Additional reporting documents

Documentation of settlements with accountable persons is not always limited to only an application, cash documents and an advance report with attached supporting documents.

Additional accountable securities include:

- a memo (if the employee went on a business trip by car), a report (when making entertainment expenses), other necessary explanatory documents;

- an order to withhold accountable amounts - it is needed if the accountable person has not submitted an advance report and has not returned the money (Article 137 of the Labor Code of the Russian Federation);

- notification (message) and order to forgive an accountable debt - are issued if the employer decides not to collect the specified amounts from the employee (clause 2 of article 145 of the Civil Code of the Russian Federation, clause 6 of article 226 of the Tax Code of the Russian Federation).

Reimbursement of business trip expenses

Situations also often arise when an employee goes on a business trip without issuing accountable amounts, and upon returning receives reimbursement for his expenses. In this case, we adhere to the same strategy, that is, we do not consider such an employee an accountable person, and he should report not according to the advance report, but according to the report on spent funds indicated in the previous part of the article. Thus, paragraph 26 of the regulations on business trips, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749, refers to the advance report as a document confirming the use of money issued in advance before the trip. By the way, do not forget to include the daily allowance for each day of the business trip in the report. Reimbursement of daily allowances is guaranteed by Art. 168 Labor Code of the Russian Federation. An application for reimbursement of expenses is attached to the report on the funds spent, and then an order from the manager for reimbursement is issued.

Find out how to reimburse an employee for expenses in foreign currency on a business trip abroad by getting a free trial access to ConsultantPlus.

Currently, all unified forms are not mandatory (clause 4 of article 9 of law dated December 6, 2011 No. 402-FZ). To draw up a report form on the funds spent, you can modify the advance report form AO-1.

You can download the report form on our website - see. .

Tax risks of documentary reporting errors

If there are errors in the documents of accountable persons or supporting documents are not attached to the advance report, various types of risks may arise, including tax ones:

| Type of violation in reporting documents | Emerging risks |

| Documents confirming expenses are not attached to the advance report |

In “profitable” expenses, it is permissible to take into account accountable expenses if the supporting documents are drawn up in accordance with the legislation of the Russian Federation, and from them it is possible to establish what expenses were incurred (clause 1 of Article 252 of the Tax Code of the Russian Federation, letters of the Ministry of Finance dated January 28, 2020 No. 03-03- 06/3/4915, dated 01/28/2020 No. 03-03-06/1/4913, dated 03/21/2019 No. 03-03-06/1/19017, dated 03/20/2019 No. 03-03-06/1/18478 )

In the absence of documentary evidence of expenses, employees may receive income in kind (Article 211 of the Tax Code of the Russian Federation). Such amounts are not exempt from personal income tax (Letter of the Ministry of Finance dated May 14, 2018 No. 03-03-06/1/31933) |

| Accountable funds were issued without filing applications. Material assets purchased with money issued on account are not related to the company’s activities and are not registered | Fine 40,000 rubles. (Part 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation) for violation of Art. 2 and 5 of the Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment...” (Resolution of the Ninth Arbitration Court of Appeal dated October 3, 2017 No. A40-62347/2017) |

| Payment of part of wages under the guise of travel expenses | Additional accrual of insurance premiums on amounts paid (Resolution of the Fifteenth Arbitration Court of Appeal dated December 14, 2017 No. A32-36856/2016) |

| The advance report was not submitted on time, accountable funds were not withheld from the salary of the accountable person | Funds issued for reporting, for which the employee did not report within the established time frame, are recognized as his debt to the employer and are subject to deduction from wages (Article 137 of the Labor Code of the Russian Federation). If deduction is not made, insurance premiums must be charged for the amount of the unreturned report, as for payments in within the framework of labor relations (Articles 420, 421 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated 01.02.2018 No. 03-04-06/5808, Letter of the Ministry of Labor dated 12.12.2014 N 17-3 / B-609) |

In addition to tax risks, other negative consequences are possible. For example, if inventory items purchased with accountable money without supporting documents are not capitalized, a claim may be brought against the accountable person for causing damage to the company (Resolution of the Administrative District of the North Caucasus District dated October 5, 2017 No. A32-12049/2015).

Is it possible to issue a report to an employee’s card?

The legislation of the Russian Federation does not have a separate regulatory document establishing the procedure for issuing accountable funds to an employee’s card.

The Bank of Russia directive “On the procedure for conducting cash transactions for legal entities and individual entrepreneurs” dated March 11, 2014 No. 3210-U, known to accountants, regulates the issuance of sub-reports only in cash. But based on the regulation of the Central Bank of the Russian Federation “On the issue of payment cards” dated December 24, 2004 No. 266-P, we can conclude: organizations and individual entrepreneurs have the right to pay their expenses through a card issued to an individual authorized by them (clauses 1.5, 2.5). This position is confirmed by official explanations of the Ministry of Finance of the Russian Federation:

- letter dated July 21, 2017 No. 09-01-07/46781;

- letter dated August 25, 2014 No. 03-11-11/42288;

- letter dated October 5, 2012 No. 14-03-03/728.

Central Bank Regulation No. 266-P dated December 24, 2004 also provides a list of expenses that organizations and individual entrepreneurs are allowed to pay through the card of an authorized individual (see clause 2.5):

- payment of expenses related to the activities of the organization (IP) on the territory of the Russian Federation;

- payment of travel and entertainment expenses on the territory of the Russian Federation and abroad;

- carrying out other operations not prohibited by the legislation of the Russian Federation.

How to use cash register systems when making payments through accountable persons? Find out the expert opinion at ConsultantPlus by getting trial access for free.

See also “Errors made in accounting for settlements with accountable persons.”

Ways to reduce risks

Several actions will help reduce the risks of errors in documenting reports to the employer:

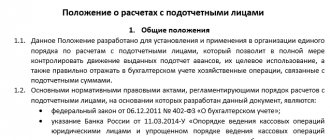

- Detail the procedure for preparing sub-reports in local acts.

Include a condition on the possibility of issuing money on account and returning unused accountable amounts, both in cash and in non-cash forms, into internal local acts (accounting policies, Regulations on the issuance of accountable amounts or other internal documents).

Also provide that with non-cash payments, accountable amounts are transferred to the personal or salary cards of employees from the employer’s current account.

Don’t forget to specify the deadline for submitting an advance report on the sub-account transferred to the employee’s card - such a deadline is legally established only when issuing a cash sub-account. This is necessary to stop abuse by employees.

Familiarize employees with their signature with the company's established accountability rules.

- Issue an order regarding accountable persons.

In the order, record:

- a list of employees entitled to receive money on account;

- the maximum amount allowed for issuance;

- deadlines for which accountable funds are issued.

Typically, such an order is issued at the beginning of the year for 12 months or a longer period. If necessary, changes and additions are made to it.

- Control the purpose of payment in payment slips for the transfer of accountable funds.

To ensure that controllers do not confuse the account listed on an employee’s card with salary income, and that such a transfer does not arouse suspicion among bankers, when issuing payment orders, it is important to ensure the proper wording of the purpose of the payment (field 24):

Systematic work with employees will help reduce risks - give them reminders about the deadlines for reporting on accountable amounts and lists of documents attached to expense reports for different situations, develop templates for applications for the issuance of money, and conduct training for employees on accountable rules.

Postings for transferring funds to the employee’s card in the report

The issuance of accountable funds to the employee’s card in accounting is recorded by the following posting:

Dt 71 Kt 51 (52).

When returning unused accountable funds in cash through the cash register, the following entry is made:

Dt 50 Kt 71.

When transferring an unused sub-report by non-cash method - from an employee’s card to the company’s bank account - the following entry is made:

Dt 51 (52) Kt 71.

Find out about the nuances of accounting for settlements with accountable persons in ConsultantPlus. If you don't already have access to the system, get a free trial online.

Accountable document flow and new Directive of the Central Bank of the Russian Federation No. 5348-U

From the end of March 2021, when issuing accountable money, companies must be guided by the new rules for cash payments (Instruction of the Central Bank of the Russian Federation dated December 9, 2019 No. 5348-U “On the rules for cash payments”). They did not radically change the previous norms from Directive No. 3073-U dated October 7, 2013, but partially corrected them.

The new instruction prescribes cash payments between companies, individual entrepreneurs and individuals using cash received at the cash desk of a participant in cash payments from his bank account (Central Bank Letter No. 45-19/5013 dated 06/04/2020).

It turns out that it is possible to issue cash on account from cash proceeds, but immediately issuing an unspent accountable advance returned by one employee to the cash desk to another accountable person will become a risky procedure that will attract the attention of controllers. The penalty for such a violation is for officials from 4,000 to 5,000 rubles, for companies from 40,000 to 50,000 rubles. (Part 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

In such a situation, you will have to first hand over the money to the bank, and then withdraw it and only then give it to the accountant.

Will this procedure affect the accountable document flow? Most likely no. There will be more work for cashiers and accountants to prepare cash receipts and expenses, but the set of documents for the accountant will not change.

Trouble from the bank

An analysis of judicial practice (in cases No. 33-17131/2016, No. 33-1316/2016, Determination dated 09/07/2016 No. 4g-10455/2016) shows that banks often block cards of individuals to which accountable amounts are received, without explanation . This is due to the classification of such a transfer as a dubious transaction. The transfer of funds to an individual who is not an entrepreneur, with the subsequent cashing out of such funds, especially on a regular basis, justifies the actions of banks in accordance with Law 115-FZ on legalization.

And only if documents are submitted that will remove the bank’s suspicion and confirm the economic meaning of the transfers, the blocking will be lifted. This takes time and, possibly, additional legal costs.

Transferring a report to a card is simpler and more modern, but you first need to assess possible risks: writing off proceeds to pay off an employee’s debts, blocking a bank employee’s account until the circumstances are identified. Therefore, for frequent and significant transfers, it is more advisable to take advantage of the bank’s offer to open a payment card for the organization’s account.

Let's sum it up

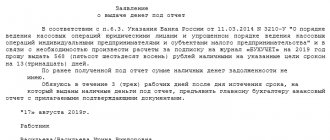

- Registration of accountable money begins with an application from the accountable person or an order (instruction) from the employer.

- Based on this document, cash is issued from the cash desk or current account after the execution of payment documents (payment order or payment order).

- To report for spent accountable funds, the employee must collect supporting documents and fill out an advance report.

- If documents on accountable amounts are drawn up with errors or an advance report is not submitted, and the advance issued against the report is not returned, tax risks arise.

Source

KA "Personnel Method" is a recruitment agency in Moscow for fast and effective search and selection of personnel in Moscow and Russia. Our recruitment agency will provide recruiting services for the personnel you need. We are looking for and selecting top personnel (top managers, directors, senior managers), middle management personnel, IT specialists, sales managers, line personnel, accountants, doctors, stylists, ... We offer for Moscow and the Moscow region - mass recruitment of personnel - the cost is discussed separately . We provide guarantees for the personnel selected by our agency. Information for employers on personnel search and selection services can be found on this page . On the “Promotions” page you can find out about our latest promotions and special offers on personnel recruitment for Customers (employers). On the job description catalog page, read what the job description should be and download the basic options. We will search for employees and search for workers for you in a short time. For your convenience, we have created a section “Recruitment by profession” in which we have posted detailed information on the main positions of popular applications from Search and Selection Customers, but linked to a specific job title, for example, secretary, sales manager, merchandise manager, remote sales manager sales, purchasing manager, top personnel, managers, etc., as well as the section “Search and selection (recruiting) of personnel by specialization.” We also have a personnel selection service at a fixed cost!

Payments using a corporate card

An enterprise can open one or more corporate cards. The card is issued to an accountable person based on an application in which the employee asks to issue a card for the purchase of materials, payment for work or services. For example, it is advisable to open such a card to the head of a garage, who independently purchases spare parts and pays for periodic repairs of vehicles.

It is better to establish the procedure for using cards in an order, which also states the frequency of the employee’s report for the money spent.

Money is credited to the card based on the approved application of the employee or the order of the head of the organization.

In accounting, funds are accounted for only at the time of withdrawal of money from the card or payment for goods (services). You can track payment or cash withdrawal transactions using a bank statement.

Since the card is a means of payment, it can be taken into account as part of monetary documents in account 50-3:

Debit 71 Credit 50-3 - a corporate card was issued for reporting to an employee.

When an employee is fired, job responsibilities are changed, or in cases where the need to use the card disappears, you need to make the following entry:

Debit 50-3 Credit 71 - the card was returned by the employee to the company’s cash desk.

Card transactions are accounted for on account 55, sub-account “Special card account”:

Debit 71 Credit 55 - money was written off from the card to pay for services (goods) by the accountable person;

Debit 10 Credit 71 - on the basis of the advance report, materials purchased by the accountable person were capitalized.

Error No. 3 You took into account expenses before you paid off the debt to the accountant

For whom is it relevant? For simplified taxation system payers with an object, income minus expenses. Quite often there is a situation where an employee received money on account, but there was not enough to pay for the purchase. So he added his own. Accordingly, according to the advance report, there was an overexpenditure.

What is the problem.

Do not take into account the entire purchase amount in tax costs under the simplified system until you have paid the accountant. Let's explain why. Only paid expenses are reflected in the tax base under the simplified tax system. And they will be paid when the company has no debt (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). If you overspend, you have a debt to the employee. Therefore, it is incorrect to take into account expenses until it is repaid.

What to do.

Expenses are considered paid when you issue the overage amount to the employee. This is also confirmed by the Russian Ministry of Finance in letter dated January 17, 2012 No. 03-11-11/4. Therefore, if you have settled with the accountant, fulfilled other conditions and have supporting documents, you can write off the entire amount of expenses.

Example 1. Accounting for expenses paid by an accountable person with personal money

O.I. Grishin, who works at Polet LLC, received 2,000 rubles as a report on June 5. to buy a printer cartridge. On June 8, an employee purchased a cartridge for 2,500 rubles. (without VAT) and brought an advance report to the accounting department of Polet LLC. He attached a sales receipt and a cash register receipt for the purchase of a cartridge to the report. On June 9, the director of Polet LLC approved the report, the company capitalized the cartridge and immediately put it into operation, installing it on the printer. And on June 10, the accountant-cashier issued O.I. Grishin, the amount of overexpenditure according to the advance report is 500 rubles. (2500 rub. – 2000 rub.). When can the cost of a cartridge be included in expenses?

LLC Polet has the right to reflect the cost of a cartridge for a printer in material costs immediately after the property is capitalized and payment is made (subclause 5, clause 1, article 346.16 and subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). The cartridge was capitalized on June 9, and paid in full on June 10 - after the debt to the employee was repaid. According to the condition, the employee attached a sales receipt and a cash register receipt to the report. These documents are sufficient to record expenses. Therefore, on June 10, Polet LLC will enter in column 5 of the Accounting Book the cost of the cartridge - 2,500 rubles. The accounting entries will be as follows:

DEBIT 71 CREDIT 50

— 2000 rub. - money was issued against the report of O.I. Grishin;

DEBIT 10 CREDIT 71

— 2500 rub. — the cartridge purchased by the accountant has been capitalized;

DEBIT 20 CREDIT 10

Error No. 2 Expenses of the accountable person were paid with someone else’s bank card

For whom is it relevant? For all the “simplified people”. Everything seemed to be in order, the employee drew up a report, attached documents for purchase and payment. But upon closer examination, you noticed that the cash register check contains the bank card details of not the accountant himself, but someone else, for example his relative. Indeed, in this case, the cash register receipt indicates the full name of the person who owns the card.

On a note

If the reporting employee paid for expenses with someone else’s card, ask him to write an explanatory note stating that he returned the money to the card owner for the purchase.

What is the problem.

It will be risky to leave everything as is and accept the report only with the documents attached by the accountant. Suddenly, during an inspection, you will come across particularly attentive inspectors who will consider that the expenses paid by someone unknown have nothing to do with your company. Therefore, they should be excluded from the tax base. And include this amount in the employee’s income subject to personal income tax, and also charge insurance premiums from it.

What to do.

Ask the employee to write an explanatory note. And indicate that the purchase was made by a relative or friend on his behalf. Additionally, let the accountant attach a receipt from the person whose card he paid with. In the receipt, the friend or relative will confirm that he received his money from the accountable person and has no claims. In this case, you will have evidence that the expenses were actually paid from the funds of your company issued on account. Similar recommendations are given, in particular, by the financial and tax departments (letters from the Ministry of Finance of Russia dated October 11, 2012 No. 03-03-07/46 and the Federal Tax Service of Russia dated June 22, 2011 No. ED-4-3/9876). We have provided samples of documents that will need to be completed below.