Previously, simplified entrepreneurs could work without online cash registers, subject to certain conditions. CCPs were used only for non-cash payments using electronic means of payment. But an online cash register for individual entrepreneurs using the simplified tax system in 2021 becomes mandatory if a businessman has hired at least one employee.

Link to the cash register

There is Law No. 54-FZ of May 22, 2003 on the use of cash registers (hereinafter referred to as the Law on Cash Registers), which states that all those organizations and individual entrepreneurs that carry out various calculations must use cash registers in their activities.

Therefore, keep in mind: even when working under a simplified tax system, there are no advantages in cash matters. Although many people mistakenly think so. Moreover, the obligation to use cash registers does not depend on what form of taxation or legal organization of business has been chosen.

Merchants and firms under the simplified, general regime are required to process cash and non-cash payments using cash receipts. Please note here: if, when registering as an individual entrepreneur for an online store, the OKVED code “Retail trade by orders” was specified, this rule also works.

However, there are exceptions, which will be discussed below.

Is acquiring required?

By law, all commercial structures that sell goods or provide services must provide customers with the opportunity to choose a method of payment for services. This applies to all businessmen, including simplifiers. However, at a certain annual turnover, this requirement is removed. It also does not apply to individual entrepreneurs who install autonomous cash registers to operate away from communication lines.

But for businessmen it is more profitable to use acquiring services, providing clients with the opportunity to pay in cash or by card. This helps to increase customer loyalty, increase the average check, and speed up the service process.

Who can work without a cash register?

Relatively recently, the Law on CCP received changes that practically did not affect legal entities and individual entrepreneurs under the simplified regime. They are more dedicated to credit institutions, as well as to those who have acquired a patent.

In cases where it does not make sense to purchase, install and maintain a cash register for objective economic reasons, you can avoid such a fate: according to paragraph 2 of Article 2 of the Cash Register Law, it is possible to perform certain works and provide certain services to the population without cash register equipment. However, for these moments the use of strict reporting documents is provided.

Decree of the Government of the Russian Federation dated May 6, 2008 No. 359 provides a list of documents that replace punching and issuing a cash receipt. The same regulatory document describes exactly how to handle these forms. In addition, it is possible to develop BSO based on your own samples. However, they should be focused on the general requirements for their mandatory details established by law. So, they must have the following columns:

- company name or full name merchant;

- document number and date;

- content of work/service;

- FULL NAME. the person who signed the form;

- transaction amount;

- settlement date.

At the same time, it is necessary to work with a cash register if an organization using the simplified tax system or individual entrepreneur is engaged in wholesale and/or retail trade.

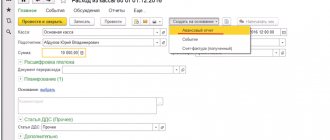

Installing a cash register

After installing a new cash register or upgrading an old one, you need to select a FD operator and enter into a service agreement with him. A list of such companies is presented on the Federal Tax Service website. The functions of operators are to receive data about all operations performed on the cash register, their transmission, and storage. To conclude an agreement, a qualified electronic signature will be required. If necessary, it can be purchased from the same operator.

The installation proceeds as follows:

- An application for registering a cash register is generated in your personal account on the Federal Tax Service website.

- In the “My cash registers” tab, you indicate the address where the equipment will be located, the number of the device and drive, information about the FD operator, the model of the drive and the cash register itself, as well as the purpose of its use.

- The application must be signed and submitted.

- The results of the application consideration will be displayed in the corresponding section of the account.

Next, the necessary software is installed, data for fiscalization is entered: TIN, information about the OFD, the taxation system used by the individual entrepreneur, the serial number of the device and drive.

Important! If incorrect data is entered during the fiscalization process, the procedure will have to be repeated.

After completing fiscalization, you need to print the first check, which is considered a registration report. The document reflects the time and date of fiscalization, the number of the drive and the receipt.

The next stage is linking the cash register to the OFD and choosing a service tariff. This is done in your personal account on the operator’s resource. After generating the report, the information is entered into the account on the Federal Tax Service website, signed and sent. To complete the registration procedure, all that remains is to check the CCP registration card. The last step will be to verify the transfer of the check on the OFD website.

When cash register is not required

As already mentioned, there is such an area as the provision of services. And those who are involved in it, on the simplified tax system, can do without cash registers not only until 07/01/2018, but also after this date in the specific cases indicated below:

- 1. Retail trade at exhibitions, fairs and markets.

However, you need to understand that this paragraph does not include those cases when there is a retail space that has everything necessary for the presentation and storage of goods. Simply put, when trading from a table/counter, a cash register is not required until 07/01/2018, but through a kiosk it is necessary. At the same time, when selling draft drinks and ice cream at kiosks, you do not need to have a cash register.

- 2. Trade in vegetables, live fish.

- 3. Sale of drinks from tanks.

- 4. Reception of scrap or glassware.

- 5. Small retail trade from hands.

- 6. Sale of objects of worship or religious literature.

All types of activities in which the use of CCP is permissible on a voluntary basis are listed in paragraph 2 of Art. 2 of the Law on CCP.

In addition, if a businessman or a simplified company wants to work without a cash register, then this is possible in remote and impassable areas. The list of such settlements is approved by the leadership of your region.

Is there a tax deduction on purchase?

Entrepreneurs are entitled to a tax deduction for purchasing an online cash register. Its amount is 18,000 rubles. You can apply for compensation for:

- purchase of a fiscal drive;

- purchase of cash register software;

- provision of services for setting up equipment and putting it into operation;

- modernization of the old cash register.

Receipt of payments is available via cash registers included in the register and registered with the Federal Tax Service in a certain period.

However, deductions are not provided for entrepreneurs on the simplified tax system. An exception is the case of combining this special regime with PSN or UTII. It will be possible to offset expenses only for equipment that is used for imputation or patent.

Responsibility for the simplified tax system for the absence of a cash register

In the event that a person applies the simplified tax system and ignores the rules discussed above, he may be fined under Part 2 of Art. 14.5 of the Code of Administrative Offenses of the Russian Federation from 30,000 rubles to the amount of the actual payment, bypassing the cash register. It is also worth noting here that a check for the use of cash register systems can be carried out without the presence of a manager or individual entrepreneur.

If the equipment does not comply with legal requirements or the registration procedure is violated, users are also fined. Articles 4 and 4.1 of the CCP Law specify all the necessary requirements. The most important of them are:

- the cash register model must be known to the relevant state register;

- if the cashier does not punch or gets rid of the receipt, this is equivalent to working without a cash register. And also, if the amount in the check does not match the purchase price or the receipt of revenue is not reflected in the cash book. All of this will most likely result in a fine;

- The cash register must have all the necessary stickers and seals. Namely: two seals on the case and two inside, as well as a corresponding hologram about inclusion in the state register. It confirms that the device is due for service for the current year and is fit for use. You also need a sign of the company that produced this device.

If a payment terminal accepts cash, then it must have a built-in cash mechanism with an online element. It also needs to be registered with the tax authority. Note that this requirement once caused a lot of controversy. Few payment devices included fiscal recorders of received funds.

Terms of use

Settlements with the population or organizations are carried out by the client transferring cash to the cashier or providing a bank card to write off the required amount. Using online cash registers has some features:

- A buyer who wishes to receive a check in electronic format must inform the seller about this before generating a fiscal document.

- The cashier enters information about the operation being performed into the cash register and generates a paper receipt.

- Purchase data is transferred to FN.

- The drive encrypts information for sending OFD.

- The operator receives the information, sends confirmation to the cash register equipment and once a day transfers the received information to the tax office.

A check with fiscalization has legal force. If the seller is legally obligated to return the money, but refuses to do so, the buyer has the right to appeal to the courts.

Important points

Before reporting the cash register to your tax office, check that all the rules discussed are followed. And above all:

- presence of stickers;

- serviceability of the device;

- availability of a package of documents.

After an application for registration of the cash register has been submitted, the owner receives back the documents for the device along with its registration card.

When operating cash registers, monitor the good condition of the unit, which is responsible for storing information about calculations, registering them and sending them online to the tax office. If it is more than 90% full, the device cannot be operated. The control tape needs to be changed urgently.

It should also be noted that it is impossible to use cash registers after the standard depreciation period has expired. In this case, the cash register is subject to deregistration.

Check: perhaps the device of your model has already been excluded from the state register because it is technically outdated, although its service life has not expired. If yes, but it is in good working order, the law allows you to use such a cash register for exactly 1 more year.

Some companies prefer to play it safe and additionally sign up for another device. In the event that cash register equipment fails, they will be able to continue serving customers and immediately begin using the backup unit.

Read also

15.08.2019

Adviсe

There are a lot of nuances regarding whether a cash register is needed for individual entrepreneurs using the simplified tax system and other systems. In practice, questions arise regarding the interpretation of the introduced changes. Whenever in doubt, write to the tax authorities. State your situation in detail: what you do, who your clients are, and ask “do I need a cash register.” The tax service is obliged to provide explanations that can be used as a guarantee if an audit comes and does not find your cash registers.

If you are one of the lucky deferred recipients, do not delay installing the cash register. Register, check, get used to it, teach employees how to use it - this should be done early, without waiting for 2021. After all, the requirements for the procedure for use, registration and re-registration are quite strict.

A cash register for individual entrepreneurs on the simplified tax system is required much more often than for entrepreneurs on a patent. Therefore, think: perhaps a patent will save you from cash hassles. If the tax burden on a patent is similar or lower than on a simplified one (taking into account the possibility of reducing the tax on insurance premiums), it would be more advisable to switch to PSN.

Clothing tailoring and repair shop

It can be difficult to understand for those who do not sell anything, but simply provide services. It is worth noting that this is one of the types of household work that is offered to ordinary people.

Anyone who falls into this category could do without cash registers until mid-2021. This year, old-style BSOs are no longer suitable and are not considered proof of purchase.

Now they should also buy and start using modern cash registers that can transmit data to tax authorities online.

Features of the transition to online cash register for individual entrepreneurs and organizations using the simplified tax system

Table No. 2. Features of the use of CCT in the simplified sleep system

| Transition period | From July 1, 2021 |

| Cost of a new cash register | from 10,000 – 35,000 rub. |

| Cost of fiscal data operator services (annual service) | from 3,000 rub. |

| Software cost | from 5,000 rub. |

| Validity period of the fiscal accumulator | 36 months |

| Possibility of obtaining a deduction for the costs of purchasing and installing an online cash register | No* |

Note: unlike imputation and patent entrepreneurs, simplified entrepreneurs are not given the right to receive a tax deduction for expenses on the purchase of an online cash register.

Currently, entrepreneurs have sent a proposal to the Government of the Russian Federation to include simplified workers among beneficiaries in order to receive a tax deduction. At the moment, there has been no response, as well as information about the adoption of a bill providing for this benefit, from the legislative bodies. Having briefly reviewed the procedure for switching to online cash registers in simplified terms, we will determine the most relevant types of online cash registers for this category of small business, their cost and features of their application.

Table No. 2. Main models of cash registers and their cost

| KKM model | Price | Peculiarities |

| SHTRIKH-M-01F | 40,000 rub. |

|

| Evotor Standard Plus FN | 39 000 |

|

| Mercury 185F | 23 000 |

|

| ATOL 90F | 23,000 rub. |

|

| KASBI-02K | 13,000 rub. |

|

Let's summarize the above:

- Entrepreneurs and companies using the simplified system must apply for online cash registers no later than July 1, 2021, and individual entrepreneurs and organizations providing services to the public no later than July 1, 2021;

- The validity period of the fiscal accumulator in the new cash register must be at least 36 months.

Table of application of cash registers depending on the taxation system

| Tax system | Kind of activity | KKM is required | BSO can be issued | You can issue a sales receipt or |

| BASIC | Trade and other | + | ||

| Providing services to the public | + | |||

| simplified tax system | Trade and other | + | ||

| Providing services to the public | + | |||

| Unified agricultural tax | Trade and other | + | ||

| Providing services to the public | + | |||

| UTII | Trade and other | + | ||

| Providing services to the public | + | |||

| PSN | Trade and other | + | ||

| Providing services to the public | + |