In the article we will look at how a desk audit of 3-NDFL is carried out, its timing, and also how to find out its result. A desk audit is carried out by the supervising tax specialist of the desk department at the location of the tax office based on the provided tax and primary documentation. This type of inspection is carried out on an ongoing basis by a department specially designed for this purpose.

A desk audit will be carried out if the personal income tax payer applies to the tax office:

- For receiving deductions of various nature (property, social);

- For a refund of overpaid tax due to incorrect use of deductions;

- When declaring income received in the past year.

Any appeal to the Federal Tax Service with 3-NDFL is a reason for conducting a desk audit.

When checking 3-NDFL, the clerk will need the declaration itself, as well as documentation justifying the application of the specified rate and deductions. If necessary, the necessary primary documentation is requested from the taxpayer. If the inspection specialist does not understand any points, he will ask the taxpayer for clarification in writing. If anything in the documentation being checked appears suspicious, the matter will be transferred to the department performing on-site inspections. Read in more detail about the verification of entrepreneurs in the article: → “How the desk verification of individual entrepreneurs is carried out on the simplified tax system, PSN, UTII and at closure.”

The desk audit procedure is carried out by tax specialists; the procedure for organizing it is determined by Article 88 of the Tax Code of the Russian Federation.

Deadlines for conducting a desk audit of 3-NDFL

Paragraph 2 of this article determines that a desk audit must be carried out no later than three months from the date of transfer of 3-NDFL to the tax office .

The starting point for the specified three months is the moment of submission of 3-NDFL. This declaration can be submitted by an individual in several ways:

- personal delivery to a tax specialist;

- electronic transmission;

- mailing.

Date of submission of 3-NDFL depending on the method of submission:

| Feeding method | The date of submission from which the period for the desk audit will begin |

| Personally | The actual day the documents are handed over to the tax specialist. |

| Electronically | The moment of sending the electronic form 3-NDFL to tax specialists. |

| By mail | The actual date of dispatch of the mail with attached documentation. |

Thus, the moment the desk audit begins is the date of transfer of 3-NDFL to the tax office; within 3 months from this date, the desk clerks must check the declaration.

If the taxpayer is required to provide an updated or adjusted 3-NDFL, then the three-month period will be recalculated from the date of submission of the last document or explanation.

What difficulties may arise in obtaining information?

Difficulties may arise due to errors in the operation of the site.

As a rule, users do not have any difficulties with tracking the declaration, since if they have a compiled 3-NDFL, the tracking page opens independently; to do this, just follow a few simple steps.

Problems may arise if maintenance work is being carried out on the server itself. Sometimes not all site features are available to the user. This is due to errors occurring on the server. In this case, you need to wait, the support service will quickly resolve all problems.

Progress of desk audit

The verification is carried out on the basis of the provided declaration and accompanying supporting documentation, and there is no connection with any events or grounds. No written notice is sent to the taxpayer about the start of a desk audit.

A written decision or other document is not required to begin a desk inspection; inspectors conduct it independently without any order from above.

If the inspector establishes any violations, a desk audit is carried out and primary documentation is requested from the payer. Within 5 days, the individual is asked to explain the identified inconsistencies, provide additional information, and make adjustments. The clerk can contact the taxpayer using the telephone number specified in 3-NDFL or send a written request for any additional information.

The procedure itself is partially automated - the received 3-NDFL form is checked by a specialized program, which, based on the testing, identifies arithmetic errors, contradictions in indicators and data inconsistencies. The machine cannot identify all possible errors in the declaration indicators; its capabilities have their limits, and therefore, after the machine check, cameramen get down to business.

Information about exactly how a desk audit is carried out is confidential. The tax office does not disclose any precise information about the methods and techniques used by cameramen during this procedure.

During the procedure, inspectors identify cases of understatement of the base for calculating tax by logically checking the specified digital indicators in the fields of the declaration. Information from the declaration is compared with other information obtained from previous reports and external sources.

Based on the fact of the desk audit, a list of payers is formed for whom an on-site audit will be carried out.

In the process of desk audit of 3-NDFL, the following stages can be distinguished: (click to expand)

- It is determined whether all documentation has been submitted by the payer;

- The deadline for filing the declaration is compared with the approved deadline;

- Visually inspect the filled fields and the degree of compliance of their design with the established rules;

- The correctness of accounting operations is checked;

- The correct application of the specified tax benefits in the form of deductions of various nature is determined;

- The correct application of rates is checked;

- The correct calculation of the base for personal income tax is monitored.

It is important to indicate a valid telephone number in the declaration so that the controlling inspector can contact the taxpayer as soon as possible to obtain additional information and notify him of identified violations and inaccuracies.

Errors when submitting reports

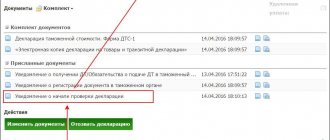

Disagreements between the tax inspectorate and taxpayers often arise during the reporting process. If declarations and calculations are filled out incorrectly, the reporting verification program automatically refuses to accept them, indicating errors.

What are these errors:

1. The reporting is signed by a representative with a power of attorney, but the tax inspectorate’s database does not contain either the power of attorney itself or data on the representative.

2. The reporting is signed by a representative under a power of attorney, but the information message about the power of attorney indicates a power of attorney without the right to sign.

3. The declaration is signed by the head of the organization. But his data in the declaration does not coincide with the information in the Unified State Register of Legal Entities.

4. The primary declaration is submitted with the attribute “corrective” or vice versa.

5. Reporting is submitted using outdated and ineffective forms.

Status of desk audit of 3-NDFL. How to check?

If the taxpayer wishes to personally control the desk audit procedure and monitor its current status, then the following actions can be taken:

- Check the telephone number of the department involved in desk audits of income declarations of individuals, and then monitor the status of the audit using periodic calls;

- Register your personal account on the tax service website.

These actions allow the taxpayer to monitor the actions of cameramen, clarify the necessary questions, deadlines for completing the audit, and its progress, which is especially important when receiving personal income tax deductions.

Who can take advantage of the property deduction

Not every person can take advantage of the tax benefit; in order to receive it, certain conditions must be met.

To whom can the property deduction be returned:

- Individuals who have official income and pay 13% income tax on it.

- Pensioners can also count on a property deduction.

The following categories of citizens cannot receive a tax refund:

- Individuals who have completed a purchase and sale transaction with a husband or wife, parents, brothers and sisters.

- Citizens who received real estate as a gift or inheritance.

- Taxpayers who filled out the declaration incorrectly or provided an incomplete package of documents.

Result of desk audit 3-NDFL

You can find out the result using the above methods. You can also send an official written request to the tax office. It is most convenient to view the result in your personal account; if incomprehensible situations arise, it is recommended to contact directly the office tax department located at the place of filing 3-NDFL, that is, at the place of residence of the individual.

Upon completion of the check, the following result can be established: (click to expand)

- Identification of an error - a request is sent to the taxpayer to provide the necessary documents or correct inaccuracies by submitting a corrective 3-NDFL (the deadline for the desk audit begins to count anew);

- No errors - a receipt is sent for payment of the personal income tax amount specified in the declaration, or a decision is made to reimburse the previously transferred excess tax, or a decision is drawn up to provide a deduction;

- Refusal to provide a deduction or tax refund.

If the result is a refusal, then the reasons for this should be clarified; as a rule, such decisions are made due to a lack of necessary supporting documentation. If the taxpayer does not agree with the conclusions of the tax specialist, he may file a written objection.

If the result of the desk audit is a decision to grant a deduction, then within one month from the end of the audit the funds are transferred to the taxpayer’s account specified in the application submitted along with 3-NDFL as part of the attached documentation. Violation of the specified period is the reason for a written demand for the accrual of interest for each day of delay due to the illegal use of other people's funds.

Also read the article about VAT refund from the budget based on the results of a desk audit.

Simple taxes

Not certainly in that way. If an overpayment amount appears, this only means that your declaration has been entered into the inspection database. That is, the operator entered it into your personal card. But the check is not finished yet; it may not even have begun. The tax office has 3 months from the date of submission of documents to verify the declaration.

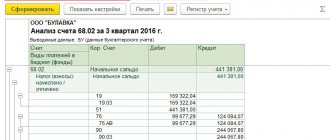

You will see the number assigned to your declaration, the date of submission, and the date of registration. We are interested in the “Progress of the desk audit.” When the status becomes COMPLETED, then from this completion date we count one month for transferring money. The date, as you can see in the picture, appears next to the status.

An example of obtaining a personal income tax deduction

Potapenko A.A. On April 18, 2016, I submitted 3-NDFL to the tax office at my place of residence to receive a property deduction when purchasing an apartment. He accompanied the declaration with a statement and documentation confirming the costs of purchasing housing. In what time frame can he expect the required deduction?

The deadline for conducting a desk audit in this situation is 3 months from the date of submission (until July 18, 2016). If the specialist of the office department does not identify any inaccuracies or errors, all the documentation is available, then after the end of the inspection period, Potapenko will receive the deduction amount within one month, the last date for receiving the money is 08/18/2016.

If Potapenko does not receive the money by August 18, then he should write a complaint, sending it to the head of the tax office.

Tax deduction through government services

Today, in order to submit a 3-NDFL format declaration to the Federal Tax Service, a citizen does not have to use or come to the district inspectorate in person. You just need to go to the government services portal and follow these steps:

Organization of tax deductions through government services

This is partly due to the export of goods and energy raw materials, but the main budget revenues come from taxpayers. Thus, every working citizen is required to pay income tax, the withholding of which is controlled by the state, the owner of a vehicle or property annually pays property tax, etc. All this money makes it possible to maintain the social development of the state at a decent level.

As with regular filing, the period for checking the 3-NDFL declaration for tax deduction online takes 3 months, including weekends and holidays. However, violation of this deadline does not entail any consequences for the Federal Tax Service and its employees, since the deadline established by Article 88 of the Tax Code of the Russian Federation is not preemptive, and its expiration is not regulated by the Tax Code of the Russian Federation, as stated in the letter of the Presidium of the Supreme Arbitration Court of Russia No. 71 dated March 17 2021. Thus, the payer will have to wait for his documents to be verified, even if the KNI goes beyond 3 months.

Previously, desk audits were distinguished by location: field audits were carried out on the territory of the payer, and desk audits were carried out on the territory of the tax authority. But with the introduction of amendments to Article 92 of the Tax Code of Russia, inspectors conducting a “camera room” received the right to go for an inspection.

Why is the amount of tax to be refunded from the budget 0?

The consequences of a desk audit are no less serious if violations of tax legislation are revealed - additional assessment of taxes, fees, contributions and penalties, imposition of fines, freezing of accounts, forced collection of debts, etc.

Individuals have the right to receive standard, social, property and investment deductions when calculating and paying personal income tax (clause 3 of Article 210 of the Tax Code of the Russian Federation). Some types of deductions can be provided by the employer, that is, when deducting personal income tax from the salary, the accountant will immediately take into account the deduction and reduce the tax base for it. He will do this if the employee submits the appropriate application and documents, that is, receiving a deduction at work is of a declarative nature. The main document for issuing a standard deduction is the employee’s application; in other cases, it is a notice of the right to deduction, which is issued by the Federal Tax Service after checking the supporting documents submitted by the taxpayer to the regulatory authority.

We recommend reading: Topics of Scientific Articles on Civil Law

Multiple rights to deduction

In current legislative acts one can often find the concepts of one-time and multiple-time deduction rights. It is often not easy for a person uninformed in matters of legislation and taxation to understand these concepts. We will try to explain everything in simple, accessible language.

Let's imagine that you bought an apartment worth 870,330 rubles. (amount less than 2 million). The transaction and ownership rights were completed before 01/01/14. By submitting the necessary documents, you will receive a tax refund of RUB 113,143. (RUB 870,330 * 13%). Next year (after 01/01/14) you bought half of the house at a price of 1,040,502 rubles. Since the first transaction was completed before 01/01/14, you cannot receive a deduction when purchasing part of the house. This rule applies in accordance with the one-time right to deduction. That is, despite the fact that after the first transaction there was a deduction balance of 1,129,670 rubles. (RUB 2,000,000 – RUB 870,330), you cannot receive a refund.

As for the right to multiple use of the deduction, it arises if the first transaction was completed before 01/01/14. For clarity, let's change the above example. Let's say you bought an apartment after 01/01/14 (cost 870,330 rubles). As in the first case, you received a refund of 113,143 rubles. But, unlike the first example, having bought half a house for 1,040,502 rubles, you can also apply for a deduction and receive a refund of 135,265 rubles. (RUB 1,040,502 * 13%). Thus, based on the results of two transactions, the amount of the used deduction will be 1,910,832 rubles. (870,330 rubles + 1,040,502 rubles) out of a possible 2 million rubles. This means that, having purchased any type of residential real estate for the third time, you have the right to apply for a deduction for the remaining amount of 89,198 rubles. (RUB 2,000,000 – RUB 1,910,832) and receive a refund of RUB 11,592. (RUB 89,198 * 13%).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Refund of personal income tax when purchasing a home

Buying real estate is an important and desirable step in the life of every family. But this event is always associated with significant financial expenses. In order to support families who decide to improve their living conditions and acquire their own housing, the state gives citizens the right to return part of the funds spent.

Persons who have purchased any type of residential real estate (apartment, room in a communal apartment, house or part of it, etc.) have the right to return the amount of personal income tax from the purchase price. In general, the refund is 13% of the housing price. If the property is recognized as expensive (price more than 2 million rubles), then the citizen can return no more than 260 thousand rubles.