Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Example of accounting policy for an organization with a simplified tax system”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

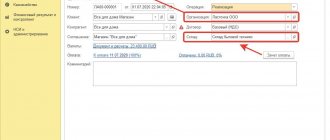

Sample order for approval of accounting policies: simplified tax system

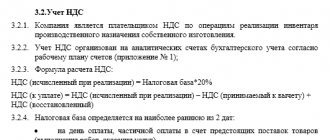

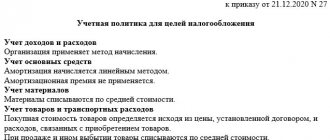

If an organization or individual applies a simplified taxation system, then its accounting policy for 2018 must also be approved by order. Accordingly, if an organization applies the simplified tax system with the object of taxation “income”, then the accounting policy needs to describe the elements associated specifically with “income”. Here is a sample order approving the accounting policy for tax purposes of an LLC with the object “income”. In this order, the accounting policy for 2021 is issued as an annex to the order. .

If an organization applies the simplified taxation system with the object “income minus expenses,” then by order it is necessary to approve the accounting policy for 2021 in relation to this taxation regime. As an example, you can take an order to approve a policy with the “income” object.

How to properly approve

The accounting policy is approved by the head of the enterprise or another person vested with appropriate authority. Usually, a separate order or corresponding order or resolution is issued for this purpose.

It is permissible to approve both documents with one order, for example, in December. That is, combine the UE for BU and UE for NU in one administrative document. Prepare the text of the accounting policy itself as an appendix to the order. Additionally, complete with attachments forms, blanks and other registers that will be used in the business life of the company.

Please note that there is no special form for the order or instruction for approval of the UP. Officials have not approved a uniform form for this situation. Therefore, make an order in any form. In it, indicate all the necessary details for paper of this category. Be sure to write down:

- Number and date of compilation.

- Legislative standards on the basis of which the decision was made.

- The essence of the order.

- The start date of the order, from which moment the provisions come into force.

- Responsible for compilation (chief accountant, for example).

- Determine the person responsible for monitoring the execution of the order.

Comments on the document “Example of accounting policy for an organization with a simplified tax system”

Reply 0

| 5 Lyubasha | 04/29/2014 at 10:57:17 Thank you! Just in time! |

Reply 0

| 5 Olga | 03/02/2015 at 12:15:54 Thank you very much! They helped a lot! |

Reply 0

| 5 Irina | 11/20/2015 at 12:10:21 Thanks a lot! They helped a lot, because there is not enough time for everything, but here is such help! THANK YOU!! |

Reply 0

| 5 Olga Kalugina | 01/25/2016 at 14:08:55 Helped a lot, thank you |

Reply 0

| Valya | 02/16/2016 at 21:22:04 Thank you very much it helped a lot! |

Reply 0

| Sun))) | 03/24/2016 at 09:48:31 Thank you. In any case, you need to make your own adjustments))) |

Reply 0

| 4 Kate | 04/22/2016 at 07:19:05 Thank you! sample helped! |

Reply 0

| 5 Tatiana | 05/21/2016 at 13:22:34 Thanks a lot!!!!!! |

Reply 0

| Maria | 05/30/2016 at 15:11:06 Thanks for the help!! |

Reply 0

| Tatiana | 09.19.2016 at 11:23:38 Thank you! Very good UP! |

Reply 0

| Larisa Evgenievna | 08.11.2016 at 12:46:40 thank you, you helped a lot. |

Reply 0

| 5 Ksenia | 02/09/2018 at 09:35:42 Great! Helped a lot |

The concept of irrelevant information has appeared

PBU 1/2008 introduced a new concept - non-essential information. This is information the presence, absence or method of presentation of which does not affect the economic decisions of users of these reports. Each company must independently decide what information is immaterial, based on its size and nature (new clause 7.4 of PBU 1/2008).

When generating such information, the accountant is allowed to choose accounting methods, guided only by the requirement of rationality, that is, without the use of standards.

If simplified accounting is used

Separate rules are provided for organizations that have the right to use simplified accounting methods and submit simplified reporting (clause 7.2 of PBU 1/2008). In particular, these include non-profit organizations, participants in the Skolkovo project, as well as small businesses, regardless of the tax system they choose.

Such companies, like all others, are required to apply accounting methods established by the Federal Accounting Service, and if there are several methods, choose one of them. However, if the FSB does not have a single method, those who conduct simplified accounting are allowed to formulate accounting policies based only on the requirement of rationality. In other words, someone who uses simplified accounting may not be able to consistently apply IFRS, related standards and accounting guidance.

When can you deviate from the FSBU?

PBU 1/2008 added special rules on what organizations should do if the application of the general procedure does not allow them to reliably reflect all of the company’s financial activities. Clause 7.3 of PBU 1/2008 clarifies that the standards apply only in exceptional cases. A company that finds itself in such a situation has the right to deviate from the standards. However, the following conditions must be met:

- the reasons that prevent the reflection of objective information in accounting and reporting have been identified;

- there is an alternative option that will solve the problem;

- this option excludes the emergence of new circumstances that will lead to distortion of reporting;

- the economic entity has properly disclosed that it has deviated from the rules and is using an alternative method of accounting.

The new clause 20.2 of PBU 1/2008 contains requirements for the disclosure of information about deviations from the general rules. The company must indicate the name and brief description of the FAS from which it deviated, the reasons why its application distorts the financial picture, the content of the alternative method and an explanation of how it eliminates the unreliability of the presentation of information. Plus, she must present the value of each accounting indicator in such a form as if it did not deviate from the standards, and indicate the amount of adjustment for each indicator.

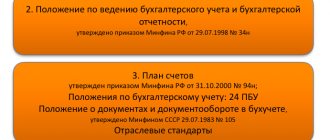

Accounting can be secured by standards

A number of PBU standards are brought into compliance with 402-FZ. Thus, in paragraph 8, examples of organizational and administrative documentation, which are used to formalize the accounting policies adopted by the organization, are supplemented with such type of documents as organization standards. Previously, only orders and instructions were mentioned.

We also remind you that the accounting policy must approve the form of the waybill. Which has changed in 2021. Read more about this in the article “Creating waybills in a new way: instructions for an accountant.”

If the changes to PBU 1/2008 have no impact on your work, check your accounting policies to see what acceptable accounting methods are available using our cheat sheet.

Lyudmila Fomina, certified auditor

There is no need to write an explanatory note

In the old edition of PBU 1/2008 there was a mention of an explanatory note. It was supposed to be submitted as part of the accounting reports and disclose in it the essential methods of accounting. In addition, the explanatory note should have announced changes in academic policy for the year following the reporting year.

The concept of “explanatory note” is not used in the updated PBU 1/2008.

Information about changes in accounting policies and significant methods of accounting still needs to be disclosed, but not in the explanatory note, but in the accounting reports. In which document and in what form this information will be disclosed, companies decide for themselves. For example, this may be the text part of the Explanations to the Balance Sheet and the Statement of Financial Results, where the provisions of the relevant paragraphs should be referenced in the listed accounting forms.

Use the accounting policy wizard for various industries and tax systems. Simply select your organization's options

To learn more

Retrospective reflection of changes in accounting policies has been clarified

Clause 15 of PBU 1/2008 determines that the consequences of changes in accounting policies are reflected in accounting, as a rule, retrospectively. The changes clarify that retrospective reflection consists of adjusting the opening balance not only under the item “Retained earnings (uncovered loss)”, but also (or) the balance under other balance sheet items that were affected by the changes. The adjustment is made to the earliest date presented in the accounting (financial) statements.

The changes are due to the fact that retained earnings are not always used in the adjustment process.