The profitability of any economic entity depends on the correct reflection and accounting of costs. Their optimization, control, and distribution affect the cost of goods (services) and reduce the risks of sanctions from tax authorities. At the initial stage of activity, each company plans and forms a list of costs necessary to implement production processes. An important aspect reflected in the accounting policy is the methods for distributing general production and general business expenses.

Cost classification

The pricing policy of an enterprise takes into account the market situation regarding a certain type of goods, services or work, while the cost is regulated due to the amount of invested profit or the redistribution of business expenses. Production costs are a constant value that is the sum of actual cost indicators. The selling price (of work, services, goods) includes cost, commercial expenses and the amount of profit.

Each organization creates provisions in its accounting policies that regulate the accounting of expenses, methods of their distribution and write-off. Accounting regulations (Tax Code, PBU) recommend a list and classification of costs included in the cost price. The consumption rate of each item is established by the internal documents of the enterprise. Costs are systematized according to various criteria: by economic content, by time of occurrence, by composition, by the method of inclusion in the cost, etc. To formulate calculations, all costs are divided into indirect and direct. The principle of inclusion in the cost depends on the number of types of products manufactured by the company or services provided. Methods for distributing direct costs (salaries, raw materials, depreciation of capital equipment) and indirect (expertise and maintenance work) are determined in accordance with regulatory documents and internal regulations of the company. It is necessary to dwell in more detail on general and general production expenses, which are included in the cost by the distribution method.

Calculation of general production costs

To account for general production costs, account No. 25 is provided. Analytical accounting is carried out for the production premises and divisions of the company. Expenses accumulate on it for a month, after which they are written off to the main production. The write-off method must be defined in the company's accounting policies.

The calculation of overhead costs is carried out according to:

- Remuneration of employees involved in production maintenance;

- Payment of rent for production workshops and operating facilities;

- The price of MPZ for the repair and maintenance of special equipment;

- Costs for dismantling special equipment;

- Depreciation charges on fixed assets;

- Costs for heating and lighting of workshops;

- Other expenses.

The composition of general production costs includes a constant (does not change when the volume of production of goods changes) and a variable (changes when the quantity of goods produced changes) parts.

Read more about the composition and types of overhead costs in the article.

Calculating production costs based on variable costs is the formation of cost estimates by expense items.

ODA: composition, definition

With a branched production structure aimed at producing several units of products (services, works), the enterprise incurs additional costs that are not directly related to the main type of activity. At the same time, accounting for expenses of this type must be kept and included in the cost price. The structure of the ODA is as follows:

— depreciation, repair, operation of equipment, machinery, intangible assets for production purposes;

— maintenance, modernization of workshop premises;

— contributions to funds (FSS, Pension Fund) and wages of personnel serving the production process;

— utility costs (electricity, heat, water, gas);

- other expenses related directly to the production process and its management (write-off of used equipment, equipment, travel expenses, rent of space, services of third-party organizations, provision of safe working conditions, maintenance of auxiliary units: laboratories, services, departments, leasing payments). Production costs are costs associated with the process of managing the main, service and auxiliary departments; they are included in the cost price as general production costs.

Definition

Manufacturing overhead costs are costs directly related to production activities. The main distinguishing feature from direct costs of manufacturing products is that the amounts cannot be attributed to a specific type of product. General production expenses may include costs for:

- depreciation deductions;

- equipment maintenance;

- payment for utility services;

- rent of industrial premises;

- wages for workers involved in the service process;

- other expenses.

Although costs are not directly related to any type of product, they must be taken into account when calculating production costs.

Accounting

Methods for distributing general production and general business expenses are based on the total value of these indicators accumulated during the reporting period. To summarize information on ODA, the chart of accounts provides for a cumulative register No. 25. Its characteristics: active, collectively distributive, has no balance at the beginning of the month and the end (unless otherwise provided by the accounting policy), analytical accounting is maintained by divisions (shops, departments) or types of products. During a certain period, information on actual expenses incurred is accumulated in the debit of account 25. Typical correspondence includes the following operations.

- Dt 25 Kt 02, 05 – the accrued amount of depreciation of fixed assets and intangible assets is allocated to OPR.

- Dt 25 Kt 21, 10, 41 – goods of own production, materials, inventory are written off as production expenses.

- Dt 25 Kt 70, 69 – salary accrued to the personnel of the operational development department, deductions were made to extra-budgetary funds.

- Dt 25 Kt 76, 84, 60 – invoices issued by contractors for services rendered and work performed are included in general production expenses; the amount of shortfalls identified based on the results of the inventory is written off.

- The debit turnover of account 25 is equal to the amount of actual expenses, which at the end of each reporting period are written off to the calculation accounts (23, 29, 20). In this case, the following accounting entry is made: Dt 29, 23, 20 Kt 25 - accumulated expenses are written off for auxiliary, main or servicing production.

Accounting and distribution of general production and general business expenses

Home Favorites Random article Educational New additions Feedback FAQ⇐ PreviousPage 7 of 14Next ⇒

General production and administrative expenses are expenses that cannot be attributed to a specific type of product at the time of their occurrence. General production expenses include expenses associated with the organization of production and management of a separate branch of production or division. General economic expenses include expenses associated with the organization of production and management of the economy as a whole. Accounting for these expenses is carried out on account 25 - “General production expenses” and account 26 - “General business expenses”. Account 25 has the following subaccounts: 25/1 - “Crop production”; 25/2 - “Livestock”; 25/3 - “Industrial production”. Accounts 25, 26 are active, collecting and distributing. Costs are collected by debit, and they are distributed by credit. Costs are distributed to the 20th account in proportion to the wages of workers in the main production or in proportion to the main costs minus seeds - crop production, feed - in livestock farming, raw materials - in industrial production. Distribution is made monthly or quarterly. The data from primary documents for account 25 is accumulated monthly by items and cost objects in the accumulative sheet for accounting for general production expenses, and for account 26 - in the accumulative sheet for accounting for general business expenses. The final data of the statements is transferred to the analytical accounting register - production report (form No. 83-APK). Synthetic accounting is maintained in journal order No. 10-APK. Cost accounting is carried out in the context of the following items: Material costs. Wages. Social contributions. Depreciation of fixed assets . Services of auxiliary production. Taxes, fees and other payments. Other expenses. Unproductive expenses (losses from downtime, damaged valuables during storage in brigade storerooms, etc.). Correspondence accounts: Materials consumed -D 25.26 K 10 Salaries accrued to management personnel -D 25.26 K 70. Deductions made for social needs -D 25.26 K 69, Depreciation of fixed assets accrued -D 25.26 K 02. Services provided to auxiliary production -D 25.26 K 23. General production and general business expenses -D 20/1,2,3 K 25.26 Accounts are closed 25.26 after the account is closed 23.97 General production and general business expenses arising in connection with the organization and maintenance of the production process, management of the business entity and its divisions, refer to invoices.

General production expenses, their composition and size are determined by estimates for the maintenance and operation of equipment, administrative and business expenses of departments. Planning and accounting of such expenses is carried out according to the following nomenclature of items:

depreciation of production equipment and vehicles; contributions to the repair fund or expenses for the repair of production equipment and vehicles; equipment operation; wages and social contributions for workers servicing equipment; maintenance of the workshop management apparatus; maintenance of workshop buildings and workshop structures; to conduct tests, experiments and research; labor protection of workshop workers;

losses from defects, from downtime due to internal production reasons, etc.

Synthetic accounting of general production expenses is kept on account 25 “General production expenses”, analytical - in special statements for each workshop and according to budget items. In the journal-order form of accounting, overhead costs are recorded in statement No. 12, which serves as both analytical and synthetic accounting registers. Entries in this sheet are made according to the distribution sheets for materials consumption, wages, social contributions, depreciation and other documents.

General production expenses are reflected in the accounting accounts as follows:

Debit account 25 “General production expenses”

Credit account 02 “Depreciation of fixed assets”, 10 “Materials”, 60 “Settlements with suppliers and contractors”, 70 “Settlements with personnel for wages”, 69 “Calculations for social insurance and security”, 96 “Reserves for future expenses”, 97 “ Future expenses”, etc.

At the end of the month, the amount of general production expenses recorded as the debit of account 25 is written off (distributed), and the account is closed.

Manufacturing overhead costs are charged not only to the cost of finished goods, but also to the cost of work in progress at the end of the month. The amount of overhead costs, which is included in the cost of finished products, is distributed between individual types of labor products. The choice of method for distributing expenses in accounting between accounting objects and calculating the cost of products, works, and services is made by the organization independently, based on the specifics of its activities. The basis for the distribution of general business expenses can be the amount of the basic salary of production workers, or direct costs of materials, other criteria, the values of which correspond to standard (planned) or actual costs.

To distribute overhead costs between types of products, the ratio of the amount of these costs to the total value of the indicator taken as a criterion (for example, the wages of production workers in a workshop) is determined.

General expenses are associated with managing the organization as a whole and its maintenance. The composition and size of these expenses is determined by the estimate.

Planning and accounting of general business expenses are carried out according to the following nomenclature of items:

content of the management apparatus; on official business trips of the management apparatus;

maintenance of fire, paramilitary and security guards; entertainment expenses related to the activities of the organization; maintenance of other business personnel; office and postal expenses; depreciation of fixed assets for general purposes; contributions to the repair fund (upon its creation);

for the maintenance of buildings, structures and equipment for general economic purposes;

for testing, experiments, research, maintenance of general economic laboratories; on labor protection of the organization's employees; training and retraining of personnel; mandatory deductions, taxes and fees; unproductive general business expenses; other.

Synthetic accounting of general business expenses is carried out on account 26 “General business expenses”, analytical - according to budget items in a special statement. The register for analytical accounting of general business expenses is statement No. 15, which is filled out according to the development sheets specified in statement No. 12. In the accounting accounts, general business expenses are reflected by the entry:

Debit account 26 “General business expenses”

Credit account 02 “Depreciation of fixed assets”, 10 “Materials”, 60 “Settlements with suppliers and contractors”, 70 “Settlements with personnel for wages”, 69 “Calculations for social insurance and security”, 96 “Reserves for future expenses”, 97“ Future expenses”, etc.

At the end of each month, general business expenses are written off, which is carried out in accordance with the organization’s accounting policies in one of the following ways:

1) by debiting production cost accounts (20, 23, 29);

2) to the sales account.

General business expenses attributable to labor products, as well as general production expenses, are distributed between individual types of products, works, and services in proportion to the selected base.

If general business expenses are included in the costs of production of specific types of products, an entry is created in the accounting accounts:

Debit account 20 “Main production” (by type of product)

Credit account 26 “General business expenses”.

With this option of assigning general business expenses to the accounting accounts, the full production cost of products, works, and services is formed.

The basis for the distribution of general economic expenses, both between the balances of work in progress and finished products, and other objects of cost accounting and calculating the cost of products, works, services, can be the basic wages of production workers; costs of raw materials and materials; direct costs, both actual and standard (planned); other indicators.

If general business expenses are assigned to account 90 “Sales” as semi-fixed expenses, then the following entries are made in the accounting accounts:

Debit account 90 “Sales”, subaccount 90-2

Credit account 26 “General business expenses”. In this case, the reduced cost of products, works, and services is formed in the cost accounting accounts, which corresponds to the “direct cost” system used in foreign practice.

Despite the fact that the second option greatly simplifies the write-off of general business expenses, it is applicable provided that all products produced during the reporting period are sold or the share of these expenses in the cost of production is insignificant.

To account for costs in auxiliary production departments using the journal-order form, sheet No. 12 is used. The results of the activities of auxiliary production units, depending on their purpose, are documented in invoices for delivery of products, acts of acceptance and transfer of work performed, waybills, certificates from the heads of energy services, technologists, mechanics, etc.

Products, works, and auxiliary production services are consumed within the organization or sold to buyers and customers. Actual costs for labor products of auxiliary production consumed within an economic entity are distributed between divisions - consumers of products, works, services, and within divisions - among other accounting and costing objects.

The criterion for such a distribution, depending on the option adopted in the accounting policy of the organization, can be indicators of the standard (planned) cost of products, works, services, wages, material costs, direct costs, etc.

Data on the accounting and distribution of general production, general economic and auxiliary production costs are entered into the consolidated accounting sheet for the costs of production of products (works, services), as well as in order journals No. 10 and 10/1.

Direct costing system

Direct costing (or direct costing from the English Direct Costs

) is a concept introduced by the American economist D. Harris in 1936, which means taking into account direct costs. The essence of the direct costing system is to divide costs into fixed and variable. The direct costing system developed in the second half of the 20th century. With the development of production and a significant increase in product output, enterprises from various countries sought to minimize their costs in order to increase their competitiveness and strengthen the position of their companies in the market. This goal set them the task of accurately determining the cost of production, as well as determining the break-even point, price reduction reserves, etc. The actual introduction of the direct costing system was in 1953, when the National Association of Accountants and Calculators published a description of this system in its report. Subsequently, the same association conducted and published large studies of companies that use the direct costing system.

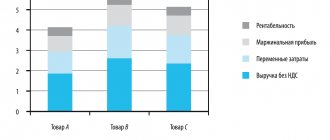

In the direct costing system, fixed costs (associated with a certain period and do not directly depend on the volume of production) are not included in the cost of production, while variable costs (directly dependent on the volume of output) are. Finished products and work in progress are assessed only in the amount of variable production costs, and the fixed costs of the reporting period in the total amount are included in the financial result of the organization and are not distributed by type of product. Fixed costs are costs, the amount of which in a given period does not directly depend on the volume of production (work, services) of an economic entity. If production volume increases or decreases by no more than 20%, then total fixed costs do not change. As production volume increases, fixed costs per unit of output steadily decline.

Variable costs are costs, the value of which for a given period directly depends on the volume of production and sales of products, as well as on the cost structure in the production and sale of several types of products. If the value of this indicator increases by 10%, then, accordingly, total variable costs also increase by 10%. However, as production volume changes, variable costs per unit remain unchanged.

Marginal analysis plays a major role in the study of factors that influence the amount of profit; with its help, the ratio of indicators is studied: volume of production (sales) of products, costs, profit and forecasting the amount of each of the listed indicators at a given value of the others. Marginal analysis applies the category of marginal income, which is the difference between profit (P) and fixed costs of an economic entity (N).

Profit from the sale of a certain type of product is determined by the formula:

P = K * (C – V) – N,

where K is the volume of product sales in physical terms; C – selling price per unit of production, rub.; V – variable costs per unit of production, rub.

The break-even sales volume and the safety zone depend on the amount of fixed and variable costs, and at the same time on the price level for the products. If prices rise, then the volume of product sales must be reduced to compensate for the fixed costs of the economic entity, and vice versa.

The safety zone (Zbez) is determined by the formula:

Z without.

= (K

pl

- K) / K

pl

* 100%,

where K pl

– planned volume of product sales, K – current volume of product sales.

With an increase in the volume of variable and fixed costs per unit of production, the profitability threshold increases and the safety zone decreases. Consequently, every enterprise strives to reduce fixed costs.

In the direct costing system, the scheme for constructing a financial results report is multi-stage. An important feature of direct costing is that thanks to it it is possible to study the relationships and interdependencies between production volume, costs and profits.

Currently, there are two options for organizing management accounting using the direct costing system:

1. organization of separate accounting in financial and management accounting accounts;

2. integration of financial and production accounting and the use of accounts 20-29 familiar for cost accounting.

Accounting based on the direct costing system opens up wide opportunities for company management in making effective management decisions. Thus, based on this method, an analysis of the relationship between production volume, profit, cost, and gross revenue can be carried out. This method also allows you to calculate the company’s break-even point, the maximum share of fixed costs that the company can incur at the existing level of profitability. The direct costing system is also of great importance for in-depth analysis of the operation of an enterprise, based on mathematical methods (correlation analysis, regression analysis, etc.).

The financial results report prepared using the direct costing system shows changes in profit due to changes in variable costs, selling prices and the structure of products. The information received in the direct costing system allows you to find the most profitable combinations of price and volume and implement an effective pricing policy.

The main problem of direct costing is the difficulty in defining and differentiating variable and fixed costs, since very often in practice they are difficult to classify and assign to any specific group.

Currently, the direct costing system is widespread in all developed economies, such as Germany, USA, Japan, Canada, UK and others.

⇐ Previous7Next ⇒

Distribution

The amount of overhead costs can significantly increase the cost of manufactured products, work performed, and services provided. At large industrial enterprises, pilot projects are planned and the concept of “consumption rate” is introduced; deviations of this indicator are carefully studied by the analytical department. In organizations engaged in the creation of one type of product, methods for distributing general production and general business expenses are not developed; the sum of all costs is fully included in the cost price. The presence of several production processes implies the need to include all types of costs in the calculation of each of them. The distribution of general production costs can occur in several ways:

- Proportional to the selected basic indicator, which optimally corresponds to the combination of ODA and the volume of output (volume of goods produced, wage funds, consumption of raw materials or supplies).

- Maintaining separate accounting of ODA for each type of product (costs are reflected in analytical sub-accounts opened to register No. 25).

In any option, methods for distributing indirect costs must be enshrined in the accounting policies of the enterprise and not contradict regulations (PBU 10/99).

Formula for calculating overhead costs

The formula for calculating overhead costs includes a basic value that maximally reveals how much the costs influence the final cost of the product. Based on the obtained indicator, the total amount of costs is transferred to the cost of goods produced. The basis may be one of the following factors:

- Salary of employees of the main production;

- Material costs;

- Number of personnel employed in production;

- The price of fixed assets or the volume of production workshops;

- Direct costs;

- Production volume.

The formula for calculating the production overhead ratio will be as follows:

K = amount of general production costs / base value.

Also, to calculate overhead costs, it is necessary to add up the following indicators:

- Depreciation of fixed assets per year. The formula for calculating it is as follows:

A = (PS * Na) / 100.

Where:

- A – the amount of depreciation;

- PS – the initial price of special equipment and other objects;

- Na is the depreciation rate.

- Costs of materials and raw materials. The calculation formula is as follows:

Р=К*∑(Н*Ц).

Where:

- P – total amount of costs;

- K – transport costs;

- N – cost rate;

- C – the cost of materials required to repair special equipment.

OCR, composition, definition

Administrative and economic costs are a significant factor in the cost of goods, work, products, and services. General business expenses are a total reflection of management costs, they include:

— maintenance and servicing of structures, non-production buildings (offices, administrative areas), rental payments;

— contributions to social funds and remuneration of management personnel;

— communication and Internet services, security, postal, consulting, audit expenses;

— depreciation charges for non-production facilities;

— advertising (if these expenses are not commercial);

— office, utility bills, information services;

— expenses for personnel training and compliance with industrial safety rules;

- other similar costs.

The maintenance of the management apparatus is necessary for the implementation of production processes and further marketing of products, but the high proportion of this type of expense requires constant accounting and control. For large organizations, the use of the standard method of calculating operational and technical expenses is unacceptable, since many types of administrative expenses are variable in nature or, in case of a one-time payment, are transferred to the cost of production in stages, over a certain period.

Accounting

Account No. 26 is intended to collect information about the company’s management expenses. Its characteristics: active, synthetic, collecting and distributing. Closed monthly to accounts 20, 46,23, 29, 90, 97, depending on what methods of distribution of general production and general business expenses are adopted by the internal regulatory documents of the enterprise. Analytical accounting can be carried out in the context of divisions (departments) or types of products (work performed, services provided). Typical account transactions:

- Dt 26 Kt 41, 21, 10 - the cost of materials, goods and semi-finished products is written off for maintenance.

- Dt 26 Kt 69, 70 – reflects the calculation of wages for administrative and economic personnel.

- Dt 26 Kt 60, 76, 71 – general business expenses include services of third-party organizations paid to suppliers or through accountable persons.

- Dt 26 Kt 02, 05 – depreciation of non-production objects, intangible assets and fixed assets was accrued.

Direct cash costs (50, 52.51) are usually not taken into account as part of the OCR. An exception may be the accrual of interest on loans and borrowings, and this accrual method must be specified in the accounting policy of the enterprise.

Write-off

All general business expenses are collected in monetary terms as a debit turnover of account 26. When closing a period, they are written off to the main, servicing or auxiliary production, may be included in the cost of goods to be sold, charged to future expenses, or partially allocated to the enterprise's loss. In accounting, this process is reflected by the following entries:

- Dt 20, 29, 23 Kt 26 – OChR are included in the cost of production of the main, service and auxiliary production.

- Dt 44, 90/2 Kt 26 - general business expenses are written off in trading enterprises, to the financial result.

Distribution

General business expenses in most cases are written off similarly to general production expenses, i.e., in proportion to the selected base. If this type of cost is long-term in nature, then it is more appropriate to attribute them to future periods. Write-offs will occur in certain parts attributable to cost. Conditionally variable general business expenses can be attributed to the financial result or included in the price of the goods produced (in trading enterprises or those providing services). The method of distribution is regulated by internal documents.

Results

There are several ways to distribute costs in 1C. They depend on the applied accounting policies and individual preferences of users of reports, which are obtained based on the results of management distribution.

Read more about the rules for keeping records of production operations in 1C: “Procedure for recording production of products in 1C.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

1C

Currently, accounting for general production and general economic costs is carried out in accounting databases and programs of the 1C group. Methods for distributing indirect costs are regulated by special settings. When calculating the cost of experimental work and industrial maintenance, it is necessary to check the boxes opposite the approved base in the “production” tab. When writing off as deferred expenses, it is necessary to establish the period and amount. To include costs in the financial result, fill in the appropriate tab. When the “period closing” function is launched, general production and general business expenses accumulated in registers 25 and 26 are automatically written off to the debit of the specified accounts. This process forms the cost of the finished product.

Features of postings for the distribution of indirect costs

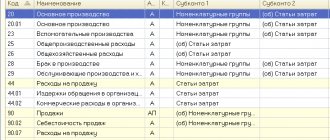

The transactions generated by the “Month Closing” document look like this (see Table 5):

Table 5

It should be noted that according to account 25, the subconto “Items of overhead costs” is “current”, i.e. According to this subconto, the reports show only turnover and no balances. Balances can only be obtained in the context of the “Divisions” sub-account or for account 25 as a whole. When generating transactions for the credit of account 25, the sub-quote “Items of overhead costs” remains empty. This technique reduces the number of transactions and simplifies the understanding of the distribution result.

According to account 26, both sub-accounts are “current” - “Items of general economic expenses” and “Divisions”. When generating transactions for the credit of account 26, the sub-quote “Items of general economic expenses” and “Divisions” remain empty.

Why are indirect costs not automatically allocated (possible reasons)?

- The distribution base for indirect costs is not specified.

- For account 20, there are no debit turnovers for the cost items indicated as the distribution base for indirect costs for the month being closed.

- Account 25 has balances for departments for which there are no debit turnovers for account 20.