation, which sets out the employer’s responsibilities for labor protection and creating safe working conditions for its employees.

This regulatory legal act clearly states that the employer is obliged to organize preliminary, scheduled and extraordinary medical examinations for staff, paying for the services of doctors . In addition, during the inspection, the employee retains his position and average daily earnings.

Violation of these conditions threatens with a fine (Part 3 of Article 5.27.1 of the Code of Administrative Offenses of the Russian Federation):

- organizations - up to 130,000 rubles;

- individual entrepreneurs - up to 25,000 rubles;

- official - up to 25,000 rubles.

For a repeated similar violation, the fine will be greater (Part 5 of Article 5.27.1 of the Code of Administrative Offenses of the Russian Federation):

- organizations - up to 200,000 rubles;

- individual entrepreneurs - up to 40,000 rubles;

- official - up to 40,000 rubles.

Important!

The employer retains the right not to allow an employee to perform official duties if the medical examination is not passed or contraindications are identified by doctors. Download for viewing and printing: Article 212 of the Labor Code of the Russian Federation “Obligations of the employer to ensure safe conditions and labor protection”

Common mistakes when organizing medical examinations for certain categories of workers

Error. 1. Many employers, as well as employees, are wondering whether office employees who work on computers, as well as applicants who apply for such work, need to undergo medical examinations. After all, many of them spend a lot of time at the computer. If we translate it into working hours, it turns out that the computer “takes away” at least 50% of work hours. time, which can be attributed to a potentially harmful factor.

Explanations on this issue were provided by Rostrud in letter No. TZ/942-03-3 dated February 28, 2017.

As Rostrud notes, the need to undergo a medical examination for such workers is determined based on the results of a special assessment. If it shows that working conditions are harmful, then, accordingly, there is a need to organize medical examinations.

As Rostrud points out, the employer does not have an obligation to organize preliminary (periodic) medical examinations if the results of a special assessment showed that working conditions during the certification of workplaces were recognized as optimal or acceptable.

Head of the State Labor Supervision Department E. Ivanov.

BASIC

When calculating income tax, take into account the amount of salary during the mandatory medical examination as part of labor costs (clause 7 of Article 255 of the Tax Code of the Russian Federation).

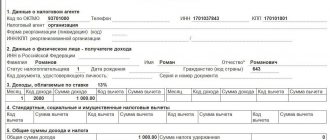

An example of how wages accrued during a mandatory medical examination are reflected in accounting and taxation. The organization applies a general taxation system

Worker of LLC “Production Company “Master”” A.I. Ivanov was sent for periodic mandatory medical examination from April 22 to April 24, 2015 inclusive (3 days). During this time, he retains his average earnings. Ivanov's working hours are recorded in days.

Ivanov worked in full for the entire billing period (from April 1, 2014 to March 31, 2015 inclusive). The billing period is 245 working days. During this time, Ivanov was credited with 120,000 rubles.

Ivanov’s average daily earnings are: 120,000 rubles. : 245 days = 489.80 rub./day.

The salary due to the employee during the mandatory medical examination is equal to: 489.80 rubles/day. × 3 days = 1469.70 rub.

From this amount, Master’s accountant withheld personal income tax, and also assessed contributions for mandatory pension (social, medical) insurance and insurance against industrial accidents. Ivanov has no rights to deductions for personal income tax.

Insurance contributions for pension (social, medical) insurance are calculated by “Master” at general rates. The contribution rate for insurance against accidents and occupational diseases is 0.2 percent.

The organization’s accountant made the following entries in the accounting:

Debit 20 Credit 70 – 1469.70 rub. – Ivanov’s salary was accrued for the period of undergoing a mandatory medical examination;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 191 rubles. (RUB 1,469.70 × 13%) – personal income tax withheld;

Debit 20 Credit 69 subaccount “Settlements with the Pension Fund” – 323.33 rubles. (RUB 1,469.70 × 22%) – pension contributions have been accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 42.62 rubles. (RUB 1,469.70 × 2.9%) – compulsory social insurance contributions have been assessed;

Debit 20 Credit 69 subaccount “Settlements with FFOMS” – 74.95 rubles. (RUB 1,469.70 × 5.1%) – contributions for health insurance to the Federal Compulsory Medical Insurance Fund have been accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 2.94 rubles. (RUB 1,469.70 × 0.2%) – premiums for insurance against accidents and occupational diseases are accrued.

When calculating the income tax, the Master's accountant included 1,469.70 rubles in expenses, as well as insurance premiums accrued on this amount in the amount of 443.84 rubles. (323.33 rubles + 42.62 rubles + 74.95 rubles + 2.94 rubles).

What documents confirm payment for the medical examination?

So, in order to receive compensation, the applicant must present to the employer and accounting department documents that prove the fact of payment and the types of medical care provided. services. The employer pays for medical care. performs services based on supporting documents. The legislation does not establish a list of such documents.

Meanwhile, the law puts forward a very clear requirement for confirmation of such expenses. It states that all expenses for medical examinations must be confirmed by documents, the execution of which complies with the requirements and norms of the legislation of the Russian Federation. If we are talking about primary documentation confirming business transactions, they must be drawn up in accordance with approved standard forms. If the form of a document is developed independently, then it must contain mandatory details, etc.

In a situation where the employer has entered into an agreement with the medical organization, the supporting document can be, for example, a payment order or an act of providing specific services. The act does not have a unified form, therefore, when drawing it up, you should include the details required by law.

If the applicant applied to honey. organization personally, and paid for the services himself, then, accordingly, completely different documents are presented certifying the fact of payment. This could be, for example, a cash receipt or other documents from which it follows that such and such honey. the service is provided.

Example 1. Preliminary medical examination for taxi drivers (ambulance and other emergency services)

Citizens who are going to get a job that involves driving ground vehicles are required to first undergo a medical examination.

The examination of the future driver includes visits to several doctors: an ophthalmologist, a neurologist, a surgeon, an endocrinologist, and a dermatovenerologist. The subject's height, weight, blood type, Rh factor are determined, visual acuity, color perception are determined, the vestibular analyzer is examined, etc.

If at least one contraindication is identified, the examinee will not be allowed to work. So, for example, a driver of a passenger vehicle (category D1) with severe stuttering (or other speech defects) is allowed to work individually.