In the process of conducting business activities, individuals and legal entities, in accordance with the Tax Code of the Russian Federation, are obligated to submit reports and pay taxes. In the course of checking the reliability of the information provided, the correctness of the calculation and transfer of the required amounts, Federal Tax Service employees may require certain documentation reflecting the data of interest to them. Failure to submit documents at the request of the tax office due to the fact that such an action may be regarded as an attempt to conceal information becomes the reason for prosecution and punishment established in accordance with the Tax Code and the Code of Administrative Offenses of the Russian Federation.

Taxpayer liability

Responsibility for failure to provide documents at the request of the tax authorities lies with individual entrepreneurs, companies, their managers and officials. Refusal to provide requested documents during inspections by Federal Tax Service employees is a tax offense (clause 4 of Article 93 of the Tax Code of the Russian Federation).

The fine for failure to provide documents at the request of the tax authorities for business entities will be determined on the basis of two articles of the Tax Code of the Russian Federation:

- Art. 126 (failure to provide documents and information to the Federal Tax Service);

- Art. 129.1 (illegal (untimely) failure to provide information to tax authorities).

Valid reasons for failure to submit documents on time

The addressee of the explanatory note (in whose name it is drawn up, for example, the general director) and the person to whom it should be transferred (for example, the secretary or the head of the personnel department) will most likely be different people. If the employee really had good reasons for behavior that the employer did not like, and in general they are adequate people, then you should not be afraid of the explanatory note - it will come to the defense of the “accused”. Then there is no need to wait for a written request from the employer. At his verbal request, it is better to immediately draw up an explanatory note, attaching to it as much evidence as possible that he is right. Not only official documents will do, even a printout from a news site about interruptions in the work of the metro line that a latecomer uses to get to work.

- Types of explanatory notes;

- Form of explanatory note;

- How to write an explanatory note;— To work;— About absence from the workplace;— About an error at work;— About failure to fulfill official duties;— To kindergarten;— To the class teacher;— To a child at school;— To school about absence from a parent-teacher meeting ;- To university;

- What the law prescribes;

- Archival storage periods for explanatory notes.

Amounts of fines under various articles of the Tax Code of the Russian Federation

Sanctions under paragraph 1 of Art. 126 are applied for failure to provide documents to the Federal Tax Service, including those requested by tax authorities during audits. The fine for late submission of documents to the tax office will be 200 rubles. for each unsubmitted document. Refusal to provide the tax authorities with a declaration of profit of a controlled foreign company and documents related to it (clause 5 of Article 25.15 of the Tax Code of the Russian Federation) will entail the collection of a fine in a fairly large amount - 100 thousand rubles.

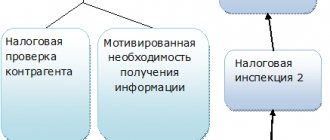

Fine under clause 2 of Art. 126 threatens organizations and individual entrepreneurs who refused to submit the information they have about another taxpayer at the request of the Federal Tax Service, or provided false information about him. This norm is applied during “counter” checks. The tax inspection fine for legal entities and individual entrepreneurs will be 10 thousand rubles, for individuals who are not individual entrepreneurs - 1000 rubles.

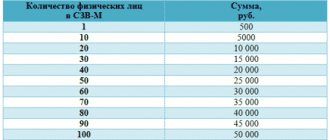

Punishment under Art. 129.1 applies to taxpayers who unlawfully failed to provide Federal Tax Service employees with the necessary information or failed to transmit the required information in a timely manner. In particular, the norm is applied for the lack of explanations in case of failure to submit on time the “clarification” requested as part of a desk audit (clause 3 of Article 88 of the Tax Code of the Russian Federation). Violators face fines in the amount of RUB 5,000. If such a violation is repeated within one calendar year, the fine will increase to 20 thousand rubles.

Explanatory note about late submission of documents

At its core, untimely provision of documents is a failure to fulfill direct job responsibilities, because a number of professions involve working with documentation. If any paper was not provided on time, this may cause a delay in other processes at work or simply negatively affect the result.

If an employee has made such a deficiency in his work, management has the right to demand from him an explanatory note, which should set out the reasons that led to the delay in documentation.

- do not try to shift your own mistake onto someone else;

- counter-accusations in the explanatory note will not work in your favor;

- if guilt really exists, it is more correct to admit it, apologize and express the intention not to allow this to happen in the future;

- you should not indulge in detailed and lengthy explanations, it is enough to indicate one reason;

- The text of the note, according to unwritten rules, should not extend beyond 1 sheet.

An example of an explanatory note about late provision of documents

To the Chairman of the Moscow Arbitration Court N.A. Novikov, specialist of the records management department, R.M. Maryanova.

EXPLANATORY NOTE About late submission of a document

I, Maryanova Raisa Mikhailovna, as a young specialist, have been working in court since September 12, 2017. Until now, I had virtually no experience working with court documentation. Today the document flow is about 200 documents per day.

Due to the heavy workload and lack of practical experience, I failed to cope with my official duties, sending a judicial act dated September 18, 2017, in violation of the established deadlines.

Please do not take disciplinary action against me. From now on I will try to do my work more carefully and focused, gaining experience.

09/20/2017 Specialist of the office management department /Maryanova/ R.M. Maryanova

Everything about the explanatory note and other examples is here.

Source: https://assistentus.ru/forma/obyasnitelnaya-zapiska-o-nesvoevremennom-predostavlenii-dokumentov/

In what situations cannot fines be applied under Art. 126 and 129.1 of the Tax Code of the Russian Federation?

- During inspections, tax authorities have the right to request from the organization only those documents that relate to the period and tax being audited. You cannot be fined for failure to provide those documents that the Federal Tax Service does not have the right to demand.

- Representatives of the tax service do not have the right to repeatedly request documents previously provided to them. Accordingly, it is impossible to impose penalties for failure to provide in this case.

- In paragraph 1 of Art. 126 of the Tax Code of the Russian Federation states that fines are imposed only for failure to provide documents that are mentioned in accounting and tax legislation. If the Federal Tax Service requests other documents, but the organization has not submitted them, this is not a violation and cannot be punished with a fine. The courts come to this conclusion.

- If an organization does not provide the requested papers or information for the reason that it does not have them, it cannot be fined either. To avoid problems with tax authorities, it is necessary to promptly inform the Federal Tax Service in writing about the absence of the necessary documents.

Case from practice

The taxpayer-organization did not receive a request to submit documents, nor did it receive any other document during the attraction procedure.

The taxpayer learned that he was fined for failure to submit documents only when he received a demand for payment of the fine and challenged it with a higher tax authority - the department of the Federal Tax Service for the subject of the Federation.

It would seem: I didn’t receive the demand, which means I couldn’t physically fulfill it.

But here’s how tax officials dealt with this situation.

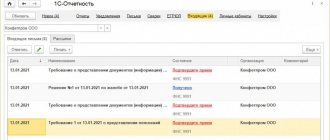

Responsibility for desk and field inspections

A desk audit is carried out without the participation of the taxpayer in accordance with Art. 88 Tax Code of the Russian Federation. Federal Tax Service employees check the documentation provided to them. Penalties are applied to violators under Art. 126 and art. 129.1 Tax Code of the Russian Federation:

- Violation of deadlines or refusal to provide documentation requested from an organization or individual entrepreneur entails a fine of 200 rubles. for one document;

- if the company’s management refuses to provide information about activities related to other entities (counterparties, etc.), it will have to pay a fine of 10 thousand rubles;

- Providing the required documents with false information is punishable by a fine of 10 thousand rubles.

Officials (managers, chief accountants, bookkeepers, and other employees charged with providing information to the tax service) will also not be able to avoid punishment. For refusal to provide Federal Tax Service employees with the required papers and information, as well as for submitting them incompletely or in a distorted form, violators will have to pay an administrative fine, the amount of which will be 300-500 rubles. Basis – Art. 15.6 Code of Administrative Offenses of the Russian Federation.

During an on-site inspection, representatives of the Federal Tax Service have the right to request a package of documents from individual entrepreneurs and legal entities, but due to the large volume, taxpayers do not always have time to prepare them in a timely manner. If documents are submitted late or not presented at all, inspectors have the right to issue a fine.

The amount of the fine for failure to provide documents at the request of the tax authorities under clause 1 of Art. 126 of the Tax Code of the Russian Federation can be very significant. In accordance with it, violators must pay 200 rubles. for each document not presented, and if there are more than one hundred such documents, then the fine will amount to many thousands.

In order to avoid such sanctions, the management of the organization or individual entrepreneur must ask the Federal Tax Service to extend the deadline for submitting documents. To do this, no later than the next day after receiving the request, a notification must be sent to the tax authority indicating the reasons and the period within which the taxpayer can submit documents. The Federal Tax Service has the right to either agree to a deferment or refuse it (Clause 3, Article 93 of the Tax Code of the Russian Federation).

If you do not have time or cannot fulfill the requirement

If an organization or individual entrepreneur understands that it will not be possible to submit documents to the Federal Tax Service within the deadline (10 days), then a special notice must be submitted to the tax office to extend the deadline for submitting them.

At the same time, we will immediately say that there is no exhaustive list of reasons for the inability to submit documents. Therefore, please cite any circumstances that prevent the company from submitting documents on time. For example, vacation or sick leave for the chief accountant. You can also indicate the following as a reason for renewal:

- requesting a very large amount of information (it is impossible to quickly make all copies);

- the need for additional time to deliver documents from a branch of the organization;

- business trip of the general director.

Notification of the impossibility of submitting documents on time must be submitted to the Federal Tax Service within the day following the day of receipt of the request for their submission. Only in this case will they be able to satisfy him. If you are late, then most likely your request for an extension will not be considered.

Please keep in mind that the notification must indicate the exact date by which the taxpayer will deliver the documents to the Federal Tax Service.

Fines for seizure of tax documents

Seizure of documents is carried out by employees of the Federal Tax Service in accordance with Art. Tax Code of the Russian Federation. This procedure is carried out forcibly after the refusal of the organization’s management to voluntarily release the requested documentation to the inspectors. Only the originals of those documents that relate to the subject of the inspection are subject to seizure. It is unacceptable to seize other documents.

If the inspected organization refuses to provide the requested papers, it faces penalties under Art. 126 of the Tax Code of the Russian Federation (200 rubles for each document not submitted).

Disobedience of officials to a lawful order of the Federal Tax Service will entail administrative liability. Guilty officials will have to pay a fine of 2,000 to 4,000 rubles, individuals – from 500 to 1,000 rubles. Grounds – Part 1 of Art. 19.4 Code of Administrative Offenses of the Russian Federation.

How is an employee punished for being absent from the workplace without a valid reason for more than 4 hours?

The note should indicate the worker’s absence from the workplace and the measures taken to find him (call a mobile phone, home phone, etc.). As soon as an unscrupulous employee appears at work, you should immediately demand from him an explanation for his absence, documented in writing.

After the employer receives an explanatory note from the employee, the validity of the reasons for the worker’s absence is assessed. This is a rather difficult task, since labor legislation does not provide an approximate list of reasons considered.

Determination of the Volga District Arbitration Court dated June 7, 2021

According to the legal position set out in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 25, 2013 N 99 “On Procedural Time Limits,” when deciding on the issue of reinstating the missed deadline for filing a complaint, the arbitration court should evaluate the validity of the arguments of the person insisting on such restoration in order to prevent abuse when appealing judicial acts and take into account that the unreasonable restoration of a missed procedural deadline may lead to a violation of the principle of legal certainty and corresponding procedural guarantees.

To justify the validity of the reasons for missing the deadline, the applicant of the cassation appeal points to the absence of a ruling from the court of appeal, as well as to the traveling nature of the work of the director of the company.

Why is the counterparty in no hurry to return the documents?

1. Disinterest of the business partner in the return of the DMP. The counterparty provided the services in full, the money was credited to the account - he is satisfied with everything. And sending or returning primary documents is additional effort, labor-intensive, again, there are always more important things to do.

2. Savings on sending documents. One registered letter costs approximately 60 rubles including VAT. If the amount is multiplied by the number of counterparties, as a rule, the expense item becomes decent. Many small companies prefer to save on postage costs.

3. Poor organization of document flow. In the stream of paper documents that wander from desk to desk, some copies simply get lost or end up in the waste paper basket.

4. Avoidance of contractual obligations. The customer (buyer) may deliberately delay signing documents in order not to pay for the service (product) or, at a minimum, to delay payment.

Common situation?

A small company services and repairs office equipment. Most of the clients are legal entities, although the amount of each service provided is small, but there are a lot of orders, and accordingly, there are also documents. However, slightly more than half of customers return signed primary documents on time - approximately 60%.

There are situations when a representative or courier comes from the customer, leaves the equipment for repair or immediately receives the service, takes documents with him with a promise to sign them or at least simply transfer them to the accounting department. But the next time everything repeats itself. The company provides services, provides documents, but clients are in no hurry to accept them and, accordingly, pay for the services.

The management of the service company is forced from time to time to carry out activities to return documents: calls, messages and letters, personal meetings, reprinting of documents. And even with such efforts, it is not always possible to return documents.

Absent from work for a valid reason

If you are not sure that the employee is sick, for the first week it makes sense to draw up reports of his absence every day; in the future, you can limit yourself to a report of the employee’s absence during the week, drawn up on Fridays. This issue is not regulated by law, so you need to be guided by common sense and judicial practice.

Absenteeism is considered to be absence from the workplace without good reason during the entire working day (shift), regardless of its duration, as well as absence from the workplace without good reason for more than four hours in a row during the working day (shift).