Documents to confirm the zero VAT rate

To confirm the zero VAT rate when exporting goods, the following documents are required (clause 1 of Article 165 of the Tax Code of the Russian Federation):

- a contract (a copy thereof) with a foreign person for the supply of goods outside the Customs Union;

- customs declaration (its copy) with the corresponding marks of the customs authorities;

- copies of transport, shipping and (or) other documents with appropriate marks from customs authorities.

This list of documents is exhaustive.

For which transactions do you need to confirm the VAT exemption?

Before moving on to explanations for filling out the register, let's decide for which transactions you need to submit a document confirming the VAT exemption, and for which you do not.

To do this, let's get acquainted with the concept of tax benefits. Tax benefits are tax breaks for certain groups of taxpayers, including the opportunity not to pay taxes at all or to pay them in a smaller amount (Clause 1 of Article 56 of the Tax Code of the Russian Federation). In other words, VAT benefits include transactions that are not taxed for some taxpayers, but are taxable for others. And it is necessary to create a register of documents based on them.

But operations for which VAT exemption is available to all categories of taxpayers are not eligible. And there is no need to compile a register of supporting documents for VAT benefits (clause 14 of the Resolution of the Plenum of the Supreme Arbitration Court dated May 30, 2014 No. 33).

Our material “Art. 149 of the Tax Code of the Russian Federation (2018): questions and answers.”

And to obtain complete and up-to-date information on VAT benefits, we suggest taking a look at our special section.

Registers of customs declarations

Starting from the fourth quarter of 2015, instead of transport and shipping documents, exporters can submit their electronic registers to the tax inspectorates. The forms, formats and procedure for compiling such registers are approved by Order of the Federal Tax Service of Russia dated September 30, 2015 No. MMV-7-15/427 (hereinafter referred to as the Order) (Part 4 of Article 3 of Federal Law dated December 29, 2014 No. 452-FZ).

“Electronic” registers do not replace all documents that must be submitted to confirm the application of the zero VAT rate. In particular, a contract with a foreign company for the supply of goods must be submitted on paper (Clause 19, Article 165 of the Tax Code of the Russian Federation).

In addition, during a desk audit, the tax inspectorate has the right to request transportation documents, information from which is included in the registers. And also request the necessary documents if the information on export operations received from customs authorities does not correspond to the data contained in the “electronic” registers. Documents will need to be submitted within 20 calendar days after receiving the request. They must have Russian customs marks (clauses 15–18 of Article 165 of the Tax Code of the Russian Federation). If the exporter has not fulfilled the inspection requirement (in whole or in part), the justification for applying a 0 percent tax rate in the relevant part is considered unconfirmed.

At the moment, 14 registers have been approved, depending on the type of export transactions performed (clause 15 of article 165 of the Tax Code of the Russian Federation, clause 1 of the Order). Each register is “linked” to the corresponding subparagraph or paragraph of Article 165 of the Tax Code of the Russian Federation, as one of the documents confirming the right to apply the zero VAT rate.

The “electronic” register must contain information about the size of the tax base to which the zero VAT rate applies. The tax base is determined for each transaction, confirmed by documents, the details of which are reflected in the register.

Receipt of goods

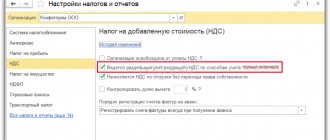

Let’s create the document “Receipts (acts, invoices)” with the operation “Goods (invoice)”.

An important feature is that in the “VAT Accounting Method” field the option “Blocked until 0% is confirmed” is available. It is used in the sale of export goods.

We will also indicate the commodity nomenclature code (HS). It determines whether a commodity is a commodity, which means that a commodity can be sold at a 0% rate.

Let's go through the document and look at the postings.

We also register an invoice and pay the goods to the supplier.

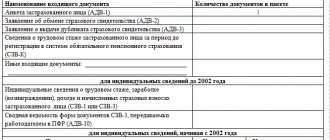

Register No. 5

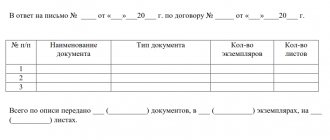

Registry form No. 5 is given in Appendix No. 5 to the Order. Here is the tabular part of the register:

| N p/p | Registration number of the customs declaration (full customs declaration) | Tax base for the corresponding transaction for the sale of goods (works, services), the validity of applying a tax rate of 0 percent for which is documented (in rubles and kopecks) | Code of the type of vehicle by which goods were imported into the territory of the Russian Federation or exported from the territory of the Russian Federation | Transport, shipping and (or) other document confirming the export of goods outside the Russian Federation or the import of goods into the territory of the Russian Federation | Note | ||

| Document type | Number | date | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

Section VI of Appendix No. 15 to the Order is devoted to filling out register No. 5. The following information is indicated in register columns No. 5:

- in column 1 - the serial number of the corresponding operation for the sale of goods (works, services);

- in column 2 - registration number of the customs declaration (full customs declaration) for the corresponding operation for the sale of goods (work, services);

- in column 3 - the tax base for the sale of goods (work, services), the validity of applying a tax rate of 0 percent for VAT for which is documented;

- in column 4 - codes of types of vehicles by which goods were imported into the territory of the Russian Federation or exported from the territory of the Russian Federation;

- in column 5 - types of transport, shipping or other documents (CMR, bill of lading, railway waybill, air waybill, TIR Carnet, shipping order, sea waybill, other document) confirming the export of goods outside the Russian Federation or the import of goods into the territory of the Russian Federation for the corresponding sale goods (works, services);

- in column 6 - the numbers of the documents indicated in column 5. If the number is missing, “b/n” is indicated;

- in column 7 - the dates of the documents indicated in column 5;

- in column 8 - other information related to the transaction, the details of the documents for which are reflected in register line No. 5. This is the type, number and date of the document submitted simultaneously with the VAT return, with the exception of the documents specified in columns 2, 5 - 7 For example, agreement (contract) No. 5-VAM-1991 dated May 21, 2015. If several documents are indicated, column 8 reflects the type, number and date of each document, separated by the sign “;”.

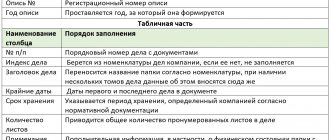

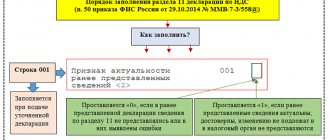

Title page

In the field “Submitted to the tax authority”

The name of the tax authority to which the register is submitted is reflected. By default, the field is automatically filled in with the tax authority that was specified when the client registered in the system.

In the field “Report for VAT”

the details (date, adjustment number, file name, Federal Tax Service code) of the VAT declaration to which this register is attached are indicated.

In the "Reporting period"

the period specified in the VAT tax return with which the register of information is submitted is selected.

When filling out the “Adjustment number”

“0” is automatically entered in the primary register; in the updated register for the corresponding period, it is necessary to indicate the adjustment number (for example, “1”, “2”, etc.).

In the "Taxpayer"

indicate: name of the taxpayer - organization (separate division of a foreign organization), individual entrepreneur, as well as tax identification number and checkpoint. If the client is registered in the system, this data is filled in automatically.

Attention! Fields “Form of reorganization (liquidation) (code)”

and

“TIN/KPP of a reorganized organization”

are filled out only by those organizations that are reorganized or liquidated during the tax period.

If the register of information is submitted by the taxpayer, then “1” is indicated in the corresponding field; if by a representative of the taxpayer, then “2”. In this case, the name of the representative and the document confirming his authority are indicated.

Also, the date of its compilation is automatically indicated on the title page of the register.

How to fill out column 4

Column 4 of register No. 5 indicates the codes of the types of vehicles with which goods were exported from the territory of the Russian Federation, by type of transport in accordance with Appendix No. 3 of the Decision of the Customs Union Commission dated September 20, 2010 No. 378.

In addition, in the declaration for goods in the first subsection of column 25 “Mode of transport at the border” the code of the type of vehicle is indicated in accordance with the classifier of types of transport and transportation of goods (subclause 25, clause 15 of section II of the Instructions for filling out customs declarations and customs declaration forms , approved by the Decision of the Customs Union Commission dated May 20, 2010 No. 257). That is, when filling out column 4, you can use the information from column 25 of the goods declaration “Mode of transport at the border”.

How to fill out columns 6 and 7

Column 6 of Register No. 5 indicates the numbers of transport, shipping or other documents confirming the export of goods outside the Russian Federation for the corresponding sale of goods (work, services). Column 7 indicates the dates of these documents. Regardless of the type of transport, if there is no number on the document, “b/n” is indicated in the register.

International waybill

With regard to filling out columns 6 and 7 of the international consignment note (hereinafter referred to as CMR), the Federal Tax Service of Russia notes the following.

The consignment note must contain the place and date of its preparation (Article 6 of the Convention on the Contract for the International Carriage of Goods by Road (CMR), concluded in Geneva on May 19, 1956, hereinafter referred to as the Convention). However, the Convention does not provide for a universal form of CMR. The CMR number can be indicated in the upper right corner, and the date of its completion (registration) and the name of the locality where the CMR was compiled can be indicated in column 21 “Compiled on/date”.

Railway consignment note

In the column “Consignment note No.” the shipment number assigned by the carrier is indicated (clause 3.3 of the Rules for filling out transportation documents for the transportation of goods by rail, approved by order of the Ministry of Railways of Russia dated June 18, 2003 No. 39 (hereinafter referred to as the Rules). In the column “Calendar stamps, documentation acceptance of cargo for transportation" on the reverse side of the original waybill and waybill, as well as on the front side of the spine of the waybill and receipt of cargo acceptance, a calendar stamp "Documentary registration of acceptance of cargo for transportation" is affixed, which indicates the date of documentary registration of acceptance of cargo for transportation (p 3.10 of the Rules) The consignment note must also contain the shipment number and the date of conclusion of the contract of carriage (Article 15 of the Agreement on International Rail Freight Transport of November 1, 1951).

In this regard, the register should indicate the shipment number and either the date of documentary registration of acceptance of the cargo for transportation, or the date of conclusion of the contract of carriage.

Shipping order and bill of lading

In column 7, when exporting goods by sea, river, mixed (river-sea) transport, the date of the transport, shipping or other document (bill of lading, sea waybill or any other document) confirming the fact of acceptance of the goods for transportation and the order for shipment is indicated.

The bill of lading must include the time and place of issue of the bill of lading, as well as the date of acceptance of the cargo by the carrier at the port of loading (Article 144 of the Merchant Shipping Code of the Russian Federation dated April 30, 1999 No. 81-FZ). Appendix 8 to Order No. 182 of the Ministry of Transport of Russia dated July 09, 2014 provides a recommended sample of an order for the shipment of export cargo, which contains the columns “Date of loading” and “Date of issue of the order.” Therefore, if there is no date on the document confirming the fact of acceptance of the goods for transportation, or in the order for shipment, the date of acceptance of the goods for transportation is indicated in column 7 of register No. 5.