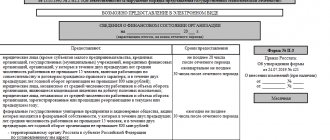

Rosstat is engaged in a statistical study of the economic state of the business segment, for which it maintains relevant statistics. Rosstat collects accounting reports so that after processing the annual financial reports of business entities, a generalized picture of the pace of development of the country’s economy, its individual industries and regions will emerge.

According to the current rules, every enterprise must prepare accounting reports after the end of the year (accounting law dated December 6, 2011 No. 402-FZ). If a company generates reporting throughout the year to summarize results by month or quarter, this reporting is interim and is intended, as a rule, for internal users. Only annual reports need to be submitted to Rosstat, as well as to the tax office. We will tell you further how to submit accounting reports to the statistical authorities for 2021, and what will change from 2019.

Taxnet.ru - online checking of reports

Taxnet specializes in everything “electronic”: signatures, tenders, document flow, including reporting. If you connect to the “Declaration.Online” service, you will be able to submit reports to the Pension Fund, Social Insurance Fund, Rosstat and the Federal Tax Service. The price of the issue depends on the timing and number of users. For example, an individual tariff for 12 months will cost 1,500 rubles per year. Full price list here.

You can work with “Declaration.Online” from any computer. All data is stored in the cloud. For those who do not want to upload their data to the Internet, there is a computer program called Taxnet-Referent.

The program automatically checks all reports. She checks the control ratios and, if a problem is detected, asks to correct them.

The developers even took care of those who did not buy a subscription to the service. On the website you can check any report for free in three simple steps:

- upload the report file in .xml or .txt format;

- we select the type of document flow, but in practice the system determines it itself;

- send for verification.

The verification takes place in just a minute.

Stage 1. Studying the counterparty

As a rule, when choosing a contractor, the company most likely understands what kind of supplier it is and whether it is worth taking the risk.

There are different categories of counterparties, different approaches to them and different amounts of evidence of their reliability.

There are small, harmless companies - suppliers - for water and stationery. It is unlikely that anyone will challenge the deal with them. There are strong state-owned companies - monopolists with an impeccable reputation. You shouldn't waste your time on them either. Their test of integrity is essentially formal.

There are also strong partners with whom you have been working for decades. It's worth being on the safe side here. You never know.

And, of course, special attention is required when choosing new persistent strangers - potential counterparties, “dark horses”.

First, it’s worth going over the characteristics of fly-by-night companies. Symptoms of “one-day events” are not news for a long time. About them in the order of the Federal Tax Service dated May 30, 2007 No. MM-3-6/333 and the letter of the Federal Tax Service dated July 10, 2021 No. ED-4-15/13247. The letter from the Federal Tax Service has lost force in terms of instructions for canceling tax returns, but the list of vicious signs is still relevant today.

Completely ordinary companies may fall under a number of suspicious criteria. It is important to carefully assess the data about the counterparty and, most importantly, your risks.

Even in a real transaction, the counterparty’s dishonesty may lead to a negative audit result. Therefore, we collect evidence that the counterparty is respectable, negotiable and can be trusted.

Information from official sources

I advise you not to request the documents necessary to verify the counterparty, but to obtain them yourself from official sources on the Internet.

What information do we obtain first?

- electronic extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs. The Federal Tax Service website has a lot of other useful services - about tax debt, about disqualified persons, about the mass of addresses, founders and managers. The older the company, the more likely it is to be conscientious;

- the presence of outstanding debts under writs of execution in the data bank of enforcement proceedings https://fssprus.ru/iss/ip/;

- legal disputes of the counterparty in the file of arbitration cases https://kad.arbitr.ru/;

- the relevance of the notarized power of attorney of the representative (in case the agreement is signed by an authorized person) on the website of the Federal Notary Chamber (https://reestr-dover.ru/;

- licenses - on the websites of the relevant licensing authorities (for example, Rosalkogolregulirovanie - https://www.fsrar.ru/licens/reestr);

- to check the Russian passport of the person signing the agreement - on the website of the State Administration for Migration Issues of the Ministry of Internal Affairs of Russia (https://services.guvm.mvd.rf/info-service.htm?sid=2000,

- the database of concluded government contracts - if there is a counterparty in it - this is a good sign.

Another useful site is the website of the Prosecutor General's Office. There you can study the inspection plan, obtain information about the actual location of companies, violations identified, inspections performed and other information.

I also like convenient verification services: Contour, Instant Verification Service, My Business, Taxcom-Dossier.

Requesting documents from a potential counterparty

In addition to information from open sources, request documents from the counterparty that you cannot obtain on your own:

- a copy of the charter to verify the manager's powers or limitations.

- order for the appointment of a director. Pay attention to the term of office of the director and the relevance of the information in the extract from the Unified State Register of Legal Entities

- power of attorney to represent the interests of the company (if the agreement is signed by proxy);

- copy of the director's passport,

- tax registration certificate, certificate from Rosstat.

- a decision to approve a major transaction or a letter stating that the transaction is not a major transaction;

- copies of licenses, an extract from the SRO register (if the type of activity falls under the relevant legal requirements);

- information about bank details. The higher the rating of the bank in which his account is, the calmer you will be. Banks also check their clients.

- accounting, tax, statistical reporting. Better in 2-3 years.

The scope of evidence of the exercise of care and caution is unlimited. Perhaps only the principle of reasonable sufficiency.)) Without fanaticism.))

The more documents you collect, the better your decision. And the lower your risk.

The composition of the evidence may depend on the type of transactions and the characteristics of the business. For example, when purchasing expensive real estate, it is advisable to track all previous transactions with it according to Rosreestr data.

Internet search

Check the business reputation of a potential counterparty on the Internet:

- Enter the name of the company and the full name of its director into a search engine and see in what context they are mentioned. Search for any information: mentions in the media, participation in tenders, legal proceedings... Print and save.

- Carefully study the counterparty's website. Make screen copies of Internet pages - home page, contact page, customer reviews, copies of licenses, price lists (fragments), answers and questions, advertising... Put the date.

Don't rely on being able to print at any time when checking. You may not be able to make it in time by the time of the check - the counterparty may disappear, not pay for hosting, the provider may sell his site.

A broken page, outdated information, lack of advertising are alarming signs.

If the counterparty does not have a website, this is a bad sign. In our time? Don't have a website? And there is no landing page? A business page on social networks maybe? Or advertising?

I foresee a reasonable question from the inspectors: how did you find it? From what public sources did you learn about it? Is it about you? Or are you talking about him? – Collect such data. How did you meet (physically)? Have you met or not?

If your information is personal and you don’t want to disclose it, consider the option of meeting someone at a specialized exhibition that does not require registration of participants. But this exhibition must actually take place (theme, city, date) - this data is verifiable. Your counterparty's answers to such questions should match your answers.

And importantly: record contact information for communicating with officials - their telephone numbers, email addresses. Save business correspondence.

And further. I advise you to record all received data and information on paper or additionally store it electronically. Date stamped. So as not to forget over time and not to lose. Characters change, many topics are forgotten - that’s why all documents should be here! and now!

And one more news! On November 9, 2021, the Federal Tax Service pleased us with another useful service for checking a counterparty. And even online! In the service via the link https://service.nalog.ru/regmon, enter your email address and submit a request to receive information about all registration actions of the counterparty you are interested in (by TIN). And notifications will be sent to the specified e-mail. And quite quickly - no later than the next business day. It is convenient to track all changes - change of address, director and others - for all your partners.

Taxpayer Online - checking reports to the Federal Tax Service and the Pension Fund of Russia

The Taxpayer Service helps organize the submission of electronic reporting. Through the service you can submit reports to the Federal Tax Service, Social Insurance Fund, Pension Fund and Rosstat. Price - from 3,000 rubles. The system will independently check that all forms are filled out correctly. In the program you can generate 2-NDFL and SZV-M for free.

You can also check reports with the Federal Tax Service and the Pension Fund for free. To do this you need to register on the site. You cannot check reports for the Social Insurance Fund and Rosstat for free. Legal advice from a trusted partner

Submit your application

BukhSoft - testing reporting to the Federal Tax Service, Pension Fund and Social Insurance Fund via

Through BukhSoft you can check a large list of reports:

- Pension Fund - RSV-1, RSV-2, RSV-3 and other documents;

- financial statements;

- all tax returns, except 3-NDFL and 4-NDFL;

- form 4-FSS;

- Rosalkogolregulirovanie - declaration for retailers of alcohol and beer.

The check is absolutely free. As an additional advantage, the developer emphasizes the powerful server on which the program is hosted - there will be no freezes during verification. To test you need to take 4 steps:

- register and log into your BukhSoft account;

- Click “Start” and select “Testing reporting”;

- click “Select file”, you can select one or more reports, after downloading, the message “Done” will appear next to each file;

- click “Check”. After testing, the “Download protocol” button will appear; it will contain all the information about compliance or non-compliance with control ratios.

A paid service, through which reports can not only be checked, but also submitted to the authorities, costs from 3,437 rubles per year.

How to check an organization’s earnings: step-by-step instructions

Currently, there are several ways to obtain information about a company's revenue indicator. You can obtain information directly from the company’s accounting department or find out the necessary data on the Internet. So, let's look at both methods in more detail.

In the Internet

In the age of technology, there are more and more opportunities to obtain information of interest regarding any counterparty in a short period of time.

Thus, today there are many information sites where financial statements of various business entities are published for wide use (For example, spark-interfax.ru, zachestnyibiznes.ru, unirate24.ru, etc.). Using Internet resources, you can quickly view the revenue of any company.

So, let's imagine the general algorithm of actions:

- First, you should go to the page of a pre-selected information portal.

by company name;- by TIN (of the enterprise itself, its manager, founder, individual entrepreneur);

- according to OGRN/OGRNIP;

- by full name of the director, founder, individual entrepreneur;

- by the address.

On different sites, the lists that you can search through may differ slightly. You will be redirected to a page where detailed information about the company will be presented, namely:

- "Common data";

- "Financial statements";

- "Court cases".

In order to see the company’s revenue, you need to go to the “Financial Statements” tab and find the “Profit and Loss Statement” by scrolling the mouse cursor just below the text. Information on revenue is contained in the section “Income and expenses from ordinary activities”.

OKNESU - free report check

You can check the reporting to the Pension Fund, Social Insurance Fund, tax office and Rosalkogolregulirovanie. The service is completely free. The full package costs from 6,000 rubles and includes not only checking the statements, but also submitting them with full accounting support.

Glavbukh.Audit - we check interdepartmental control relationships

It is not enough to check the report; it must correspond with all the data in other reports. For example, a statement of financial results for revenue and profit should not differ from the statistical report of a 1-enterprise.

You can check in Glavbukh.Audit:

- RSV;

- 4-FSS;

- 6-NDFL;

- tax returns - simplified tax system, profit, VAT and so on.

You can upload several different reports to the service. Then the program will check not only control ratios within the form, but also interdepartmental control relationships.

Full access to the program for submitting electronic reporting with the possibility of financial analysis, verification of counterparties, and so on costs 19,800 rubles per year.

GMC Rosstat

The information received from respondents is entered for further processing into the Main Interregional Center (GMC) of Rosstat.

The goal of this project was to process the obtained statistical indicators for all regions with the further provision of consolidated data to the State Authority.

The processing of financial statements is carried out by the State Medical Center in accordance with methodological classifiers and reference books, and the Main Administration of the Register (GAR) of Rosstat is also involved in the work.

The work of the last department (GAR) is related to the maintenance, development, and improvement of systems in order to achieve rapid response and a high level of safety.

Astral - free online check of reports to the Federal Tax Service, Pension Fund and Social Insurance Fund

Through Astral you can test all forms of reports to the tax office, the Pension Fund, Social Insurance and Rosalkogolregulirovanie for free. It is enough to download the report file in .xml or .txt format. After this, the system will issue a verification protocol.

The service has a full version with extended functionality. Price - from 1,500 rubles.

Frequency of financial reporting

All organizations are required to prepare annual financial statements. It includes indicators for the full calendar year of work - from January 1 to December 31. Such reports must be submitted to the Federal Tax Service only in electronic form before March 31 of the year following the reporting year.

For cases of creation, reorganization and liquidation of a legal entity, other rules are provided. Thus, organizations that are registered on October 1 or later can independently choose the period following which the first financial statements will be prepared and submitted:

- from the date of registration until December 31 of the year in which it was carried out;

- from the date of registration until December 31 of the year following the year of registration.

The deadline for submitting the report remains unchanged - until March 31.

Some organizations also prepare interim financial statements, cumulatively on a monthly or quarterly basis. This is mandatory only if it is specified in the law, constituent documents or decision of the owner of the organization. There is no need to submit interim reports to the tax office; it is enough to hand them over to the owners, founders or shareholders upon request.

CheckPFR and CheckXML - checking reports to the Pension Fund of Russia

The Pension Fund of the Russian Federation offers free downloads of programs for checking employee reports.

- CheckPFR is designed for testing RSV-1, SZV-M and various SZV and ADV.

- CheckXML additionally checks personal data, death certificates, voluntary insurance forms, an application for the exchange of an insurance certificate, and so on.

These programs are used by the Pension Fund itself, so its data can be trusted 100%. There is only one drawback - you cannot check reports for the Federal Tax Service, Social Insurance Fund or Rosstat.

Taxpayer legal entity - free reports and declarations

You can check your tax reporting for 0 rubles through the official “Legal Taxpayer” program. It allows you to create and test all tax reports and insurance premium calculations.

Unlike other programs, Taxpayer Legal Entity is very undemanding when it comes to computer characteristics. It will run even on computers from the 2000s.

Online reporting checking is a very convenient tool in an accountant’s arsenal. Loading a report into the program is much easier than looking for control ratios and checking them on a calculator.

However, most services only check control ratios within a specific report. But regulatory authorities compare several reports at once. For example, at the end of the year, Rosstat reconciles 1-enterprise, P-1 for 12 months and the balance sheet. Since some of the information in the reports often overlaps.

What are financial statements

Financial or accounting statements are reporting forms that contain information about the financial position of an economic entity, where it spends and where it receives money, whether its activities are profitable or unprofitable.

Financial statements are prepared based on the results of the reporting period as of the reporting date. The reporting period is a calendar year, and the reporting date is December 31. The basis for the preparation of financial statements is data from accounting or management accounting, as well as the Federal Law “On Accounting” and PBU 4/99.

Accountants of organizations must annually submit financial statements to the tax authorities. But well-prepared reporting also helps to effectively manage an organization.