What are the dangers of VAT gaps and how to behave during an inspection?

10/30/2018 09:26 KIRA GIN - managing partner of a legal company, tax lawyer, auditor. Graduated from the Ural State Law Academy. Legal experience since 1995. Specializes in tax, corporate and civil law. He has extensive experience in solving complex issues of applying tax legislation, identifying tax risks, judicial appeal of non-regulatory acts and actions of inspectors. Hobbies: classical music, yoga, travel.

VAT tax gap: what is it?

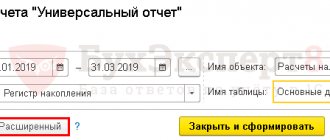

Several information resources are currently analyzing VAT “gaps”, the presence of tax evasion schemes, the level of tax burden, and other similar issues: ASK VAT (the 4th version is being tested), analytical resources FIR “information from the Bank of Russia”, FIR “transfer price", FIR Unified State Register of Legal Entities, FIR "customs", PC "PPA Selection". Sometimes the information resource “Superanalyst” is used, which studies the database of bank statements.

Fiscal officials pay special attention to “gaps” in VAT. We are talking about situations when the buyer has an invoice in the purchase book, but at the same time it is not in the seller’s sales book. This means that the buyer received a tax deduction due to the fact that the seller had to make contributions to the budget. But at the same time, the seller did not pay anything to the treasury.

Such “gaps” are called “straight”.

But the tax authorities pay the closest attention to the so-called “complex gaps”, when the taxpayer and his counterparty of the first “link” have invoices and VAT amounts reflected in their reports correctly, but the “gap”, and therefore the failure to pay VAT, occurs at 3-5 or further links. As a rule, such “gaps” indicate deliberate “schemes” for non-payment of VAT, which involve various “platforms” that manage “one-day companies”, and sometimes employees of the Federal Tax Service and banks. The fight against such schemes is one of the policy priorities of the Federal Tax Service of Russia, therefore organizations with complex gaps immediately fall under special control not only of their inspectorate, but also of the regional Office of the Federal Tax Service of Russia.

The mentioned databases find discrepancies, and then, as a rule, at the level of the regional Office of the Federal Tax Service of Russia, lists of organizations that have identified VAT “gaps” are prepared. These lists are sent to local Inspections, which formulate Requirements for the submission of relevant documents and call Taxpayers to provide explanations.

Due Diligence

This block of questions will also be directly related to clarifying the nature of your company’s relationship with contractors, or more precisely, with the criteria for their selection.

The goal of the tax inspector in this case is to find out how responsibly your company treats the choice of counterparties and by what specific criteria such a choice is made.

A sample list of questions here would look like this:

1. How and where does a company usually find its counterparties?

2. What sources and resources are used to verify information about counterparties?

3. What information about the counterparty must be checked before concluding an agreement?

4. Why was this particular counterparty chosen to complete a transaction of interest to the tax authorities?

5. Who is responsible for the choice of the company’s counterparties in general and specifically for the choice of the counterparty that is of interest to the tax authorities in particular?

6. What information does the company have about a specific counterparty and how can it confirm certain data?

When preparing answers to these questions, it is important to understand that in accordance with the requirements of the current legislation, when choosing counterparties, the manager or other responsible person of the company is required to exercise due diligence, which consists in the need for a preliminary study of the counterparty, by conducting a due diligence check on tax and other reference documents. - information resources. Judicial practice shows that the lack of due diligence when choosing counterparties is a sufficient basis for the company to experience adverse legal consequences.

What should you be wary of?

As a rule, most entrepreneurs are now most often called to the tax office to provide explanations on their activities or to a “commission.” Tax audits are not ordered immediately after a “gap” is discovered, as this is too costly and ineffective. And the general policy in the field of tax administration is aimed at reducing audits. That is why you will first go to a commission at the Federal Tax Service of the Russian Federation.

At the same time, such calls indicate the risk of an audit. Therefore, as soon as the Federal Tax Service becomes interested in you, you must immediately begin preparation. And already at this stage you need to seek professional help from a lawyer who specializes in resolving such issues.

In particular, if you have received a Notice to appear at the tax authority to provide explanations on the company’s activities, or a Request to provide documents and information on a particular counterparty for a quarter or more, then our tax lawyers will help you navigate and correctly build a dialogue with the Federal Tax Service. We will tell you what documents need to be submitted to the Federal Tax Service, including in addition to those requested.

Reliability and actual completeness of the transaction

In cases where the ASK-VAT program shows a break in the chain, it goes without saying that, in addition to its dubious links, the tax inspector will be interested in the transactions themselves, for which the tax was not received by the treasury. First of all, they will check the reality of the transaction and its actual usefulness. In this case, the inspector’s task is to establish whether the transaction was actually completed or is it only based on documents? And if the fact of the transaction can be confirmed as a whole, then did all the stages of such a transaction reflected in the documents actually take place?

An approximate list of questions in this block would look like this:

1. When and where was the goods shipped? Indicate the exact date and time of shipment;

2. Which employee accepted the goods?

3. How were the products packaged?

4. What vehicles were used for transportation?

5. Full name and contact details of the forwarders?

6. Who accepted the primary documentation for the transaction?

7. Which employee was personally present when the goods were accepted?

8. Other issues relating to the various stages of the transaction and the identification of persons responsible for carrying out the corresponding stage.

Also, the inspector will undoubtedly be interested in the economic justification of the dubious transaction, so he will check:

-whether the costs incurred by the company correspond to business goals (for example, making a profit);

- are the costs incurred for the transaction rational;

-whether there was an artificial increase in costs;

-whether the costs incurred are necessary from the point of view of business customs.

When preparing answers to the questions in this block, it is necessary to rely on the ability to provide the tax inspector with documentary evidence of the fact that the transaction was completed in stages and evidence of its economic feasibility.

As practice shows, if the tax office suspects that a company has acquired an unjustified tax benefit, an audit is ordered, during which the tax authorities usually review all the company’s transactions for at least 3 years.

How to interact with the tax office?

So, you've been called. What can you do?

There are 2 options:

- Recognize the “gap”, submit an updated tax return and pay an additional amount of tax, penalties and no longer be afraid of inspectors. This is the easiest option, and in some cases it is worth keeping in mind. Please note that if VAT is charged to you based on the results of an on-site tax audit, you will also have to pay an additional fine of 40% of the corresponding amount.

- Defend your right to a tax deduction. The very fact of the presence of an unscrupulous counterparty, especially the second or subsequent “links,” does not mean that it was you who violated something. If the counterparties of the first “link” are beyond your control and actually worked, then the tax authorities may change their position and withdraw their claims against you. This is doable if you have the proper evidence.

Note! Unfair actions of second and third level counterparties in themselves are not grounds for filing claims

to the taxpayer.

In a word, it is quite possible to defend your position. To do this, you need to collect the necessary package of primary documents that relate to specific transactions, as well as evidence of due diligence. Also impressive is the timely involvement

to the proceedings

of a tax lawyer

.

Risk-based approach of tax authorities when conducting desk audits

When conducting desk tax audits, tax officials must take into account the level of tax risk assigned by the ASK VAT-2 risk management system, as well as the result of previous desk tax audits of VAT tax returns (Letter of the Federal Tax Service of the Russian Federation dated January 26, 2017 No. ED-4-15 / [email protected] ). In this Letter, tax officials have proposed an algorithm for determining the volume of documents required from a taxpayer when conducting a desk tax audit of a VAT return.

When conducting desk tax audits, tax authorities must take into account a combination of the following factors:

- the level of tax risk assigned by the Risk Management System of JSC NDS-2;

- the result of previous desk tax audits of VAT tax returns on the issue of the legality of taxpayers using tax benefits (Letter of the Federal Tax Service of the Russian Federation dated January 26, 2017 No. ED-4-15 / [email protected] ).

How can we help you?

It should be noted that the Federal Tax Service of the Russian Federation has been rapidly increasing the efficiency of on-site inspections in recent years. This means the danger of an on-site tax audit for you, because if an audit is ordered due to VAT gaps, then with a 98% probability significant amounts of taxes and fines will be assessed, plus a criminal case may be initiated for tax evasion. Therefore, it is very important to prevent the appointment and implementation of an audit and begin to act proactively.

At the same time, the high percentage of effectiveness of tax audits means that the Federal Tax Service of the Russian Federation tries not to organize such events without identifying significant violations.

We have repeatedly provided qualified assistance in such situations. We know what needs to be done to minimize any risks.

Our lawyers will help you minimize the risk of an audit due to a VAT gap. We invite you to discuss the details.

We have extensive experience in providing assistance with any calls to the Federal Tax Service, and consultation with our lawyers is absolutely free!

Shell companies

It often happens that the chain also contains fictitious operations, or, as they are called, technical ones. They are carried out with shell companies, whose main task is the transit of funds for subsequent cashing. As a rule, such companies have formal, low-quality accounting services or are not serviced at all and last 1-2 quarters, after which the company is simply abandoned.

Most of the gaps are formed in relationships with such companies. There are certain criteria for classifying companies as one-day companies - mass manager, mass registration address, lack of number of employees, transit movement of funds through a current account, etc.

And relationships with shell companies are a reason to conduct a thorough check of any of the counterparties in the chain. After all, if someone from the chain is connected with a shell company, it is possible that the entire chain is connected, or the chain was generally built for the purpose of cashing out funds.

conclusions

Of course, for an accountant, identified VAT discrepancies are an extra headache and worry. To reduce the number of such problems, we recommend checking invoices with counterparties before sending the declaration to the Federal Tax Service.

However, discrepancies in themselves do not constitute grounds for tax sanctions or an on-site audit. The main thing is not to ignore requests for explanations and try to convince tax officials that the origin is just an annoying misunderstanding. And even if, as a result of an audit, the tax authorities assessed additional VAT, the company still has every chance to challenge this in court. Of course, if it carefully selects counterparties, does not cooperate with one-day companies and does not participate in VAT evasion schemes.

Complicated breakups are not your pain

The VAT break can be simple or complex - it depends on the number of partners involved in the transaction.

Simple - when there is one seller and one buyer, as in the case of Vanilla and the milk supplier. A difficult gap occurs if the milk supplier did not milk the cow himself, but bought milk from a peasant farmstead, and those from another farm in the neighborhood. One person did not indicate the transaction in the declaration, and now there is a VAT break in the chain.

From experience, “Vanilka” should not worry about a complex breakup; the tax office is unlikely to come to them. The main thing is that the milk supplier himself indicates the transaction in his declaration. In this case, “Vanilka” will reduce the VAT, and then the tax office will sort out between those participants in the chain who have a gap.